Gave: The End Of The Unipolar Era

Authored by Louis-Vincent Gave via Gavekal Research,

Investors today must deal with the effects of not one, but two wars, as my Gavekal-IS colleague Didier Darcet pointed out in April (see Tick,Tock Tick,Tock).

-

The first is the one we can see playing out each day on our television screens, with all the tanks, deaths and human suffering.

-

The second is a financial war, with the unprecedented weaponization of the Western banking system and Western currencies aimed at bringing Russia to its financial knees (see CYA As A Guiding Principle (2022)).

To the surprise of most people in the West, resistance against both of these war efforts has proved far stronger than expected. Almost 11 weeks into the war on the ground in Ukraine, Russian troops still seem to be taking heavy losses for relatively small territorial gains. And a little over six weeks after US president Joe Biden boasted that the ruble had been “reduced to rubble” by Western sanctions, the Russian currency is close to a two-year high against the US dollar and near a post-Covid high against the euro. At this point, both the euro and the yen appear to be bigger casualties of the Ukraine war than the ruble.

The US boast that the ruble had been “reduced to rubble” is looking premature

In this paper, I shall review the implications of this stronger-than-expected resistance – both on the battlefield and in the financial markets – and attempt to draw some salient conclusions for investors.

The evolution of warfare

In October 1893, some 6,000 highly-disciplined warriors of King Lobengula’s Ndebele army launched a night-time attack on a camp occupied by 700 British South Africa Company police near the Shangani river in what is now Zimbabwe. It was a massacre. The BSAC “police” killed more than 1,500 Ndebele for the loss of just four of their own men. A week later, they did it again, killing some 3,000 Ndebele warriors for just one policeman dead. These one-sided victories were not won by courage or superior discipline, but because the British were armed with five machine guns and the Ndebele had none. As Hillaire Belloc wrote in The Modern Traveller: “Whatever happens, we have got / The Maxim gun, and they have not”.

The technological superiority of the machine gun allowed Britain, and France, Germany and Belgium, to subjugate almost all of Africa, even though outnumbered by the Zulu, Dervish, Herero, Masai and even Boer forces they opposed. All were rendered helpless by the machine gun’s firepower.

I revisit this ancient history to illustrate how military technology is a lynchpin of the geopolitical balance.

Dominance of military technology is also a key factor underpinning the strength and resilience of a reserve currency. Today, one of the main reasons why Taiwan, South Korea, Japan, Saudi Arabia, the United Arab Emirates and others keep so much of their reserves in US dollars is that the US is widely regarded as being a generation (if not more) ahead of the competition in the design and production of smart bombs, anti-missile systems, fighter jets and naval frigates. In short, the superiority of US weaponry has been one of the principal factors underpinning the US dollar’s status as the world’s reserve currency. However, recent events raise important questions about whether the US can retain this superiority.

-

In September 2019, drones allegedly deployed by Yemeni Houthi forces took out the Saudi Aramco oil processing facilities at Abqaiq.

-

Between late September and early November 2020, Armenia and Azerbaijan fought a war over the Nagorno-Karabakh region. The conflict ended in near-total victory for the Azeris. This result stunned the military world. Observers had assumed that Armenia, with a bigger army, larger air force, more up-to-date anti-aircraft and anti-missile systems, and a history of Russian support, would easily triumph. But all Armenia’s expensively-acquired military “advantages” were quickly taken out in the early days of the fighting by Azerbaijan using Turkish-made drones costing no more than US$1mn each.

-

On successive occasions between March 2021 and March 2022, Houthi drones attacked Saudi Arabian oil facilities, notably the giant terminal at Ras Tanura on the Persian Gulf.

-

In December 2021, Turkish-made drones allowed the Ethiopian government to tip the balance in a civil war that until then had been going badly for government forces.

-

In January 2022, Houthi drones hit oil facilities in the UAE.

Now, imagine being Saudi Arabia or the UAE. Over the years you have spent tens, if not hundreds, of billions of US dollars purchasing anti-missile and anti-aircraft systems from the US. Now, you see relatively cheap drones penetrating these defense systems like a hot knife through butter. This has to be frustrating. What is the point of spending up to US$340mn on an F-35c (and US$2mn on pilot training), or US$200mn on an anti-aircraft system, if these can be taken out by drones at a fraction of the cost?

This evolution in warfare may help to explain the impressive resilience of the Ukrainian army in the face of Russia’s onslaught. When the Russian troops marched into Ukraine, consensus opinion was that the Ukrainian forces would crumble before the Russian military juggernaut. It is always hard to know what is happening on the ground amid the fog of war. But judging by the number of tanks destroyed, warships sunk and the apparent failure of the Russian air force to establish control over Ukraine’s skies, it seems the invasion of Ukraine is proving far more costly in terms of blood and treasure than Russian president Vladimir Putin had imagined.

Could this be because Putin failed to factor the impact of drones into his military outlook? It may be premature to jump to that conclusion. But judging from afar, it appears inexpensive Turkish drones have helped level the battlefield in the Ukrainian-Russian David versus Goliath confrontation— the biggest and bloodiest on European soil since World War II.

This helps to explain why the US military assistance package for Ukraine Biden announced this month included 700 Switchblade drones. These are surprisingly cheap—the Switchblade 300 reportedly carries a price tag as low as US$6,000—yet highly effective. In essence, they are single-use kamikaze drones. Apparently, they fly faster than the Turkish Bayraktar TB2 drones that the Ukrainians, like the Azeris before them, have used to such devastating effect. This suggests the Switchblades should be able to evade the air defenses that Russia has attempted to maintain over its troops.

The US military deployed Switchblades sparingly in Afghanistan, so it is hard to know whether these will perform as billed in combat conditions. But before this shipment to Ukraine, only the UK was permitted to purchase Switchblades. This implies that the Pentagon considers the Switchblade a valuable and potent weapon.

David Petraeus, the former Central Intelligence Agency director who, as a four star general, commanded the US campaigns in both Iraq and Afghanistan, singled out the weapon in a recent interview with historian Niall Ferguson:

“I’ll mention one item in particular: the Switchblade drone. It’s a loitering munition that takes a one-way trip. The light version can loiter for 15 to 20 minutes. Heavy version, 30 to 40 minutes with a range of at least 40 km. The operator selects a target, it locks on and it follows. Then it strikes when the operator gives that order. This is extraordinarily effective because you can’t hear it on the ground. The first time the enemy knows it’s there is when it blows up. If we can get enough of those into Ukraine, they could be a true game-changer.”

However, I digress.

Returning to the discussion about why drones might matter for financial markets:

1) If ever-cheaper and more readily available drones are going to revolutionize war, much as the Maxim gun did 140 years ago, then it is questionable whether it still makes sense to invest in tanks, airplanes, anti-aircraft and anti-missile systems. If it does not, what does this mean for the value of the large, listed death-merchants?

Cheap drones are bad news for the stocks of defense giants

Historically, buying the merchants of death after a big rally in oil made sense, if only because so much of the world’s high-end weapon consumption occurs in the Middle East. But in the world of tomorrow, will Middle Eastern oil kingdoms still line up to buy multibillion US dollar systems from Raytheon, Boeing, Lockheed and the like, if those systems are vulnerable to attacks from relatively cheap drones?

2) Talking of Middle Eastern regimes, the deal prevailing in the Middle East for the past five decades has been that oil would be priced in US dollars, and that the oil-exporting regimes in Saudi Arabia, the UAE or Kuwait would use these US dollars to buy US-made weapons (and US treasuries). With this bargain, the US implicitly guaranteed the survival of the Gulf Arab regimes. Fast forward to 2022, and following the invasion of Ukraine, countries such as Saudi Arabia and the UAE have failed to condemn Russia. What’s more, Saudi Arabia let it be known that it might start to accept payment for its oil in renminbi. Perhaps this makes sense if Saudi Arabia feels it no longer needs US$340mn F-35s, but instead more US$1mn Turkish-made drones?

3) If, as the Azeri-Armenian and the Ukrainian-Russian wars suggest, drones have radically leveled the battlefield in war, this profound development has a multitude of implications. Does it undermine the long-held superiority of vastly expensive armament systems, tilting the balance in favor of much cheaper and much more widely-available weapons? If so, does this mean another pillar supporting the US dollar’s reserve currency status is crumbling in front of our eyes?

In a world where military might is no longer the monopoly of a single superpower, or the duopoly of two, does the world become, de facto, multipolar? In such a world, would there still be a compelling reason for trade between Indonesia and Malaysia to be settled in US dollars, rather than in their own currencies? Wouldn’t trade between China and South Korea now be settled in renminbi and won?

Drone tactics are a radically different form of warfare, and they are evolving fast. So, it would be premature to offer any definitive conclusions about the extent to which drones will dominate warfare in the future. However, their recent use in Ukraine (and Yemen, Azerbaijan and Ethiopia) means that investors have to be open to the idea that drones will change the battlefield of the future. Because if they are going to change the battlefield of the future, then they will also change the economic and financial realities of today.

In this sense, drones might well be the modern-day equivalent of aircraft carriers. In World War II, aircraft carriers made big-gun battleships and other traditional naval warships obsolete, or at least highly vulnerable. Two early Pacific battles proved the point. The Battle of the Coral Sea in May 1942, generally considered by historians to have been a draw, was the first naval engagement ever fought in which the opposing fleets never made visual contact with each other. Carrier-based aircraft drove the action. A month later, the far more consequential Battle of Midway established the new reality beyond all doubt. The Imperial Japanese Navy was ambushed northwest of Hawaii and lost the bulk of its carrier force in a single action. It would be on the defensive for the rest of the war.

With hindsight, Midway marked the start of US dominance over the world’s oceans. In short order, this translated into US dominance over global trade. But with the nature of warfare again changing, is this dominance of the oceans and of other battlefields guaranteed to last?

Investors need to consider the uncomfortable possibility that it might not.

The dramatic shift in the global financial landscape

We are all the offspring of our own experiences. One important formative event in my own modest career was the Asian financial crisis of 1997-98. Witnessing how quickly things could unravel left a deep mark. I highlight this because I am not alone in having lived through the shock of 1997-98. Pretty much every emerging market policymaker aged 50-75 (which is most of them) went through a similar trauma. Seeing your country’s entire middle class wiped out in the space of a few weeks—which is what happened in Thailand, Indonesia, Russia, Argentina and others in the period from 1997 to 2000—is bound to leave a few scars.

Among emerging market policymakers these scars took the form of a deepseated conviction of “never again” (see Our Brave New World). To ensure their countries’ middle classes were never again wiped out, they adopted a straightforward set of policy prescriptions that in the early 2000s Gavekal dubbed the The Circle Of Manipulation. It went something like this:

1) To avoid a future crisis, your central bank needs to maintain a healthy safety cushion of hard currency bonds, mostly US treasuries and bunds.

2) The more you become integrated with the global economy, the larger this cushion should be.

3) To build up this safety cushion, you need to run consistent and large current account surpluses.

4) To run consistent large current account surpluses, you need to maintain an undervalued currency.

Among the results of these policy prescriptions were charts looking like this:

By all previous standards, this was an odd state of affairs: an economic arrangement under which poorer countries with high savings rates and vast infrastructure investment needs ended up subsidizing consumption in rich countries with low savings rates and ever-accelerating twin deficits.

To cut a long story short, for the last 25 years, we have lived in a world in which undervalued currencies in emerging markets allowed Western consumers to buy attractively priced goods and services imported from developing countries. Meanwhile, the individuals, companies and governments in the emerging markets which earned capital from these sales largely recycled their earned capital into Western assets—because Western assets were perceived to be “safe.”

But this perception of safety may now be changing in front of our eyes.

Consider the following changes:

1) Developed economy government bonds have proved anything but safe. As stresses of increasing severity have affected the world economy over the last 12 months, investors in local currency Indonesian and Brazilian government bonds and in gold have generated positive returns of between 3% and 4% in US dollar terms. Chinese government bonds are up by just over 1.5%. Meanwhile, Indian and South African government bonds have lost -4%. These performances contrast with US treasuries, which have lost -9%, and the train wrecks suffered by investors in eurozone bonds and Japanese government bonds, which are down anywhere between -17% and -23%. Of these, which can be considered the safest?

2) The confiscation of Russia’s reserves. I will not repeat here arguments I have made at length elsewhere (see What Freezing Russia’s Reserves Means). But in a nutshell, the decision to freeze Russia’s central bank reserves has been the most important financial development since US president Richard Nixon closed the gold window in 1971. From now on, any country that is not an outright US ally—China, Malaysia, South Africa and others—and even some historical friends—Saudi Arabia? The UAE? India?—will think twice before reflexively accumulating US treasuries from fear they may get canceled.

Over the course of a weekend, with no discussion in the US Congress, and no discussion with the Federal Reserve, the US administration unilaterally turned the US treasury market on its head. From that moment on, the whole nature of a US treasury security would depend entirely on who owned it.

3) Running roughshod over property rights. It is hard to pin down what the West’s single most important comparative advantage might be. Having the world’s strongest military? Being the seat of almost all the world’s greatest universities? Issuance of the world’s reserve currencies? The list goes on. But surely somewhere near the top of the list should be the sanctity of property rights, guaranteed by rock-solid “rule of law.” The main reason Chinese tycoons for years purchased Vancouver real estate, the Emirati central bank bought US treasuries and Saudi princes parked their wealth in Zurich was the knowledge that, whatever happened, and wherever you came from, you were guaranteed property rights, and a fair trial to ascertain those rights, in any courtroom in New York, London, Zurich or Paris.

Better still, since the implementation over the last 850 years in the West of habeas corpus and various bills of rights, you have been able to have confidence that you would be judged as an individual. One of the fundamental tenets of Western democracies’ legal systems is that there is no such thing as a collective crime—or collective punishment. You can only be held responsible and punished for what you have done as an individual.

Unless – all of a sudden – you are a Russian oligarch. This is a dramatic development, if only because every Chinese tycoon, Saudi prince, or emerging market billionaire will now wonder whether he will be next to get canceled. If the wealth of Russian oligarchs can be confiscated so abruptly, then why not the assets of Saudi princes?

Stretching this a little further, maybe it shouldn’t just be Saudi princes or Chinese billionaires who should be worried. If wealth can be seized without any trial, but simply because of guilt by association, maybe in the not-too distant future Western governments could confiscate the wealth of anyone who mined coal or pumped oil out of the ground. Don’t they have blood on their hands for causing tomorrow’s climate crisis? And while we are about it, perhaps we should also confiscate the wealth of social media barons for failing to prevent a mental health crisis among our youth?

4) Russia’s counter-attacks. Older readers may remember how in the days that preceded the Lehman bust, US Treasury secretary Hank Paulson walked around proclaiming that he had “a big bazooka,” and that if the market pushed too hard, he would fire this bazooka and blow shortsellers out of the water. Unfortunately, with Lehman it became obvious to all and sundry that Paulson’s bazooka was firing blanks.

Today’s situation is similar. In the wake of the Russian invasion of Ukraine, the US decided to go for full weaponization of the US dollar, proclaiming the ruble had been turned to rubble. Last week, the ruble hit two-year highs against both the US dollar and euro. Biden’s financial bazooka seems to have been no more potent than Paulson’s. Why? Because Russia decided to fight back, requiring buyers from “unfriendly” countries to pay for their purchases of Russian commodities in rubles. And in effect, the only way unfriendly customers can acquire rubles is by offering gold to the Russian central bank (see The Clash Of Empires Intensifies).

This has created a sudden and profound shift in the global trading and financial architecture. For decades, global trade was simple. If Russia produced commodities that China needed, then China first had to earn US dollars by selling goods and services to the US consumer. Only in this way could it acquire the US dollars it needed to purchase commodities from Russia. But what happens now that China or India can purchase their commodities from Russia or Iran for renminbi or Indian rupees? Obviously, their need to earn and save US dollars is no longer so acute.

Conclusion

Warfare is changing and the financial system has been weaponized like never before. However, the weaponization of the financial system has so far failed to deliver the intended results. At this point, investors can adopt one of two stances. The first might be described as “nothing to see here; move along.” The second is to accept that the world is changing rapidly, and that these changes will have deep and lasting impacts on financial markets. Different war, different world, different consequences

For now, there are some clear takeaways.

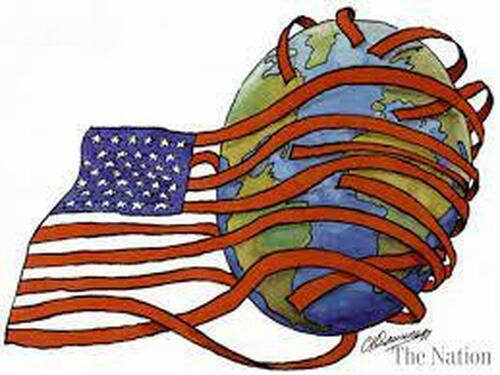

1) The Ukraine war may be telling us that modern history’s unipolar age is now well and truly over. As big as the Russian army is, and as powerful as the US Treasury might be, the current crisis has demonstrated that neither is powerful enough to impose its will on its perceived enemies. This includes even relatively weak enemies; Ukraine’s army was hardly thought of as formidable, while Russia was supposed to be a financial pygmy.

2) This is a very important message. In an age of drones and parallel financial arrangements, there is no longer such a thing as absolute power—nor even the perception of absolute power. The pot has been called, each player has had to show his cards, and all are sitting with busted flushes! The fact that military and financial dominance may be harder to assert in the future opens the door to a much more multipolar world.

3) For 25 years, emerging market workers have subsidized consumption in developed markets, as emerging market policymakers kept their currencies undervalued and recycled their current account surpluses into “hard” currencies. If this arrangement now comes to an end, then the developed market consumer will struggle while the emerging market consumer will thrive.

4) Much consumption in emerging markets tends to occur at the “low end” of the product chain. This plays into a theme I have been harping on about for the last year: that investors should focus on companies that deliver products that consumers “need to have” rather than products that are “nice to have.”

5) Over the last two years, US treasuries and German bunds have failed in their job of providing the antifragile element in portfolios. There are few reasons to think that this failure is about to reverse any time soon. Today, investors need to look elsewhere for antifragile attributes. Precious metals, emerging market government bonds, high-yield energy assets and foodstuffs are all leading candidates.

6) High-end residential real estate in Western economies will lose the emerging market money-recycling bid and will struggle.

7) New safe destinations for emerging markets’ excess capital will emerge. Obvious candidates include Dubai, Singapore, Mauritius, and perhaps even Hong Kong (should China eventually decide to follow the rest of the world and to live with Covid). It is hard to be too bullish on these destinations. They are so small that even a marginal, influx of financial and human capital will have a disproportionate impact.

The world’s unipolar era is over. Few portfolios reflect this reality – and definitely not the indexed portfolios that are today massively overweight an overvalued US and a desperately ill-omened Europe.

Tyler Durden

Sun, 05/22/2022 – 23:50

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com