Second Term Repo Oversubscribed As Funding Shortage Keeps Getting Worse And Nobody Knows Why

Overnight, we cited two icons in rates/repo business, both of whom confirmed that contrary to what so-called self-professed twitter “experts” claimed, what is going on in the repo market is bad and getting worse, and more problematic is that nobody knows what is causing it.

The first one was BMO’s rates guru, Ian Lyngen who had this to say:

As we approach quarter-end, it’s intuitive that funding markets are attracting heightened attention after last week’s repo fiasco. One thing has become clear, however, and that is that the Fed is willing to provide significant amounts of liquidity to primary dealers to alleviate as much stress as possible. By upsizing injections to $250 bn or more (assuming overnight remains at $100 bn through October 1 and the terms are $30 bn/$60 bn/$60 bn, respectively) the fact that we’re discussing a quarter trillion dollars is telling as to the depth of the constraint in repo.

The second one was from Curvature securities repo wizard, Scott Skyrm, who was even more laconic:

It’s great that the Fed is pumping liquidity into the system, however, why were the existing operations insufficient?

As of today, the Fed had injected $105 billion in liquidity into the Repo market, but rates were still stubbornly high. Whatever changed last week to cause the funding spikes is clearly still an problem.

Which in turn brought us to this morning’s commentary from ICAP’s Lou Crandall. As a reminder, ICAP is the world’s biggest interdealer broker, and as such the plumbing in the bond market is its bread and butter. This is what Crandall had to say ahead of the conclusion of today’s second, expanded (from $30BN to $60BN term repo), quoted by Bloomberg:

Increases in the Fed’s overnight and term-repo operations Thursday may be “sufficient to ensure that the remainder of the Fed’s operations through quarter-end are undersubscribed.”

As a result, Wrightson ICAP’s “tentative guess” is that dealers take $50b of the term operation and $60b of the overnight action, though risks are on the high side of the term estimate and on the low side for the overnight. However, as Crandall added, “risk remains that dealers might take the full $60 billion of term operations.”

And… Bingo, because moments ago, the NY Fed confirmed that one day after the most oversubscribed overnight repo operation yet, which saw $92BN in securities tendered for the latest overnight repo op before it was expanded from $75BN to $100BN…

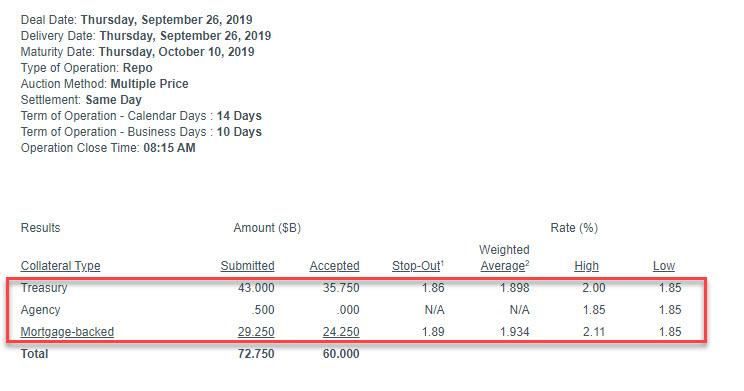

… moments ago the Fed announced results from the second Term Repo meant to address the quarter-end liquidity shortfall is what ICAP would have dubbed the worst case scenario: not only was it oversubscribed, but it was so by a whopping $13BN, as some $72.5BN in securities ($43BN in TSYs, $29.25BN in MBS, $0.5BN in Agencies), were submitted for today’s $60BN repo.

In other words, not only is the liquidity shortage getting worse, but the more liquidity the Fed provides via repos, the more liquidity primary dealers indicate they need.

And with it now appearing guaranteed that the full allotment of $250BN across term and overnight repo will be used up, we look to today’s overnight repo result in a few minutes, where if the term repo is any indication, the full $100BN allotment will be blown through with ease as banks confirm that their dollar shortage is far, far worse than anyone expected… and certainly is not going away after last week’s “one-time” tax payment and bill settlements.

Tyler Durden

Thu, 09/26/2019 – 08:29

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com