Apple Slides On Weak iPhone Sales, Inventory Surge, 3rd Straight Quarter Of Declining Revenues

With all other megatech companies reporting solid earnings, all eyes were on the results from the last giga-cap kahuna, the world’s largest company, Apple and its $3+ trillion market cap.

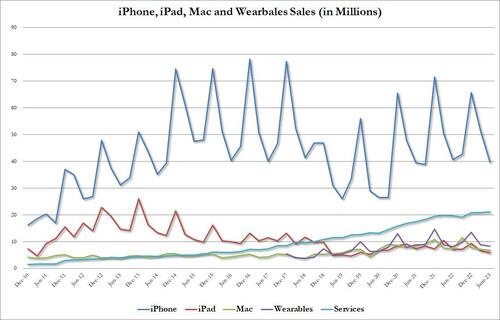

As previewed earlier, analysts expected Apple to report a modest revenue slowdown YoY (iPhone revenue of $49 billion, down from $50.6 billion, iPad revenue: $6.7 billion, down from $7.6 billion; Mac revenue: $7.7 billion, down from $10.4 billion; Services revenue: $21.1 billion, up from $19.8 billion and Wearables/Home/Accessories revenue: $8.5 billion, down from $8.8 billion) while EPS of 1.20 would be flat from 1.20 a year ago.

With that in mind, this is what Apple just reported for its fiscal Q2:

- EPS $1.26, up from $1.20 a year ago, and beating the estimate of $1.20

- Revenue $81.80 billion, down 1.4% y/y, but also beating estimates of $81.55 billion.

- Products revenue $60.58 billion, -4.4% y/y, missing estimates of $60.67 billion

- IPhone revenue $39.67 billion, -2.4% y/y, missing estimates of $39.8 billion

- Mac revenue $6.84 billion, -7.3% y/y, beating estimates of $6.37 billion

- IPad revenue $5.79 billion, -20% y/y, missing estimates of $6.33 billion

- Wearables, home and accessories $8.28 billion, +2.5% y/y, missing estimates of $8.38 billion

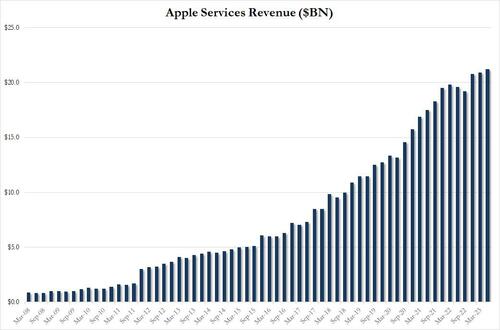

- Service revenue $21.21 billion, +8.2% y/y, beating estimates of $20.77 billion

- Greater China rev. $15.76 billion, +7.9% y/y, beating estimates of $14.59 billion

- Gross margin $36.41 billion, +1.5% y/y, beating estimates of $36.03 billion

- Cash and cash equivalents $28.41 billion, +3.3% y/y, beating estimates of $24 billion

While the numbers were mixed, with revenue of almost $82 billion coming above expectations thanks to strong service revenue offsetting a miss in iPhone, iPad and wearables, what the market did not like is that this was the 3rd consecutive quarter of annual revenue declines: the first time for AAPL since 2016.

And while we wait for the company’s guidance during the 5pm call, the market did not surprise the market with another buyback announcement, unlike last quarter when it unveiled an additional $90 billion stock repurchase.

Looking at the revenue breakdown, Apple missed across almost all product categories, with the only exception a modest beat in Mac revenues:

- iPhone Revenue $39.67B, missing estimates of $39.8B

- Wearables, Home & Accessories revenue of $8.28B, missing estimates of $8.38B

- Mac Revenue $6.84B, beating estimates $6.37B

- iPad Revenue $5.79B, missing estimates of $6.33B

- Total products Rev. $60.58B, missing estimates of $60.67B

As we noted last quarter, what markets may be concerned about is that AAPL appears to be reaching a “double top” in product revenue, and indeed with the exception of Services, almost every product class did slowdown from a year ago.

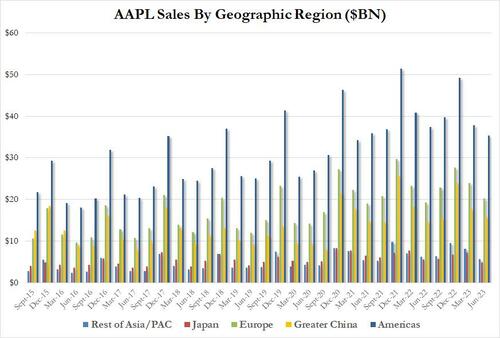

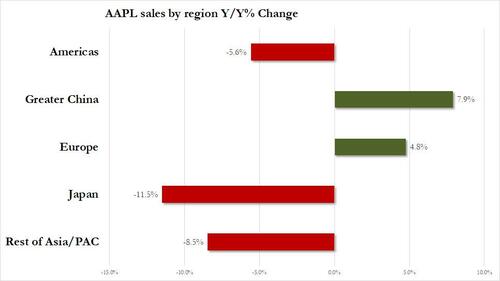

One place where investors may have been pleasantly surprised was China sales, which at $15.76 billion, beat estimates of $14.59 billion.

And while China’s YoY growth rate of 7.9% was impressive, this was more than offset by a slowdown in good old USA where revenues dropped by 5.6%, and while Europe rose 7.9%, Japan actually tumbled by double digits, sliding 11.5% perhaps as a result of the collapse in the yen’s purchasing power.

There was some more good news in Services revenue, which at a time when products continue to slowdown, printed at a fresh record high of $21.2 billion, a reversal to last quarter’s miss.

Alas, there was more bad news, and this time not so much on the income statement but the balance sheet, where inventories unexpectedly surged from where they were at the end of September, by 49%. As Bloomberg asks, “Is that a build-up ahead of a launch or a worrying accumulation of unused components?”

We hope to get an answer at the earnings call, but until then, the market was not happy with what Apple reported, and after kneejerking higher briefly, the stock has slumped down 1% after hours, sliding to one month lows, and reversing much of the post-Amazon euphoria.

Tyler Durden

Thu, 08/03/2023 – 17:08

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com