WeWork Disaster Aftermath: With 97% Of Companies Using Non-GAAP Metrics, Is Everything Fake?

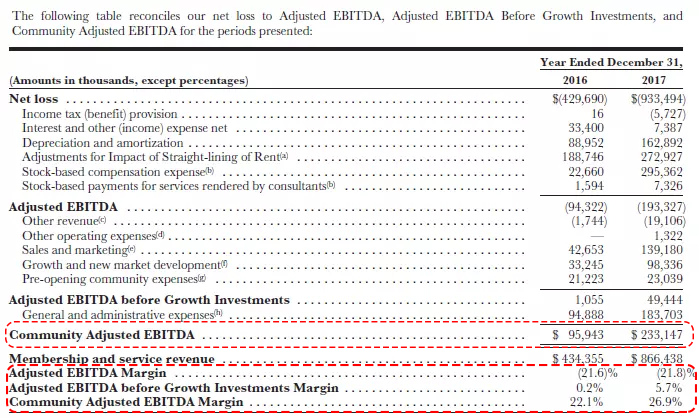

Back in August 2018, long before WeWork’s historic implosion, we discussed how WeWork’s EBITDA is “whatever you want it to be” thanks to the company’s bizarre pro forma addbacks, which transformed a $933MM net loss and a $193 million adjusted EBITDA loss, into a “positive” $233 million “community-adusted” EBITDA for 2017, and a net loss of about $1.9 billion using standard accounting, to a $467 million “profit” in 2018.

This is what we said:

Here, for the first time we saw not just one adjustment to adjusted EBITDA, but an adjustment to the adjustment to the adjustment, and it was called “Community Adjusted EBITDA”, which by the miracles of non-GAAP “accounting”, pushed the company’s EBITDA from negative $193 million to positive $233 million.

We made this observation in the context of Moody’s inexplicably scrapping its B3 credit rating on WeWork. Commenting on this, we said:

It wasn’t clear why Moody’s – the rating agency with the lowest opinion of the office space leasing company – withdrew its rating, but it could be an indication that finally rating agencies are getting tired of the bizarre – and in this case, ridiculous – adjustments that companies increasingly come up with to lipstick their pig, and present their company in a far better light than reality.

Fast forward to today, when the topic of WeWork’s community-adjusted EBITDA has once again come up after the WSJ reported that in the weeks before its now failed attempt to go public, the SEC had “ordered WeWork to remove the measure, before the company offered to substantially change it.”

Specifically, according to a WSJ report on the “wrangling” that was taking place between WeWork and the SEC over whether or not to include the grotesque EBITDA adjustment, which the company had since renamed to the less jarring “contribution margin”, as the IPO loomed, “the SEC zeroed in on how WeWork framed its heavy losses, particularly through a bespoke profitability metric called “contribution margin,” a version of which had formerly been known as “community-adjusted Ebitda.” The agency had first ordered WeWork to remove the measure, before the company offered to substantially change it.”

Demonstrating just how seriously corporations takes the SEC, however, the day before WeWork had hoped to start the roadshow to peddle its IPO to investors, the metric was still mentioned in its revised prospectus more than 100 times (WeWork supposedly planned to amend the filing before starting the roadshow — but instead shelved the IPO, as investors questioned the company’s worth and its corporate governance.)

There are two key points here: the first, of course, is that WeWork was hoping to mislead investors (all of whom were sophisticated enough to know the garbage that “community-adjusted” anything is) by keeping this massive pro forma adjustment; the second is that WeWork appears to be openly defying the SEC’s instructions on cleaning up its prospectus – something it obviously couldn’t do if it hoped to deflect attention from the company’s massive losses.

“It’s highly unusual to have issues that are so important still being disputed while they are out there marketing the stock to investors,” said Minor Myers, a law professor at the University of Connecticut who reviewed the correspondence at the Journal’s request. As WeWork was battling the SEC over its metrics, its advisers were “figuring what they can sell using these numbers,” Mr. Myers added.

The WSJ also reports that WeWork’s resistance to removing the metric was directed by Mr. Neumann himself, who had “previously boasted about the metric to reporters and investors, to show how the company’s core business was profitable.”

Of course, the core business wasn’t profitable as demonstrating previously just how dismal WeWork’s real bottom line was:

Furthermore, if WeWork was “profitable” along any metric, it would not have scrapped its IPO and demanded a SoftBank bailout.

It wasn’t just the community-adjusted EBITDA that was a concern for the SEC: among other issues the SEC targeted was what the WeWork prospectus called “illustrative annual economics.” The agency questioned how the company had arrived at some rosy numbers. “Please explain to readers and tell us how your assumed workstation utilization rate of 100% is realistic,” its letter said. In reply, WeWork agreed to drop the illustrative economics section from the prospectus.

The bottom line, as the WSJ summarizes, “WeWork’s liberal use of customized metrics that don’t comply with generally accepted accounting principles, or GAAP, was central to its wrangling with the SEC, according to people close to the process. The draft prospectus WeWork filed in December cited at least six non-GAAP metrics; by the time it issued the prospectus in August, the tally had fallen.”

Yet even after the back and forth with the SEC, and the IPO debacle, WeWork refused to change its way: on Friday, after markets closed, WeWork published a slide deck from Oct. 11—long after the company’s self-annointed messiah, Adam Neumann resigned, that showed financial results including a “location contribution margin” that appeared to be a renamed version of the metric at the center of its dispute with the SEC.

In short, once you start lying to the investing public in how you misrepresent your business, it is virtually impossible to stop, unless you are SoftBank of course in which case you just assume everyone is an idiot as Masa Son’s financial juggernaut did with these two slides.

However, it is not our intention here to focus on WeWork’s fake financials – we did that last August. Instead, it’s to point out that there is never just one cockroach. In fact, when it comes to non-GAAP adjustments, and “fake numbers”, one can say that everyone is a cockroach: as the WSJ points out, nearly all big companies now use at least one non-GAAP financial metric. Last year, 97% of S&P 500 companies used non-GAAP metrics, up from 59% in 1996, according Audit Analytics.

Which begs the question: in the aftermath of the WeWork fiasco, which relied exclusively on non-GAAP, “community” adjustments to make its financials appear respectable even though fundamentally they were a disaster, is every financial report – and with 97% out of all companies using non-GAAP metrics one can be excused to use the term “ever” – nothing but fake financial news, and when the veil is finally lifted, as was the case with We Work, what will happen to all those trillions in market capitalization built upon “one-time”, “non-recurring” addbacks and pro forma, adjusted, recasted and otherwise fake foundations?

Tyler Durden

Sun, 11/10/2019 – 19:00

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com