When the news broke yesterday that the “We Company” was prepared to slash its valuation to $20 billion to $30 billion (half its $47 billion private valuation), the financial press known as finance twitter didn’t waste any time lampooning the startup/active Ponzi scheme’s biggest champion: Japan’s VC juggernaut Soft Bank masking as a telecom giant.

When is the BOJ’s bailout of Softbank?

— zerohedge (@zerohedge) September 5, 2019

https://platform.twitter.com/widgets.js

And for SoftBank and its chairman Masayoshi Son, who is also the architect of its investment strategy – which could be described as ‘pump ludicrous amounts of capital into overhyped Silicon Valley startups’ and when that fails, pump some more and then for good measure add slides like these in your investor slidebook…

… news of WeWork’s stunning retrenchment couldn’t have come at a worse time. SB and its ‘Vision Fund’ are still licking their wounds from the Uber IPO (SoftBank was Uber’s biggest backer, and the spectacular faceplant in Uber shares post IPO has translated to billions in paper losses).

With a nearly 30% stake, SoftBank is also WeWork’s biggest backer. And the company’s decision to move ahead with its investment – which is split between SoftBank’s Vision Fund and the firm’s own capital – reportedly created tensions between Son, his employees and the Vision Fund’s backers. The inner turmoil culminated with SB dialing back its latest capital injection to just $2 billion (down from $20 billion) and reportedly led two of the Vision Fund’s biggest backers, the sovereign wealth funds of Saudi Arabia and the UAE, declining to participate in the Vision Fund Pt. 2.

Now, it appears that SoftBank’s employees might pay the ultimate the price for Son’s generous recklessness. Bloomberg reports that employees of the Vision Fund, a group that includes high-profile bankers and investors, only get paid when profits are booked. Without profitable exits, the firm’s employees don’t make any money. That’s not a problem for Son, who is already a billionaire. But for everyone else, this is less than optimal.

What’s worse, employees could be on the hook for clawbacks if the IPO proves to be a massive flop (and that’s looking more likely by the day).

Vision Fund employees, including high-profile bankers and investors, receive base salaries and bonuses, but only get payouts when profits are booked. They are also on the hook for potential losses, facing clawbacks of 20% and above for some senior staff, and 7% for more junior employees.

With so much on the line, it’s also possible that Soft Bank might essentially pay WeWork not to go public.

There is also a possibility that WeWork could delay its IPO. Adam Neumann, WeWork’s larger-than-life Chief Executive Officer and co-founder, pledged to SoftBank CEO Masayoshi Son earlier this year that WeWork will have a valuation of no lower than $47 billion when it goes public, people familiar with the matter said. A SoftBank spokeswoman declined to comment for this story.

Neumann also met with Son in Tokyo last week to discuss a potential capital infusion, the Wall Street Journal reported, citing unidentified people familiar with the matter. The possibility of SoftBank investing money to enable WeWork to delay the IPO until 2020 was also raised in the discussions, the paper said.

Alternatively, Son and SoftBank could simply eat the loss and brush off WeWork’s IPO as a speed bump on the road to helping “elevate the world’s consciousness“:

Son, a famously long-term thinker who has outlined 30- and 300-year plans for humanity, could conceivably brush off a poor showing for WeWork as a bump along the long road toward changing the world. It’s not clear the Vision Fund will be able to do the same.

Unfortunately, Vision Fund’s employees can’t afford to hide behind such long-term thinking.

To be fair, Son isn’t the only Vision Fund employee responsible for the firm’s botched investment in WeWork. Ron Fisher, one of SoftBank’s highest-paid executives (he made $31 million last year), also championed the Vision Fund’s investment in WeWork.

SoftBank’s huge bet on WeWork has also caused friction between members of the Tokyo company itself. While Son has the final say on investments, WeWork is seen internally as the bet of Ron Fisher, the Boston-based SoftBank executive and a longtime aide to Son, the people said. Fisher, who grew up in South Africa, was SoftBank’s highest-paid executive with $31 million in compensation in the last fiscal year, 62% more than a year earlier.

Before SoftBank first invested in WeWork in 2017, Fisher met with executives at IWG Plc, a European competitor with a much lower valuation and – at the time – 10 times as many sites, people with direct knowledge of the matter said. Some Vision Fund employees were surprised when instead of convincing Fisher not to invest in WeWork, the unfavorable metrics seemed to encourage him, leaving him convinced that tremendous growth lay ahead for the fledgling company. Son agreed. A month later, the Vision Fund led a $4.4 billion investment round into WeWork at a $20 billion valuation. Fisher and Mark Schwartz, the former Asia Pacific chairman at Goldman Sachs Group Inc. who was appointed to SoftBank’s board that year, joined WeWork’s board.

The big question for SoftBank’s employees, however, is whether Son will change his ways after such an embarrassing flop. Clearly, such a shotgun “big bang” approach is no longer resonating for SoftBank or ‘Vision Fund’ investors.

SoftBank’s massive bet in WeWork is emblematic of Son’s overall approach. “Why don’t we go big bang?” he told Bloomberg in an interview last year when asked about his investing style, and added that other venture capitalists tend to think too small. His goal of swaying the course of history by backing potentially world-changing companies requires that those companies make large outlays in areas from customer acquisition to hiring talent to research and development, a spending tactic that he acknowledged sometimes brings him into conflict with other investors.

“The other shareholders, they try to create clean, polished little companies,” Son said. “And I say: ‘Let’s go rough. We don’t need to polish. We don’t need efficiency right now. Let’s make a big fight. Let’s make a big, successful—a big win.'”

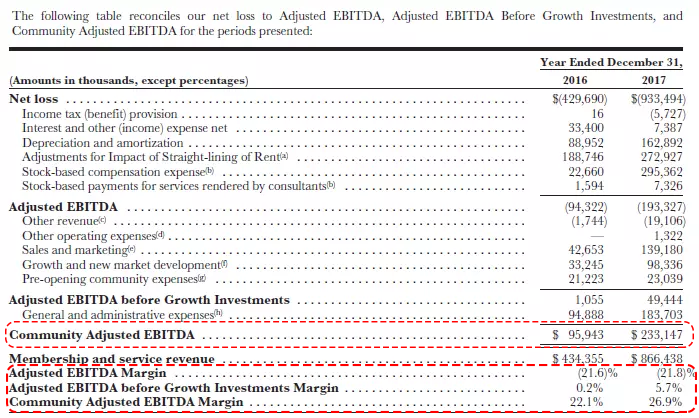

However WeWork and SoftBank decide to proceed, we could know as soon as next week. The company’s bankers, fearful of increasingly volatile markets, want the offering done asap. As of now, they’re expected to start the IPO roadshow as soon as next week. Can they convince investors to place their faith in WeWork’s “community adjusted” numbers?

If the IPO is a flop, which it most likely will be now that the company’s intangible value fluctuates by 50% almost on a monthly basis, will Masayoshi Son make his embittered employees whole by compensating them for the money they will lose? We doubt it, because while Son is so very concerned about elevating the world’s consciousness, he may find some qualms when it comes to employees bank accounts when the offset is his own – and not other people’s – money.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com