Bitcoin Mining Can Reduce Up To 8% Of Global Emissions: Report

Authored by Ezra Reguerra via CoinTelegraph.com,

A paper published by the Institute of Risk Management (IRM) concluded that Bitcoin has the potential to be a catalyst for a global energy transition.

IRM Energy and Renewables Group members Dylan Campbell and Alexander Larsen published a report titled “Bitcoin and the Energy Transition: From Risk to Opportunity.”

The paper argued that while BTC was perceived as a risk because of its energy consumption, it can also catalyze energy transition and lead to new solutions for energy challenges worldwide.

Within the report, the authors also highlighted the important function of energy and the increasing need for reliable, clean and more affordable energy sources.

Despite the criticisms of Bitcoin’s energy intensity, the study provided a more balanced view of Bitcoin by showing the potential benefits BTC can bring to the energy industry.

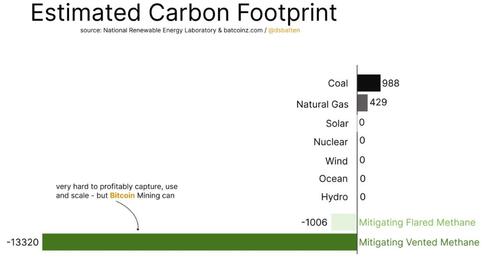

Amount of vented methane that can be used in Bitcoin mining. Source: IRM

According to the report, Bitcoin mining can reduce global emissions by up to 8% by 2030. This can be done by converting the world’s wasted methane emissions into less harmful emissions. The report cited a theoretical case saying that using captured methane to power Bitcoin mining operations can reduce the amount of methane vented into the atmosphere.

The paper also presented other opportunities for Bitcoin to contribute to the energy sector.

“We have shown that while Bitcoin is a consumer of electricity, this does not translate to it being a high emitter of carbon dioxide and other atmospheric pollutants. Bitcoin can be the catalyst to a cleaner, more energy-abundant future for all,” the authors wrote.

According to the report, Bitcoin can contribute to energy efficiency through electricity grid management by using Bitcoin miners and transferring heat from miners to greenhouses.

Tyler Durden

Sun, 09/24/2023 – 13:50

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com