Authored by Chetan Ahya, chief economist and global head of economics

This past week, media reports have indicated that China, Germany and the US could be considering new fiscal stimulus measures. China may raise local government bond issuance to accelerate infrastructure spending, Germany is possibly considering steps to potentially run a budget deficit for the first time in years, and the US may be weighing up a payroll tax cut.

Structural and cyclical challenges argue for fiscal policy action

It’s clear that monetary easing won’t be enough to reverse the deteriorating outlook for global growth. Structurally, weaker demographics, elevated debt and disinflationary pressures (our ‘3D challenge’) are exerting a drag. Declining natural interest rates have meant that monetary policy by itself will not be enough to stimulate aggregate demand and lift inflation expectations. Over the last ten years, the GDP deflator in developed economies has averaged just 1.2%, well below the central banks’ 2% goal.

Cyclical developments have made matters worse. Trade policy uncertainty is pushing global growth to a post-crisis low. Slower growth has sharpened the focus on liquidity trap challenges – long-standing in Europe and Japan – and is raising questions about the effectiveness of monetary easing. Case in point: the G4 policy rate is 0.9%, and the corresponding 10-year government bond yield is 0.5%. We’ve been arguing that monetary policy support can’t drive a recovery as long as trade policy uncertainty stifles private sector confidence and demand.

Decisive moves or disappointment?

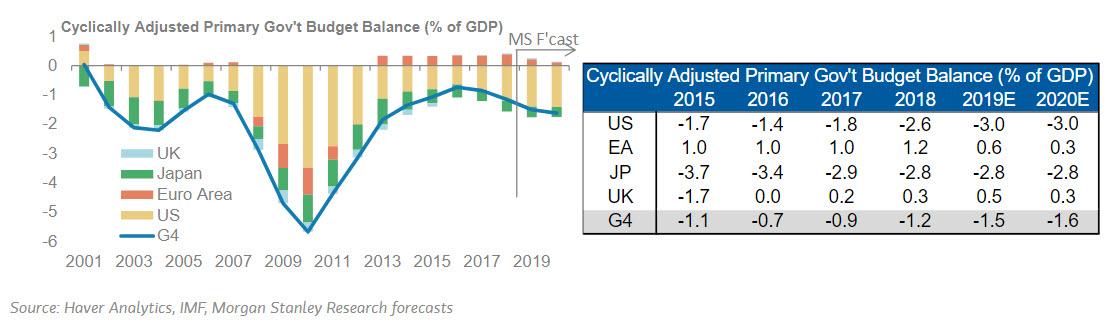

We expect the latter. The current cyclical downturn is driven by an exogenous shock (trade uncertainty), and monetary and fiscal policy has largely been reactive. Furthermore, political and legal constraints leave little room for aggressive fiscal action in the near term. While some fiscal stimulus is under way this year, we expect limited further expansion next year (the cyclically adjusted G4 fiscal deficit will rise to 1.5% of GDP in 2019 on our forecasts, from 1.2% in 2018, and will rise marginally to 1.6% in 2020).

In Germany, we think policy-makers will announce additional stimulus mostly in response to recessionary conditions. As our chief euro area economist Daniele Antonucci highlights, Germany’s constitution requires a nearly balanced structural budget through the cycle. Only in the case of a severe recession is a deficit possible, provided there’s a binding amortisation plan to reduce the extra borrowing and only with an absolute majority in parliament. Our expectation for a larger German fiscal boost would probably increase if growth was to slow more than we forecast. But, rather than proactive and swift, we believe that any additional stimulus from Germany will likely be reactive and gradual.

Similarly, in the US, the administration faces hurdles for additional fiscal expansion in the near term. Our US economics team notes that cutting the social security payroll tax from 6.2% to 4% would boost disposable income by US$250 billion (+1.5%). But as our US public policy strategist Michael Zezas argues, a payroll tax cut needs congressional support, and the election season backdrop will make passing major legislation a challenge. Hence, bipartisan agreement appears unlikely until we see a severe growth slowdown.

Among the large economies, China could implement meaningful fiscal easing. Policy-makers have already delivered a US$250 billion stimulus package (including tax cuts and reducing the corporate sector’s burden for social security). Unfortunately, weak corporate confidence means that most of the benefits will be saved. While the government could pre-emptively announce additional fiscal easing in the form of direct public spending, this may renew financial stability concerns.

We therefore expect China’s policy response to be defensive, i.e., measures will be announced if downward pressures on growth persist. Given continuing weakness in the data, our chief China economist Robin Xing expects additional fiscal stimulus of US$100-125 billion for infrastructure spending. However, with continued trade uncertainty weighing on external demand and private investment, and policy-makers maintaining a tight grip on lending to the property sector, we expect overall GDP growth to remain relatively weak at~6%Y.

A slowdown is set in motion

Lingering trade-related uncertainty has put the wheels of a global slowdown in motion. We expect global growth to slow further, to 2.8%Y in 4Q19, and remain below 3%Y for the first half of 2020, as the slowdown is broadening out to the non-manufacturing sector, labour markets and consumption. Continued trade tensions, combined with reactive monetary and fiscal policy, mean that the risk of non-linear tightening in financial conditions, triggering a global recession, is high and rising.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com