Mike Wilson Flips Back To Bearish, Says “Sell Any Bounces Until We Make New Bear Market Lows”

A lot has changed since last Monday; in fact pretty much everything was flipped on its head after the two sudden, shocking bank failures over the past 72 hours – events which offered a sideways excuse to those who were bullishly biased – if only for tactical reasons – heading into last week, even though stocks dumped well before the small bank contagion, courtesy of Powell’s Congressional testimony which came out blisteringly hot.

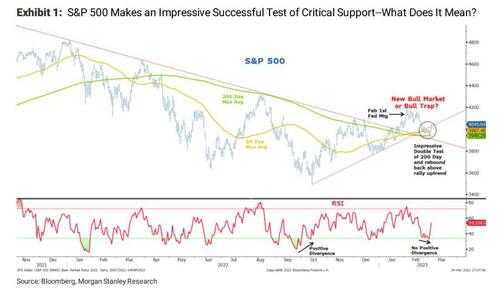

One such “tactical” bull was Morgan Stanley’s Mike Wilson who after 9 consecutive weeks of beating the bearish drum took a stab at turning bullish, telling the bank’s clients that “one will have to take their own view” of what the fundamentals and technicals suggest (after calling for a sharp drop in stocks for nearly three months which never materialized) and adding that “we could see further upside if the US dollar and interest rates continue their fall from Friday with next resistance for the S&P 500 at 4150 under such conditions.”

Well, we got both a weaker dollar and lower rates – and in spades – in the past few days, but of course there was a catalyst – namely catastrophic contagion in the regional banking sector after SIVB and SBNY both collapsed, sending shockwaves across the market.

In any case, after the recent shocking events, Wilson has quickly purged his brief flirtation with “tactical” bullishness, and since he no longer expects stocks to rise (which some sarcastically said was the catalyst why stocks dumped) is once again a die hard member of the “doom and gloom” camp – curiously even as the Fed hiking cycle now seems to lie in ruins with the 2Y absolutely clobbered in the past 3 days at the fastest pace since 1987’s Black Monday.

In his latest Weekly Warm-up note, the Morgan Stanley strategist writes that “with the unwind of a major bank (SVB) last week and now another (SBNY) over the weekend, it’s clear that the impacts of the Fed’s policy tightening are being felt.” And while the Fed’s intervention to backstop all uninsured deposits at these troubled institutions should help to prevent any further bank runs according to Wilson, he thinks “it does little to change the bigger picture of slowing growth that is already upon us” which of course is ironic because now – more than ever – the Fed is that much closer to capitulating on its hawkishness, and the moment it does so will send stocks limit up.

For Wilson, however, that is not something to lose sleep over, and he writes that “the cost of deposits has been on the rise for months and the events of last week are likely to put further upward pressure on those costs. Furthermore, Senior Loan Officer Surveys on lending standards have tightened considerably over the past 6 months and should only tighten further.”

As a result, he expects an “Equity Risk Premium Re-rating… As we have noted for months, we believe the rally from October was always just another bear market rally that would ultimately fade. The end of bear markets are typically punctuated by an event that accelerates the market’s pricing of the true downside in earnings.”

He then once again makes the claim that his view on earnings is still “very much out of consensus” even though in reality there is nothing that is more consensus than an earnings recession, for Wilson however that is not the case and he believes that it will get “properly priced via the Equity Risk Premium which has remained well below fair value. If such a period of adjustment has begun, one should expect at least a 200bps rise in the ERP from the recent lows of 150bps.”

This, again, as has been the case for the past 3 months, is the basis for his bearish bias, and he writes that “such a rise [in the ERP] would take the NTM P/E to 13-15x depending on how Treasury yields (and the Fed) react to this growth scare. That equates to significant downside from current levels.”

Digging a little deeper into his latest note, Wilson explains what – in his view – the collapse of the two banks means for markets:

First, we would remind readers that Fed policy works with long and variable lags.

Second, the pace of Fed tightening over the past year is unprecedented when one considers that the Fed has been engaged in aggressive quantitative tightening while raising the Fed Funds Rate by almost 500bps.

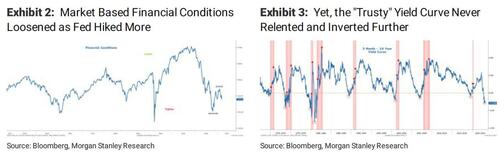

Third, the focus on “market based” measures of Financial Conditions may have lulled both investors and the Fed itself into thinking policy tightening had not yet gone far enough even though more traditional measures like the yield curve have been flashing warnings for the past 6+months. In fact, since mid October of last year, the market based financial conditions measures actually loosened considerably until the upward surprise on January payrolls was released. Since then, financial conditions have tightened again as equities and other risk markets sold off. However, at no point during this time did the trusty yield curve flinch. Instead, it has steadily inverted further, closing last week near its lowest point of the cycle at -120bps.

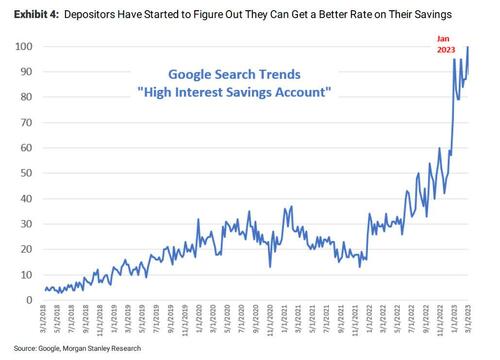

Wilson next points out one of the key catalysts behind the bank failures, namely that for the longest time banks failed to pass through higher rates to depositors (especially giant banks like JPM), however that changed recently and the small banks were the first to get whacked, to wit:

Over the past year, bank funding costs have not kept pace with the higher Fed Funds Rate allowing banks to create credit at profitable NIMs. In short, most banks have been paying well below market rates because depositors have been slow to realize they can get a much better rate elsewhere. But, that has changed more recently with depositors deciding to pull their money from traditional banks and putting it into higher yielding securities like money markets, T-Bills and the like. We expect that trend to continue unless banks decide to raise the rate they pay depositors. That means lower profits and likely lower loan supply.

Said deposit flight coupled with the fact that loan standards have been tightening sharply tightening as per the latest SLOOS report, makes Wilson believe that tightening “is likely to become even more prevalent given last week’s events and that poses headwinds for money supply, and consequently, economic and earnings growth.” In other words, the MS strategist believes that “it’s now harder to hold the view that growth will prove to be ok in the face of the fastest Fed tightening cycle in modern times. Secondarily, the margin deterioration we have been discussing for months is still getting worse. Any top line short fall will only exacerbate this negative operating leverage dynamic, in our view.”

Wilson’s bottom line is that Fed policy works with long and variable lags: “many of the key variables used by the Fed and investors to judge whether Fed policy changes are having their desired effect are backward looking–i.e., employment and inflation metrics. Forward looking survey data are often much better at telling us what to expect rather than what is currently happening. On that score, the picture is pessimistic about where growth is likely headed, especially for earnings. Rather than a random or idiosyncratic shock, we view last week’s events as just one more supporting factor for our negative earnings growth outlook–i.e. it only exacerbates key headwinds like credit/money supply growth. In short, Fed policy is starting to bite, and it’s unlikely to reverse even if the Fed were to pause its rate hikes or quantitative tightening–i.e., the die is cast for further earnings disappointments relative to consensus and company expectations.”

His conclusion:

We suggest selling any bounces on a government intervention to quell the immediate liquidity crisis at SVB and other institutions until we make new bear market lows, at a minimum. Furthermore, we do think that tighter credit availability from banks will weigh on small cap companies more significantly, and last week’s underperformance by the small cap indices supports that view and further throws cold water on the new bull market narrative we have been hearing from others over the past few months.

While we actually agree – for once – with Wilson that Fed policy is starting to bite – and how can it not when the “Credit Event” that always accompanies rate hikes which we have been warning about since early 2022 finally kicked in…

Remember, every Fed tightening cycle ends in disaster and then, much more Fed easing pic.twitter.com/zX7Dur8nLG

— zerohedge (@zerohedge) January 5, 2022

… and it is always credit events that force the Fed to end its tightening cycle, where we disagree is his argument that “even if the Fed were to pause its rate hikes or quantitative tightening” which it will in just over a week according to Nomura, “the die is cast for further earnings disappointments relative to consensus and company expectations.”

Yes, the die may be cast for the economy and company earnings, but when it comes to the markets, investors will now sniff out not only the pause but the pivot and the rate cuts – something they are already doing by pricing in 65bps of rate cuts by September, a whopping collapse from 110bps of rate hikes as recently as last Thursday.

The point being: we agree with Wilson that it’s about to get worse – in a deflationary sense – for the broader economy, and thus earnings, where we disagree is in the market’s reaction because while earnings may collapse and growth may collapse, the Fed will react much more promptly this time now that banks are failing, and will be willing to ignore some latent inflation if it means banking sector stability. And once the Fed capitulates, hold on to your hats as 16x PE are repriced to 20x or more as the muscle memory from the Covid shock kicks in.

And while we see Mike Wilson’s point, we have long been much more vocal supporters of the (much more accurate) views and predictions made by that other Michael – BofA’s Hartnett – who once again hit the bullseye with his preview of recent events, first warning on Feb 18 that “Fed Will Tighten Untill Something Breaks… And Stocks Will Swoon To 3,800 By March 8” which was absolutely spot on…

Feb 18: Hartnett: “Fed Will Tighten Untill Something Breaks… And Stocks Will Swoon To 3,800 By March 8”

off by 2 dayshttps://t.co/Aj3JWhcwjo

— zerohedge (@zerohedge) March 13, 2023

… and which he followed up by saying that ‘”The End Of The Bear Market Will Coincide With A Credit Event””…

Michael Hartnett last week:

“The End Of The Bear Market Will Coincide With A Credit Event”https://t.co/DnVJbiIvkV

— zerohedge (@zerohedge) March 10, 2023

… a credit event the likes of which we just had, and now the only missing link is for the Fed to admit as much and restart the only game in the centrally-planned town.

Michael Wilson’s full note can be found here.

Tyler Durden

Mon, 03/13/2023 – 23:57

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com