With the US-China trade war getting thrust to the backburner – if only briefly – following news that trade negotiations will resume in October, leading to an explosion of global optimism, traders will now focus on tomorrow’s payrolls report for an indication of any unexpected reversals in the Fed’s widely priced in 25bps rate cut on Sept 18.

And although analysts look for an above-trend 160k nonfarm payrolls to be added to the US economy in August with a whisper number of over 200K the underlying indicators, as RanSquawk notes, are mixed: On the one hand, there is the upside (temporary) boost from census hiring; on the other, there is downside drag from August residual seasonality as payrolls have exhibited a tendency toward weak August first prints; then there was the ADP private payrolls report which surprised to the upside; however, Challenger job cuts ticked higher, and the employment sub-indices within the ISM surveys also declined (though remain expansionary). At the same time, consumer confidence data showed the differential between jobs ‘plentiful’ and ‘jobs hard to get’ rising, auguring well for the NFP data, but the outlook on the labor market was less positive, while consumers are also becoming less optimistic about the prospects for wage growth. Overall, a mixed picture as we head to the most important economic datapoint ahead of the September FOMC meeting.

Here is a summary of what Wall Street expects:

- Non-farm Payrolls: Exp. 160k, Prev. 164k.

- Private Payrolls: Exp. 150k, Prev. 148k.

- Manufacturing Payrolls: Exp. 8k, Prev. 16k.

- Government Payrolls: Prev. 16k.

- Unemployment Rate: Exp. 3.7%, Prev. 3.7%. (FOMC currently projects 3.6% unemployment by the end of 2019, and 4.2% in the longer-run).

- U6 Unemployment Rate: Prev. 7.0%.

- Labour Force Participation: Prev. 63.0%.

- Avg. Earnings Y/Y: Exp. 3.1%, Prev. 3.2%; Avg. Earnings M/M: Exp. +0.3%, Prev. +0.3%.

- Avg. Work Week Hours: Exp. 34.4hrs, Prev. 34.3 hrs.

More details on what to expect tomorrow, courtesy of RanSquawk

TREND RATE OF PAYROLL GROWTH:

Whether one looks at the consensus expectations for the NFP print of 160K, or Goldman’s forecast of 150K, the pattern is clear: the trend-rate of payroll growth is easing. The one-year average sits at 187k, the six-month is at 141k, and the three-month is 140k. However, the latest ADP employment report bodes well for the August headline, after an upside surprise, printing 195k against 148k expected. The strength within the survey was broad, and researchers noted that the August data was the first time in the last 12 months that we have seen balanced job growth across small, medium and large-sized companies. Moody’s economist Mark Zandi said, “Businesses are holding firm on their payrolls despite the slowing economy; hiring has moderated, but layoffs remain low,” adding that “as long as this continues, US recession will remain at bay.”

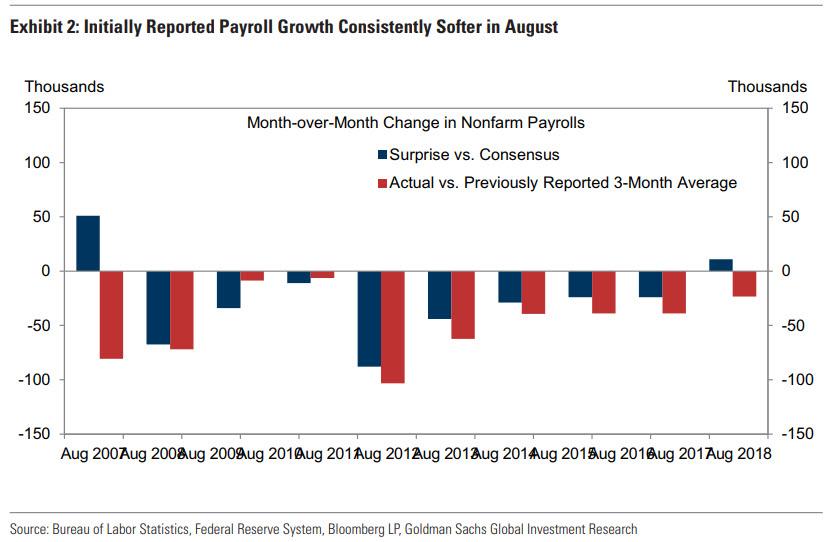

In justifying its 150K forecast, Goldman’s economists note that this reflects a 15-20k boost from hiring related to the 2020 Census whereas the private payrolls forecast is somewhat softer at +130k (consensus +150k). This slower expected pace of private job gains is consistent with the August deterioration of employer surveys, and Goldman adds that job growth had slowed meaningfully even before the early-August trade war escalation (to +140k and +141k over the last three and six months, respectively). However, it is likely that job growth remains above potential, which is now well below 100K, as initial jobless claims fell further and employer surveys remained in positive territory on net.

WAGES:

The Street is expecting wage growth to rise by +0.3% M/M, matching the pace of the July report, though the Y/Y rate is seen moderating to 3.1% from 3.2%, which Bank of America says is a result of base effects. Within the conference Board’s gauge of consumer confidence, the percentage of consumers expecting an improvement in short-term income prospects decreased from 24.9% to 23.8%, however, the proportion expecting a decrease declined, from 6.6% to 5.8%. Some analysts will also be keeping a sharp eye on hours worked, given the recent decline, which some has taken as a sign that the labour market is losing momentum.

JOBLESS CLAIMS:

Initial jobless claims have been bumping along cyclical lows; in the August nonfarm payroll survey week, jobless claims came in at 211k versus July’s 216k,; the four-week average has been chugging around 215k. With the distortions effects fading (as a result of automakers annual shutdowns), analysts see the trend rate continuing around 215k. Over the coming weeks, the trend rate may tick higher due to Hurricane Dorian.

CHALLENGER JOB CUTS:

Data from Challenger showed US employers ramping up the pace of downsizing in August; companies have announced plans to cut 53,480 jobs, up 37.7% from July’s total of 38,845, and 39% higher than the 38,472 cuts announced in August 2018. Challenger said August’s total was the fourth highest for job cuts this year, marking the eighth consecutive time job cuts were higher than the corresponding month one year earlier. “Employers are beginning to feel the effects of the trade war and imposed tariffs by the US and China,” researchers said, “in fact, trade difficulties were cited as the reason for over 10,000 job cuts in August.” The consultancy said it is continuing to see investor concerns shaking confidence in the market, and employers appear to be cutting workers in response to a slowdown in demand for their products and services.”

BUSINESS SURVEYS:

The employment sub-component in the ISM manufacturing survey fell by 4.3 points to 47.4, now in contraction after 34 months of being in expansion. An ISM Manufacturing Employment Index above 50.8, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment. “Employment contracted for the first time since September 2016,” ISM said, “August ended an expansion cycle in which the index averaged 55.8.” ISM noted that comments were generally neutral concerning hiring for attrition. “Force reduction comments were minimal, but 25% of general comments were negative regarding employment expansion,” it said. Meanwhile, the only stand-out weakness in the non-manufacturing ISM survey, which was generally pretty solid in August, was the employment sub-component, which fell by 3.1 points to 53.1; the qualitative comments were more encouraging, however, and responses included “new jobs added to compensate for the growth of business” and “we are working on recruiting individuals.”

CONSUMER SURVEYS:

Within the conference Board’s gauge of consumer confidence, the differential between jobs “plentiful” and jobs “hard to get” rose to 39.4 in August, from 33.4 in July, auguring well for the labour market data. However, the CB noted that consumers’ outlook for the labour market was also slightly less positive, over the month, since the proportion expecting more jobs in the months ahead decreased marginally from 19.9% to 19.7%, while those anticipating fewer jobs increased from 11.1% to 13.6%.

ARGUING FOR A WEAKER REPORT:

- Employer surveys. Business activity business surveys were mixed in August (with moderate gains in the manufacturing sector and little change on net in the services sector), but the employment components of those surveys underperformed (-2.6pt to 49.7 for manufacturing, -0.2pt to 53.4 for services). As shown in Exhibit 1, however, the level of the labor-market components still suggests job growth running at a healthy pace (of around 175k per month). Service-sector job growth rose 133k in July and averaged 120k over the last six months, while manufacturing payroll employment rose 16k in July and has increased by 6k on average over the last six months.

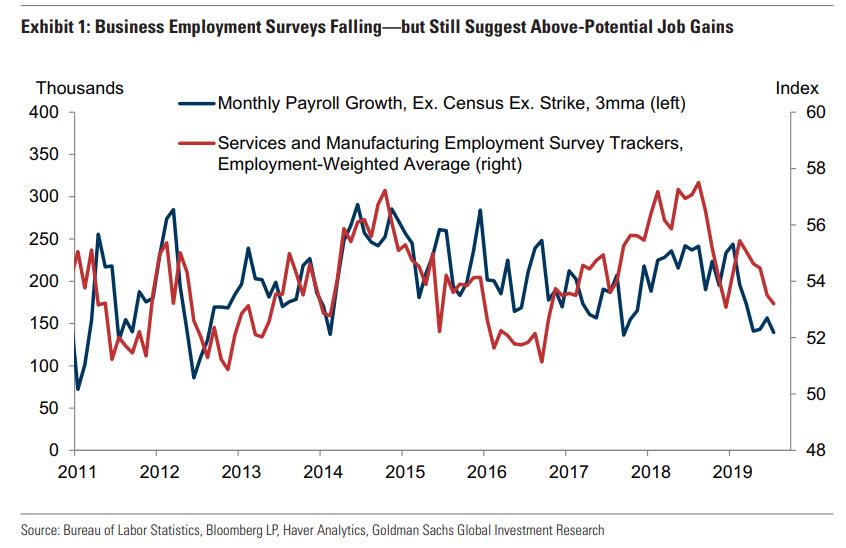

- Residual seasonality. Payrolls have exhibited a tendency toward weak August first prints, which may reflect a recurring seasonal bias in the first vintages of the data. In Exhibit 2, Goldman shows first-print payroll growth in August relative to consensus estimates and relative to the previously published three-month moving average (i.e. the average in May, June, and July, as published in the July employment report). August job growth has decelerated in each of the last ten years, and it has missed consensus in 8 of those instances. Softness in the first vintage also tends to manifest in many of the same industries—including manufacturing, professional services, retail, and information. Taken together, the bank assumes a 30k drag from residual seasonality in tomorrow’s report.

- Job cuts. Announced layoffs reported by Challenger, Gray & Christmas rose in August to 57k (SA by GS), and are somewhat above their August 2018 level (+15k yoy). The sequential increase in announced layoffs primarily reflects increases in the technology industry (+11k mom sa) and government (+4k).

ARGUING FOR A STRONGER REPORT:

- Jobless claims. Initial jobless claims declined further from already very low levels during the five weeks between the payroll reference periods (-6k to 213k on average). Continuing claims rose by 24k from survey week to survey week, but remained unchanged on average between months (at 1,698k).

- ADP. The payroll-processing firm ADP reported a 195k increase in August private employment, 47k above consensus and a sizeable pickup from the 98k average pace over the three prior months. The ADP report was slightly firmer than our previous assumptions—and in our view suggests that the underlying pace of job growth remains solid.

- Census hiring. Temporary employment related to the 2020 Census has significantly lagged that of 1999 and 2009. However, address canvassing is now underway, and the Census announced that hiring picked up during and ahead of the August payroll reference week. Given this and given that the 200+ regional Census offices were opened in late July, Goldman expects a visible boost from Census hiring in the report (it assumes 15-20k workers).

NEUTRAL FACTORS:

- Job availability. The Conference Board labor market differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—surged by 6.3pt to +39.4, a new cycle high in August. Other job availability readings were somewhat softer on a sequential basis: JOLTS job openings declined but remained high (-36k to 7,348k in June) and the Conference Board’s Help Wanted Online index edged lower (-1.2pt to 102.3 in July).

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com