Futures Surge To Two Weeks Highs As Traders Eye End Of Fed’s Hiking Cycle

Futures are pointing to solid close to the week – now that a recession and earlier rate cuts are assured…

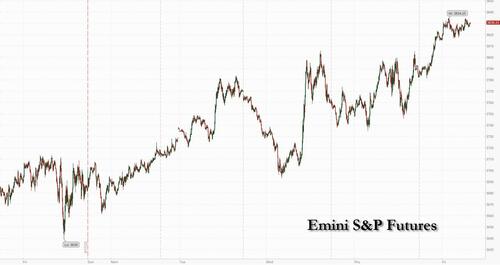

…. with a continuation of the rally which has pushed stocks to two week highs, with Tech continuing to lead while Chinese Tech is helping to fuel the global risk-on rally to end the week. Tech-heavy Nasdaq 100 futures added 1% while contracts on the S&P 500 gained 0.9%, trading near session highs at 3,833 after the main US stock gauge closed near session highs Thursday, adding more than 3% in three days. In Europe, the Stoxx Europe 600 rose 1.5%, with the benchmark set for a small bounce this week. 10-year Treasury yields rose to 3.13% after earlier sliding as low as 3.04%.

In premarket trading, software maker Zendesk Inc. soared over 50% on reports it’s close to reaching a deal to be acquired by a group of buyout firms led by Hellman & Friedman and Permira. Bank stocks were mostly higher as well after the latest stress test that results showed all 34 participating banks had passed (of course). In corporate news, Coinbase will launch its first crypto derivative product on Monday in the midst of the current crypto winter. US-listed Chinese stocks rise in premarket trading, on track for their best week since April as more market watchers turn positive on the group amid a gradual easing in Beijing’s crackdown on tech. Alibaba (BABA US) +3%, Nio (NIO US) +2.8%. Here are some other notable premarket movers:

- FedEx Corp. (FDX US) shares gained in premarket trading with analysts mostly welcoming its annual earnings forecast that was above expectations amid higher package prices and resolution on some operation issues related to labor shortage. Nevertheless, they still maintained caution amid cost pressures and macroeconomic uncertainty.

- US bank stocks may be volatile Friday after the Federal Reserve announced after the close of trading on Thursday that all banks had passed its annual stress test.

- Blackberry (BB CN) gained in postmarket trading after it reported an adjusted basic loss per share for the first quarter of 5c, in line with estimates.

- LendingTree (TREE US) shares dropped 10% in extended trading on Thursday, after the consumer finance company cut its second-quarter forecast for both revenue and adjusted Ebitda.

- Sarepta Therapeutics (SRPT US) shares may be under pressure after it announced that the FDA has placed a clinical hold on the company’s peptide-conjugated phosphorodiamidate morpholino oligomer to treat patients with Duchenne muscular dystrophy. That said, analysts believe this is mostly a hiccup and that the stock should get a lift once data from the company’s NT gene therapy is disclosed.

In his market wrap note, JPM’s Andrew Tyler asks “Does this rally have legs” and answers: “The next major catalyst is the June 30 PCE data. This current rally is seeing Tech and Defensive sectors as the largest outperformers. While some investors may play momentum, there seems to be a collective lack of conviction with many believing that this rally fizzles. Traders are looking for confirmation from a breakout above ~3900 resistant level.”

To be sure, investors are grappling with the question of what comes next if an economic downturn takes hold. One scenario – the bullish one – predicts cooling price pressures and thus scope for central banks to ease up on the pace of interest-rate hikes. In the other one, Jerome Powell hardened his resolve to cool inflation in testimony to lawmakers this week, after acknowledging that a recession may be the price to pay.

“In spite of the hawkish remarks from Fed officials, the growing worries that their hikes would trigger a recession actually meant that investors priced in a shallower pace of rate hikes over the coming 12-18 months,” Deutsche Bank AG strategists led by Jim Reid wrote in a note. “That had a knock-on impact on Treasuries.” We discussed this extensively last night. The rising probability of a peak in rates put the policy-sensitive US two-year yield on course for one of its biggest weekly drops since March 2020. Meanwhile, traders are starting to price out any Fed action on rates beyond the December meeting, scaling back the additional tightening they expect and flirting with the possibility of cuts by in 2023.

In Europe, equities traded well with the Stoxx rising 1.5% and the Euro Stoxx 50 1% higher back near Thursday’s highs. CAC 40 outperforms peers. Health care and media are the strongest sectors, autos and retail names lag. Here are some of the biggest European movers today:

- European health care stocks jump, outperforming the broader market. Societe Generale says the fundamentals of the European pharma sector are healthier than US peers. Roche rises as much as 3.4%, Novo Nordisk +3.2% and AstraZeneca +2.6% among the biggest contributors to the gain

- Ultra Electronics shares rise as much as 13% after a statement that the UK government is leaning toward approving Cobham’s planned takeover of the British defense-technology specialist.

- LVMH shares rise as much as 2.9% on Bernstein’s top luxury pick at a time of macroeconomic and geopolitical uncertanties, thanks in part to the French giant’s Dior mega-brand, which analyst Luca Solca says is one of the industry’s biggest success stories

- Telenet shares rise as much as 6.4%, with Barclays and New Street Research both noting that the stock is cheap and it may become more attractive for majority holder Liberty Global to consider buying the rest of the shares.

- Zalando shares sink as much as 18%, hitting the lowest since Jan. 2019. The online retailer warning on its sales and earnings outlook was not a total surprise, but the scale of the downgrade to its expectations was more significant than anticipated, analysts say. Fast fashion and online retailers decline in Europe following another warning in the sector, this time from Germany’s Zalando. HelloFresh slumps as much as -9.7%, Delivery Hero -6.0%, Deliveroo -2.7%.

- Fertilizer stocks sink in Europe with Morgan Stanley flagging the industry’s exposure to surging gas prices, gas supply uncertainties and related government measures in Europe to prevent shortages. K+S shares fall as much as 4.9%, Yara down as much as 4.8% and OCI down 3.9%

Earlier in the session, Asian stocks headed for a second day of gains as technology shares staged a comeback amid falling yields, with investors continuing to weigh the prospect of higher inflation and monetary tightening. The MSCI Asia Pacific Index rose as much as 1.2%, lifted by tech-heavy markets such as South Korea. A gauge of Asian tech stocks jumped, rallying from the lowest level since September 2020. A Chinese tech measure in Hong Kong advanced 4%. Consumer and health care names also contributed to Friday’s gains amid a global shift to defensive stocks. Asian equities headed for their first weekly gain in three, as the market took a breather from intense selling pressure fueled by fears that aggressive monetary tightening will push the US economy into a recession. Federal Reserve Chair Jerome Powell in testimony to lawmakers stressed his “unconditional” commitment to bringing down inflation.

Stocks have fared relatively better in Asia than in other regions as China’s move to dial back Covid restrictions supports market sentiment. Asia’s benchmark is down about 6% this month, compared with at least 8% declines in the S&P 500 Index and the Euro Stoxx 50. “The growth differentials are going to open up between China and the rest of the world,” Kinger Lau, chief China equity strategist at Goldman Sachs, said in a Bloomberg TV interview. Chinese equities “tend to do quite well going into the party congress, three to six months before that. Right now seems like we are in the sweet spot.”

Japanese stocks climbed as investors assessed hawkish comments by Fed Chair Jerome Powell on further interest rate hikes and a rally in Treasuries that sent yields lower, boosting tech shares. The Topix Index rose 0.8% to 1,866.72 as of market close Tokyo time, while the Nikkei advanced 1.2% to 26,491.97. Japan’s Mothers index rallied as much as 5.8%. Nidec Corp. contributed the most to the Topix Index gain, increasing 6.5%. Out of 2,170 shares in the index, 1,540 rose and 550 fell, while 80 were unchanged.

In Australia, the S&P/ASX 200 index completed a weekly gain of 1.6% to close at 6578.70, as technology shares staged a comeback amid falling yields. The tech benchmark had a weekly gain of 8.1%, the most since August. Nine of the 11 subgauges ended Friday higher, with only energy and mining stocks sliding after a gauge of commodities retreated. New Zealand’s market was closed for a public holiday

In FX, the Bloomberg dollar spot index dipped into the red, poised for its first weekly decline in a month as investors gauge whether aggressive Federal Reserve rate hikes would tip the US economy into a recession; the Bloomberg Dollar Spot Index fell 0.5% this week while the policy-sensitive US two-year yield is on course for its biggest weekly drop since March 2020. The Japanese yen was the only Group-of-10 currency to fare worse than the dollar, sliding back under 135. “The dollar is undermined by the weakness in PMI data and growing concerns that aggressive rate hikes will eventually cause growth slowdown,” said Akira Moroga, manager of currency products at Aozora Bank in Tokyo. “US yields are also stabilizing from recent sharp climb to weigh on the dollar,” he said. NOK and SEK are the strongest in G-10 FX, JPY is the weakest.

Rates erase initial gains, with Treasuries now slightly cheaper across the curve as US stock futures advance beyond Thursday’s highs, while core European bond gains fade and European stocks rally. US yields cheaper by 1bp-3bp across the curve and spreads within a basis point of Thursday’s close; 10-year higher by 1.5bp at 3.10%, bunds in the sector by an additional 3.5bp. Bunds futures complete a ~150 tick round trip, rallying near 149.00 before returning toward 147.50. Cash curves remain bear-steeper, long end bunds cheapen ~3bps having initially richened ~5bps. Cash USTs and gilts are comparatively quiet after following bunds price action in early trade. Italian bonds lag peers, widening the 10y BTP/Bund spread back above 200bps. Focal points of US session include early Bullard comments and University of Michigan inflation expectations, cited by Fed Chair Powell in latest policy decision.

In commodities, crude futures advance, albeit holding within a relatively narrow range. West Texas Intermediate crude traded near $105 a barrel after retreating over the previous two sessions. The US benchmark has lost almost 4% this week, putting prices on course for their first monthly drop since November. Base metals complex is under pressure, LME tin drops over 12%, nickel down over 6%. Spot gold rises roughly $4 to trade near $1,827/oz. Bitcoin traded rangebound on either side of the 21,000 level.

Sliding raw materials prices have contributed to a moderation in market-based measures of inflation expectations. Oil headed for its first back-to-back weekly loss since early April amid a broader selloff in commodities markets.

To the day ahead now, and data releases include Germany’s Ifo business climate indicator for June, Italian consumer confidence for June, and UK retail sales for May. Over in the US, there’s also the University of Michigan’s final consumer sentiment index for June, and new home sales for May. From central banks, we’ll hear from the ECB’s Centeno and de Cos, the Fed’s Bullard and Daly, the BoE’s Pill and Haskel, and BoJ Deputy Governor Amamiya.

Market snapshot

- S&P 500 futures up 0.7% to 3,826.75

- STOXX Europe 600 up 1.1% to 406.65

- German 10Y yield little changed at 1.40%

- Euro little changed at $1.0525

- Brent Futures up 0.4% to $110.51/bbl

- Gold spot up 0.2% to $1,826.53

- MXAP up 1.1% to 159.08

- MXAPJ up 1.3% to 527.68

- Nikkei up 1.2% to 26,491.97

- Topix up 0.8% to 1,866.72

- Hang Seng Index up 2.1% to 21,719.06

- Shanghai Composite up 0.9% to 3,349.75

- Sensex up 0.7% to 52,652.22

- Australia S&P/ASX 200 up 0.8% to 6,578.70

- Kospi up 2.3% to 2,366.60

- U.S. Dollar Index little changed at 104.35

Top Overnight News from Bloomberg

- Global equity funds saw their biggest outflows in nine weeks as investors piled into cash amid fears that the US economy could be headed for a recession.

- UK consumers are starting to crumple in the face of soaring prices, according a series of reports that paint a grim picture of the nation’s cost of living crisis.

- Germany’s economy minister said he can’t be sure that Russia will resume shipments through a key gas pipeline following planned maintenance next month, raising the prospect of a fresh surge in prices and rationing this winter.

A more detailed look at global markets from Newsquawk

Asia-Pac stocks ultimately followed suit to the gains on Wall St where a decline in yields and lower commodity prices helped the major indices claw back from the opening losses which were triggered by disappointing PMI data. ASX 200 was positive with tech stocks encouraged by US counterparts which benefitted from the lower yield environment although gains in the index were capped by weakness in the commodity-related sectors after the recent pressure in energy and metal prices. Nikkei 225 found early momentum alongside currency flows and held on to gains despite the JPY reversal. Hang Seng and Shanghai Comp. were positive after officials recently suggested ample policy space to sustain a steady economic performance and with the PBoC upping its liquidity efforts.

Top Asian News

- PBoC injected CNY 60bln via 7-day reverse repos with the rate at 2.10% for a CNY 50bln net daily injection, according to Reuters.

- Xi Trip to Hong Kong in Doubt After Top Officials Get Covid

- Hong Kong’s Jumbo Mystery Deepens as Restaurant May Be Afloat

- Gold Set for Weekly Drop on Powell’s Unconditional Inflation Vow

- Iron Ore Poised to End Wild Week Down as Steel Inventories Rise

- Hedge Funds Buy Dollar-Yen Downside Options on Recession Risks

European bourses have coat-tailed on the positivity seen on Wall Street yesterday and across APAC overnight, with European indices firmer to varying degrees. Sectors overall project a modest defensive bias as Healthcare, Media, Consumer Products, and Food & Beverages reside among the winners, although Tech is also buoyed by the pullback in bond yields. Europe’s largest online retailer Zalando (-12%) slumped following a profit warning, and in turn dragged the European Retail sector to the lowest level since March 2020. Stateside, US equity futures are firmer across the board – with the NQ narrowly leading the pack – participants also flagged the ES overcoming resistance at 3,800.

Top European News

- UK PM Johnson’s Conservatives lost the parliamentary seat in the Wakefield by-election to the Labour Party and lost the by-election in Tiverton and Honiton to the Liberal Democrats, according to Reuters. Subsequently, PM Johnson has been warned to “watch out for a coup”, according to reporting in The Telegraph. Furthermore, Conservative Party Chairman Dowden has resigned following the by-elections.

- 1922 Committee treasurer Sir Geoffrey Clifton-Brown hints that Tory leadership rules could be changed to allow rebels another shot at the PM, according to Mail’s Grove.

- Boris Johnson’s Party Chair Quits After Double Election Blow

- Zurich Insurance Sells Legacy German Life Portfolio to Viridium

- Ukraine Latest: Troops to Leave Key Eastern City as Russia Gains

- Airlines 2Q Seen Profitable for Most, Deterioration in 2023: DB

FX

- Kiwi elevated amidst favourable crosswinds on NZ market holiday – Nzd/Usd probes 0.6300 as Aud/Nzd retreats towards 1.0950.

- Euro encouraged by elements of German Ifo survey and Pound shrugs off mixed UK consumption data, all time low consumer sentiment and more pain for PM Johnson on risk factors and gravitating Greenback – Eur/Usd firm on 1.0500 handle, Cable tests 1.2300 and DXY close to base of 104.120-510 range.

- Aussie, Loonie and Franc all bounce within ranges as Buck backs off, but Yen continues to encounter resistance after decent retracement – Aud/Usd back over 0.6900, Usd/Cad fades from pop above 1.3000 and Usd/Chf reverses through 0.9600 pivot.

- Scandi Crowns claw back lost ground, Yuan underpinned by PBoC liquidity injection and Peso by hawkish Banxico guidance to supplement 75 bp hike – Eur/Sek sub-10.7000, Eur/Nok near 10.4500, Usd/Cnh under 6.7000 and Usd/Mxn beneath 20.0000.

Fixed Income

- Debt recoils after stretching recovery limits further – Bunds top out at 149.00, Gilts at 114.55 and 10 year T-note 118-00

- Trading volumes pick-up on the way back down towards or to intraday lows of 147.21, 113.54 and 117-10+, as risk appetite steadily improves and focus turns to pm agenda

Commodities

- WTI and Brent August futures are extending their modest gains in recent trade despite a lack of news flow.

- EIA said a status update on the weekly DOE oil inventories report will be provided on Monday.

- Spot gold remains uneventful under USD 1,850/oz – with the Dollar similarly contained intraday thus far.

- Focus has turned to base metals, with nickel, zinc, and tin among the biggest losers amid demand woes and surplus concerns.

- Chile state copper miner Codelco reached an agreement with workers to end the strike, according to Reuters.

- China is to auction 500k tonnes of imported soybeans from state reserves on July 1st, according to the trade centre cited by Reuters.

US Event Calendar

- 10:00: June U. of Mich. Sentiment, est. 50.2, prior 50.2

- 10:00: June U. of Mich. Expectations, prior 46.8; Current Conditions, est. 55.4, prior 55.4

- 10:00: June U. of Mich. 1 Yr Inflation, est. 5.4%, prior 5.4%; 5-10 Yr Inflation, est. 3.3%, prior 3.3%

- 10:00: May New Home Sales, est. 590,000, prior 591,000

- MoM, est. -0.2%, prior -16.6%

Central Bank speakers

- 07:30: Fed’s Bullard Discusses Central banks and Inflation

- 13:15: Fed’s Daly Interviewed on Fox Business News

- 16:00: Fed’s Daly Speaks at Shadow Open Market Conference

DB’s Jim Reid concludes the overnight wrap

Fears about an imminent recession have continued to dominate markets over the last 24 hours, with a combination of Chair Powell’s comments, weak economic data and renewed concerns about a European gas cutoff all helping to sound the alarm for investors. Indeed, the sudden rush for safe havens (along with doubts over how far central banks will actually hike if there’s a recession) meant that sovereign bonds rallied sharply, with yields on 10yr bunds (-20.6bps) seeing their largest daily decline in over a decade, which is quite something considering just how volatile bonds have been this year. Having said that the S&P 500 finished up +0.95% so it wasn’t all doom and gloom on what was a pretty bad day for news.

In terms of the various developments, weak data hampered the narrative and led to a flight to bonds from the outset, with the flash PMIs from Europe and the US painting a gloomy economic picture as we round out Q2. For instance, the Euro Area composite PMI fell to a 16-month low of 51.9 (vs. 54.0 expected), including larger-than-expected declines in both Germany and France. Later in the day, the US composite PMI also fell to 51.2 (vs. 53.0 expected), whilst the weekly initial jobless claims of the week through June 18 came in at 229k, thus taking the smoother 4-week moving average to its highest level since early February. So a bad run of numbers that at the very least add to the growing signs that we’re seeing a noticeable slowdown in growth.

As the data was getting weaker, there was no sign that Fed Chair Powell was going to be put off from his challenge of restoring price stability, and he even reiterated before the House Financial Services Committee that their commitment to deal with inflation was “unconditional”. Bear in mind that he left that word out of his testimony before the Senate Banking Committee the previous day, which some had interpreted in a dovish light, so there’s no sign that the Fed are set to let up on the task ahead. Furthermore, Fed Governor Bowman became the latest member of the FOMC to endorse another 75bp hike at the next meeting in July, saying beyond that she favoured “increases of at least 50 basis points in the next few subsequent meetings”.

In spite of the hawkish remarks from Fed officials, the growing worries that their hikes would trigger a recession actually meant that investors priced in a shallower pace of rate hikes over the coming 12-18 months. For instance, the rate priced in by the December meeting came down a further -5.5bps to 3.46%, whilst the terminal rate is now seen at just over 3.5%, having expected to be above 4% just before the Fed meeting. The market now sees the terminal rate being hit as early as February 2023 after most of the year so far has seen hikes priced in through the third quarter of 2023. That had a knock-on impact on Treasuries, with the 10yr yield down -6.9bps to 3.09%, and the 2s10s curve flattened -2.9bps to just 6.4bps. The Fed’s preferred indicator of the near-term forward spread also saw a large decline, with a -11.8bps move lower to 168bps, which was the lowest since early March.

US equities continued trading in wide intraday ranges but were ultimately boosted by the shallower expected path of policy tightening. The S&P 500 gained +0.95%, leaving it +3.29% on the holiday-shortened week and on pace for its first weekly gain in a month. It was an interesting sector breakdown with shares sensitive to discount rates gaining, as one might expect with the rate move, sending the NASDAQ +1.62% higher. Otherwise, there was a clear delineation between defensives, which outperformed due to the slowing outlook, and cyclicals which ended the day in the red. Utilities, health care, real estate, and staples led the index and all ended in the green, while industrials, financials, materials, and energy all finished in the red. So a risk-off defensive rally in the States. Energy was particularly hit by the fall in brent crude futures, which were -1.51% lower on the day and nearly back beneath $110/bbl for the first time since mid-May.

Over in Europe, there were further dramatic developments on the energy side, with German economy minister Habeck raising the country’s gas risk level to the second stage of the emergency plan. That takes them from the early warning phase to the alarm phase, with Habeck going as far as to warn about “a Lehman effect in the energy system” if the market collapsed. Our research colleagues in Frankfurt have written more about what this means (link here), but natural gas futures in Europe rose a further +3.33% yesterday to a fresh 3-month high of €131/MWh. The third and final stage of the plan would be the emergency phase, which occurs when there isn’t enough gas to meet general demand.

The fears of recession and the threat of energy shortages meant that European equities took a tumble again yesterday, with the STOXX 600 (-0.82%) closing at its lowest level in 16 months with banks (-3.17%) leading the way as cyclicals also got hit hard in Europe. The DAX (-1.76%) was a regional under-performer with all the focus on the German government gas alert. Sovereign bond yields also plummeted, with those on 10yr bunds (-20.6bps) seeing their largest daily move lower in over a decade, whilst those on 10yr OATs (-20.7bps), gilts (-18.2bps) and BTPs (-15.9bps) witnessed a significant pullback as well. Our European economists don’t think that growth uncertainties will derail the near-term exit path for the ECB, but they write in a blog post yesterday (link here) that the release is another catalyst for a shift in the debate from a question of how quickly they need to catch up, to how far they will be able to go.

Moving on to Asia, equity markets in the region are seeing decent gains overnight, with the Kospi (+1.66%) leading the pack followed by the Hang Seng (+1.23%), the Nikkei (+0.76%), the CSI (+0.74%) and the Shanghai Composite (+0.54%). Looking forward as well, US stock futures has risen overnight with contracts on the S&P 500 (+0.43%) and NASDAQ 100 (+0.70%) trading higher amidst the decline in bond yields.

In economic data, inflation in Japan is likely to remain closely watched after the core consumer prices climbed +2.1% y/y in May as expected, following a similar rise in April, a level not seen in seven years mainly because of higher energy prices. Excluding energy, prices were up +0.8% in May, also in line with market consensus, following a 0.8% increase in the preceding month.

Moving on to some political news, the Conservative party lost two parliamentary seats in yesterday’s by-elections, which will be unwelcome news for Prime Minister Johnson, who’s already seen 41% of his own MPs vote no confidence in his leadership at the start of the month. One of the losses was to Labour in the “red wall” seat of Wakefield, which had been Labour for the entire post-war period until it was won by the Conservatives in 2019, and the Conservative vote share was down from 47% at the last general election to 30% yesterday. Elsewhere, they also lost the usually safe Conservative seat of Tiverton and Honiton to the Liberal Democrats, with the Conservative vote share down from 60% in 2019 to 38% yesterday. Meanwhile, there was some bad news overnight on the economic front from the UK, with GfK’s consumer confidence reading dropping to a record low of -41 in June (vs. -40 expected), something not seen since the survey began 48 years ago.

To the day ahead now, and data releases include Germany’s Ifo business climate indicator for June, Italian consumer confidence for June, and UK retail sales for May. Over in the US, there’s also the University of Michigan’s final consumer sentiment index for June, and new home sales for May. From central banks, we’ll hear from the ECB’s Centeno and de Cos, the Fed’s Bullard and Daly, the BoE’s Pill and Haskel, and BoJ Deputy Governor Amamiya.

Tyler Durden

Fri, 06/24/2022 – 07:53

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com