JPMorgan Says Delta Cases About To Turn Lower As Kolanovic Calls The Bottom For Yields And Cyclicals

It has been nearly two years since JPMorgan’s Marko Kolanovic first called the rotation out of growth and into value stocks that was triggered by the repo crash in Sept 2019, a “once in a decade” event, and which he boldly predicted would continue for long time. Alas, it did not, with value stocks imploding during the covid crash of March 2020 (energy and bank stocks disintegrated for much of 2020) wiping out trillions in value (no pun intended); And while value stocks did rebound modestly courtesy of the great reflation rotation of late 2020 early 2021, growth has once again taken the baton as the best performing strategy in a time when concerns are spreading that the world is destined to live between covid lockdowns for the indefinite future, benefiting the well-known secular stagnation theme and boosting growth names.

However, even as value stocks resumed their P&L crushing ways, JPMorgan’s Kolanovic doubled, tripled, and quadrupled down on his conviction call that value is set to surge and trounce growth (see “Kolanovic: Most Are Unprepared For The Coming Inflation Shock“) as the market is grossly exaggerating the impact of the Delta variant (see “JPM’s Kolanovic: The Delta Variant Does Not Pose A Risk For Markets“) while betting his credibility on the advent of a commodity supercycle which is looking quite shaky in recent days (Kolanovic: A New Commodity Supercycle Has Begun).

Yet while markets stubbornly refuse to comply with the Croat’s views, with energy stocks disconnected from underlying commodities by the most on record, that has not prevented Kolanovic from pushing on with this value thesis and despite all recent setbacks, the JPM quant is still convinced that value stocks is the place to be, telling client in a note published today that “yields and cyclicals likely bottomed last week and are now on an upward trajectory for the rest of the year” to wit:

Over the past weeks, clients have asked us about various market risks and the possibility of a near-term correction. In this note we assess some of these risks and provide our views. Given the strong earnings season, market positioning, signs of receding COVID-19 Delta variant in the US, and normalization of bond-equity correlation, we remain constructive. In particular we like cyclical and reflation-linked market segments, and are cautious on beneficiaries of lockdowns and low bond yields. In fact, we believe that bond yields and cyclicals bottomed last week and are now on an upward trajectory for the rest of the year.

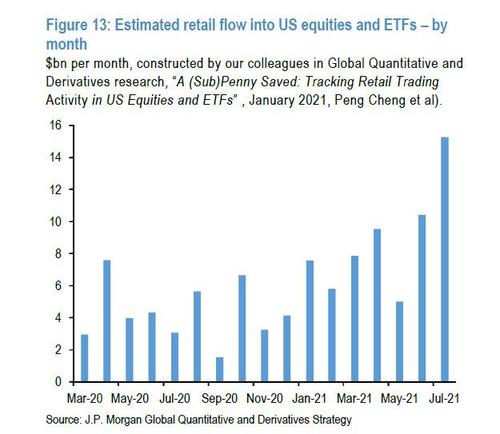

Addressing the first question, namely investor positioning, Kolanovic responds as he always does – namely that no matter how high stocks are positioning is always average at best, even though both major bank prime brokers show record gross exposure among hedge funds, which retail investors are by now clearly “all-in” stocks.

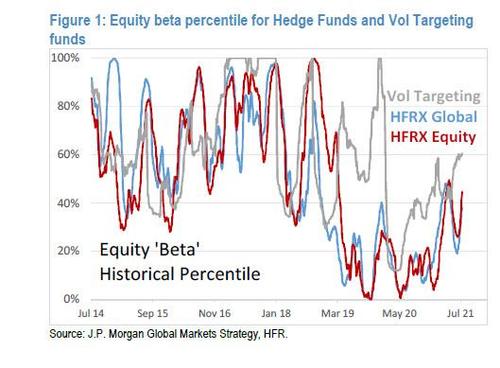

Facts aside, Kolanovic writes that while his estimates of equity positioning have been rising, they “are currently around historically average levels when compared with a 10-year history. Figure 1 shows percentile equity beta for broad hedge funds, equity long/short hedge funds and volatility targeting funds (such as insurance companies, risk parity, etc.).”

At least the Croat concedes that “increased exposure of these funds has certainly helped equity markets this year” however where the JPMorganite takes creative liberty is estimating that “these measures are near historical average levels (~50th percentile on average, with systematic higher than discretionary)” which matters because according to him “most corrections historically happen when these measures are above ~80th percentile, but we note there were cases when the exposure can stay at 100th percentile for a year without a significant correction.” In other words, everyone is all in and can be even more all in, and nothing will happen… which is of course correct in a market where broad investor positioning is completely irrelevant and just one investor’s positioning – the Fed – matters.

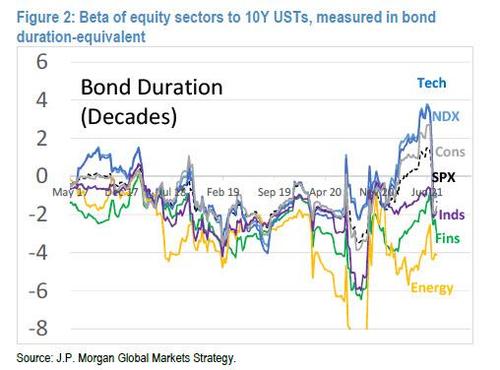

So if investor positioning is not a risk, what is? Well, according to Kolanovic, the next risk factor is a potential sharp rise in yields (e.g., related to tapering, inflation, etc.): This matters considering JPM’s view “that yields have bottomed last week and that various market segments significantly benefited from the decline in yields since April.” The beta of various market sectors to the price of 10-year bonds is shown below.

Discussing the chart above, Marko writes that during July, the Tech sector had a bond beta of +4, while financials had a beta of -3. “In other words for a 1% increase in 10- year bond prices, tech rallied 4% and financials sold off 3%, on average. Post earnings season this correlation eased, and now all equity sectors have the typical negative correlation to bond prices. Over the past month, Nasdaq sectors (i.e., tech, discretionary, communications) drove the beta of the S&P 500 to bonds higher, from negative territory in Q2 up to ~1.”

The obvious risk here – for those for whom it is not obvious as the JPM quant explains – is that a quick reversal of this correlation during the bond sell-off that could result in a var shock (bond and equity sell-off). This is what happened in February 2018 (volmagedon) and October 2018 (hawkish Fed sell-off). In both of those instances, JPM’s estimate for 1-day vol targeting selling was over $50bn (and a multiple of that with the contribution of derivative convexity, CTAs, fundamental selling, etc.) and led to an avalanche effect starting in bonds and propagating across stocks.

Not surprisingly, here too Kolanovic – who in the past 4 years has never seen a market all time high he didn’t like, in dramatic reversal from his earlier, more skeptical self – finds little risk and writes that “looking at the current level of positioning, volatility and other factors, we assess that such an event would require a ~3% selloff in both equities and 10 year bonds in 1 day. This is quite unlikely given that correlations have eased and is mitigated by the contribution of cyclical sectors, recent increase in bond yields, and post earnings price action in growth stocks.”

Still, while he assures clients that “this risk is currently not high”, Kolanovic does note that “investors can hedge it by reducing duration in bonds and equities” but only inasmuch this leads to a shift away from growth names and to his favorite “value” sector, to wit he says that investors may reduce tech exposure and increase exposure to cyclical sectors like energy, financials, and industrials.

This is actually a notably point because as Kolanovic calculates, the bond beta of a tech vs energy ‘market neutral’ position in July was 8, which was equivalent to holding an 80-year bond – risk that is frequently overlooked in, for example, ESG portfolios or Long-Short HF pods.

Still, while the Croat does admit that yields will spike, he is confident this spike won’t be fast enough to lead to a broader wipeout, to wit:

While we believe that bond yields will increase significantly, the risk of a broad market sell-off driven by tech-bond correlation is not high and can be mitigated. This is another a reason why we prefer cyclicals, international stocks, and value.

So if the risk from both positioning and rising yields (i.e. tapering) is contained, (something which both Goldman, BofA and Morgan Stanley quite vocally disagree with) is there anything at all to be worried about? According to Kolanovic, the main risk factor driving asset classes over the past few months (and certainly in July) was fear of the COVID-19 Delta variant while “narratives of peak growth, China slowdown, hawkish Fed, etc., were not helping, but did not resonate with the majority of investors.”

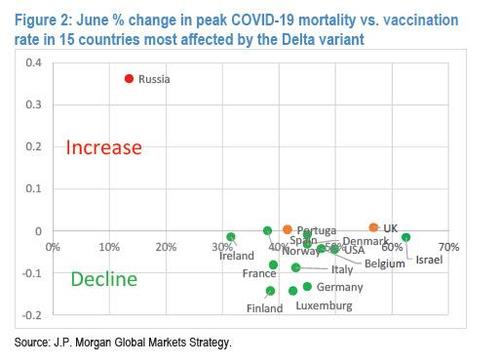

As previously discussed, Kolanovic – unlike an army of virtue-signaling Wall Street liberals – is quite confident that despite high cases, “low mortality of the delta variant in vaccinated countries should help investors look through this – likely the last – COVID-19 wave.”

Echoing what he wrote at the end of June, Kolanovic notes that “constant Delta variant COVID-19 developments in India, the UK, the US, and China dominated sentiment. The UK Delta episode, where investors could see relatively low peak mortality and the fast timeline of a spike, was not enough to change the market sentiment, and it appears that investors are waiting for the inflection in US cases.” This might be happening, he notes and – as we observed yesterday – adds that “there are strong signs the US is starting to turn the corner in the Delta variant COVID-19 infections. A significant signal of the upcoming peak in US COVID-19 infections is the effective reproduction number (Rt) that is now declining in 40 out of 50 US states (see here). For instance, in FL this indicator declined from ~1.4 to ~1 over the past few weeks, in a sign cases may start dropping soon. In fact, in several states with early Delta variant outbreaks, COVID-19 cases already started declining (Utah, Missouri, Alaska and possibly Nevada and Wisconsin).”

This, he concludes, “makes us believe that the US inflection is days away, and that bond yields and cyclicals bottomed last week.”

So positioning is average, taper risk is contained, and delta is on its way out. Does Kolanovic sees any other risks to the market?

The answer is yes, a few, but nothing that is big enough to dent Kolanovic’s permabullish outlook on stocks (where the only reason for the constant market upside has nothing to do with anything he has said and everything to do with the Fed’s balance sheet). Among the secondary risks listed by the JPM quant include another leg lower in sectors that exhibited bubble-like behavior since the onset of the COVID-19 pandemic. Those include stocks related to COVID-19 lockdowns, renewable energy and EVs, crypto, hyper-growth and innovation stocks.

While these segments experienced a significant correction early in the year, we believe that there will be another leg lower. The final level of correction is likely determined by convergence of valuations between these and equivalent traditional sectors (e.g., EVs to autos, renewables to energy, hyper-growth to growth, etc.).

But while these rolling bubble bursts may continue, Kolanovic does not think that together they are powerful enough to crash the market: “As we saw earlier in the year, these segments are not significant enough to destabilize the whole market.”

Finally, the Croat quant expect an increase and amplification of geopolitical and political risks next year: “these will be related to various interdependent issues such as geopolitical relationships with China, Russia, Iran, issues around energy security, inflation, and US political developments.” However, we are confident that if and when these materialize, Kolanovic will remain bullish (and pitching value) as long as the Fed continue to inject billions of liquidity into markets every single month.

Tyler Durden

Thu, 08/12/2021 – 14:28![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com