It may come as a surprise to some that while the Fed ended its Quantitative Tightening prematurely last month, about a year before its scheduled end, it has been engaging in some rather aggressive Quantitative Easing, and as we noted a few days ago, the Fed has purchased a not insignificant $11 billion in the past weeks.

Source: Bloomberg

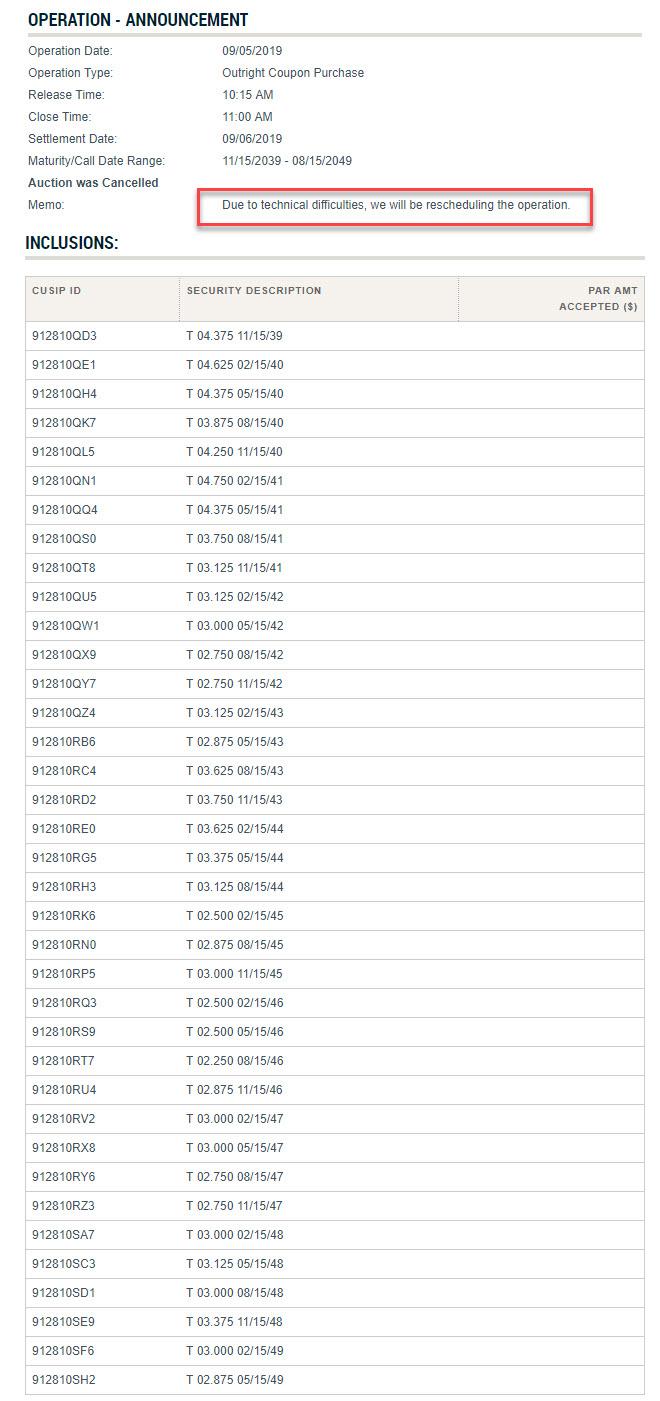

This meant that the good old POMO days quietly returned, and today at 10:15am, the Fed was expected to purchase about $2.25 billion in Treasury coupons with a maturity between 20 and 30 years. Only… that did not happen because as the NY Fed advised earlier today, “Due to technical difficulties, we will be rescheduling the operation.”

It was unclear just what the technical difficulties were that prevent the Fed from buying a modest $2.25BN of long-dated bonds in the open market, although one almost wonders if the decision had something to do with today’s blow out in 30Y yields which surged from 1.9692% to as high as 2.09% just before noon when the Fed made the announcement it had canceled the POMO.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com