S&P Futures Surge Above 3,000 Amid Confusion Over Successful Brexit Deal

“Brexit’s the only show in town today”

– Rabobank FX strategist Lyn Graham-Taylor.

For once traders were less focused on the US-China trade deal rumorflow, and instead the catalyst for the overnight moves was the frentic last minute Brexit horsetrading which went from i) despair, as Northern Ireland’s DUP party said it could not support proposed solutions to Irish border checks “as things stand”, to ii) euphoria as Juncker said the UK and EU have reached a deal, and back to iii) disappointment after the DIP again said it won’t vote for Johnson’s Brexit deal when it is set for a vote on Saturday.

Predictably, futures initially slumped on the first DUP refusal to cooperate, then surged after Europe opened, spiking above 3,000 on the Juncker statement, then sliding back under 3,000 after the DUP once again poured cold water on the party.

Hot on the heels of trader optimism that a Brexit deal is almost done, Europe’s Stoxx 600 Index climbed as every major national benchmark in the region turned higher, while US equity futures followed the advance, though the moves eased as investors assessed its chances of winning crucial support. Treasuries led a government bond retreat, with the 10Y TSY climbing as high as 1.80%, before fading much of the move while gold initially slipped alongside bonds as haven demand ebbed. The Bloomberg dollar index also dropped.

The excitement over the deal breakthrough, which however may not last long with headlines such as this one around…

- DUP WON’T VOTE FOR JOHNSON’S BREXIT DEAL: PARTY OFFICIALS

… was enough to tip investors off the fence after a mixed bag earnings from major European companies. Unilever said growth fell short of estimates while Nestle announced a $20BN buyback. Ericsson boosted its sales target for next year. Netflix gained in early trading after it met international subscriber estimates and despite slashing Q4 growth expectations in a time of surging new competition from the likes of Disney, Apple and HBO.

Earlier in Asia, a five-day stocks rally ground to a halt as Wednesday’s disappointing U.S. retail sales data on spread gloom; stocks fell in Tokyo, Sydney and Seoul, rose in Hong Kong and were barely changed in Shanghai. Taiwan Semiconductor, the primary chip supplier to Apple, projected current-quarter revenue ahead of analysts’ estimates. The Australian dollar strengthened after the country’s jobless rate unexpectedly fell and full-time employment climbed.

Brexit: the latest (via RanSquawk)

- A EU-UK Brexit deal has been agreed; according to both the EU and UK side. However, initial reports noted that the DUP were on board with this, subsequently, multiple DUP sources have noted that their position has not changed from the statement earlier as such they do not support the deal. The FT notes the new protocol on the NI consent mechanism does not provide the DUP with a veto for the first 8-years. Which pushes back the veto time-line from 6-years to 8-years as was reported overnight.

- The DUP stated that they cannot support PM Johnsons Brexit plan, stating there are issues on customs, consent along with a lack of VAT clarity. Additionally, reports indicate UK PM Johnson has no plans to meet with the DUP today.

- According to reports the Northern Ireland Assembly will be allowed to hold a vote on whether to continue the border arrangements in six years and, if they agree to continue, every four years after this. ITV’s Peston suggested that EU leaders can still ratify before the weekend if legal text can be agreed by 0800BST on Thursday but added if not, there will be no deal before the weekend. EU Council President Tusk said a deal is ready, but cautioned there are “certain doubts on the British side”.

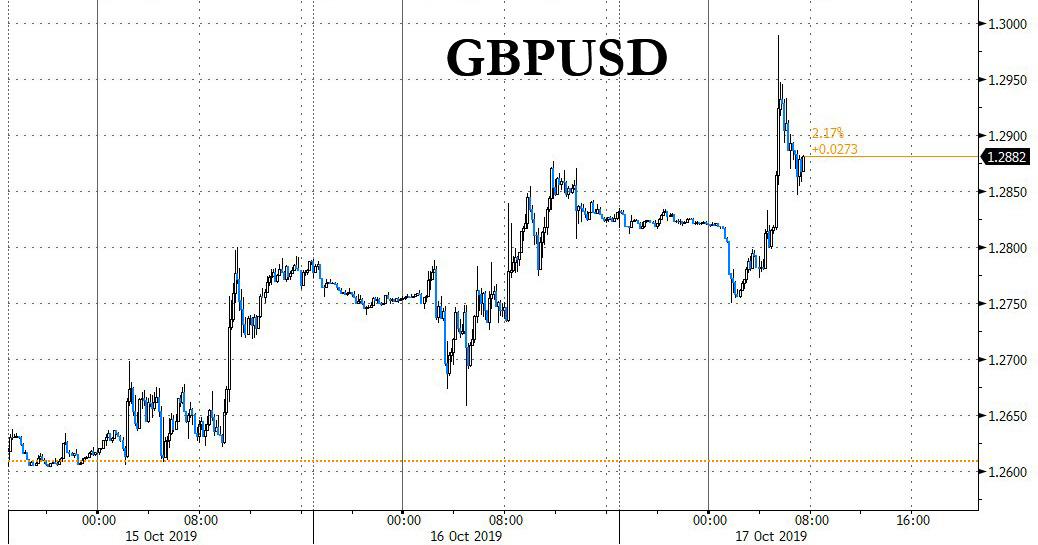

Sure enough, with “Brexit’s only show in town today”,” as Rabobank’s Lyn Graham-Taylor said, attention fell on the Sterling, which tracked equity futures closely, and which had shot to five-month highs, fell as much as 0.6% against the dollar to $1.2748 after the initial disappointment, before surging just shy of 1.3000 after Juncker said there was a deal, before sliding back to 1.2850 after the DUP crashed the party again.

Now Britain will either vote on Saturday, hoping the DUP supports the deal, or will seek an extension to the Oct. 31 departure date.

Meanwhile, in emerging-market, stocks gained for a sixth day, their longest winning streak since early April, after Treasury Secretary Steven Mnuchin said that U.S. and Chinese trade negotiators were nailing down a Phase 1 trade deal text for their presidents to sign next month. But U.S. retail sales fell for the first time in seven months, suggesting manufacturing-led weakness was spreading to the broader economy. U.S. consumption has been one of few bright spots in the global economy, so the data fanned worries the Sino-U.S. trade war would ultimately tip the world into recession.

“While the U.S. suspended a hike in tariffs, it hasn’t gone as far as scrapping the tariffs altogether, so it is hard to expect a quick pick-up in the economy,” said Yoshinori Shigemi, global market strategist at JPMorgan Asset Management.

Attention was also glued to the diplomatic fiasco with Turkey, after the country’s military advance in Syria created tensions with United States and Europe and brought about mild sanctions. Turkish President Tayyip Erdogan is to meet with U.S. Vice President Mike Pence and Secretary of State Mike Pompeo later. Although the U.S. pulled its troops out of the area to allow Turkey’s push, Pence and Pompeo are expected to urge Erdogan to declare a ceasefire, which Erdogan says will “never” happen. U.S. President Donald Trump warned of “devastating” sanctions if discussions did not go well. Turkish stocks were down 1.8% and the lira weakened to 5.8840 to the dollar. It has lost nearly 5% this month, making it the world’s worst performer for October.

Treasury Secretary Mnuchin said US President Trump expects there will be a cease-fire regarding Turkey’s actions in Syria and suggested that increased tariffs on Turkey’s goods have been successful in the past. In related news, US conducted a pre-planned air strike in Syria to destroy some ammunition and abandoned vehicles as troops depart according to a US official.

The dollar index was last at 98.075, recovering from its lowest since Aug. 27 touched on Wednesday. Against the yen, it was a flat at 108.72 after peaking at 108.95.

In commodities, oil prices slipped after industry data showed a larger-than-expected build-up in U.S. crude stockpiles, adding to concerns that global demand for oil may weaken amid further signs of an economic slowdown. Brent crude futures fell 0.89% to $58.89 a barrel. U.S. West Texas Intermediate crude lost 1.03% to $52.81.

Looking ahead highlights include, US Housing Permits & Starts, Philadelphia Fed, Industrial Production and EIA Weekly Stocks, EU Council Summit Begins, Fed’s Evans, Bowman, Williams, RBA’s Debelle, ECB’s Coeure, Riksbank’s Ingves and Jansson. Honeywell, Morgan Stanley, and Philip Morris are among companies reporting earnings

Market Snapshot

- S&P 500 futures up 0.2% to 2,996.00

- STOXX Europe 600 up 0.03% to 393.56

- MXAP up 0.04% to 159.87

- MXAPJ up 0.3% to 514.91

- Nikkei down 0.09% to 22,451.86

- Topix down 0.5% to 1,624.16

- Hang Seng Index up 0.7% to 26,848.49

- Shanghai Composite down 0.05% to 2,977.33

- Sensex up 0.8% to 38,922.85

- Australia S&P/ASX 200 down 0.8% to 6,684.68

- Kospi down 0.2% to 2,077.94

- German 10Y yield rose 0.2 bps to -0.385%

- Euro up 0.1% to $1.1084

- Italian 10Y yield fell 1.0 bps to 0.586%

- Spanish 10Y yield rose 2.3 bps to 0.276%

- Brent futures little changed at $59.39/bbl

- Gold spot down 0.3% to $1,485.85

- U.S. Dollar Index down 0.5% to 97.56

Top Overnight News

- The U.K. and the European Union reached an agreement Thursday that could pave the way for Britain to finally break its 46- year-old ties to the bloc this month. The withdrawal accord was completed just in time for EU leaders to assess it when they gather for summit talks in the Belgian capital later in the day. The deal then needs to win the backing of the U.K. Parliament on Saturday

- The biggest issue, as Brexit technical talks continued into the night, was how to handle sales tax in Northern Ireland. Conversations in London and Brussels suggested a deal is close. In a concession to Arlene Foster and her supporters, the Northern Ireland assembly will be allowed the chance to give or withdraw consent for arrangements to cover the Irish border

- A White House meeting between Donald Trump and congressional leaders to contain fallout from the Syria crisis broke down abruptly Wednesday, with the president hurling insults at House Speaker Nancy Pelosi, who accused him of having a “meltdown”

- Republican senators said Wednesday they want to move quickly on legislation to support pro-democracy protesters in Hong Kong despite a threat of retaliation from China

- Hong Kong’s legislature struggled again to hold another meeting Thursday as opposition lawmakers disrupted Chief Executive Carrie Lam’s effort to answer questions about her policy address

- RBA Deputy Governor Guy Debelle conceded that the central bank had been caught off guard by the scale of the slump in building activity, which turned down “sooner and by more than we had expected.” Building approvals are now around 40% lower than their late 2017 peak, he said

- For almost half a million British companies, a Brexit deal that ends three years of uncertainty about the future can’t come soon enough. The number of U.K. firms in “significant” financial distress has increased 40% to 489,000 since the country voted to leave the European Union in 2016, according to research published on Thursday

- HSBC Holdings Plc may partially exit stock trading in some developed Western markets as part of a cost-cutting drive by Noel Quinn, the interim chief executive who wants the top job on a permanent basis

- The Chinese foreign ministry said it has detained two American citizens who run an English-teaching business in China, a development that comes as a trade war stokes broader tensions between the countries

- Elizabeth Warren took a lot of flak at this week’s Democratic presidential debate for being evasive about the taxes needed to pay for the $30 trillion Medicare for All plan she champions. There’s a reason for being vague: Her team hasn’t yet figured out how to pay for it

Asian equity markets traded mixed after the lacklustre tone rolled over from Wall St where all majors finished with marginal losses as participants digested earnings and with sentiment dampened by weak US Retail Sales. ASX 200 (-0.8%) was led lower by underperformance in tech and with mining names closely behind including BHP after its quarterly updates showed iron ore output was flat Y/Y, while Nikkei 225 (U/C) was choppy around the 22500 level and near its YTD highs with mild JPY weakness just about keeping the index afloat. Conversely, Hang Seng (+0.7%) outperformed as property names surged and Shanghai Comp. (Unch.) failed to benefit from recent comments by China’s Cabinet that it will step up efforts to attract foreign investment and will not allow forced technology transfers, while China will also ensure lower tax for manufacturing and other sectors. Finally, 10yr JGBs declined as Japanese stocks remained afloat near 10-month highs and following mixed results at the 5yr JGB auction which showed slightly higher yields and lower accepted prices.

Top Asian News

- Fresh Chaos in Hong Kong’s Legislature Shows Gridlock Facing Lam

- Hong Kong Tycoons Are $3 Billion Richer on Lam’s Housing Policy

- China Wants Companies to Sell Dollar Bonds in Shanghai FTZ

- Profit Warnings Plague Corporate China as Economy Worsens

Major European Bourses (Euro Stoxx 50 +0.3%) are in the green, albeit off highs, after EU officials confirmed a provisional Brexit deal had been agreed ahead of the EU Council Summit today/tomorrow (although the DUP are reportedly yet to be onboard), news which saw the DAX (+0.5%) make fresh YTD highs earlier in the session. The FTSE 100 (+0.5%) enjoyed some early outperformance on an initially weaker pound but remain choppy as the currency surged on the latest Brexit updates, although the index is supported by domestic banks and housing names. Separately, some outperformance is being seen in periphery bourses (FTSE MIB +0.8%, IBEX 35 +0.8%); Italy’s Cabinet yesterday approved its draft 2020 budget and submitted it to the EU, while the latest polling out of Spain saw the country’s conservative People’s Party making healthy gains following the sentencing of Catalan separatist leaders at the expense of the ruling Socialist Party (ahead of 10 November elections). Sectors are mixed but mostly in the green, with outperformance seen in Health Care (+0.6%) and underperformance in Tech (-0.1%). Energy (+0.5%) is higher despite lower crude prices. Chip names, including Wirecard (-2.9%), were weighed after Taiwan’s TSMC warned of a single digit Y/Y decline in global semiconductor market growth this year in its earnings report (although Q3 earnings were strong). In terms of notable movers; Ericsson (+6.7%) shot higher after the Co. posted strong earnings, including an increase to its 2020 revenue guidance. Unilever (+1.0%) were also buoyed by decent earnings. Conversely, weak earnings from Faurecia (-4.3%), Telia (-5.2%) and Pernod Ricard (-3.4%) saw their respective stocks under pressure. Elsewhere, Iliad (+4.8%) shares moved higher after the Co. was upgraded at JPM.

Top European News

- WH Smith Buys Marshall Retail to Boost U.S. Growth Prospects

- Ericsson Jumps After Lifting Sales Goal on 5G Spending Boost

- Domino’s Pizza Group to Exit Four International Markets

- Temenos Shares Fall as Software Company Misses Low Estimate

In FX, the Antipodean Dollars are outperforming in wake of overnight data showing an unexpected dip in the Aussie unemployment rate and a jobless tally that would have almost doubled consensus barring a decline in the part time count. Aud/Usd has crossed the 0.6800 mark, with perhaps some added impetus from positive Chinese trade chat regarding the outcome of recent talks in Washington, and nudging towards one of several hefty option expiries spanning the big figure (see 7.02BST post on the headline feed for details of all today’s major NY cut rollovers). In similar vein, the Kiwi has reclaimed 0.6300, albeit lagging in cross terms as Aud/Nzd rebounds over 1.0750 and sets sights on 1.0800 again.

- GBP – Sterling may not quite be the biggest G10 winner, but it remains well on top in cumulative price and volatility terms given another 200+ pip gap from top to toe in Cable and full point+ range in Eur/Gbp. Another cascade of Brexit-related headlines has been paramount, and especially those relating ongoing intransigence from the DUP over several components of the compromised draft treaty hammered out by UK and EU negotiators. In short, EU diplomats and PM Johnson have declared that a deal is finally back on or even done pending Parliament approval, but HoC approval remains in doubt even discounting DUP rejection. However, the Pound has emerged from its latest bout of whipsaw trade firmer, albeit off best levels and seemingly relieved if not completely satisfied that another hurdle has been overcome, or perhaps merely assuming that enough progress towards a final withdrawal agreement has been achieved to warrant a further (technical) extension rather than a no deal departure on October 31. Cable is holding above 1.2900 and Eur/Gpp around 0.8600.

- USD – The Greenback is softer across the board, with the DXY dipping under 97.500 and only the safest-havens alongside a few other laggards faring worse than the Buck ahead of more top tier US data/Fed speak and post-disappointing retail sales on Wednesday.

- EUR/CHF/CAD – All benefiting from a largely Brexit-inspired upturn in risk sentiment, not to mention the aforementioned US Dollar demise, with the single currency scaling 1.1100, Franc back up near 0.9900 and Loonie edging closer to 1.3150 in advance of Canadian manufacturing sales.

- NOK/SEK – The Scandi Crowns are striving to stop the rot after plumbing new multi-year/record lows in wake of significantly weaker than forecast Swedish labour stats, but the Nok is lagging after slipping below 10.2000 even though the data may yet convince the Riksbank to roll back or possibly remove its rate hike guidance next week.

In commodities, a choppy session thus far for WTI and Brent futures which initially received a double whammy from larger-than-forecast US crude stockpiles and as sentiment took a turn for the worse as Brexit developments reach a stalemate on the domestic front, albeit prices saw upside as EU announced that a Brexit deal has been reached. As a recap, the weekly API data (which was delayed due to Monday’s US Columbus Day holiday) showed a US inventory build of 10.5mln barrels vs. Exp. build of 2.9mln barrels. WTI and Brent futures immediately declined some 0.3-0.4/bbl and continued to be pressured throughout the APAC and early EU sessions. WTI futures reside just around the 53/bbl mark (having tested 52.75/bbl overnight) whilst Brent futures gained ground above 59/bbl level but pared some of the gains. Traders will continue eyeing Brexit/US-Sino newsflow for sentiment-driven action whilst the EIA is due to report weekly crude stocks at 1600BST with the headline forecast to show a build of 2.878mln barrels. Elsewhere, gold prices are flat intra-day and within a tight range below 1500/oz (1483-93/oz) as the yellow metal eyes Brexit developments, whilst copper recovered some losses and moved into positive territory amid mostly constructive comments from China’s MOFCOM whilst the red metal received a boost from the aforementioned Brexit headlines.

US Event Calendar

- Oct. 17-Oct. 18: Monthly Budget Statement, est. $83.0b, prior $119.1b

- 8:30am: Housing Starts, est. 1.32m, prior 1.36m; Building Permits, est. 1.35m, prior 1.42m

- 8:30am: Building Permits MoM, est. -5.26%, prior 7.7%;Housing Starts MoM, est. -3.23%, prior 12.3%

- 8:30am: Philadelphia Fed Business Outlook, est. 7.6, prior 12

- 8:30am: Initial Jobless Claims, est. 215,000, prior 210,000; Continuing Claims, est. 1.68m, prior 1.68m

- 9:15am: Industrial Production MoM, est. -0.2%, prior 0.6%; Manufacturing (SIC) Production, est. -0.3%, prior 0.5%

DB’s Jim Reid concludes the overnight wrap

Back from Germany and back in the EMR hot seat this morning after a day away from it yesterday. As I was flying back it made me wonder whether this was my last trip to the continent as an EU citizen. The next 48-72 hours will likely go a long way towards answering that question.

So where are we with Brexit. Well there have been more deadlines missed over the last few days than there are nightly in my house over bedtime for the kids. Believe me that’s a lot. However the fact that the breaking of these has not proved terminal to the process means that negotiations have been inching forward bit by bit.

Most media reporting suggests that all that stands in the way of a deal being agreed prior the EU summit meeting today and then to Parliament on Saturday is the DUP support. Given their red lines this is by no means guaranteed but without them the deal looks unlikely to pass through Parliament.

DB’s Oliver Harvey has an updated note ( here ), where he lays out the possible and likeliest scenarios and their implications for the pound. For now, he is staying bullish on the currency which gained +0.35% yesterday despite trading in a +/-1.55% range yesterday on very conflicting headlines.

Ultimately, the most important factor will be: does Prime Minister Johnson put pen to paper and agree to a deal with the EU? If he does, as looks increasingly likely, then the details of whether or not the DUP and ERG stay onside will be a timing of events issue more than anything else. If they support the deal, then it will likely pass parliament and the UK would leave the EU with a deal. If they do not support it, we would likely get either a referendum or an election where the Conservative Party runs on the platform of a pre-signed deal. Interestingly polling company ComRes published the biggest opinion poll since the referendum yesterday and this suggested that excluding don’t knows, 54% said their current preference was to leave the EU. So it’s not clear that a “People’s Vote” would change things. There was a preference for leaving with a deal though. For balance I should say that most polls this year have shown a small lead for remain but they’ve all been relatively close.

If Johnson doesn’t reach a deal, and reverts to a no-deal stance, whether due to pressure from his Brexiteer flank or otherwise, then Brexit tail risks are reintroduced. This is because the UK government’s political incentives will likely shift back towards a no deal Brexit. Failure to reach an agreement with the EU27 will be the result of Mr Johnson failing to secure support from the DUP/ERG. As a consequence, pressing ahead with negotiations next week after having been forced to extend Article 50 by the Benn legislation will make the government look weak, particularly if Mr Johnson’s deal is characterised politically as a ‘sell out’ by the DUP/ERG/Brexit Party. So today is probably more crucial than Saturday. Indeed some headlines have suggested the opposition might vote against a Saturday sitting. Given they’ve recently put a 4-day week in their policy aspirations perhaps that’s the reason. In reality a motion against the sitting is unlikely to be voted down even if it does clash with the England Rugby World Cup quarter-final. Expect another flurry of headlines today.

A quick check on Sterling this morning shows that its trading largely flattish overnight at 1.2821. Meanwhile the rest of Asian markets are trading mixed with the Hang Seng (+0.74%) up while the Kospi (-0.16%) is down and the Shanghai Comp and Nikkei are trading flat. Elsewhere, futures on the S&P 500 are also broadly unchanged. WTI oil prices are down c. -0.81% this morning as the American Petroleum Institute reported that US crude inventories rose by 10.5 mn barrels last week, marking the biggest increase since February 2017 if confirmed by the official Energy Information Administration figures due today. In other news, Japan remained the biggest foreign owner of US Treasuries in August with a holding of $1.17 tn (+$44bn during the month) as China’s holdings continued to drop. They fell -$6.8bn to $1.1 tn.

This all follows a fairly damp squib of a session on Wall Street yesterday which saw the S&P 500 (-0.19%), DOW (-0.08%) and NASDAQ (-0.30%) all end the day little changed. Earnings didn’t really change the narrative although Bank of America shares rose +1.51% after beating consensus earnings forecasts. After markets closed, Netflix reported a strong earnings beat of $1.47 per share compared to expectations for $1.04, and despite weaker new subscribers numbers, the stock was up +9.86% in after hours trading. Alcoa (+4.23%) also reported after the close, and rallied despite lowering their demand outlook. President Trump also said at a meeting with Italian President Mattarella that “China has started buying already from the farmers” but that a deal probably won’t be signed until Trump’s meetings with Chinese President Xi Jinping next month at the APEC summit.

Some of the more interesting price action at the moment is going on in European bond markets where 10y Bunds broke above -0.40% yesterday to close at -0.387%, a level they haven’t been at since 26 July. That now means yields are +35bps above the September intraday lows or if you prefer meaningless percentages, a near 48% move. The recent positive Brexit news has contributed (n.b. 10y Gilt yields rose +9.6bps from the intraday lows yesterday) while there was a story on Bloomberg about the CDU caucus in the Bundestag breaking its long-term commitment to the “black zero” should an economic downturn require fiscal easing. The hurdle for fiscal easing in Germany remains very high but the pressure and headlines keep on building.

Meanwhile we heard from a number of ECB Governing Council members over the last 24 hours with the ECB’s Chief Economist Philip lane advocating fiscal easing by saying “If there were fiscal expansion in these current conditions, the multiplier will be quite big. This goes back to finance ministers thinking about fiscal policy as a macro tool.” On growth, he said “Our assessment is that we’re not at the edge, but of course we’re closer to the edge than we were.” However, Bundesbank President Jens Weidman, who also spoke overnight was measured in his response on fiscal easing as he said that while some additional spending might be possible in the short term, “with respect to macroeconomic stabilization, any further stimulus appears unnecessary, unless a perceptible deterioration in the economic outlook becomes apparent. Germany’s output gap is about to close and forecasts don’t foresee a marked deterioration.” On the other hand, Dutch governor Klaas Knot and French Governor Francois Villeroy de Galhau both called for a review of both the ECB and EU’s economic strategy with Klass Knot saying that the ECB could increase its flexibility by introducing a symmetric band around the inflation aim, and governments could simplify the Stability and Growth Pact to put more emphasis on debt levels relative to budget deficits. French Governor Francois Villeroy de Galhau also said that Germany among euro-area countries has fiscal room to spend more and could help take some weight off the ECB. Lastly, Austrian Governor Robert Holzmann, said that one of the main tasks of Christine Lagarde will be to restore harmony in the decision-making Governing Council and added “I expect that Lagarde will start a process in the ECB that more strongly integrates national central banks.”

Back to yesterday and Treasuries were marginally stronger at the end of the day with 10y yields down -2.6bps and 2y yields down -2.8bps. That being said they did nudge off the lows despite a poor September US retail sales report. Indeed there were misses at a headline level (-0.3% mom vs. +0.3% expected) and core (0.0% mom vs. +0.3% expected) along with the most important control group (0.0% mom vs. +0.3% expected) component. Upward revisions to the prior data were cited as a reason for the misses however there was no such revision to the control group component. The market is now almost completely priced for a cut at the end of this month (92% to be exact) with little significant data due before the meeting now.

Those higher odds of a cut were consistent with yesterday’s Fed rhetoric. Chicago’s Evans reasserted himself as a dove, saying “there is some argument for more accommodation” and that “inflation expectations, which are a key determinant of actual inflation, have slipped further this year and today are at uncomfortably low levels.” Dallas’s Kaplan was more circumspect, saying that he feels “a little more agnostic” about additional cuts compared to his strong support for the last two cuts. Finally, the Fed’s beige book of economic commentary downgraded its characterisation of the pace of growth to “slight to modest” from “moderate,” which equates to a minor downgrade.

As for the other data out yesterday, the October NAHB housing market index print rose 3pts to 71 after expectations were for no change, while business inventories were flat in August. Here in the UK the inflation data was in line to slightly soft with the headline at 1.7% yoy (vs. 1.8% expected) and core at 1.7% yoy (vs. 1.7% expected). It was noted that PPI core output prices continued to soften however. For completeness there was no change for the Euro Area’s final core CPI reading in September of 1.0% yoy.

To the day ahead now, which this morning includes September retail sales data in the UK, while in the US the data consists of September housing starts and building permits, October Philly Fed business outlook, weekly jobless claims and September industrial and manufacturing production. Away from that we’re due to hear from the Fed’s Evans, Bowman and Williams while over at the ECB Villeroy, Visco and Knot are all due to speak. The EU summit will obviously be a big focus, while the BoE’s latest credit conditions survey is also due out. Earnings highlights include Morgan Stanley.

Tyler Durden

Thu, 10/17/2019 – 07:47![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com