If Success Has Many Fathers, Inflation Is An Orphan

Authored by Bruce Wilds via Advancing Time blog,

The proverb “success has many fathers” means there is no shortage of people willing to claim they contributed to a successful enterprise. If success has many fathers, inflation is an orphan. When it comes to inflation not only does nobody take credit for it, but instead they rush to blame others for its very existence. An example of this is how President Biden and his anti-fossil fuel administration has come out swinging and blamed Russia for higher gas prices in America.

Inflation is generally viewed as a general increase in the prices of goods and services in an economy because of or coupled with a fall in the purchasing value of money. This is where the peanut gallery and purest generally go berserk and argue fiat currency is not money. The most common reason given for rising prices is that demand is stronger than supply. Still, a lot more factors feed into creating inflation than supply and demand making price stability more than a delicate balancing act.

The “inflation puzzle” is highly complex and includes a slew of related confounding variables. The role productivity and savings play in inflation are often overlooked. Most people, even many economists make the mistake of throwing spending into one big pile with little consideration to the fact not all spending is equal. Please note the following;

-

The spending of government often is far different than that of the individual. Unproductive government spending tends to be inflationary.

-

Inflation can stem from a growing lack of faith in a currency, or all currencies, rather than just a lack of available goods. Governments that waste and spend do not generate long-term confidence in their currency.

-

As inflation takes root the goods available for sale often contract as sellers retreat from the market awaiting higher prices, this can be followed by workers then demanding higher wages which creates a self-feeding loop.

-

Also, the velocity of money plays into inflation. When money moves faster it tends to increase demand. What many people fail to consider is why money moves rapidly through the economy or the reason it gets parked in one place.

-

The ever-changing economic rules by which we play, include taxation and incentives for saving or not saving. Any “incentive” that steers money into intangible assets may feed the wealth effect but often dampens demand for the things we need that are included in the consumer price index. In short, it can lessen inflation but increase investments that may be risky.

What people spend their money on and where impacts inflation. So does whether they pay cash or charge the purchase and have to pay interest on the goods. When people buy American goods and invest in their community the money moves from business to business creating jobs. When people buy goods made in Asia from a company like Amazon, their money takes the fast track out of the country and weakens our country.

Productivity is another huge part of the inflation puzzle. An example of an institution that has not been able to adjust and stay relevant in our changing world is the United States Postal service. It is an example of poor spending on the part of our government and could not exist if it were not for continued financial infusions. Years ago the USPS delivered important materials and correspondence, today it delivers the junk mail that fills our landfills. The main reason the USPS exists today is to employ people. It employs not only carriers but those that build and maintain its vehicles as well as those that create and send the junk mail we hate to get.

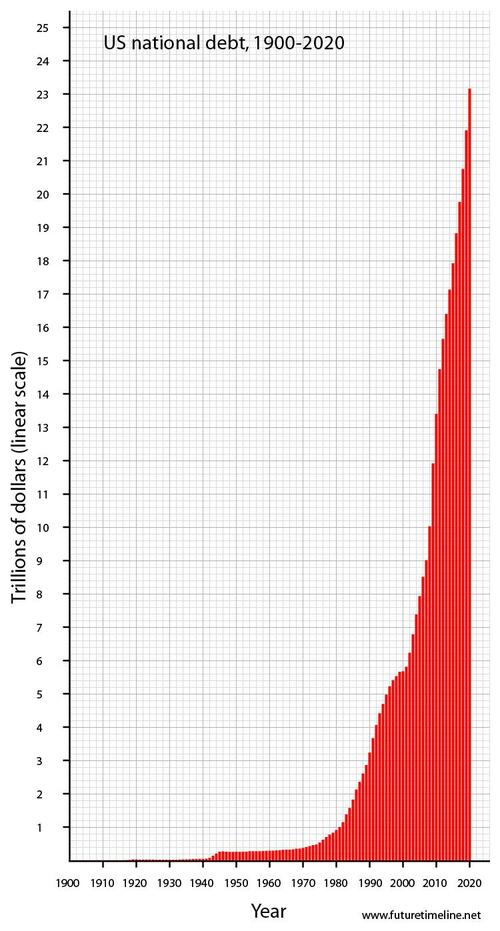

Now Over 30 Trillion And growing

While it is easy to point to supply chain disruptions as the reason for much of our inflation, it could be argued inflation has been brewing for a long time. The chart to the right shows bat shit crazy spending has soared. It is only logical to think the consequences would catch up with us at some point. This is why, as we look into the future many of us have arrived at the conclusion inflation has not peaked and more inflation remains a certainty.

It seems our government is out of control and simply cannot stop spending. With the Secretary of the Treasury having been the former head of the Fed, and the current Fed chairman both hellbent on spending to boost the economy, our government has embarked on an unsustainable spending spree. This has enabled the global financial system to do the same with few ramifications.

Circling back to the idea inflation is an orphan, this means when inflation hits the average consumer they yell out in pain. When that happens it seems none of the players that helped create the situation want to take credit for their actions. Inflation tends to hammer away at most people eroding their wealth. It acts as a stealth transferer of wealth moving it from the masses and into the hands of the few positioned to benefit

We should not forget what we were told by central bankers until recently. In late 2018 Jean-Claude Trichet, who served as President of the European Central Bank from 2003 to 2011, opined about his outlook for the global economy and monetary policy by repeating the line declaring 2% inflation the desirable goal of intelligent central bankers.

Yes, the central bankers were fast to tell us we needed some inflation and everything is “data-dependent.” This translates into the idea central banks have the ability to, and will squash inflation if it begins to run too hot. Well, they better start squashing. The only other option is that we as a society get a great deal more productive or inflation is here to stay. With so many people choosing not to work or unable to find jobs that add substance to the economic pie, that is unlikely.

Tyler Durden

Mon, 05/16/2022 – 07:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com