“Liquidity Dies In Darkness”: Trillions In Assets Have No Financial Disclosure To Support Them

While there has been extensive discussion of the passive/ETF/index fund bubble, most recently by Michael “Big Short” Burry, who most recently joined the parade of skeptics warning of the implicit and explicit dangers the passive investing bubble carries with it, perhaps the most interesting angle of the ETF stampede into fixed income securities – which include junk bonds and leveraged loans in addition to the recent frenzy for investment grade debt – is the fact that a substantial portion of it now trades with virtually no fundamental information. In other words, assets are being bought (if not so much sold) simply to accommodate the flood of investor money, with no regard for actual financial data or corporate newsflow.

This is highlights in a recent note by TCW’s Chief Investment Officer of Fixed Income, Tad Rivelle, who currently manages some $170 billion in AUM, and who writes that as a result of the above, “not only have the debt markets ballooned in size, but the growth has come disproportionately from those segments of the debt market where financial disclosure is poor.“

As a result of this, Rivelle observes that “If democracy dies in darkness, so does liquidity in that embodiment of economic democracy, i.e., the capital markets.” His conclusion is jarring: this lack of underlying information, while ignored when the tide is rising, leads to an immediate collapse in liquidity when the selling begins and results in a scramble for information, to wit:

When information is scarce, investors must color in between the lines. That which is not known nor well quantified must be assumed or modeled. The door is therefore open to different investors reaching quite different conclusions about the underlying value of an asset leading, of course, to illiquidity.

His conclusion is eerily similar to that of Burry: “the rise of portfolio trading suggests to us that passive funds have, heretofore, played an outsized role in the supply of market liquidity.” Yet while passive investing dominates on the upside, or when stocks are rising, what happens when selling commences is a liquidity discontinuity that leads to unprecedented gaps lower as passive investors are unable to discover price once there is demand for actual underlying fundamentals.

Here is the key except from his recent note:

The Debt Markets Have Already Gone (Mostly) Dark

If democracy dies in darkness, so does liquidity in that embodiment of economic democracy, i.e., the capital markets. When information is scarce, investors must color in between the lines. That which is not known nor well quantified must be assumed or modeled. The door is therefore open to different investors reaching quite different conclusions about the underlying value of an asset leading, of course, to illiquidity.

More so perhaps than any other in history, this cycle is the wellspring of the theories and actions of the central bankers who, in their infinite wisdom, determined that they could model interest rates better than markets could price them. Central banks have flooded the system with what they call “liquidity” but which are actually nothing more–nor less–than electronically conjured “loanable funds.” Under the banner of “doing whatever it takes,” trillions in loanable funds were created so that now $17 trillion in global debt is priced to yield less than nothing.

The magic trick of inverting economic logic with negative rates results from the capacity of the central banks to create unlimited quantities of loanable funds at no cost. Trouble is, while loanable funds can be created without limit, the things that can be purchased with these funds is finite. But, “free money” not only makes loans cheap, it also erodes the capacity of lenders to ask for such reasonable terms as traditional loan covenants and basic financial disclosure.

Traditionally, leveraged borrowers had this choice: borrow in the high yield bond market and live by the disclosure and reporting standards of the public debt markets. In the alternative, if management preferred to adhere to a lesser standard of disclosure, the company could issue in the (private) loan market and subject itself to a battery of covenants designed to limit the ability of management to engage in risky or lender unfriendly actions. Thanks to the central banks, borrowers this cycle no longer had to choose: they could obtain cheap loans without agreeing to restrictive covenants nor providing on-going financial disclosure.

Hence, not only have the debt markets ballooned in size, but the growth has come disproportionately from those segments of the debt market where financial disclosure is poor:

And the punchline: “While a paucity of financial disclosure is not problematic during a bull market for credit, it is a defining feature of a liquidity crisis during a bear market. Human beings are naturally inclined towards fear–even panic–when they are unable to obtain the information they deem critical to their (financial) survival.”

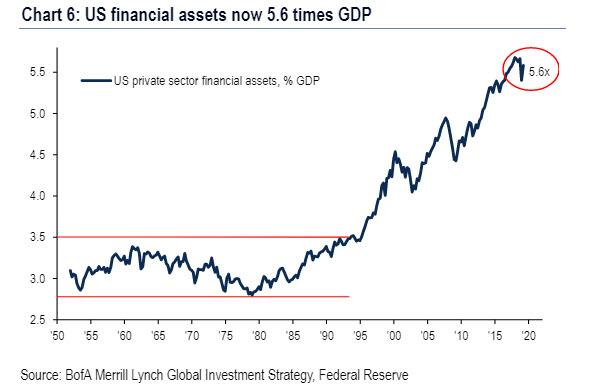

It also explains why, as Bank of America pointed out last week, with the wealth of the US – more than 5x the US GDP – concentrated in the form of financial assets, and any financial crisis would result in an unprecedented loss of (fake) wealth …

… central banks are now “all in” and no longer even have the option of not protecting asset prices from falling.

Tyler Durden

Sun, 09/15/2019 – 19:52![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com