Adios, Mario! Here’s What To Expect From Draghi’s Final ECB Meeting

The day has finally arrived.

After eight years of leadership, Mario Draghi is stepping down from the helm of the European Central Bank. His final press conference as ECB president, which will be held Thursday afternoon in Frankfurt, is expected to be something of a lovefest for the man whom many economists have credited with saving the euro (for better or worse).

Courtesy of Bloomberg

What’s more, seven years after his infamous promise to do “whatever it takes” (within the central bank’s mandate) to save the joint currency, Draghi will leave the central bank in the hands of Christine Lagarde, a former French finance minister and leader of the IMF who was appointed to lead the central bank despite having little in the way of pertinent experience, whose term begins next Friday. Back in September, Draghi did her the favor of setting the central bank on a new policy course by restarting QE (over the objections of one-third of the governing council’s members) but this time leaving it open-ended. He also lowered the already negative deposit rate to – 0.5%, rejiggered the central bank’s system for publishing forward guidance and much, much more.

While Lagarde has been pretty well provisioned, Draghi’s will leave his post under a cloud of uncertainty: Despite the central bank’s best efforts to revive economic growth in the eurozone, the bloc’s economy is instead teetering on the brink of another recession. And Draghi’s last meeting will likely be peppered with serious questions about the outlook for growth and the possibility of fiscal stimulus – will Germany step up to save the bloc from recession? It’s going to be an interesting meeting, to say the least.

Thanks to Draghi’s decision to follow the Fed with an about-face back toward stimulus, economists don’t expect rate hikes in the eurozone until 2022, two years into Lagarde’s term. The answer to the question of whether the central bank has done all it can do to save the underlying economy, while seemingly obvious to thousands of market participants who have watched economic inequality soar during the international QE experiment, still hasn’t dawned on many economists.

During his final press conference, Bloomberg’s economists David Powell and Maeva Cousin expect Draghi to deliver an even more forceful plea to national governments to step in with fiscal stimulus.

“Draghi will likely reiterate – if not intensify – calls for fiscal policy to play a larger role. He can afford to shout louder and perhaps be more specific about who needs to act now that he’s leaving office. Further details on monetary policy are unlikely to emerge.”

But that likely won’t be all for Draghi. Here’s a roundup of what to expect during his final press conference, courtesy of Bloomberg.

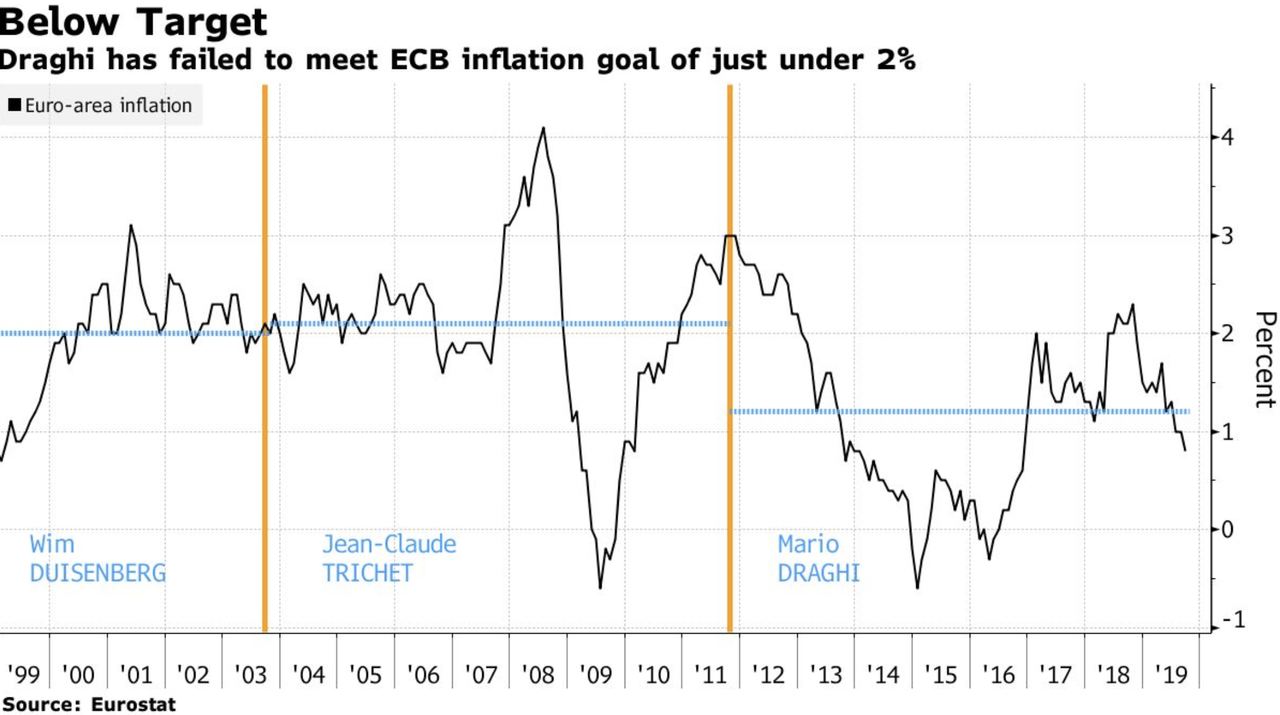

Inflation Miss

Despite unprecedented monetary stimulus, Draghi has fared worse than his two predecessors on inflation, falling well short of the goal of below, but close to, 2%. The rate was 0.8% in September, the lowest in almost three years.

Officials have pledged to pursue record-low interest rates and large-scale asset purchases until price growth is firmly in line with the target, which they don’t expect until after 2021. Investors are trying to judge whether more rate cuts will be needed, and how long quantitative easing can run without the ECB hitting self-imposed limits on how much debt it can buy.

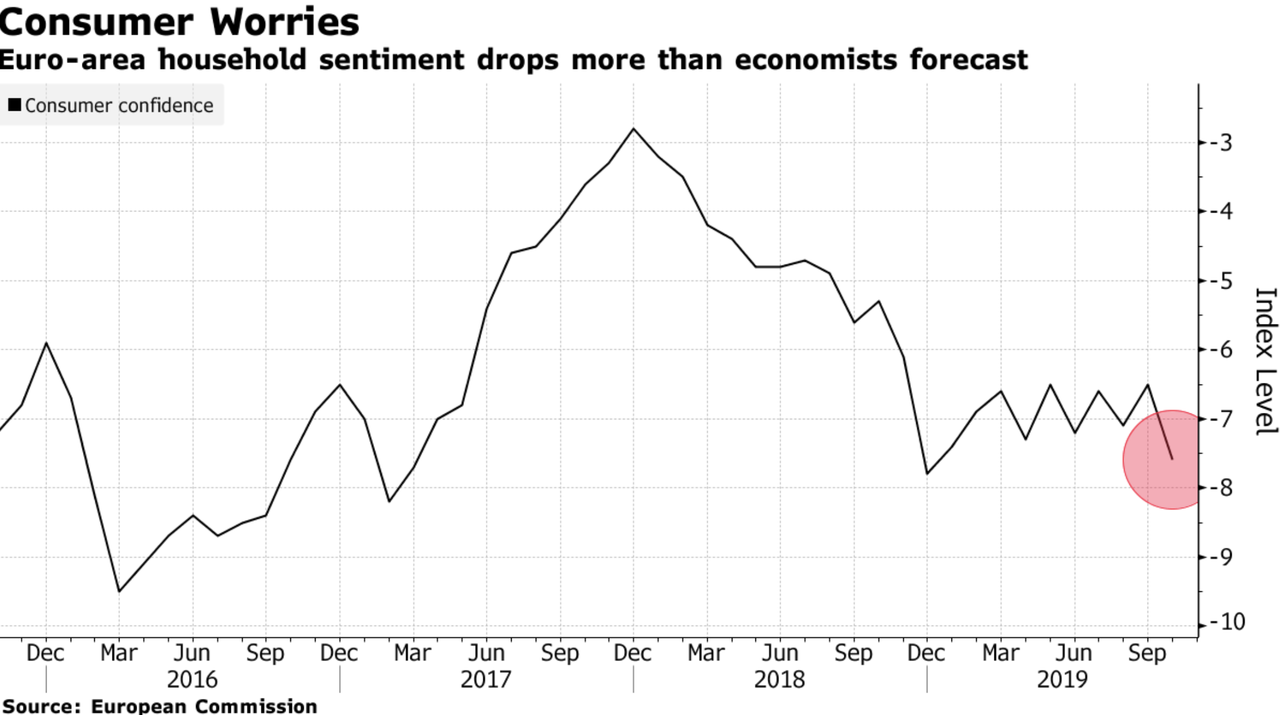

Worrying Outlook

ECB chief economist Philip Lane said last week that the currency bloc is facing a more extended slowdown than previously anticipated amid global trade tensions. Consumer confidence is at the weakest this year, and a survey of purchasing managers showed Thursday that the economy remained close to stagnation at the start of the fourth quarter.

While euro-area officials expect a downgrade to growth forecasts in December, that may not be enough to provoke more action though. Last month’s divisive decision has left little appetite to add to more stimulus any time soon.

Stimulus Controversy

The dispute over September’s decision was extraordinary. A third of the Governing Council opposed restarting QE and some of them vented their frustration publicly, prompting the president to warn that such dissent can undermine the ECB’s credibility.

For the first time, skepticism toward ever-looser monetary policy reached beyond the region’s core. Italy’s Ignazio Visco – usually a strong supporter – signaled he would be reluctant to back another rate cut further below zero. His maverick colleague Robert Holzmann of Austria wants a return to positive borrowing costs.

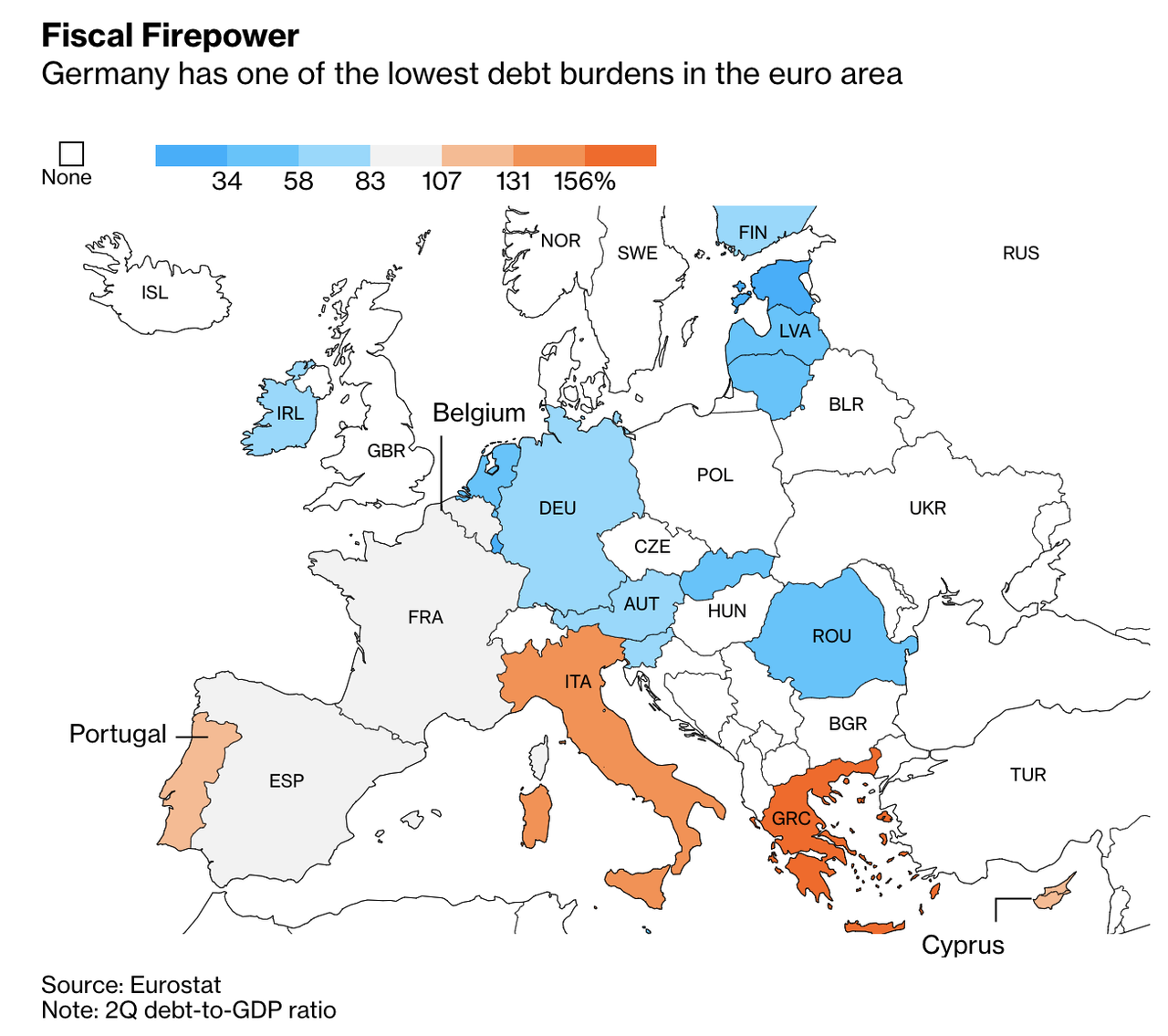

Fiscal Boost

With monetary policy stretched, Draghi has cranked up his call for governments to boost spending, telling an audience in Milan this month that countries such as the U.S. where fiscal support played a bigger role after the financial crisis saw a faster return to price stability. He’ll almost certainly hit that subject again. Whether he’ll be listened to is another question.

Germany is the country best placed to act because of its economic heft and its budget surplus. Yet Bundesbank President Jens Weidmann is skeptical, and the government has been reluctant – though there are signs it’s warming to the idea.

Data next month should confirm that the nation slipped into a recession. Even if that sparks a fiscal response though, it’s not clear how much the rest of the euro zone would benefit.

And maybe, for old time’s sake, we’ll get one more glitter bomb:

[youtube https://www.youtube.com/watch?v=8aF985r-C78]

Tyler Durden

Thu, 10/24/2019 – 06:00

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com