Chinese Homebuying In US Plunges To 8 Year Low

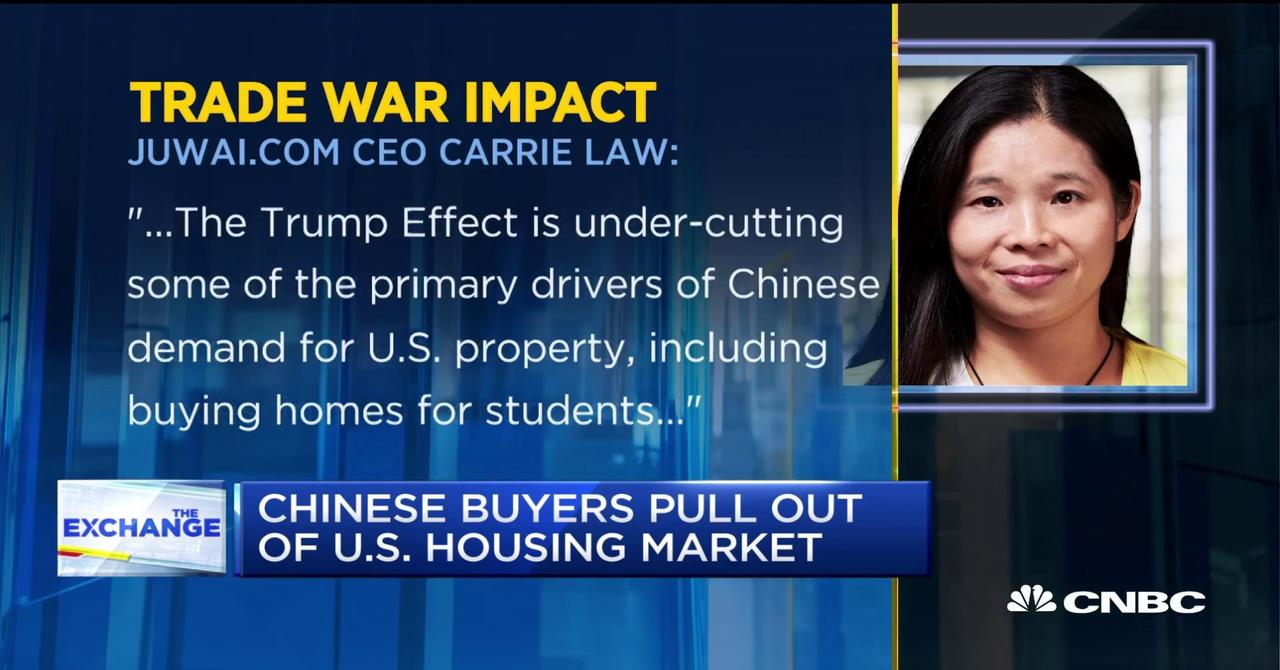

According to a new report from Reuters, leading Chinese real estate website, Juwai.com, estimates that Chinese buyers purchasing US homes will plunge to an eight-year low by the end of 1Q20.

Real estate data from Juwai estimates US home sales of Chinese buyers would drop to between $10 billion and $12 billion by the end of March 2020, is down from the $13.4 billion reported for the year ended in March 2019 via National Association of Realtors (NAR) and down from $30 billion seen in 2017 and 2018.

The site’s executive chairman, Georg Chmiel, told Reuters that the exodus of Chinese buyers comes at a time when many have worried about obtaining US visas, the weakening yuan, escalating trade tensions between the US and China, and overpriced real estate in the US, had spurred buyers to go elsewhere in the hunt for yield.

“The Trump administration’s tariffs, aggressive rhetoric, targeting of Chinese graduate students at US universities, and new visa red tape have all hurt Chinese demand,” Chmiel told Reuters.

He said Chinese buyers commonly use US real estate as investments and second or third homes.

“With the trade war going on, it’s easy to imagine a scenario in which you might be forced to sell or your investment might otherwise lose value,” he warned.

The removal of Chinese buyers has already started to weigh on luxury homebuilder Toll Brothers Inc, warning about slumping sales in California.

Lennar Corp has also warned about the housing slowdown on West Coast markets, and how it’s likely due to a pullback in buying from the Chinese.

Gay Cororaton, a senior economist at the NAR, said a manufacturing slowdown in China and a declining yuan had deterred many Chinese homebuyers from purchasing US properties in 2018/19, mainly in the regions of the West Coast.

“Chinese buyers form a significant portion of international home sales in California, where home prices have been increasing steadily, and that has been one of the factors acting as a deterrent for home purchases, when the yuan has declined,” Cororaton said.

“They might look for properties in areas that are less expensive than California, such as Texas and Seattle. And this could put downward pressure on prices in California,” he added.

Dean Jones, principal and owner at Seattle-based brokerage Realogics Sotheby’s International Realty, said Chinese homebuyers shifted their attention to Seattle markets this year, away from California, because prices were selling for a third or half the price than San Francisco or Los Angeles.

Chinese buyers could be marking the top of the US real estate market.

S&P CoreLogic Case-Shiller’s 20-City Composite price index rose just 2.13% YoY in June – the weakest growth since August 2012, with the expectation the index could go negative before the 2020 election year.

This is the 15th straight month of YoY declines in price. The slide in home prices is happening at the same time when the Chinese buyer is pulling back on US real estate. Not even a plunge in mortgage rates managed to save housing this summer.

And the removal of Chinese buyers comes at a time when Nobel laureate Robert Shiller warns of an imminent housing correction, accompanied by a recession.

Nobel laureate Robert Shiller said he “wouldn’t be at all surprised” if U.S. house prices start to fall https://t.co/tqjfeGfo1l pic.twitter.com/mknbODH4Iq

— Bloomberg Economics (@economics) September 5, 2019

https://platform.twitter.com/widgets.js

So what happens to real estate prices in California when the Chinese turn to net sellers? It’s likely a housing correction for West Coast markets has already arrived.

Tyler Durden

Tue, 09/24/2019 – 21:25

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com