No Time To Pannick, Yet

Submitted by Michael Every of Rabobank

The Fed’s 25 bps but still hawkish cut and the volatility in short-term dollar funding markets continued to dominate the news cycle, yet other key asset classes didn’t exhibit any particularly unusual volatility. The S&P 500 ended the day unchanged at 3,006 points, while the 10y Treasury yield fell 4 bps to 1.76%. At the same time, the lacklustre reaction in US stock markets could be seen as an indication that risk appetite remains somewhat subdued as the Fed continues to respond to reserve shortages on an ad hoc basis. Yesterday’s USD 75bn repo operation was oversubscribed again, with USD 83.375bn in total bids submitted. The rate was 1.845%. Later today we’ll learn whether this was indeed sufficient to push the effective fed funds print back inside the 1.75%-2.00% target range. There’s no real need for panic, but it won’t take long before we could see renewed attention on possible quarter-end disruptions.

Whilst Fed Chair Powell said on Wednesday that these repo operations are temporary and that rates are expected to stabilize in the target range, we do think that the repo squeeze may be symptomatic of a wider liquidity problem. Due to post-crisis regulation banks are no longer taking the risks necessary to keep the plumbing of the financial system open in times of stress. If the US economy slides into a recession liquidity problems could pop up everywhere. Therefore, as Philip argued on Wednesday, a more lasting effect would be achieved by raising the level of reserves in the system and launching a standing repo facility with regular auctions. But the Fed is apparently not ready to take these decisions yet, so we are likely to see more of these ad hoc overnight repo operations by the New York Fed in the near term.

The UK Supreme Court concluded a three-day hearing in a case that will determine whether Prime Minister Johnson’s decision to prorogue parliament for five weeks was lawful or not. Their decision is expected early next week. As of now, it remains uncertain as to what a verdict that the suspension was indeed under false pretences would mean, and whether it would amount to saying that prorogation actually never happened. Lord Pannick QC, the lawyer who represents the lead claimant, has told the court that Speaker Bercow should then be entitled to reconvene parliament as early as next week. Moreover, it’s also uncertain what would happen to Prime Minister Johnson, who effectively stands accused of lying to the Queen about his motives to suspend parliament. While this would be explosive stuff in normal times, and possibly a cause for his resignation, Mr. Johnson is already publicly contemplating whether he might try a further suspension. No time to Pannick, yet?

The Bank of England managed to stay out of the fray –for a change– when it decided to keep rates unchanged yesterday. The statement read as fairly dovish. Whilst the official guidance of a slow rise in rates remains sacrosanct, the MPC now explicitly conditioned this on the assumption that the economy is on a clear path to a smooth Brexit and that global growth recovers a bit. The casual reader of the Global Daily knows that we believe these assumptions to be a bit far-fetched. Perhaps the MPC agrees as well, as they also warned that the “entrenched uncertainty” regarding Brexit could lead to a period of below-potential growth in demand and, in turn, softer inflation. This was new language, and provided yet another clue that the Bank of England isn’t going to raise interest rates anytime soon, despite the official guidance.

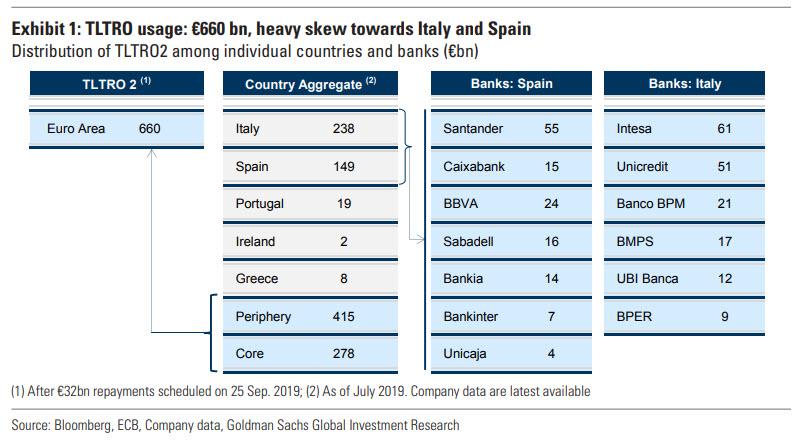

The TLTRO-III programme didn’t get off to a flying start. Banks in the Eurozone only asked for EUR 3.4bn of the first of the ECB’s new loans. If we add this to the EUR 57.7bn of TLTRO-II repayments of June and September, the use of the facility has actually decreased by EUR 54.3bn over the course of the summer. Interestingly, the lack of TLTRO-funding being rolled over is despite the fact that the lower residual maturity of the first two TLTRO-II loans had sparked concerns about the potential negative impact on the net stable funding ratio at peripheral banks. It thus seems that this impact is (for now) less than expected.

Furthermore, the TLTRO-IIIs are arguably cheaper than their predecessors, assuming banks display similar outperformance of their lending benchmarks. The lack of interest could thus reflect uncertainty amongst banks whether they would qualify for a borrowing rate as low as -0.50%, possibly due to persistent uncertainties (global trade, Brexit, etc.) and hence lower credit demand. The most recent Bank Lending Survey doesn’t support this hypothesis, however. Another possibility is that the time window between the September ECB meeting –in which the modalities were eased– and the deadline for TLTRO-III.1 was simply too short for banks to determine whether and for what amount they wanted to participate. Additionally, some may prefer to wait until the full impact of the ECB’s tiered deposit rate come into effect. The December TLTRO-III should provide more clarity on this front.

Tyler Durden

Fri, 09/20/2019 – 10:10

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com