Lira Plunges After Erdogan Appoints Co-CEO Of Failed First Republic Bank As New Central Bank Governor

Turkish President Erdogan, fresh from his re-election as president, has named Hafize Gaye Erkan as the new central bank head – and first ever female CBRT governor – replacing Sahap Kavcioglu in a move that some optimists claim may signal an attempt at returning to more conventional monetary policy (spoiler: it won’t). But even if it does mean the attempted end of Erdoganomics, the outcome will be another disaster for the Turkish economy for the simple reason that Erkan was formerly co-CEO of the failed First Republic Bank, and before that she of course worked at Goldman Sachs. Her current job will be to oversee the failure of Turkey, and take as much of the blame as possible even though the real culprit is someone else entirely.

The announcement, made through a decree in the Official Gazette, completes a makeover of Erdogan’s top economic team after Mehmet Simsek’s appointment as treasury and finance minister. In his time as governor, Kavcioglu never deviated from Erdogan’s belief that lowering interest rates can slow inflation.

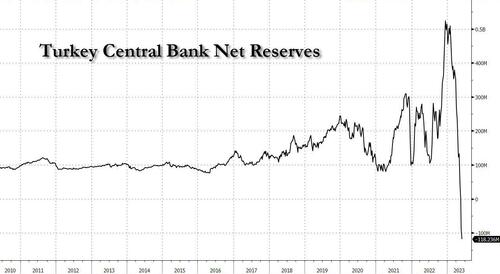

And now that Turkey is out of reserves, even if Erdogan wants to put an end to the devastating MMT episode he put his country through, there simply is no more money.

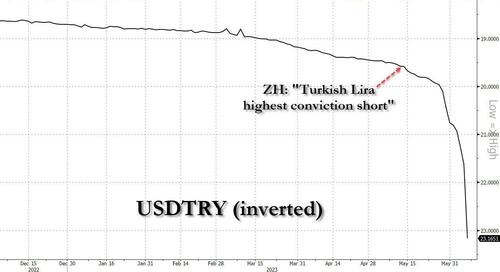

While Bloomberg incorrectly claims that her appointment “was taken by markets as a sign of possible normalization in Turkey’s monetary policies after years of ultra-low borrowing costs” the reality is just the opposite and the lira quickly tumbled to a fresh record low in Asia on Friday after the news hit. The currency was indicated down almost 2%, which would mark a fresh record low.

While we expect Erkan to be fired within a month or two, if not weeks, her success will also depend on how much policy autonomy she will enjoy under Erdogan, according to Nick Stadtmiller, head of product at Medley Global Advisors.

“Erkan’s appointment hopefully marks an improvement over the policies of her predecessor,” he said. “The lingering question is whether Erdogan will allow the central bank to raise rates sufficiently to bring down inflation.”

And since Erdogan will never allow anyone else to have full autonomy over Turkey’s money printer, the answer of how much Erdogan will allow rates to rise is zero.

The Turkish central bank has been at the center of the growth-at-all-costs strategy that Erdogan has pursued since he turned his office into the nexus of all executive power in 2018. Erdogan argues lower interest rates slow inflation, a belief that contradicts conventional economic theories. There is no reason why Erdogan’s outlook on economics should change now that a return to normalcy would mean a devastating economic depression: at least as long as he pursues the status quo, Erdogan can pretend that it’s some evil outside force that is causing Turkey’s misery, much as he has been doing for the past decade.

And to show just how much Erdogan demands to be in charge of the central bank, before installing the outgoing central bank Kavcioglu as governor in March 2021, Erdogan ousted his three predecessors for tightening monetary policy too much as he wielded more power over the direction of interest rates.

Kavcioglu never deviated from Erdogan’s guidance on borrowing costs. Despite price growth reaching a peak of 86% last year, the central bank under his stewardship delivered zero rate hikes and instead slashed the benchmark to 8.5% from 19% at the start of his tenure. The result is hyperinflation, economic collapse and a currency that looks like this.

Finally, since merely switching around puppets will do nothing for the country which now needs to sell most of its gold to kick the can for at least a few months, we expect that today’s news will inevitably lead to an even faster collapse in the Turkish Bolivar. Indeed, at least check the USDTRY was trading at 23.56 for the dollar, a fresh record low.

Tyler Durden

Thu, 06/08/2023 – 21:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com