China Auto Sales Fall 6% In October As Global Auto Recession Shows No Signs Of Slowing

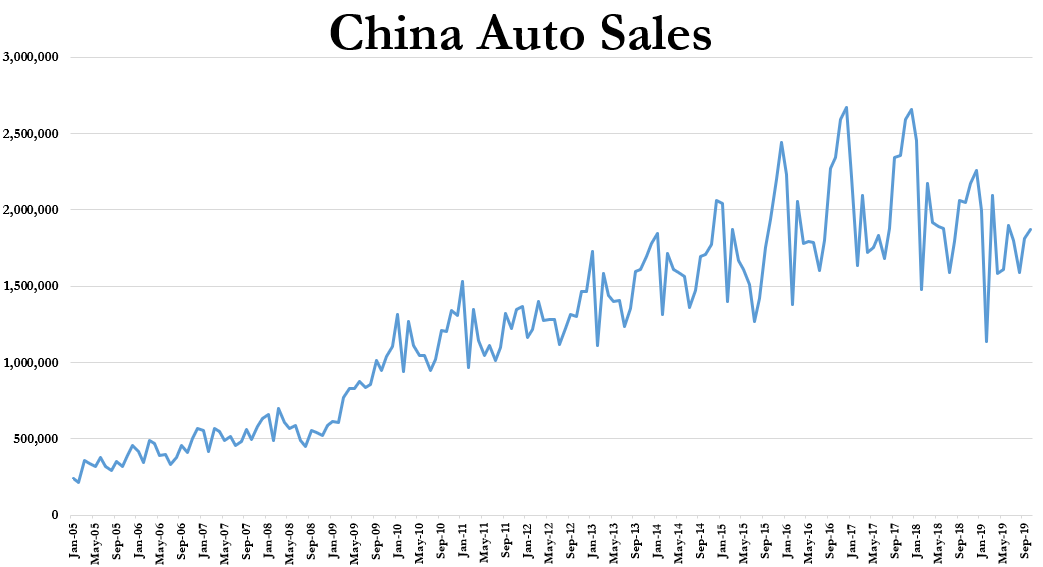

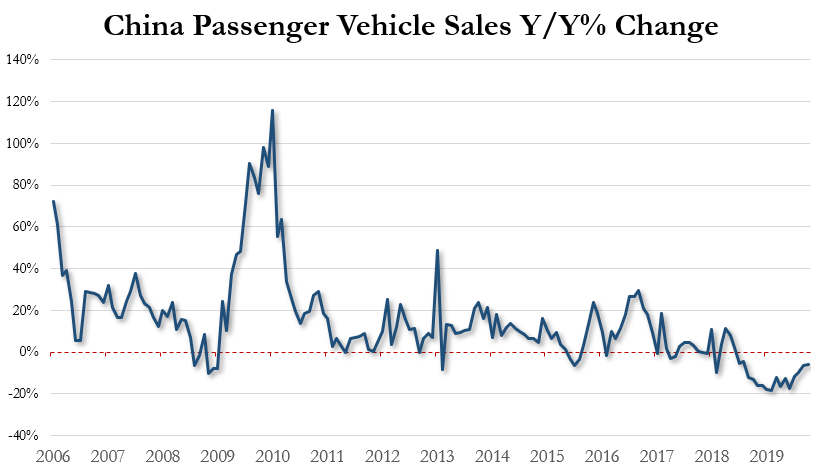

China has been spearheading the global recession in the automotive industry and, as one more month has come to pass, there are still no signs of the bleeding letting up.

As the U.S. and China continue to grapple with solving “Phase 1” of the allegedly upcoming trade deal, pressure remains on the automobile industry globally. For October, China retail passenger vehicle sales were lower by 6% year over year to 1.87 million units, according to the Passenger Car Association. October SUV retail sales also fell 0.7% y/y to 853,130 units.

Additionally, individual OEM data for China for October has also started to trickle in. Names like Toyota, Nissan and Mazda all posted low single digit drops for the month, while Honda was able to squeeze out a positive month.

Auto data aggregator Marklines reported:

- Nissan announced on November 6 that it sold 139,064 units in October in China, reflecting a 2.1% y/y decrease in sales.

- October sales of the 7th-generation Altima, Sylphy, Tiida, Qashqai and Kicks increased. Year-to-date (YTD) sales from January to October totaled 1,230,047 units, reflecting a 0.6% y/y decrease.

- Toyota sold 131,700 units in October, reflecting a 2.9% y/y decrease.

- YTD sales totaled 1,313,000 units, reflecting a 7.2% y/y increase.

- Honda announced that its October sales were 147,716 units, reflecting a y/y increase of 6.5%.

- Sales of the Accord, Crider, Vezel, Civic, CR-V and XR-V exceeded 10,000 units. The Civic topped 20,000 units in monthly sales for the fifth consecutive month from June to October. Sales of the Accord, Odyssey, CR-V, Inspire and Elysion, all of which are equipped with the SPORT HYBRID, a highly efficient double-motor hybrid power system, totaled 15,373 units. YTD sales totaled 1,271,286 units, reflecting a 15.2% y/y increase.

- On November 6, Mazda announced that sales in October reached 19,882 units, reflecting a 9.1% y/y decrease. YTD sales totaled 181,624 units.

Meanwhile, to add insult to injury, China’s Passenger Car Association said on Friday that NEV deliveries fell for a fourth straight month, down 45% in October as a result of subsidy cuts occurring while the global consumer remains under pressure.

China is considering cutting back on subsidies for electric vehicles, which have been the sole silver lining (if you can even call it that) over the last 12-18 months for the industry. The country has accounted for about half of the world’s sales of EVs and the last time the government cut subsidies, it triggered the first drop in EV sales on record.

That drop could arguably come at the most devastating time for China and the rest of the global auto industry, should it happen now.

Tyler Durden

Fri, 11/08/2019 – 22:05

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com