Has The Narrative Been All Priced In?

Authored by Lance Roberts via RealInvestmentAdvice.com,

The Bullish Narrative

This past week was built for the “bulls” as just about every item on their “wish list.” was fulfilled. From a “trade deal” to more “QE,” what more could you want?

Trade Deal Near?

Concerning the ongoing “trade war,” our prediction that Trump would begin to back peddle on negotiations to get a “deal done” before the election came to pass.

Trump has once again delayed tariffs to allow the Chinese more time to position. China, smartly, is using the opportunity to buy soy and pork products (which they desperately need due to a virus which wiped out 30% of their pig population) to restock before the next meeting.

This is a not so insignificant point.

China is out for “China’s” best interest and will not acquiesce to any deal which derails their long-term plans. In the short-term, they may “play the game” to get what they need as a country, but in the long-run, they will protect their own interests. As we noted previously:

“If China does indeed increase U.S. imports, the stronger dollar will increase the costs of imports into China from the U.S., which negatively impacts their economy. The relationship between the currency exchange rate and U.S. Treasuries is shown below.”

“China uses U.S. Treasury bonds to “sanitize” trading operations. When the currency exchange rate is not favorable, China can adjust treasuries holdings to restore balance.”

However, don’t mistake China’s move as “caving” into Trump. Such is hardly the case.

While Beijing will allow Chinese businesses to purchase a “certain amount of farm products such as soybeans and pork” from the US, China has also cut a deal for soy meal from Argentina.

“China will allow the import of soymeal livestock feed from Argentina for the first time under a deal announced by Buenos Aires on Tuesday, an agreement that will link the world’s top exporter of the feed with the top global consumer.”

Hmmm…that sounds very familiar:

“Trade is a zero-sum game. There is only a finite amount of supply of products and services in the world. If the cost of U.S. products and services is too high, China sources demand out to other countries which drain the supply available for U.S. consumers. As imbalances shift, prices rise, increasing costs to U.S. consumers.” – Game Of Thrones 05-10-19

As Hua Changchun, an economist at Guotai Junan Securities, a brokerage in the PRC, said:

“Beijing’s latest ‘gesture’ has increased the prospects for a narrow trade deal with the US. But it’s a small deal. It means that there would be no escalation of tariffs as China has agreed to make more purchases. It could provide a certain level of comfort to US farmers and give Trump something to brag about.”

China knows how to play this game very well, and they know that Trump needs a way “out” of the mess he has gotten himself into.

Not surprisingly, as Trump said on Thursday, while he prefers a broad deal, he left open the possibility of a more limited deal to start, which is also code for:

“Let’s get a deal on the easy stuff, call it a win, and go home.”

Hmm, this is what we wrote earlier this year:

“Importantly, we have noted that Trump would eventually ‘cave’ into the pressure from the impact of the ‘trade war’ he started.”

For Trump, he can spin a limited deal as a “win” saying “China is caving to his tariffs” and that he “will continue working to get the rest of the deal done.” He will then quietly move on to another fight, which is the upcoming election, and never mention China again. His base will quickly forget the “trade war” ever existed.

Kind of like that “Denuclearization deal” with North Korea.

ECB Goes All In

If the potential for a “trade deal” wasn’t enough to spur equities, then surely the ECB throwing in the monetary policy stimulus towel would do the trick. Last week, the ECB went “all in” by:

-

Cutting already negative deposit rates for the first time since 2016 to stimulate the sagging European economy, by 10bps to -0.50%.

-

Restarted QE by €20 billion per month and it will be open-ended

-

The ECB dropped calendar-based forward guidance and replaced it with inflation-linked guidance, noting that key ECB interest rates will “remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon.”

-

The ECB eased TLTRO terms with banks whose eligible net lending exceeds a benchmark.

-

Additionally, the maturity of the operations will be extended from two to three years.

-

Finally, the ECB will introduce a two-tier system for reserve remuneration in which part of banks’ holdings of excess liquidity will be exempt from the negative deposit facility rate, in an attempt to mitigate the adverse impact to banks.

We had previously stated the Central Banks are going to act to bail out systemically important banks which are on the brink of failure – namely, Deutsche Bank ($DB)

Not surprisingly, this was the same conclusion Bloomberg finally arrived at:

“Deutsche Bank AG will benefit the most by far from the European Central Bank’s new tiered deposit rate. Germany’s largest lender stands to save roughly 200 million euros ($222 million) in annual interest paymentsthanks to a new rule that exempts a big chunk of the money it holds at the ECB from the negative rate the central bank charges on deposits. That’s equivalent to 10% of the pretax profit the analysts expect the bank to report in 2020, compared with an average of just 2.5% for the EU banks included in the analysis.”

Duetsche Bank was heard singing:

“Thank you for the bailout,

On your way out,

Mr. Draghi.”

But it isn’t just the ECB easy monetary policy to support global markets and economies. According to Charlie Bilello, everyone is doing it:

Fed: easing

ECB: easing

BOE: easing

BOJ: easing

Australia: easing

New Zealand: easing

Brazil: easing

Russia: easing

India: easing

China: easing

Hong Kong: easing

Korea: easing

Indonesia: easing

SouthAfrica: easing

Turkey: easing

Mexico: easing

Philippines: easing

Thailand: easing pic.twitter.com/1jzS8HYDPo— Charlie Bilello (@charliebilello) September 12, 2019

https://platform.twitter.com/widgets.js

Importantly, QE and negative rates are destroying the banking system globally. These programs DO NOT stimulate economic growth or an incentive for productive investment. Rather, these programs only succeed in inflating asset prices, increasing demand for risky debt, and acting as a “wealth transfer” system from the middle-class to the wealthy.

The reality is that these interventions have been “required” just to hold the current construct up. As we will discuss in a moment, the Federal Reserve tried to normalize rates, but was only able to make minimal progress before the “wheels came off the cart.”

The question is, what’s going to happen when a recession finally occurs?

That is a question for later.

The Economy Shows Signs Of Life

Adding fuel to the “bullish” case, the economy did show signs of improvement.

Before you get all excited, all this indicator denotes is that economic data is “less bad” than it was previously. The chart below is our RIA Economic Output Composite Index which is a comprehensive measure of the U.S. economy from both the manufacturing and service side of the ledger.

While the data may have surprised recently, the overall economy is not accelerating; it just isn’t declining as quickly. With the Citi index already much improved, the temporary run of “less bad” data will likely reverse in the next couple of months.

Then, there is the last “hold out.”

The Fed Is On Deck

All the bulls need now is the Fed to “cut” rates at the meeting next week.

It is expected the Fed will cut rates by 0.25% at the next meeting. However, what will be important is how they couch their views going forward.

The problem for the Fed is two fold.

-

If they come out too “dovish,” they will appear to be “caving” to Trump’s demands which would threaten their “independence.”

-

If they come out too “hawkish,” they run the risk of disappointing the markets, and already weaker consumer confidence.

The Fed is in really a tough spot. Given they have already cut rates once this year, they have already depleted what little bit of “ammunition” they have to combat the next recessionary downturn in the economy.

Furthermore, core CPI jumped over the past month, which will lead the Fed’s preferred measure of inflation which is the Personal Consumption Expenditure (PCE) index.

With PCE forecasted to rise over the next several months, this potentially puts the Fed in a box. Interestingly, when Fed began “hiking rates” in 2015, over concerns of rising inflationary pressures, PCE is now higher than back then. This is going to make it difficult to support the case for “zero interest rates.”

With markets hovering at all-time highs, the unemployment rate near record lows, and inflationary pressures near their target levels, there is little reason to be cutting rates now.

For the bulls, the good news is, they will cut rates anyway.

Is It All Priced In?

With all the bullish news this past week, it is certainly not surprising that market rallied sharply.

Oh, wait….it was only a 0.6% gain?

“But, it’s a lot higher for the month. “

Yes, the market has rallied 3.4% for the month so far, but since the May highs, the market has risen by only 1.9%. Given the volatility and angst of the summer months, bonds have provided a better return.

However, with all the “bullish” news one could hope for, it certainly seems like the markets would/should have responded better.

Or, maybe its the fact that the markets have been front running this news ever since the December lows. From December 24th to today, the market has already risen markedly.

-

The Dow Jones Industrial Average has risen 5427 points

-

The S&P 500 has risen 656 points.

-

The Nasdaq Composite has surged 1983.79 points.

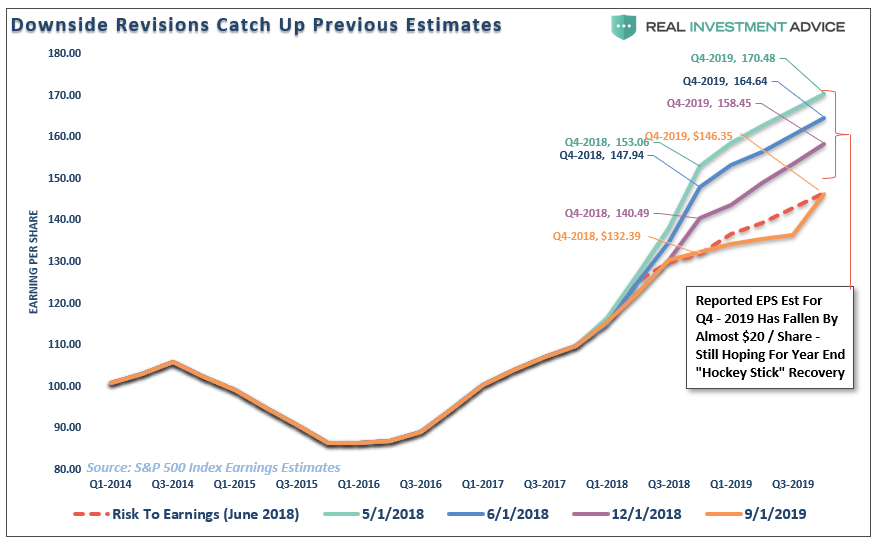

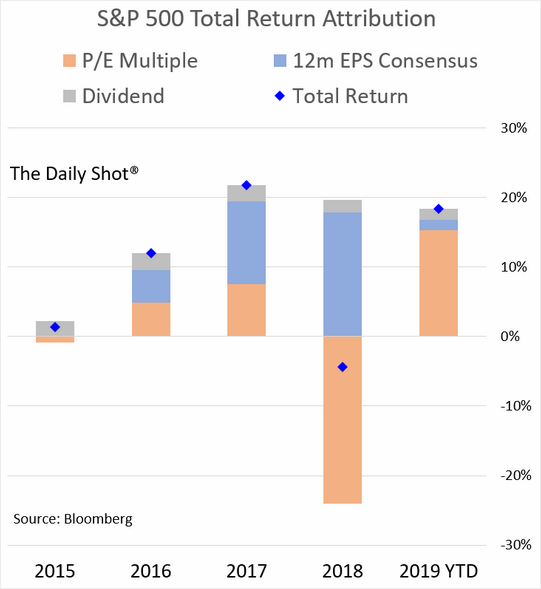

At the same time as markets were surging on hopes of a trade deal, Fed rate cuts, and more ECB QE, corporate profits have declined. (Note: Profits have fallen on a pre-tax basis and are barely stable at 2012 levels despite a full 5% decline in effective tax rate)

Earnings expectations have fallen.

There is a decent argument to be made that whatever positive benefit may come from all these actions have already been priced into equities currently.

As we noted last week, the “bulls” regained the narrative when the S&P 500 broke above 2945. Unfortunately, they just haven’t been able to do much with it so far.

Currently, the risk/reward is not in the bulls favor short term. With the market back to very overbought conditions, the upside to the top of the bullish trend channel is about 1.9%. The downside risk is about 5.5%.

What about that bloodbath in bond yields?

Yes, we finally got the much-needed sell off in bonds. This is something we have been expecting now for several weeks as discussed with our RIAPRO subscribers:

-

Like GLD, Bond prices have surged on Trump ramping up the trade war.

-

The overbought condition is rather extreme, so be patient and wait for a correction back to the breakout level to add holdings.

-

Prices could pullback to the $135-137 range which would be a better entry point.

-

Long-Term Positioning: Bullish

That correction came last week with bonds taking it on the chin as shown in the chart below.

However, let’s keep it in perspective for a moment. That little red square, if you can see it, is the rate jump this past week.

I will note that previous overbought conditions (bonds are inverse from stocks) have led to decent reversals in rates, which have repeatedly been outstanding buying opportunities for bond investors.

This is because higher rates negatively impact economic growth. It is also worth noting that collapsing bond prices tends to lead the S&P 500 as it suggests that something “just broke” in the market.

While there are certainly many arguments supporting the “bullish case” for equities at the moment, the reality is that much of the “news” has already been priced in.

More importantly, if that is indeed the case, then where will the next leg of support for the bull market going to come from?

It is hard to suggest there will be a aggressive reversal of economic growth, profit margins, and confidence considering the current length of the economic cycle.

I will reiterate from last week:

“This is why, despite the bullish overtone, we continue to hold an overweight position in cash (see 8-Reasons), have taken steps to improve the credit-quality in our bond portfolios, and shifted our equity portfolios to more defensive positioning.

We did modestly add to our equity holdings with the breakout on Thursday from a trading perspective. However, we still maintain an overall defensive bias which continues to allow us to navigate market uncertainty until a better risk/reward opportunity presents itself. “

That remains the case this week as well.

Tyler Durden

Sun, 09/15/2019 – 11:30

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com