S&P Tumbles Below Key Technical Support, Bonds Bid

As this morning’s chaotic open uncoils into another leg lower, Nasdaq is now suffering its worst start to a year in at least 30 years (it is very slightly worse than 2008), and the S&P’s longest weekly losing streak since Sept 2020.

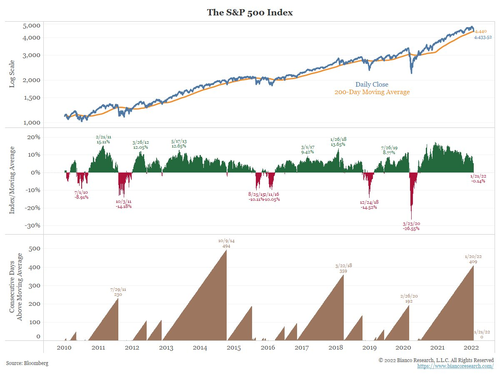

Crucially, the S&P 500 just broke below its 200DMA…

Which now means all the US majors are below their 200DMAs…

As Jim Bianco notes, if the S&P closes below the 200DMA, this ends a 409 trading day streak above it – the longest streak in 8 years.

And as stocks are getting hammered, bonds are bid with the long-end yield tumbling to 3 week lows…

But, but, but, we were told tech was getting trashed because yields were rising?

Tyler Durden

Fri, 01/21/2022 – 10:32

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com