The September rollercoaster has started early.

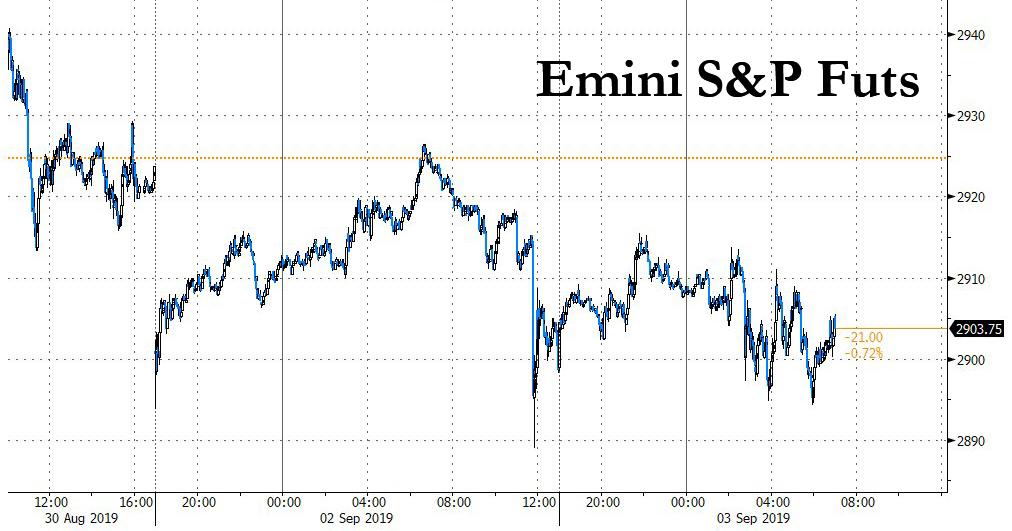

One day after stocks first tumbled, when the US and China launched a new round of sanctions over the weekend, then rebounded for no comprehensible reason, then tumbled again following a Bloomberg report of difficulties in setting a schedule as both sides had failed to agree on a date for Chinese officials to meet their U.S. counterparts in Washington, S&P futures once again magically recovered all losses but not for long and have since sunk again, sliding 0.8% to just above 2,900 as investors awaited the next batch of news on trade talks.

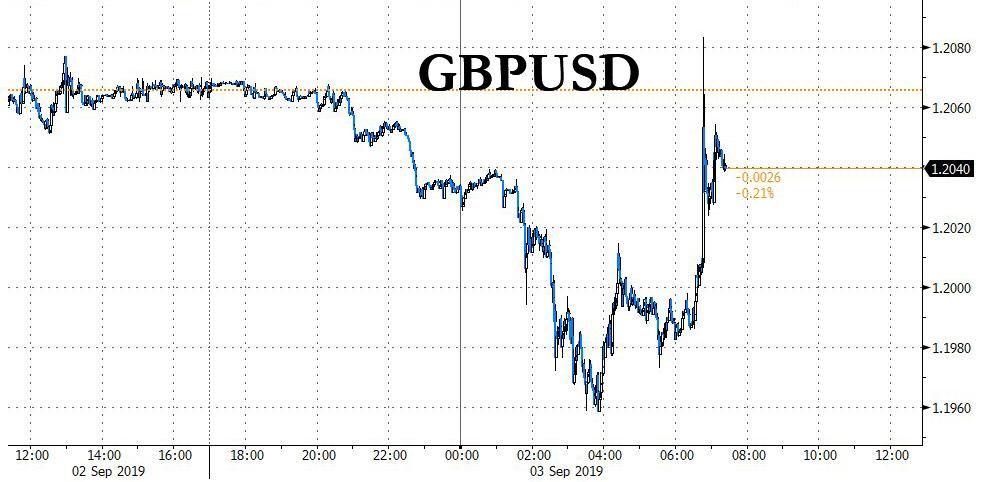

US futures dragged the world lower and global stocks slipped toward a recent two-month low on Tuesday, as U.S.-China trade tensions drove investors to the relative shelter of gold, the Japanese yen and government debt; as a result treasuries advanced, while the pound first sank below 1.20 against the dollar for the first time in three years as Brexit brinkmanship raised the possibility of an early election in the U.K, only to surge shortly after for reasons not exactly clear.

To be sure, September has been off to a rocky start for risk assets as traders remained sensitive to the twists and turns of the Sino-U.S. trade war. With mistrust on both sides, officials from the world’s two largest economies are struggling to agree on basic terms of re-engagement and even when to hold meetings planned for this month, Bloolmberg reported while violent confrontations in Hong Kong and the risk of an imminent Chinese incursion continue to weigh on sentiment.

With U.S. markets closed on Monday, global markets took their cue from weak PMI survey data in Europe and China which raised concerns the global economy was struggling on many fronts. An index of global stocks slipped 0.2% on Tuesday, heading toward a two-month low hit in early August. An index of Asian stocks was down 0.7%. In the trade war between Washington and Beijing, tensions have shown little sign of abating even though U.S. President Donald Trump has said they would meet for talks this month.

“Since the trade dispute has become the driving force behind equity markets, we advise against adding significantly to equity exposure, particularly for those with an adequate strategic allocation,” Mark Haefele, chief investment officer at UBS Global Wealth Management said.

European stocks were on the back foot as investors locked in profits from a three-day streak that saw indices scale near one-month highs, with the Stoxx Europe 600 Basic Resources Index falling for a second day, down as much as 1.4%, on news Chinese and American officials were struggling to schedule trade talks; metals retreated with copper hitting a 2-year low as diversified miners fall, with Rio Tinto -0.7%, BHP Group -0.5%, Anglo American -1.4%, Glencore -1.3%. Steelmakers also dropped: ArcelorMittal -1.2%, Evraz -1.7%, Voestalpine -1.3%, hit after Fitch analysts cut their 2019 global steel price forecast to $600/t from $650/t, as global prices continue to be hammered by poor sentiment from the ongoing U.S.-China trade tensions, increasing downside risks to the global economy. Base metals also fell in London, with copper -0.6%, zinc -1.5%, nickel little changed; aluminum -0.5%; iron ore -1.6% in Singapore.

Earlier in the session, Asian stocks dropped for a second day, led by energy producers, as Beijing and Washington struggled to set a meeting schedule for trade negotiations. Markets in the region were mixed, with Japan advancing and India retreating. The Topix climbed 0.4% in thin trading, supported by automakers and chemical producers. The Shanghai Composite Index closed 0.2% higher, with Foxconn Industrial Internet and China Yangtze Power among the biggest boosts. Sports-related shares jumped after China announced a plan to boost athletic development. India’s Sensex fell 1.4%, dragged down by financial shares, amid concerns that the biggest bank overhaul in decades may hurt the nation’s bad loan cleanup and slow lending approvals.

The move away from equities boosted demand for government debt with yields on benchmark U.S. Treasury debt tumbling to toward a three-year low hit last week as investors also ramped up their bets the global economy is headed toward a recession. Market watchers are hoping that U.S. data would undermine some of those bearish bets on the global economy with surveys from the Institute for Supply Management due later in the day while U.S. payrolls data is due on Friday.

“The ISM … is going to be (a) particular important market mover as those who have been buying bonds strongly, suggesting that the U.S. is on course for recession, need to see some sort of justification,” said Andrew Milligan, head of global strategy at Aberdeen Standard Investments.

The yield on 10-year U.S. Treasuries fell 2 basis points to 1.4876%, off a three-year low of 1.443% touched last week. The yield dropped more than 50 basis points last month, the biggest monthly drop since August 2011. U.K. gilts and Italian debt led the rally in European sovereign bonds.

In FX, Sterling was the big mover in currency markets, nearing a three-year low with British Prime Minister Boris Johnson set for a showdown with Parliament over a no-deal Brexit. On the opposite performance end, the Bloomberg Dollar Spot Index touched the highest since May 2017 as uncertainty over the planning of U.S.-China trade talks supported the greenback; its seven-day winning streak is the longest since March. The dollar strengthened against all G-10 peers barring havens – the yen and the Swiss franc – as risk sentiment deteriorated; the biggest declines were seen in the NZ dollar and Norwegian krone.

After dropping to a record low on Monday, the offshore yuan failed to stage a rebound overnight as China and the U.S. struggled to set a date for planned trade talks this month. The onshore currency extended its decline Tuesday to the lowest level since February 2008, after news emerged that both sides had failed to agree on a date for Chinese officials to meet their U.S. counterparts in Washington. The offshore yuan fell as much as 0.47% overnight on the news, inching closer to 7.2 per dollar, before rising 0.2% as of 5:20 p.m. in Hong Kong. “The yuan will remain bearish, but the People’s Bank of China has been tightening its grip in the onshore yuan fixing and may attempt to anchor trading at the 7.1-7.2/USD range,” said Ken Cheung, chief Asian FX strategist at Mizuho Bank. The central bank set its daily yuan fix at a level stronger than market watchers expected for a 10th straight day, the longest stretch since June. When the onshore currency breaches the 7.2 level, the PBOC may step up measures such as issuing verbal comments to reinforce its intention to smooth the pace of the depreciating yuan, Cheung said.

In commodities, oil prices were also dented by trade war concerns. U.S. West Texas Intermediate crude lost 0.47% to $54.84 per barrel. Brent futures dipped 0.05% to $58.63 per barrel amid concerns an economic slowdown from the trade war may dent demand. Forecasters are looking for signs a weakening Hurricane Dorian will turn north from the Bahamas rather than slamming head on into Florida.

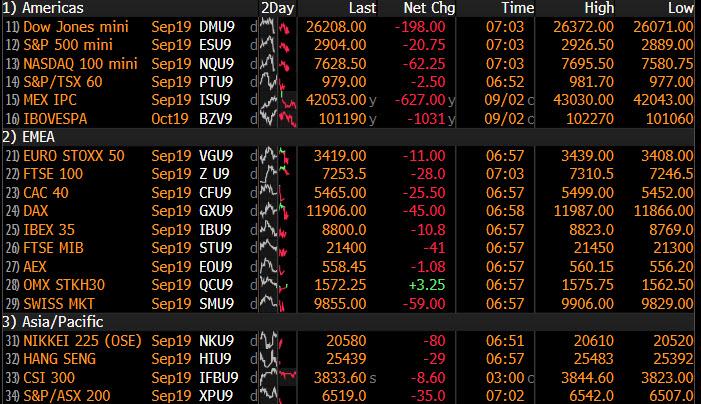

Market Snapshot

- S&P 500 futures down 0.8% to 2,901.50

- STOXX Europe 600 down 0.5% to 378.78

- German 10Y yield fell 3.4 bps to -0.736%

- Euro down 0.2% to $1.0945

- Brent Futures down 1% to $58.07/bbl

- Italian 10Y yield fell 3.1 bps to 0.626%

- Spanish 10Y yield fell 4.0 bps to 0.088%

- Brent Futures down 1% to $58.07/bbl

- MXAP down 0.3% to 152.31

- MXAPJ down 0.7% to 490.16

- Nikkei up 0.02% to 20,625.16

- Topix up 0.4% to 1,510.79

- Hang Seng Index down 0.4% to 25,527.85

- Shanghai Composite up 0.2% to 2,930.15

- Sensex down 1.6% to 36,743.43

- Australia S&P/ASX 200 down 0.09% to 6,573.40

- Kospi down 0.2% to 1,965.69

- Gold spot up 0.2% to $1,532.04

- U.S. Dollar Index up 0.3% to 99.25

Top Overnight News from Bloomberg

- Britain faces its third election in just over four years after Johnson said he would rather risk losing office than have his negotiations with the EU undermined. In a dramatic ultimatum, Johnson will try to trigger a snap vote on Oct. 14 if he loses a crunch vote in Parliament on Tuesday evening

- BOE Governor Mark Carney is running out of opportunities to warn lawmakers just how much a no-deal Brexit will harm the economy. With Parliament set to be suspended next week, Carney’s appearance before the Treasury Committee Wednesday could be one of his last chances to publicly address MPs before Oct. 31

- Chinese and U.S. officials are struggling to agree on the schedule for a planned meeting this month to continue trade talks after Washington rejected Beijing’s request to delay tariffs that took effect over the weekend, according to people familiar with the discussions

- Italy’s new government would push through an expansionary 2020 budget and demand a review of European Union fiscal rules, according to a draft program seen by Bloomberg

- France is taking advantage of record-low borrowing costs to plan its biggest-ever debt sale this week, just as signs emerge that investor sentiment may be faltering after a global rally

- The U.S. East Coast from Florida to the Carolinas was bracing for devastating winds and a life-threatening storm surge from Hurricane Dorianas the Category 3 storm wreaks havoc on the Bahamas

Asian equity markets traded indecisively following a non-existent lead from Wall St due to the Labor Day holiday and as upcoming key risk events, as well as reports US and China are struggling to set a meeting for trade talks this month, added to the non-committal tone. ASX 200 (U/C) and Nikkei 225 (+0.1%) were choppy with upside in Australia limited by mixed data and amid the RBA rate decision where the central bank kept rates unchanged as expected, while advances in Tokyo were restricted by a mixed currency. Hang Seng (-0.4%) and Shanghai Comp. (+0.2%) conformed to the indecisive tone after reports noted difficulty in setting up planned US-China trade talks and after MOFCOM lodged a case against the US at the WTO, with PBoC inaction and a net daily liquidity drain of CNY 80bln also contributing to the lacklustre sentiment in China. Finally, 10yr JGBs were subdued after the pullback in T-notes but then gradually recovered after mixed 10yr JGB auction results.

Top Asian News

- Japan Companies Are Sitting on Record $4.8 Trillion in Cash

- Hong Kong’s Lam Says She Never Asked China’s Permission to Quit

- China Sees Some Positive Signs in Hong Kong Despite Violence

European indices are marginally lower on the day [Eurostoxx 50 -0.4%] following on from a mostly subdued Asia-Pac lead and ahead of US markets’ first chance to react to the implementation of further US/China tariffs. UK’s FTSE 100 (-0.2%) derives some modest support, but remains in negative territory, from the weaker Pound as UK Parliament returns from their summer recess to challenge PM Johnson’s attempt to prorogue Parliament until 14th October. Sectors are mostly in the red, albeit defensive sectors are less dented than cyclicals. Turning to individual movers, easyJet (-3.9%) rests at the foot of the Stoxx 600 index due to a broker downgrade at Kepler Cheuvreux, whilst Iliad (-4.3%) is not far behind on the back of earnings. On the flip side, Renault (+1.2%) and Fiat Chrysler (+2.5%) shares spiked higher amid source reports that Renault and Nissan are seeking ways to end their alliances discord, a resolution may potentially lead to a Fiat Chrysler deal.

Top European News

- U.K. Construction Shrinks Again as Brexit Sees New Work Dry Up

- Moscow Police Detain Opposition Activists After Orderly Protests

- Italy’s Draft Government Plan Pledges Expansionary 2020 Budget

- Lego Reports 12% Drop in Profit Dragged Down by Asian Investment

In FX, the Pound has racked up more losses in advance of UK Parliament reconvening after the Summer break and in anticipation of a showdown between anti-no deal politicians across party divides and PM Johnson’s pro-Brexiteers. Like yesterday, stops were triggered in Cable once the previous 1.2015 ytd low was breached and again through the psychological 1.2000 before another round was tripped on a break of 1.1980 that sat just below 1.1986-83 ‘support’ from mid-May 2017. The selling has subsequently abated even though construction PMI missed expectations in line with Monday’s manufacturing headline print, but Sterling remains weak and extending relative declines vs G10 pears with Eur/Gbp firmly above 0.9100 and Gbp/Jpy hovering around 127.00 after an order driven lurch to circa 126.70 at one stage.

- AUD/JPY/CHF – In contrast to the underperforming Pound, and despite ongoing strength in the Greenback (ie DXY up to 99.356 at best), the Aussie and Yen are at the top of the major ranks, as Aud/Usd reclaims 0.6700+ status and Usd/Jpy slips back to test underlying bids/support around 106.00. No change in rates or wait-and-see guidance from the RBA overnight has helped the Aussie stabilise amidst the ongoing US-China trade stalemate and further Yuan weakness, while a broader downturn in risk sentiment is keeping the Yen underpinned alongside Gold, but not the Franc uniformly. Indeed, Usd/Chf is still holding above 0.9900, while Eur/Chf creeps deeper below 1.0850, albeit largely due to Euro depreciation on top of no verbal intervention from the SNB, so far.

- CAD/NZD/EUR – The Loonie and Kiwi have both lost more ground relative to their US peer (and latter against the aforementioned recovering Aussie as Aud/Nzd eyes 1.0700), with Usd/Cad climbing above 1.3350 ahead of NA Markit manufacturing PMIs, and ISM in the US, while Nzd/Usd has pulled back under 0.6300 into the latest GDT auction and not really gleaning support from NZ Finance Minister Robertson noting some robust domestic data and firm economic fundamentals, as he also stated that the Government is ready to react in the case of a shock. Elsewhere, the single currency continues to decline as noted above, and closer to 1.0923 support ahead of 1.0900, but may find some traction from hefty option expiries close by (2 bn between 1.0945-50).

- EM – The Rand and Lira look technically and fundamentally ripe to claw back ground vs the Buck, with Usd/Zar reversing from almost 15.2900 towards 15.1250 and Usd/Try touching 5.7650 compared to 5.8220 at the other extreme in wake of SA GDP and Turkish CPI that confounded forecasts on the upside and downside respectively.

- RBA kept the Cash Rate unchanged at 1.00% as expected. RBA stated the outlook for global economy is reasonable and that it is to ease policy if needed to support sustainable growth, while it added rates are to remain low for an extended period. RBA reiterated that it will monitor developments in labour market closely and that signs of a turnaround in housing market but sees inflation likely to be subdued for some time and noted the outlook for consumption remains the main domestic uncertainty.

In commodities, WTI and Brent futures are on the backfoot in early EU trade, with prices around 54/bbl and under 58/bbl respectively. Prices may also see divergence as WTI had no settlement yesterday due to the US Labor Day Holiday, which will also see the weekly API and DoE inventory data pushed back by a day. Price action has largely been dictated by sentiment thus far, with ongoing US/China, Brexit and Hong Kong woes weighing on risk appetite. State-side, NHC said a tropical cyclone is expected to form later today over SW Gulf of Mexico, tropical storm warnings have been issued for portions of NE Mexico. The potential tropical cyclone Seven is located about 220 miles East of La Pesca, Mexico, with maximum sustained winds of 35mph. Meanwhile, Hurricane Dorian is reportedly stationary and is expected to drift North/Northwest later, away from the Gulf of Mexico. Elsewhere, gold is relatively flat but off of intra-day lows and in positive territory despite the DXY printing fresh YTD highs as investors increase positions in safe-haven assets. Conversely, the risk aversion has taken a toll on copper prices which currently reside below the 2.50/lb level. Finally, Dalian iron ore futures rose in excess of 4% amid a rosier demand outlook for the base metal as steel mills restock their supplies.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 50, prior 49.9

- 10am: ISM Manufacturing, est. 51.2, prior 51.2;

- 10am: Construction Spending MoM, est. 0.3%, prior -1.3%

DB’s Jim Reid concludes the overnight wrap

For a brief moment yesterday the main headline out of No.10 Downing Street yesterday was the arrival of a very cute new adopted Jack Russell puppy named Dilyn. However fast moving political events soon overshadowed this. Although before moving on I can’t help wonder what Larry the Downing Street cat made of the new arrival.

The news quickly moved from puppies to polling as speculation intensified as the day progressed that a government commitment to a general election was imminent. PM Boris Johnson spoke outside No.10 just after 6pm UK time and suggested that if Parliament blocks no deal this week and votes for a delay, they are making his negotiations with the EU impossible. This move comes in the wake of news that lawmakers plan to raise a motion today to take over the order paper tomorrow and raise a bill to force the government to extend A50. It specifies the government must seek an extension to 31st January 2020 or agree to any extension EU27 provides. It also says this must be complied with by 19th October. The vote will likely take place tomorrow evening. Mr Johnson didn’t actually say that an election will follow a loss in tomorrow’s vote as was expected beforehand but it’s hard to see what the alternative is and there are plenty of well respected and connected journalists suggesting that an election on October 14th is being lined up. Interestingly this is a Monday as the crucial EU summit takes place on the 17-18th and takes the usual Thursday UK election slot. The last non-Thursday general election was in 1931. Apparently historically Fridays were always ruled out as politicians were worried that burgeoning end of the week pay packets were likely to lead to drunken voting. Insert your own jokes here but people from both sides of the Brexit debate might need a stiff drink at the end of this week! We should also add that with fixed term parliaments the PM can’t automatically call an election as 2/3rds of the House requires to vote for it. However this is surely a formality if the PM supports it as the opposition party has been calling for one. The most interesting scenario though is that the PM loses the vote tomorrow and the opposition refuse to vote for an election or insist on it being held after October 31st thus leaving the PM trapped. One to watch.

Sterling had a tough day on continuous speculation about the day’s likely news and weakened about -0.80% by the afternoon and was then relatively unmoved by the PM’s statement, partly helped by no US trading. It is trading down a further -0.27% this morning though.

In light of yesterday’s developments, it’s worth noting where the latest polls are. YouGov has run two separate polls in the last week with the 28-29 Aug poll showing a 33% versus 22% Conservatives-Labour split. The poll from 27-28 August in conjunction with the Times had a 34% versus 22% split. The Brexit Party picked up 12% and 13% respectively and Lib Dems 21% and 17% respectively. Since then the Survation/Daily Mail poll conducted over 29-30 August had a slimmer lead for the Conservatives over Labour at 31% versus 24% (albeit with a much smaller sample size). Most recently, the Deltapoll/Mail on Sunday poll had a 35% versus 24% split. It feels to me that the country is still very close to being 50/50 split on Brexit and the key to any election is which side unites more around one party than the other side. With Boris Johnson doing everything he can to win back a high proportion of the those who flocked to the Brexit Party, the Labour and Liberals are probably going to need a plan as how they can avoid splitting the remain vote.

So expect there to be a lot more focus on the polls in light of yesterday’s news, especially if the government lose tomorrow’s vote as expected. Over in markets 10y Gilts (-6.7bps) tracked the move in Sterling however most other European bond markets were a shade weaker to unchanged after the manufacturing PMIs broadly printed in line with expectations (more on those below). Indeed 10y Bund (-0.1bps) and OAT (+0.6bps) yields were flat to slightly higher along with 10y yields in Spain (+2.3bps) and Portugal (+0.9bps) although BTPs (-3.0bps) extended their strong recent run with the spread over Bunds now down to 167bps. To think that spread was closer to 240bps in early August.

In equity markets, with the US off on holiday, volumes were down some 50% or so however markets did finish slightly on the positive side with small gains for the STOXX 600 (+0.32%) and DAX (+0.12%). The FTSE 100 (+1.13%) was a standout thanks to the currency move while Italy’s FTSE MIB also closed up +0.50%. In EM the Argentinian Peso strengthened +6.21% after the nation imposed capital controls while in commodities Gold (+0.59%) closed up but is trading down -0.30% this morning while Brent oil futures were down -2.90% yesterday.

In other news, yesterday late afternoon Bloomberg reported that the US and China were struggling to agree on a date to meet this month. S&P futures after being flattish at around Europe’s lunchtime traded as low as -1% down after headlines. They are down -0.54% as we type.

Bourses in Asia are trading flat to down amidst low volumes this morning. The Nikkei (+0.04%) and Shanghai Comp (-0.05%) are trading broadly unchanged while the Hang Seng (-0.10%) and Kospi (-0.17%) are slightly lower. In Fx, all G10 currencies are trading weak (range c. -0.1% – -0.5%) with the US dollar index trading up +0.37% at 99.281, the highest level since May 2017. Asian EM Fx is also trading weak with the onshore Chinese yuan down -0.15% to 7.1824 with the Indian rupee leading the declines (-0.88%). Meanwhile the 10y UST yield is up +2.9 bps this morning and the 2y yield up +1.5bps bringing the 2s10s curve back in marginally positive territory (+0.4bps). The yields on the 30y UST is up +3.9bps. As for overnight data releases, South Korea’s August inflation printed at 0% yoy (vs. +0.2% yoy expected and +0.6% yoy last month) – a record low – and core inflation printed in line with expectations at +0.9% yoy (vs. +1.0% yoy last month) while the final Q2 GDP was revised down one tenth from the initial read at +2.0% yoy. Separately, the BoK said that the recent low inflation is mainly due to supply-side factors and government’s policies on welfare and it’s hard to say it’s the precursor of deflation while adding that inflation will quickly rebound around the end of this year.

Back to yesterday, where with the ECB meeting now just a stone’s throw away, the PMIs were always going to be a bit more peripheral than normal and the fact that they were broadly close to consensus only furthered that argument. Indeed the manufacturing reading for the Euro Area was confirmed at 47.0 and unrevised from the flash with a slight upward revision for France (51.1 from 51.0) offset by a slight downward revision for Germany (43.5 from 43.6). There were however slight positive surprises for Italy (48.7 vs. 48.5 expected) and Spain (48.8 vs. 48.5 expected) although this needs to be taken in context of both still being in contractionary territory.

Meanwhile, the UK’s manufacturing PMI (47.4 vs. 48.4 expected) hardly made for pretty reading. The market is obviously more focused on Brexit developments however this was still the lowest reading in 85 months with new orders also at the lowest level in over 7 years. Most of the forward-looking indicators were fairly weak too with the data still very much consistent with the manufacturing sector in recession.

So the baton passes to the US today where we’ll get the August ISM manufacturing and final manufacturing PMI revisions. The market expects the ISM to have held steady at 51.2 which as a reminder was the lowest since August 2016. The reading has also dropped for 4 consecutive months and 8 of the last 11 months. We should flag that our US economists expect a temporary bounce in today’s ISM to 52.5 in light of the regional survey data however they do expect further downside risks in the near term owing to trade uncertainty.

To the day ahead now, where the only data of note this morning is the July PPI print for the Euro Area. In the US this afternoon the highlight is likely to be the August ISM manufacturing report, while the final August manufacturing PMI revisions will also be made. The July construction spending print is the only other data of note. Away from that the Fed’s Rosengren is due to speak late this evening.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com