“So Much For Infinity QE”: Draghi Fumbles As Market Realizes ECB Can Only Do QE For 12 Months

While on the surface today’s ECB announcement was underwhelming, with both the size of the rate cut (-0.10%) and the amount of QE (€20BN), coming in well below what was already priced in, the biggest saving grace in Mario Draghi’s “swan song” conference was that the newly restarted QE would be, in the words of the ECB, open-ended. Which is great in theory, but a disaster in principal for the bond-constrained Europe.

Sure enough, with one of the most pressing questions at today’s ECB press conference being just what the open-ended nature of QE means for the ECB’s existing 33% issuer purchase limits, Draghi was laconic: the ECB president admitted there was “no appetite to discuss bond buying limits” instead merely saying that “we have relevant headroom to go on at quite a long time at this rhythm without the need to raise the discussion about limits”, which translates roughly as “I am punting this most critical topic to Christine Lagarde.”

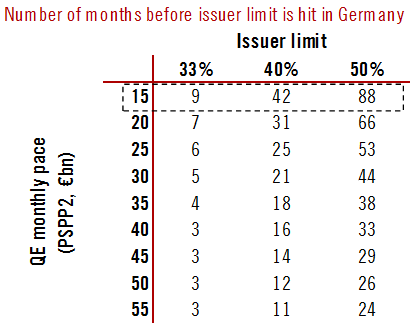

Because while Draghi may be leaving the ECB by implementing what some have called QEternity, the reality is far more problematic, and unless the ECB charter is changed to raise issuer limits to 50% or more – in the process informing the hyperinflation sensitive Germans that half of its bonds will have to be monetized – the open-ended QE will be very limited, and that limit will be reached very soon.

How soon?

Here opinions differ slighlty, but converge on roughly 12 months of possible QE under the current limits.

According to Pictet’s Frederik Ducrozet, at the proposed €20bn/month in QE, and assuming a split of €5bn in corporate bonds and the balance in sovereign, QE can run for roughly 9 months under current limits.

Separately, Danske Bank’s strategist Peter Sorensen said that according to his calculations, the ECB can buy German bonds under its fresh €20b per month program for about 14 months. Here, Italy has the most most months left, at 87 while France, and Spain have 57 months and 25 months respectively. On the other end, Finland will have only five months of buying before limits reached while Slovakia has already hit the buffers.

Finally, Credit Agricole’s Valentin Marinov was even less subtle: the FX strategiust pointed out the same thing we did, namely that “Draghi indicated that there was no discussion of raising the issuer limit as a way to boost the size of the pool of assets available to buy under QE.” The problem: this will limit the duration of QE at 20 billion euros to between just six to 12 months, according to Credit Agricole estimates.

“So much for the infinity QE. Assuming that the capital key is sacrosanct, they cannot boost the size of their balance sheet in a meaningful way without an increase in the issuer limit.”

His conclusion is that “this could put a base under the euro for now” and sure enough, upon realizing that open-ended QE is just a myth, the EURUSD has not only recovered all losses but is now up for the day!

Tyler Durden

Thu, 09/12/2019 – 10:10![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com