Former Head Of Plunge Protection Team Says Fed Has To Buy More Debt

We have lift off.

Last Wednesday, as stocks hit session lows amid fears that the Fed was so polarized on further easing and with the Fed’s dot plot suggesting no more cuts this year that odds of further rate cuts in 2019 dropped precipitously, Chair Powell catalyzed a dramatic rebound in risk assets when during his press conference he said that “It is certainly possible that we’ll need to resume the organic growth of the balance sheet sooner than we thought.“

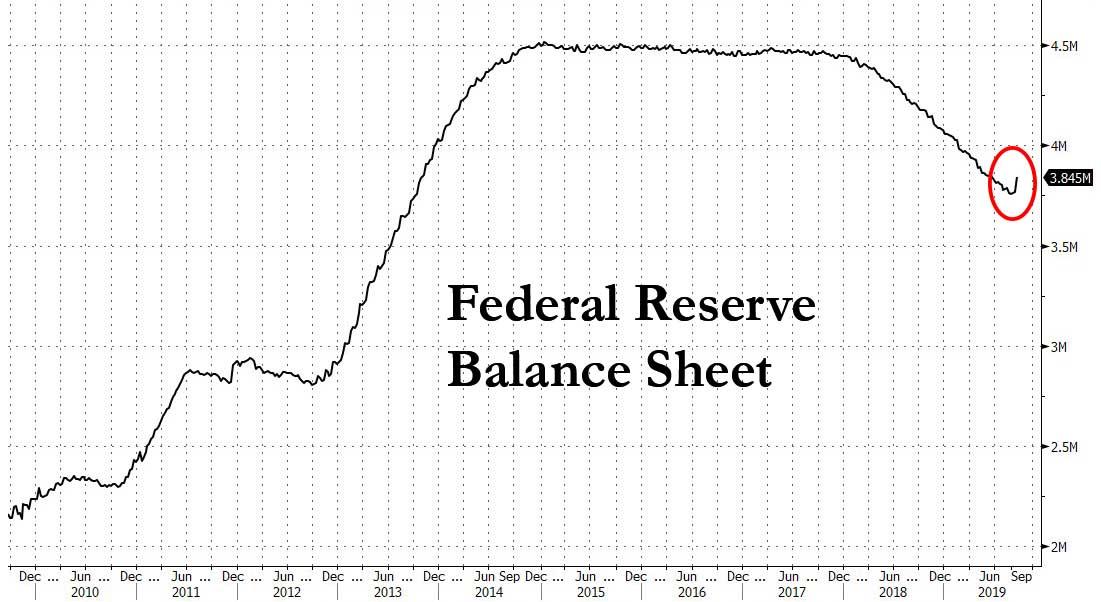

One day later, with the Fed engaging in overnight repos to unfreeze the clogged up plumbing in the repo market, the release of the Fed’s weekly H.4.1 statement confirmed that Powell was spot on: the Fed had indeed resumed the growth of the Fed’s balance sheet “sooner than we thought.” Whether or not said growth is “organic” is the topic of a separate discussion, but as expected the week’s rolling $75 billion overnight repo facility meant that the Fed’s balance sheet posted its first substantial increase for the first time since the end of QE3 in 2014, rising by $75 billion to $3.845 trillion.

The offsetting balance sheet liability was the Treasury General Account, or the cash the US Treasury holds at the Fed, which soared by a whopping $119 billion in one week, rising to $303 billion as of September 18, which increase frequent readers will recall, was precisely the catalyst we said at the start of August would precipitate a dollar shortage, and unleash a tantrum in the repo market. That’s precisely what happened.

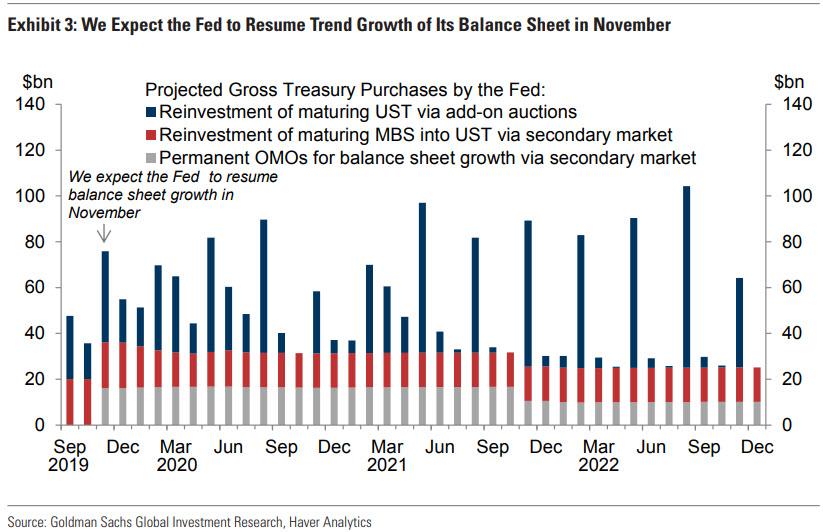

Incidentally, we also said that since both overnight and term repos would be insufficient to resolve a problem that was ultimately a function of too few reserves in the system, that this would culminate with a return of open market purchases of securities by the Fed, i.e. QE. This, we now know, is what Goldman also now believes will happen some time around the November FOMC, with the bank predicting a roughly $15bn/month rate of permanent OMOs, enough to support trend growth of the balance sheet plus some additional padding over the first two years to increase the size of the balance sheet by $150bn, restoring the reserve buffer and eliminating the current need for temporary OMOs. That strategy would result in balance sheet growth of roughly $180bn/year and net UST purchases by the Fed (the sum of the red and grey bars) of roughly $375bn/year over the next couple of years.

Ok, but a conspiracy theory blog (first) and then Goldman Sachs (eventually) predicting a return of POMO/QE does not mean it will happen, right? Perhaps… but throw in the highly respected former head of the NY Fed’s open markets desk (and plunge protection team) predicting that bond purchases are coming, and one can be certain that it’s just months, if not weeks, before QE is back (just as we said last week).

Speaking during a Friday conference call hosted by Bank of America for its clients, Simon Potter who oversaw the NY Fed’s trading desk until he was fired in May, echoed what we have said for the past week, namely that the actions taken so far to normalize this turmoil in money markets would not be enough to keep conditions calm, and warmed tjat fresh debt purchases will be needed.

Potter, quoted by Bloomberg, cautioned that the Fed “may have to expand the central bank’s balance sheet through outright purchases of U.S. Treasury securities, to ensure stable liquidity conditions at the end of the quarter as well as at year-end.”

Potter’s recommendation followed a tumultuous week of upheavals in money markets which saw overnight repo rates soar as much as 10%, and pulled the Fed’s benchmark rate outside its target range. In response, the NY Fed announced on Friday that it would offer term repo agreements over the upcoming quarter-end, which would allow financial institutions to borrow cash from the Fed either overnight or for two-week periods, secured by Treasury collateral, and which would provide much-needed funding during the critical quarter end period when bank funding needs tend to surge by hundreds of billions of dollars. The question is whether the Fed’s makeshift term repos – three for $30 billion all maturing well in October – will be sufficient to meet the liquidity needs of the US financial system.

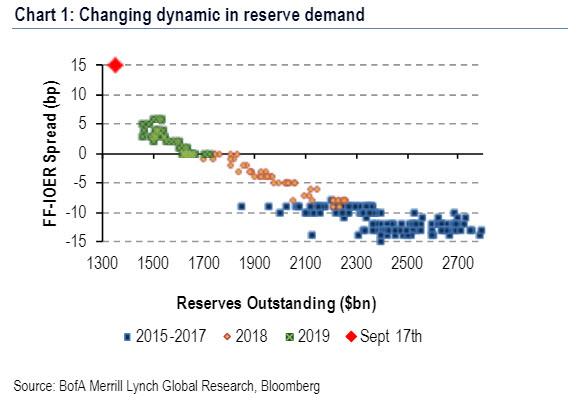

To Potter, the answer is no, because in his view the core problem has to do with a shortage of reserves in the system (why there would be a shortage when there is currently $1.4 trillion in “excess reserves” will be something we cover in a subsequent post, although as we noted previously, the Fed will urgently need to elevate the level of reserves to at least $1.8 trillion to normalize funding markets).

This recommendation for the Fed to resume open market bond purchases comes from the person who is perhaps most intimately familiar with the plumbing of the US financial system: as a reminder, the 21 year Fed veteran served as head of the Fed’s markets desk from 2012 until May 2019, when he was unexpectedly fired by the NY Fed’s new president, career economist John Williams, who as consensus came to realize, is completely clueless about the functioning of markets and whose recent bloviating prompted the New York Fed to issue a statement refuting what he had recently said to avoid sparking a crash by a “disappointed” market. Even Bloomberg admits that “the departure of Potter… raised concerns about Williams — a widely-respected monetary economist — because of his relative lack of experience with financial markets. The New York Fed has yet to announce Potter’s successor.”

While virtually nobody, except this website and a few others, were discussing the return to POMO as recently as a month ago, it is now “consensus” that the Fed has to resume POMO/QE, and even Bloomberg now writes that this week’s repo turmoil “raised questions about whether the Fed went too far in removing cash from the financial system, and focused attention on when the central bank would begin resuming balance-sheet expansion to keep pace with the needs of a growing economy.”

Of course, with first Goldman and then someone as “erudite” as Potter chiming in to clue his former boss, John Williams, what has to be done, we expect it is now only a matter of time before POMO is back. The only question is whether the Fed will ram it through no questions asked, or if – just like 2008 – the Fed will first create an “event” that has Congress begging (on one knee a la Hank Paulson… if not the president, after all Trump has already been urging Powell to launch “some QE“), the Fed to do everything in its power to stabilize the financial system. We’ll find out in the coming days.

Tyler Durden

Sat, 09/21/2019 – 15:15

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com