Stocks Slide After Trump’s Top China Trade Advisor Says “Tariffs Could Go To 100%”

Yesterday, moments ago Powell reminded president Trump that all he would need to see to cut rates further, would be additional weakening in the global economy, we – jokingly – said that any second now Trump would announce China tariffs would be hiked to 100%.

POWELL: IF ECONOMY WEAKENS, MORE EXTENSIVE CUTS MAY BE NEEDED

Trump tweets China tariffs hiked to 100% in 5… 4… 3….

— zerohedge (@zerohedge) September 18, 2019

https://platform.twitter.com/widgets.js

In retrospect, it turns out it wasn’t a joke, because following earlier trade talk “optimism” from Larry Kudlow as US and Chinese deputies begin their trade talks ahead of October senior level talks, stocks faded much of their earlier gains after the SCMP reported that according to Michael Pillsbury, described by US President Donald Trump as “the leading authority on China”, tariffs on Chinese goods “could to go 50 percent or 100 percent.“

Well, just in case Powell needs to see the economy weakening, we no know how it will happen.

Some more details: according to Pillsbury’s SCMP interview, the United States is set to ramp up the pressure on China “if a trade deal is not agreed soon” noting that Washington has so far imposed only “low level tariffs” on the Asian giant.

According to Pillsbury, Trump had been “remarkably restrained in the pressure he has brought to bear on China in the trade field” – although we doubt Beijing would agree- adding that “the president has options to escalate the trade war” eyeing far higher tariffs: “These are low level tariffs that could go to 50 per cent or 100 per cent,” he said, adding that Trump’s critics were wrong to assume the president was “just bluffing” when he threatened an all-out trade war.

“There are other options involving the financial markets, Wall Street, you know, the president has a whole range of options,” Pillsbury warned.

For those unfamiliar, here is a reminder on Pillsbury’s background:

Pillsbury, the American director of the Centre on Chinese Strategy at the Hudson Institute in Washington, is known to speak to Trump regularly on China issues, but has said repeatedly that the president’s “most important adviser on China is himself”.

Then again, Pillsbury does not necessarily agree with that designation:

“I believe President Trump uses social media, especially on China, to convey his thinking. So I reject the idea that I or anyone else is some kind of adviser to him on China,” he said. “His focus is revealed frequently in the tweets that I think everybody should take very seriously as presidential statements.”

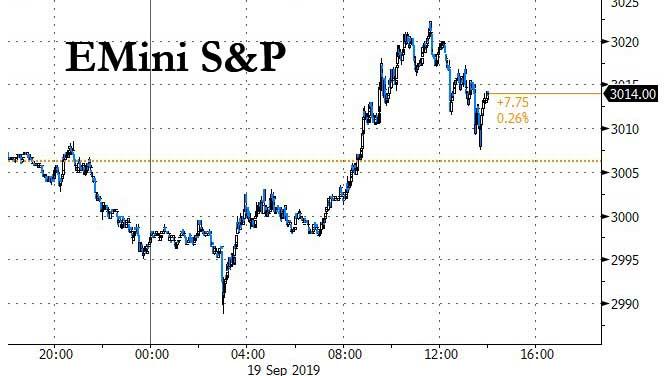

Whatever their relationship, the report, which hit just after noon ET, top-ticked the market, and sent the Emini sliding from a session high of 3,022 back to around 3,010 as traders once again remember that for stocks to surge even higher on the back of lower rates and/or QE, they first have to tumble amid trade war escalation which forces the Fed to ease even more.

Tyler Durden

Thu, 09/19/2019 – 14:18![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com