Global Markets Slide, S&P Futures Back Under 3000 On Oil Chaos, China Slowdown

On the 11th anniversary of the Lehman default, global stock markets and US equity futures are broadly lower after this weekend’s drone attack on Saudi oil facilities resulted in the biggest oil price surge in history. State energy producer Saudi Aramco lost about 5.7 million barrels a day of output on Saturday after 10 unmanned aerial vehicles struck the world’s biggest crude-processing facility in Abqaiq and the kingdom’s second-largest oil field in Khurais.

As extensively documented over the weekend, for oil markets, this was the single worst sudden disruption ever, and while Saudi Arabia may be able to return some supply within days – even though Aramco has said it is “less optimistic” on the pace of oil output recovery – the attacks highlight the vulnerability of the world’s most important exporter. They also revive political risk in prices, with the heightened danger of conflict in a region that holds almost half of global crude reserves.

Iran-backed Houthi rebels in Yemen claimed credit for the attack, but President Trump has already said that the US is “locked and loaded depending on verification” that Iran staged the attack, an assertion also made by his secretary of state Mike Pompeo and backed by administration officials. However, Saudi Arabia has still not confirmed that it was Iran behind the attack. It wasn’t totally clear to us which way US treasuries would open up this morning as higher Oil is clearly bearish but the geopolitical tensions that this brings, especially as the US is leaning towards putting the blame at Iran’s door, are significant.

“We have never seen a supply disruption and price response like this in the oil market,” said Saul Kavonic, an energy analyst at Credit Suisse Group AG. “Political-risk premiums are now back on the oil-market agenda.”

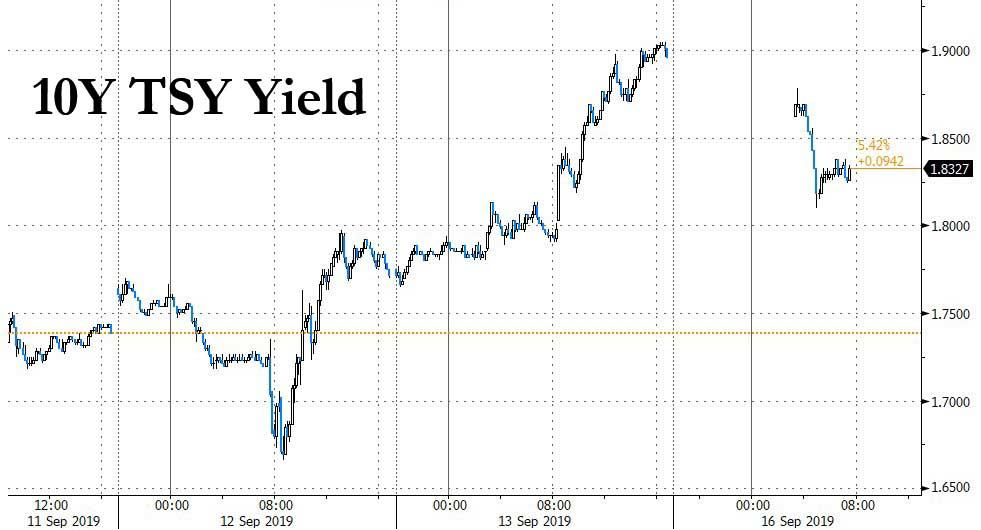

The shock collapse in Saudi oil output pushed S&P futures back under 3,000 and yields on 10Y Treasurys down 8bps to 1.81%, while the dollar shortage has returned, sending the Bloomberg Dollar index to session highs.

Adding to the downward pressure on risk assets was the latest dismal news from China which saw the country’s economic slowdown deepen in August as core data missed across the board and industrial production tumbled to its weakest 17-1/2 years as reported last night: August industrial output growth unexpectedly weakened to 4.4% in August, the slowest pace since February 2002 and receding from 4.8% in July. Fixed asset investment growth was marginally below market expectations and the July reading. Retail sales growth also moderated significantly on the back of weaker automobile sales. The relentless slowdown has reinforced views that China is likely to cut some key interest rates this week for the first time in over three years to prevent a sharper slump in activity.

While most European markets were lower, European oil stocks surged the most since January, with Europe’s SXEP Index climbing as much as 3.1%, the most since Jan. 4. Biggest gainers included Total +3.1%, BP +3.8% and Shell +3%, although the gains failed to offset losses by virtually all other sectors. Oil names aside, airlines are feeling the squeeze from the increase in oil prices with the likes of Lufthansa (-2.7%) and easyJet (-2.2%) under pressure. Elsewhere, Airbus (-3.8%) are towards the bottom of the Stoxx 600 following the WTO’s ruling that the US can legally impose tariffs in response to the illegal subsidising of the Co.; which has also resulted in significant downside across luxury names and most notably in LVMH (-3.6%).

Earlier in the session, Asian stocks fell, led by financial firms, as risk appetite waned after an attack on Saudi Arabia’s oil facilities. Energy shares jumped, while gold and the yen rallied as investors sought haven assets. Markets in the region were mixed, with Indonesia leading losses and South Korea advancing. Japanese markets are closed for a holiday. The Shanghai Composite Index closed little changed, as a rally in energy stocks was offset by a slide in some financial shares. The world’s second-biggest economy slowed further in August, indicating current stimulus policies may not be enough to cushion the blow of the trade war with the U.S. Indonesia’s Jakarta Composite Index slumped as much as 2.2%, dragged down by cigarette producers following the announcement of a sharp increase in the tobacco excise tariff

The burst of political tension following the strikes on Saudi Arabia’s oil facilities has presented another conundrum for emerging-market traders. As Bloomberg notes, fresh from their longest rally in 20 months, many currencies foundered after the weekend drone attack on the Saudi Aramco installations led Riyadh to halve productionand triggered the biggest intraday jump in crude prices on record. The Indian rupee, Turkish lira and South African rand were among the worst-hit, while MSCI’s index of emerging stocks ended a three-day winning streak. The conflagration added a fresh layer of complexity to a market that last week took heart from signs of a U.S.-China truce on trade and expectations that central banks will ratchet up stimulus to stem a global economic slowdown. The concerns centered on how long oil supplies will be disrupted – underpinning prices and fanning inflation – and how the U.S. will respond, after blaming Iran for the attack.

“The market had become too sanguine about geopolitical risks over the last few months,” said Patrick Wacker, a fixed-income fund manager at UOB Asset Management. “While Saudi Arabia’s sovereign fundamentals are still firm, bond prices will need to factor in higher geopolitical risk going forward, which will weigh on Saudi Arabia’s and Aramco spreads.” Monday’s declines in Asia were far from extreme though, and some strategists saw the selloff as a buying opportunity. “If the markets decode this as a one-off lucky strike, risk should come roaring back,” said Stephen Innes, a strategist at AxiTrader Ltd. in Bangkok. “Investors will turn to bargain-hunting as trade-war winds blow fair, and of course with the prospects of Federal Reserve easing and all the other central banks leaning dovish.”

In yields, renewed fears about China’s economy and concerns that an oil price spike may depress global economic growth, coupled with a flight to safety helped send yields sharply lower after last week’s blowout move which pushed the 10Y north of 1.90% by the close on Friday. This morning the same paper was yielding as low as 1.81%, while European bonds were similarly higher.

China’s sovereign bonds pared declines after weaker-than-expected economic data indicated more stimulus may be needed to offset the impact of the trade war with the U.S. The yield on China’s benchmark 10-year government notes pared a gain of as much as 5 basis points, while 10-year bond futures rose as much as 0.2%.

In FX, the Bloomberg Dollar Spot Index was steady after two weeks of declines; U.S. Treasuries advanced for the first time since Sept. 3, driving the 10-year yield down by 7bps to 1.83%. USD/JPY was down 0.3% to 107.75 after sliding as much as 0.6%; USD/NOK fell 0.2% to 8.9711, after sliding as much as 0.8%. The biggest loss against the greenback was seen in sterling on profit-taking as a deal is seen as unlikely in the latest meeting of U.K. and EU leaders over Brexit; GBP/USD falls as much as 0.6% to 1.2426 after earlier touching 1.2523, its strongest since July 22.

In commodities, naturally energy markets remain in the spotlight after the Saudis supply shock lifted Brent crude just shy of $72 on the Asian open, a record 20% surge. However, since then Around half of the move has faded but both Brent and WTI remain ~8% higher leading oil and gas stocks to outperform in otherwise downbeat equity indices.

Of immediate focus will now be whether the Saudi attack escalates, and drags Iran in. On Sunday night, President Trump tweeted there is reason to believe that we know the culprit, are locked and loaded depending on verification, but are waiting to hear from the Kingdom as to who they believe was the cause of this attack and under what terms to proceed, while he tweeted that there is plenty of oil and suggested it is fake news he is willing to meet with Iran without conditions.

While traders will now focus on this week’s Fed and BOJ meetings, today’s economic data include Empire State manufacturing survey.

Market Snapshot

- S&P 500 futures down 0.5% to 2,993.00

- STOXX Europe 600 down 0.6% to 389.63

- MXAP down 0.04% to 159.90

- MXAPJ down 0.2% to 514.76

- Nikkei up 1.1% to 21,988.29

- Topix up 0.9% to 1,609.87

- Hang Seng Index down 0.8% to 27,124.55

- Shanghai Composite down 0.02% to 3,030.75

- Sensex down 0.6% to 37,162.83

- Australia S&P/ASX 200 up 0.06% to 6,673.48

- Kospi up 0.6% to 2,062.22

- German 10Y yield fell 1.1 bps to -0.46%

- Euro down 0.1% to $1.1060

- Brent Futures up 8.8% to $65.51/bbl

- Italian 10Y yield rose 1.3 bps to 0.541%

- Spanish 10Y yield fell 0.5 bps to 0.297%

- Brent futures up 9% to $65.66/bbl

- Gold spot up 0.8% to $1,500.80

- U.S. dollar Index up 0.02% to 98.28

Top Overnight News from Bloomberg

- In an extraordinary start to trading on Monday, London’s Brent futures leapt almost $12 in the seconds after the open, the most in dollar terms since they were launched in 1988. Oil’s jump came after a strike on a Saudi Arabian oil facility removed about 5% of global supplies

- President Donald Trump said the U.S. is “locked and loaded depending on verification” that Iran staged the strike on Saudi Arabia’s plant, an assertion already made by his secretary of state and backed by administration officials. Trump authorized the release of oil from the nation’s emergency oil reserves following the drone attacks

- Iranian-backed Yemeni rebels said oil installations in Saudi Arabia remain a target after drone attacks on two major sites slashed the kingdom’s output by half and triggered a record surge in oil prices.

- U.K. Prime Minister Boris Johnson and his government sounded a more optimistic note on the likelihood of reaching a Brexit deal, even as he prepares to take a hard-line approach in his first negotiations with European Commission President Jean-Claude Juncker on Monday

- China’s economy slowed further in August, indicating current stimulus policies may not be enough to shield the economy from the worsening effects of the trade war with the U.S.

- The Bank of Japan is growing more open to the idea of cutting short-term interest rates deeper into negative territory, the WSJ reports, citing people familiar with the bank’s thinking. Policy board is leaning toward maintaining policy at this week’s meeting, and wants to see the impact of the Oct. 1 sales tax increase

- North Korean leader Kim Jong Un invited Trump to visit Pyongyang, Joongang Ilbo reported, citing multiple people familiar with the matter., The offer to hold another summit was made in a letter delivered on the third week of August, the report said

- Federal prosecutors are closing in on JPMorgan Chase & Co. officials in their investigation of price rigging in precious metals markets

Asian equity markets began the week cautiously as oil prices surged and geopolitical concerns heightened following drone attacks on Saudi refineries which shut down 5.7mln bbls or more than half of the kingdom’s production. Furthermore, the US are pointing the blame on Iran which the latter have denied, while disappointing Chinese Industrial Production and Retail Sales data, as well as this week’s heavy slate of central bank activity added to the tentative tone. ASX 200 (+0.1%) traded indecisively as weakness in the broader market was counterbalanced by strong gains in commodity-related sectors, especially energy stocks after oil prices briefly spiked as much as 20% due to the attacks on OPEC’s largest producer and although it expects to restore a third of the disrupted output today, some sources suggested a large percentage of the offline crude could be lost for some time. Hang Seng (-0.8%) and Shanghai Comp. (U/C) were mixed with underperformance in Hong Kong following another weekend of violent protests and with the mainland choppy as disappointing data and downbeat comments on China’s economy from Premier Li, fuelled stimulus hopes and as the PBoC’s previously announced 50bps RRR cut took effect today. As a reminder, Japanese markets remained shut for Respect for the Aged Day. China Premier Li said maintaining economic growth at 6% or higher is very difficult and that the Chinese economy faces certain downward pressure due to slowing global growth, protectionism and unilateralism.

Top Asian News

- Lendlease Seeks to Raise Up to $539 Million in Singapore IPO

- Chinese Developer Exits Key Macau Project Amid Local Land Probe

- Mega Mergers Fail to Lure Funds to India’s State-Run Bank Stocks

- Budweiser in Talks With GIC for ~$1B H.K. IPO Investment: IFR

Major European indices are softer this morning [Euro Stoxx 50 -0.7%] as risk sentiment is impacted by the attack on Saudi Arabia’s oil refineries over the weekend; which is seen to reduce their output by as much as 5.7mln/bbl. Unsurprisingly, the energy sector is the only one in the green and is posting gains just shy of 3.0% thus far; notable movers within sector include heavyweights BP (+4.0%) and Shell (+2.8%) amongst the gainers, though Tullow Oil (+8.8%) is leading the way. Oil names aside, airlines are feeling the squeeze from the increase in oil prices with the likes of Lufthansa (-2.7%) and easyJet (-2.2%) under pressure. Elsewhere, Airbus (-3.8%) are towards the bottom of the Stoxx 600 following the WTO’s ruling that the US can legally impose tariffs in response to the illegal subsidising of the Co.; which has also resulted in significant downside across luxury names and most notably in LVMH (-3.6%). Other notable movers include, Wirecard (+1.2%) who are topping the Dax (-0.6%) after signing a MoU with UnionPay; while Atlantia (-7.1%) are at the bottom of the FTSE MIB (-1.1%), as the Co. are state they are open to an audit regarding falsified reports concerning viaduct safety and are to investigate whether their own procedures were correctly adhered to.

Top European News

- Johnson to Meet EU’s Juncker for Talks Over Lunch: Brexit Update

- Benettons Weigh Options on Atlantia Including Replacing CEO

- China Rebuff Leaves Hong Kong Bourse Isolated in Bid for LSE

- LVMH, Burberry, Hermes Fall After Weekend of Hong Kong Violence

In FX, The best performing G10 currencies are NOK/JPY/CAD/NZD/AUD on a mixture of geopolitical and crude factors as attacks on Saudi oil facilities over the weekend cut production and reignited tensions between the US and Iran, with Tehran announcing that President Rouhani will not be seeing Trump on the side-lines of the UN as had been mooted. No surprise that the Norwegian Krona and Loonie are benefiting from the spike in oil prices, along with the RUB, as Eur/Nok straddles 9.9000, Usd/Cad hovers around 1.3250 and the Rouble holds circa 64.000, albeit all some way from the lows seen when crude was at its extreme peaks (Brent almost Usd72 and WTI over Usd63). Meanwhile, the Yen has regained a safe-haven bid alongside XAU (bullion back on the Usd1500 handle) between 108.00-107.50 and decent option expiries from the big figure to 108.15 (1 bn) may also be keeping Usd/Jpy capped. Elsewhere, the Kiwi has regained the initiative down under and got close to 0.6400 vs its US counterpart again, as Aud/Nzd drifted down ahead of 1.0800 and Aud/Usd eased within a 0.6883-60 range amidst sub-forecast Chinese IP and retail sales data that underscored relatively downbeat remarks from Premier Li.

- CHF/EUR/GBP – The Franc has pared most of its safe-haven gains vs the Dollar as the DXY consolidates off last Friday’s sub-98.000 lows in a 98.038-98.310 band, with Usd/Chf back up near 0.9900 from 0.9865 or so at one stage, but retains a firmer bid vs the Euro ahead of Thursday’s SNB meeting around 1.0950. Latest weekly Swiss sight deposits suggest a return to FX dabbling, while the single currency is struggling to keep pace with the Greenback after its post-ECB exertions, although Eur/Usd is keeping its head above the 21 DMA (1.1055) and well above expiries sitting at 1.1000-10 (1.2 bn) and 1.1025 (1 bn) in 1.1059-91 parameters. Conversely, the Pound has pull up pretty sharply from best levels of 1.2500 in Cable and circa 0.8855 on the Eur/Gbp cross as UK PM Johnson heads for his first face-to-face meeting with EU’s Juncker to try and hammer out an Irish backstop resolution. Note also, 1.2 bn options expire at 1.2500 and could be weighing on Sterling.

In commodities, crude futures made their single largest daily gain in history at the reopen of trade on Sunday, after Iranian-backed Yemeni Houthi rebels attacked critical Saudi Arabian oil infrastructure with drones, taking some 5.7mln bpd of Saudi supply (5% of world) offline; although the complex has since pared gains somewhat. WTI Oct’ 19 futures moved as high as USD 63.25/bbl before falling to the low USD 59.0 area per barrel, while Brent Nov’ 19 futures reached heights of USD 68.50/bbl, before paring back to the mid USD 65s/bbl. Both hold on to gains north of USD 4.0/bbl and USD 5.0/bbl respectively. Later reports that Saudi Aramco’s full return to normal levels of oil production may ‘take months’ also resulted in some positive ticks for the crude complex. Goldman Sachs hypothesise that, should the outage last 2-6 weeks, they would expect to see a move in Brent prices of between USD 4.0/bbl and USD 14.0/bbl, keeping Brent below USD 75/bbl. Conversely, a net disruption of larger than 4mln BPD for more than three months would likely bring Brent prices above USD 75/bbl, according to the bank. While little is known at the moment about the extent of the damage or the expected duration of the outages, it seems likely that such a successful precision attack on producer as important as Saudi Arabia may result in persistent risk premium. Focus now will turn to what, if any, response occurs from the US side given the tweets from US President Trump and reports illustrating that Iran’s Revolutionary Guards were behind the attack, alongside any measures to alleviate the supply shortage via OPEC+ members. The attack itself has triggered a broader risk off move, which has seen Gold prices move back above the USD 1500/oz handle to USD 1512/oz at best. Poor data out of China, where Industrial Output and Retail Sales both disappointed, combined with the more cautious risk appetite, has seen copper underperform. Of note for steel, ING point out that China’s steel production recovered 2.2% M/M (+9.3% Y/Y) to 2.81mt per day in August 2019, as falling iron ore prices improved the profitability of steel mills. Iron ore prices in China dropped around 25% in August while domestic steel prices were down only around 5-10%. In total, Chinese steel output is up 9.1% YoY to 665mt over the first eight months of the year. Finally, of note for nickel; mining operations in the Tawi-Tawi province (nickel producing region) in the Philippines have been suspended on an indefinite basis, according to government officials. The suspension comes amid a review of the local government’s mining policy.

US Event Calendar

- 8:30am: Empire Manufacturing, est. 4, prior 4.8

DB’s Jim Reid concludes the overnight wrap

11 years ago this Monday morning we woke up to the implications of the shock Lehman default. Time flies. Exactly one decade and a year later we’re waking up to a record breaking rally in oil with Brent futures jumping c. 20% to $72/ barrel in the seconds after they opened today, marking the biggest intraday advance ($11.73) since they were launched in 1988. WTI contracts, on the New York Mercantile Exchange, were frozen at the open for about two minutes because of a circuit breaker, jumped as much as 15.5% to $63.34, the most since 2008.As we’ll see below we’ve pared about half of these gains now but it’s still a record breaking session. Prior to the weekend news it was hard to look much past the Fed meeting on Wednesday for the highlight of the week but the news that around half of Saudi’s daily oil production (5% of world total/ 5.7 mn barrels per day) has been taken offline due to drone attacks will now be a big focus for oil and geopolitics.

To give the moves some context, the attacks led to single worst sudden disruption ever for oil markets, surpassing the loss of Kuwaiti and Iraqi petroleum supply in August 1990, when Saddam Hussein invaded his neighbour. It also exceeds the loss of Iranian oil output in 1979 during the Islamic Revolution, according to the International Energy Agency. As discussed Oil has pared almost half of its opening advances as we type but with WTI and Brent still trading up +8.84% and +9.91% respectively. Meanwhile, Iran-backed Houthi rebels in Yemen claimed credit for the attack, but President Trump has already said that the US is “locked and loaded depending on verification” that Iran staged the attack, an assertion also made by his secretary of state Mike Pompeo and backed by administration officials. However, Saudi Arabia has still not confirmed that it was Iran behind the attack. It wasn’t totally clear to us which way US treasuries would open up this morning as higher Oil is clearly bearish but the geopolitical tensions that this brings, especially as the US is leaning towards putting the blame at Iran’s door, are significant. Treasuries haven’t opened as usual due to a Japanese holiday but implied levels in futures seem to indicate a 4.1bps rally in 10yrs. Spot gold prices are up c. 1% this morning to 1503/ ounce.

Bloomberg has reported overnight that Saudi Arabia can restart a significant volume of the halted oil production within days, but needs weeks to restore full output capacity. Meanwhile, Saudi Aramco said in a statement dated Saturday that it would provide an update in about 48 hours. So, one to look out for. Elsewhere, President Trump also authorized the release of oil from the nation’s emergency reserves while the IEA which helps coordinate industrialized countries’ emergency fuel stockpiles, said it was monitoring the situation. Trump also said that the amount of oil released from the SPR would be determined “sufficient to keep the markets well-supplied.” The stockpile has previously been tapped in response to Operation Desert Storm in 1991, Hurricane Katrina in 2005, and Libyan supply disruptions in 2011.

Equity markets in Asia are trading mostly down but not severely with the Hang Seng -1.00% while the shanghai comp is up +0.10% and the Kospi is up +0.40% as the markets re-open after a holiday. Markets in Japan are closed for a holiday. Futures on the S&P 500 are down -0.58%.

As for FX, the currencies of commodity exporting nations are making gains today – the Norwegian Krone (+0.51%) and Canadian dollar (+0.41%) are both up. The Japanese yen is up +0.25% while most Asian EM fx is trading weak. In terms of overnight data releases, China’s August economic data came in weaker than expected across the board with industrial production falling to +4.4% yoy (vs. 5.2% yoy expected), the lowest since February 2002 while retail sales stood at +7.5% yoy (vs. +7.9% yoy expected) and YtD August Fixed asset investment slowed to 5.5% yoy (vs. +5.7 yoy expected).

This weekend’s events follow the worst week for some bond markets for a few years. 10yr Treasury yields were up +33.6bps (+12.4bps Friday), the largest weekly increase since the week of President Trump’s election in 2016, while 10-year bund yields were up +18.9bps (up +6.7bps Friday), the biggest weekly increase since June 2017. The sell-off came about thanks to a run of positive data releases from the US (more on that below) along with a mixed message from the ECB with the number of dissenters suggesting that it will be difficult to do much more from the monetary side. Indeed Bundesbank President Weidmann struck a strongly hawkish note on Friday, saying in comments to Bild that the ECB had gone “over board”, citing positive wage growth and the lack of deflation. Furthermore, he said “I will make sure that interest-rate increases won’t unnecessarily be delayed”. Meanwhile the President of the Dutch Central Bank, Klaas Knot, said in a press release that “This broad package of measures, in particular restarting the APP, is disproportionate to the present economic conditions, and there are sound reasons to doubt its effectiveness.” The irony about the immediate market response to the meeting is that investors have assumed that the lack of cohesion at the ECB and Draghi’s strong indication that they can’t do much more, has left them assuming that government spending will have to take over sooner rather than later. As such they are ignoring the potential policy error of restarting QE (bullish for bonds all other things being equal) and the potential flattening of the yield curve as we approach or have crossed the reversal rate.

Even though we may be at the reversal rate, the thought process explained above and the fact that tiering was introduced meant that banks were the main winner last week with the STOXX Banks index up +7.80% (+3.02% Friday), which was its biggest weekly gain since March 2017, while the S&P 500 Banks Industry Group was up +6.84% (+1.42% Friday), the strongest week since January.

Equity overall continued their advance with the S&P 500 up +0.96% (-0.07% Friday), while the STOXX 600 rose +1.20% (+0.34% Friday). This was the 3rd consecutive weekly move upwards for the S&P and the 4th for the STOXX 600, and the moves mean that the S&P 500 is now just a +0.61% increase away from reaching its all-time closing high. Safe havens suffered however, with gold down -1.21% (-0.72% Friday) and closing lower for the 3rd consecutive week.

In spite of the stimulus package, the euro actually ended the week up +0.40% against the dollar, although the policy moves did seem to have some effect on market expectations of inflation, with five-year forward five-year inflation swaps up +7.4bps last week to 1.314%, their highest level in over a month, although still pretty low. Bear in mind a year ago it was at 1.691%, so there’s been a pretty big downgrade in market’s assessment of future inflation over this last year.

Yield curves steepened amidst the bond sell-off, with the US 2s10s curve up +7.8bps (+4.2bps Friday) to reach +9.2bps, its highest level in over a month, while the German and the UK 2s10s curve also ended the week +2.8bps and +7.5bps respectively. The Bund curve really struggled to know what to do post the ECB and probably still does. Meanwhile Sov spreads tightened, with the Italian 10yr yield spread over bunds falling for a 5th consecutive week, down -18.5bps to their lowest level since May last year, while the Spanish 10yr spread over bunds fell by -6.0bps.

Previewing the Fed now, the overwhelming consensus (and DB) expectation is for another 25bp rate cut, following the 25bp cut at the Fed’s July meeting, which was the first rate cut since 2008. The main focus will be on where they go after this week. Our economists think a continued dovish bias should be evident in the statement language, Summary of Economic Projections and Chair Powell’s press conference. It seems Powell is still keen to emphasise the baseline as a mid-cycle slowdown though over anything more sinister but it’s hard to imagine him not highlighting the risks, especially around trade. Expect the “act as appropriate to sustain the expansion” line to continue to be the takeaway. A reminder that after this 25bps cut our economists expect a further cumulative 75bps of rate cuts (Oct, Dec, Jan) after next week’s reduction (see “ A trade tipping point ”).

This follows a run of more positive US data releases which continued on Friday, with US retail sales up +0.4% in August (vs. +0.2% expected), while July’s reading was revised up a tenth to +0.8%. The University of Michigan sentiment indicator also beat expectations, coming at at 92.0 (vs. 90.8 expected), and rebounding from August’s reading which was the lowest since October 2016. With all the positive data releases from the US this week, which also included lower-than-expected weekly jobless claims and higher-than-expected consumer borrowing figures, investors reassessed the chances of aggressive easing from the Federal Reserve over the coming months. By the end of last week, investors saw the chances of at least 75bps of further cuts from the Fed this year at 17.6%, down from 40.6% at the end of the previous week. Meanwhile, the chances of just one further 25bp cut this year rose over the last week from 13.7% to 33.3%.

Back to the ECB now and this week we will get a chance to hear from a number of their dignitaries. Lane will be speaking today, Villeroy on Wednesday, and Coeure and Rehn on Thursday. So it will be interesting to hear their take. From the Fed, Boston Fed President Rosengren is speaking on Friday albeit after the FOMC. This week also sees policy meetings from the Bank of Japan, Bank of England and the Swiss National Bank.

From Europe, a release to watch out for will be Germany’s Zew Survey for September. Last month, the expectations reading dropped to -44.1, the lowest level since December 2011, while the current situation reading dropped to -13.5, the lowest since May 2010. So it’ll be worth keeping an eye out to see if things continue to deteriorate or if there are any signs of stabilisation.

Finally with regards to Brexit we will hear from the Supreme Court from tomorrow over the legality of proroguing Parliament and today sees Mr Johnson meet EC President Juncker for Brexit talks. It seems some red lines are being softened on the Irish issue from the UK side. It’ll be interesting to see if more progress is made towards a deal. It still looks very hard to imagine one that passing Parliament by October 31st but the odds are probably higher now than they were a week ago as some Labour MPs suggested they will now vote for a deal, hardline Brexiters seems to be slightly more likely to compromise and the DUP may be softening some of their resistance behind the scenes. We will see if more progress and compromise is forthcoming. On the flip side there are still press stories suggesting Mr Johnson won’t ask the EU for an extension even though a law has now been passed insisting he does. So clearly lots of water to flow under the Brexit bridge over the next 6 and a bit weeks.

Tyler Durden

Mon, 09/16/2019 – 07:52

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com