Late on Friday, when we noted that according to Argentina’s next president, Alberto Fernandez, the country’s upcoming bond default, its 9th since declaring Independence, was the IMF’s fault as much as that of outgoing president Mauricio Macri, we pointed out that Buenos Aires has a more pressing problem: running out of money.

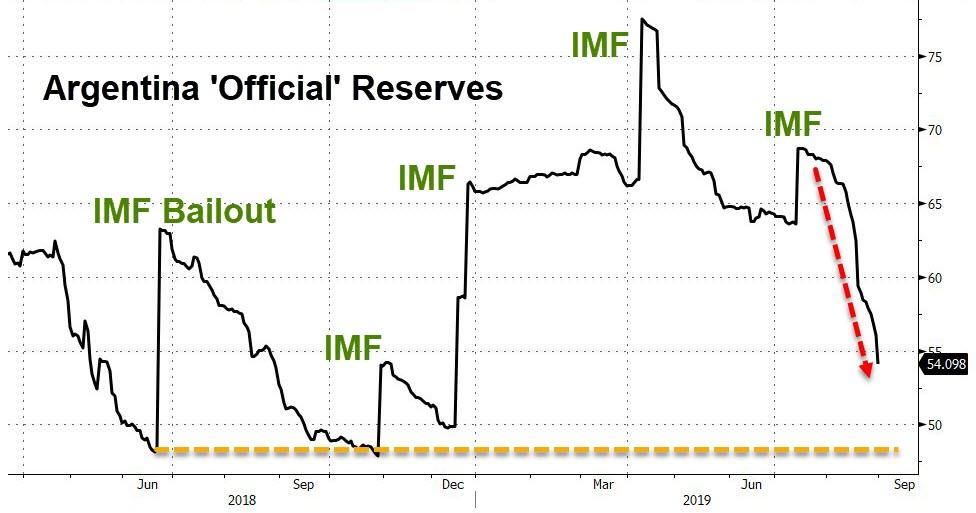

Specifically, we noted that “the central bank has spent close to $1.5 billion to meet rising demand for dollars since mid-August, or about 10% of its net foreign-currency reserves. Worse, according to calculations by First Geneva Capital Partners, Argentina will drain its net foreign currency reserves within the month if it continues spending dollars at the current rate.” “So”, we concluded, “Buenos Aires has a choice: watch as its currency becomes the next Bolivar, or run out of dollars in days.”

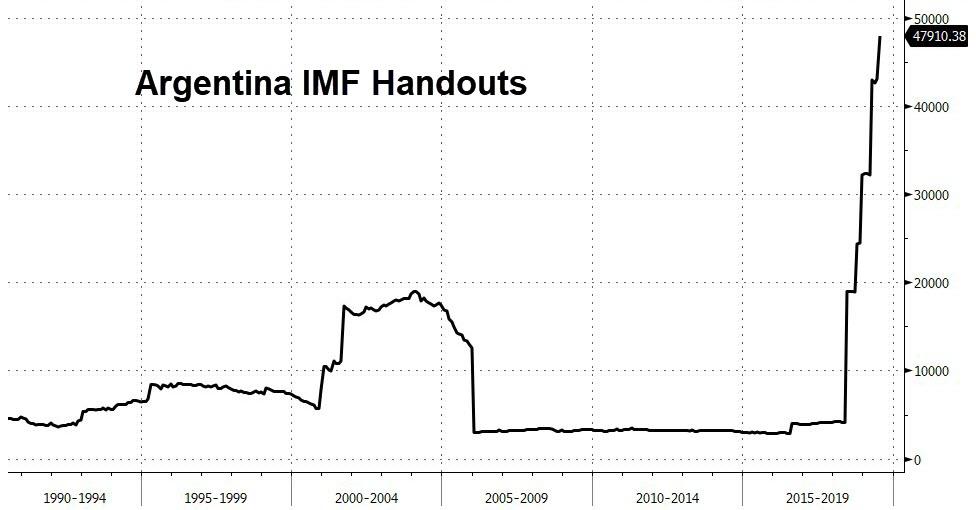

Two days later Buenos Aires, still not quite sure which path to pursue, did the only thing it could do to avoid a full-blown financial collapse: impose capital controls, which “oddly enough” appears to be a now standard development almost every time the IMF comes in to “rescue” an insolvent nation. Incidentally, without those generous (and record) IMF loans, Argentina would have run out of reserves by now.

As Reuters reports, citing a decree published in an official bulletin on Sunday, the Argentine government authorized the central bank to restrict currency purchases. The decree includes major exporters, which will need permission from the central bank to access the FX market to purchase foreign currency and make transfers abroad. The central bank will also set a deadline for exporters to repatriate foreign currency.

Things went from terrible to even worse last week, when Argentina defaulted on creditors to local short-term debt on Wednesday, at which point Argentina also said it will ask holders of $50 billion of longer-term debt to accept a “voluntary reprofiling.” It also plans to renegotiate payments on nearly $50 billion it has borrowed from the International Monetary Fund.

Argentina’s peso disintegrated last month after primary election results showed the market-friendly government has little chance of retaining power in October’s polls, sending interest rates soaring as the central bank failed to roll over debt, resulting in a decision to delay payments on $7 billion of bills coming due this year.

As the central bank tried to shore up the currency, foreign currency reserves tumbled, losing $3 billion on Thursday and Friday alone.

The opposition – which has called for currency controls, saying the government was in “virtual default” – got its wish.

Which brings us to the two outstanding questions now that Argentina is not only in default but has locked itself out of global capital markets: i) whether Emerging Market investors, such as Franklin’s Michael Hasenstab, who are getting margined out of billions in underwater positions, will be forced to liquidate other EM exposure, leading to a domino effect, and a deluge of emerging market selling; and ii) whether the IMF will cut its billions in losses, and at last check it was just under $50 billion in Argentina loan handouts…

… or will it, as the IIF’s Robin Brooks’ contends, agreed to double down and inject even more in hopes that this time, its bailout of Argentina will work.

Our long-standing view is that the IMF program was too small to begin with, given Argentina’s external borrowing spree in 2016-18 (red). Question now is how much of an effective up-sizing of the program re-profiling represents. Follow @SergiLanauIIF @mcastellano44 for our views. pic.twitter.com/IPztL3ngBW

— Robin Brooks (@RobinBrooksIIF) August 29, 2019

https://platform.twitter.com/widgets.js

Considering that the biggest source of IMF funding are US taxpayers…

… perhaps it is they who should finally have a say if the IMF should be allowed to continue its disastrous track record with Argentina.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com