What If This Is The Economic End-Cycle

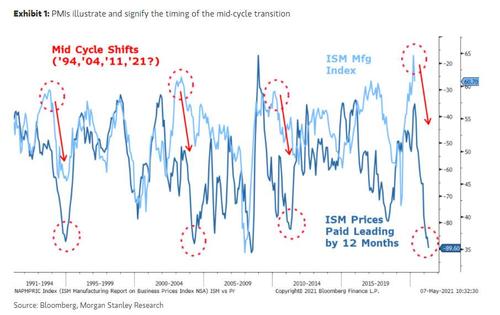

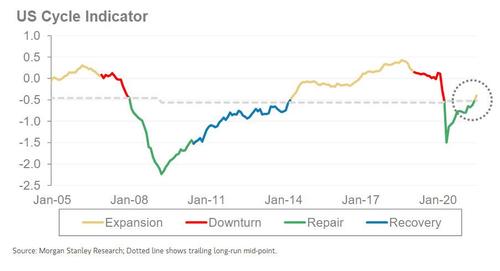

A few months ago, Morgan Stanley’s chief equity strategist Michael Wilson, who also recently emerged as the biggest Wall Street bear warning that the “rolling corrections” in the market presage a 10-20% drop in stocks, summarized the current economic state simply as “mid cycle“…

… which of course is the best place to be, as the initial euphoric surge higher in stocks tapers to a slow and steady grind as the economy chugs along at a modest pace.

But what if he is wrong? After all, yesterday the NBER determined that the covid recession – at just 2 months – was the fastest on record (even as 14 million Americans are out of a job and still collect unemployment benefits) and we are already well into the mid cycle, if not approaching the end.

Also it is none other than Wilson’s own employer Morgan Stanley, which has also said recently that this cycle will be “hotter but shorter” than usual.

Does it not stand to reason then, that the economic cycle is now so truncated – courtesy of $30 trillion in global stimulus – that we have blasted right through the midcycle phase and are now nearing the end?

That is the question Deutsche Bank’s credit strategist Jim Reid asked overnight, when he described this recovery as “undoubtedly the most unusual in history with many sectors of the economy already running ahead of their pre-recession trend” even though several serviced based ones are still well behind though. More importantly, according to Reid and DB economists, the output and employment gap will likely close in the next couple of quarters which will be the quickest for both in observable economic history.

Reid then takes a look at where real GDP, nominal GDP, CPI, unemployment, retail sales, equities, household wealth, housing, treasuries and commodities are against all other recoveries for most variables goes back over 100 years. The chart below shows real GDP and as Reid explains, “for most of these, this current post covid recovery is near the top” making this recovery neck and neck with the fastest post-WWII expansion.

As Reid puts it, “clearly this cycle saw a big drawdown due to the pandemic but so did the GFC and its notable that the post-GFC recovery was around the weakest at the same stage” which begs the question: “should this be seen as the start of a new cycle or a continuation of the last cycle after a period of covid related hibernation? The answer to this will give us clues as to how long this cycle lasts, future Fed activity, and on the inflationary consequences of the current strong rebound.”

Tyler Durden

Tue, 07/20/2021 – 10:10![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com