US Spending Growth Weakest In Six Months, Core Capex Tumbles

Americans’ personal income and spending growth in August was expected to reverse some of the moves seen in July (income slowed, spending accelerated) and it did with incomes up 0.4% MoM (as expected) accelerating over July’s 0.1% rise, but spending growth was only 0.1% (well below July’s and expectations).

This is the weakest MoM gain in six months…

Source: Bloomberg

Which sparked a slowdown in income and spending growth year-over-year (weakest annual gains in spending in six months)…

Source: Bloomberg

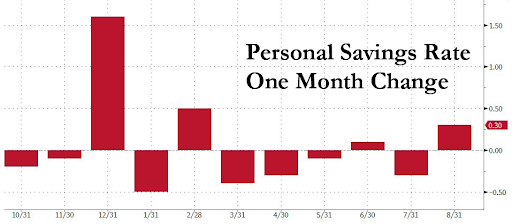

Which prompted a rise in the savings rate (to highest since March 2019)

This is the biggest MoM jump in the savings rate since Feb 2019…

The Fed’s favorite inflation indicator accelerated but remains well below the 2.00% mandate…

Source: Bloomberg

A separate Commerce Department report showed bookings for non-military capital goods excluding aircraft — a proxy for business investment — fell 0.2%, the weakest performance in four months, compared with forecasts for no change; and the biggest annual contraction in core capex since Nov 2016

Source: Bloomberg

The data suggest growth continued to cool in the third quarter, adding focus to next week’s September jobs report to show whether the labor-market slowdown is deepening.

Tyler Durden

Fri, 09/27/2019 – 08:41

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com