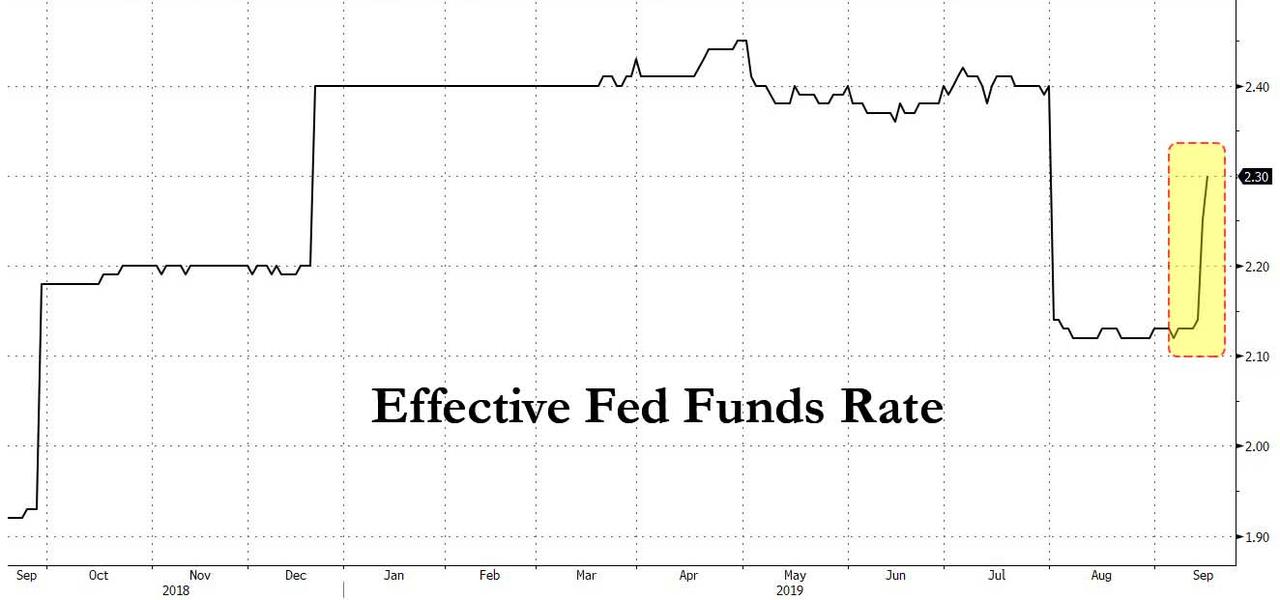

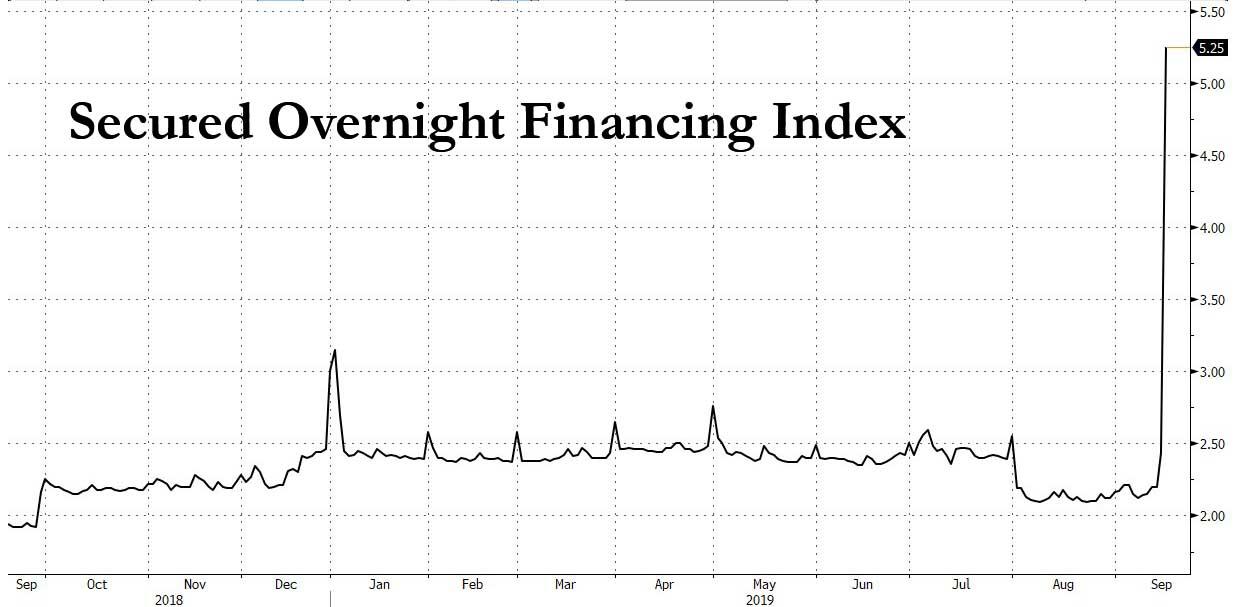

Fed Funds Prints 2.30%, Breaching Target Range, As Libor Replacement Soars To “Remarkable” 5.25%

If today’s second consecutive repo was supposed to calm the stress in the secured lending market and ease the funding shortfall in the interbank market, it appears to have failed. Not only did O/N general collateral print at 2.25-2.60% after the repo operation, confirming that repo rates remain inexplicably elevated even though everyone who had funding needs supposedly met them thanks to the Fed, but in a more troubling development, the Effective Fed Funds rate printed at 2.30% at 9am this morning, breaching the Fed’s target range of 2.00%-2.25% for the first time.

This also means that the EFF-IOER spread has now blown out to an unprecedented 20bps, yet another indication that the Fed has lost control of the rates corridor.

But in what may be the most concerning move, today’s print for the Secured Overnight Financing Index (SOFR), which is widely expected to be Libor’s replacement, exploded higher by 282bps to a record 5.25%.

Commenting on the blow out in the SOFR, Goldman had this to say on the “extremely volatile” price action in the key funding index:

The SOFR market saw extremely volatile price action over the course of the day…. Almost 20k in SERU9 blocks printed from 11:15am through the afternoon, pushing SERFFU9 from -10 to -21.5. Shortly after 4pm the market was given another jolt of adrenaline as news of a second Fed operation to be conducted tomorrow morning at 8:15am caused the spot-6mo curve to go bid into the close.

The problem here is that since SOFR is expected to replace LIBOR as the reference rate for several hundred trillions in fixed income securities, a spike such as this one would be perfectly sufficient to wreak havoc across market if indeed it had been the key reference rate.

Finally,courtesy of BMO’s Jon Hill, here is some commentary on today’s oversubscribed, and clearly insufficient, repo operation by the Fed:

Today’s emergency repo operation was oversubscribed with $51.6 bn in Treasury and $22.8 bn in MBS collateral accepted. The weighted average in USTs was 2.215%, with a high rate of 2.36% and a low of 2.10%. This should help alleviate some stress in USD funding markets, and the fact that it’s occurring earlier in the morning than Tuesday should help keep daily averages more subdued than yesterday – SOFR printed at a remarkable 5.25% (a stunning 282 bp spike) with fed funds still unknown but scheduled to be released at 9:00 AM ET and likely to print outside of the target range.

If Powell is successful at guiding the market toward assuming a mid-cycle adjustment, one specific repricing that will occur is in 2020 forwards, which are still factoring in one and a half 25 bp cuts next year as shown in the attached (admittedly, precision here is difficult due to the illiquidity of the Jan ’21 contract). This contrasts with the FOMC’s desire to execute a more modest drop in overnight rates and the price response here will be a focal point in determining how markets are responding to the impending Fed communication. If Powell is effective, look for that area of the curve to steepen sharply.

And so with funding generally locked down for the rest of the day, everyone will now turn attention to what Powell says and how he proposes to ease the funding panic at 2pm today when the FOMC cuts rates by 25bps.

Tyler Durden

Wed, 09/18/2019 – 09:17

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com