For The First Time Ever, Russia Will Issue Sovereign Bonds Denominated In Yuan

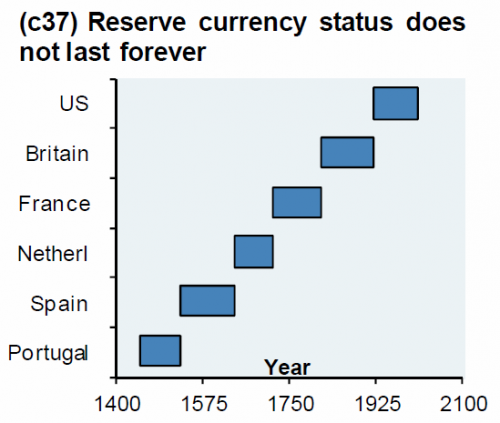

While the US under president Trump continues to avoid international entanglements and shun legacy ties with foreign allies – for better or worse – America’s challengers in the global arena are taking advantage of the void left by the deep state’s involuntary retraction from international affairs, and none more so than China and Russia, which with every passing day are preparing for that inevitable day when the dollar is no longer the world’s reserve currency.

As the SCMP reports, China and Russia are accelerating their reduction in reliance on the US dollar, with the Russian Ministry of Finance expected to launch its first yuan-denominated bond by the end of this year or in early 2020. Moscow is hoping that a yuan bond will lift interest by Chinese investors in Russian assets and it would also help to create benchmarks for the setting up of hedging options for roubles and yuan, sidestepping the use of the US dollar.

According to the SCMP, the investment-grade bond would be the first-ever Russian sovereign debt issue in yuan, and it is expected to be listed on the Moscow Stock Exchange. The idea was first proposed in 2016, although there have been several delays in putting the deal together. It was revived last year with China and Russia seeking to further strengthen ties amid escalating tensions with the United States.

“Currently, several banks led by Gazprombank and [China International Capital Corporation] are making efforts to realize this first yuan bond, [but] there are still some technical details we are working on,” said Cheng Daming, executive director at the China International Capital Corporation, one of China’s leading investment banks. “With some push, and joint efforts, we do believe we will realize this deal within the year or the beginning of next year.”

“Because Chinese bond investors are not familiar with credit risk of Russia sovereign debt and the Moscow Stock Exchange, they need more time to get familiar with the whole deal structure, that might currently be the most important thing for this deal to take place,” Cheng added.

The Russian yuan-denominated bond will give Chinese investors another investment opportunity after China’s central bank updated rules on the Renminbi Qualified Domestic Institutional Investors scheme last year. This allows Chinese investors to buy yuan-denominated products in overseas markets, as long as yuan investments are not converted into foreign currencies.

With Russia dumping all of its US Treasury in 2018, and with China periodically threatening to do the same as its trade war with the US escalated, the two nations have been keen to cut their dependence on the US dollar for some time as Washington uses access to the global US dollar payments system as a weapon to punish nations and individuals for breaking its laws, even outside the US. In fact, as reported previously, to cut reliance on the US dollar, Moscow and Beijing have also talked about establishing a new system for direct yuan-rouble payment settlements, although the project has also suffered multiple delays.

Ironically, moves to replace the dollar as a global reserve currency would have the blessing of both JPMorgan and the Bank of England’s Mark Carney, both of whom have suggested that it is time for the USD to cede global reserve currency status as the alternative threatens the world with a deflationary supernova.

To be sure, both countries are already well on their way to dollar independence, as in bilateral trade, 14% of payments are already conducted in yuan and about 7 to 8% in roubles, according to Russia’s Ministry of Finance. China is Russia’s largest trading partner, while Russia is China’s largest supplier of crude oil.

The Russian central bank has also been gradually substituting its US dollar-denominated assets for yuan assets in its foreign exchange reserves portfolio, purchasing US$44 billion worth of the Chinese currency in the second quarter of 2018, while selling more than US$100 billion. Russia held US$67 billion in yuan as of mid-2018, 15 per cent of its international reserves.

Moscow stepped up building its own financial infrastructure in the aftermath of the 2014 sanctions imposed on Moscow over Crimea, to protect from further curbs on the activity of its banks and companies. Moscow has already raised capital this year selling Eurobonds denominated in euros and the US dollar.

That said, there may be some trouble in dedollarized paradise: Russian bank and exchange representatives, however, have expressed frustration over the lack of progress on deepening financial market connections with China despite supportive rhetoric from the two governments. Denis Shulakov, first vice-president at the state-owned Gazprombank, said the yuan bond deal is important because it helps to establish a benchmark for creating more hedging options for those investing or trading in the Chinese currency. Overall, foreign investors now hold slightly more than 2 trillion roubles (US$30.2 billion) of debt issued by the Russian Ministry of Finance, he added.

“No Chinese investors are buying Russia’s Ministry of Finance debt in roubles, that’s why the idea is to buy that debt in [yuan],” he said.

“Financial instruments are all dealt on the basis of trust. While foreign investors from the West seem to trust the Russian market, Chinese investors, by not participating in it at all, are seen as unaware or hesitant. This is not a technical, rather regulatory issue, it is an issue of trust of each other’s financial systems.”

* * *

It’s not just financial and monetary proximity that the two nations are pursuing, however, and according to Xinhua, Chinese and Russian senior military officials have agreed to strengthen military cooperation between the two countries to jointly maintain global peace and stability.

Zhang Youxia, vice chairman of the Central Military Commission, and Russian Defense Minister Sergei Shoigu reached the agreement during a meeting in Moscow on Wednesday of last week. Zhang, who is also a member of the Political Bureau of the Communist Party of China (CPC) Central Committee, praised the development in China-Russia relations over the past 70 years of diplomatic ties.

China and Russia have elevated their relations to a comprehensive strategic partnership of coordination for a new era, opening a new epoch of higher-level relations with greater development, Zhang said at the meeting. He said China is ready to work with Russia to implement the important consensuses reached between the presidents of the two countries, boost military ties in the new era, deepen practical cooperation in all areas, jointly safeguard their security interests, and maintain global peace and stability.

Quoted by Xinhua, Shoigu said the Russia-China comprehensive strategic partnership of coordination for a new era “benefits the two peoples and serves as a significant force in preserving global security and strategic stability.”

He suggested the two countries strengthen coordination on major international and regional issues, jointly deal with the challenges emanating from unilateralism and protectionism, and maintain global peace and stability.

Military cooperation plays an important role in and demonstrates the “specialness” of the Russia-China ties, Shoigu said, adding that Russia is willing to improve cooperation with China in army games, drills and personnel trainings.

Tyler Durden

Sat, 09/07/2019 – 15:55

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com