Farmageddon: 12 Charts Show That Despite Trump’s Aid, Finances For Farmers Are Getting Worse

A new report from the Federal Reserve Bank of Kansas City shows that farm finances across agricultural states continued to weaken throughout the summer and into the early fall.

The survey touched on all of the key points in the industry: commodity prices, costs, leverage, production, real estate values and the effects of Trump’s ongoing trade war. The report found:

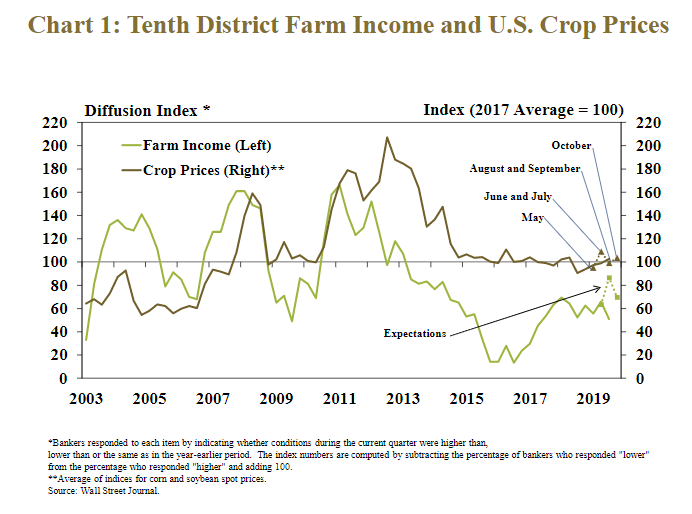

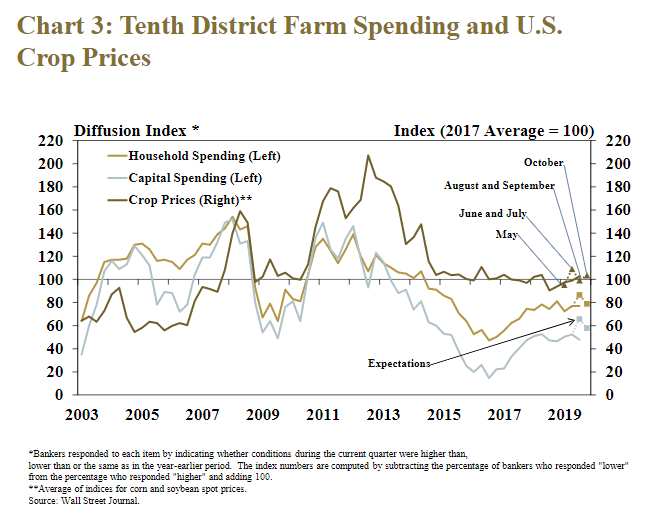

Despite a slight increase in the price of some agricultural commodities and additional support from government payments, farm income and loan repayment rates declined at a modest pace. According to District bankers, agricultural economic conditions in the quarter were influenced by uncertainty about crop production, agricultural trade and other factors that contributed to commodity price fluctuations. Persistent weaknesses in the sector put further pressure on farm finances and signs of modest increases in credit stress remained. Farmland values, however, remained stable, and provided ongoing support for the sector.

Farm income in the region remained relatively weak and continued to decline, the report found.

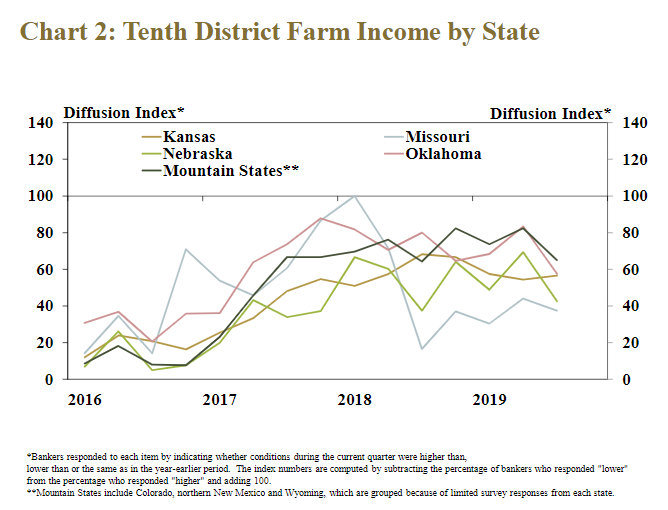

The report also showed that farm income decreased from a year ago across all states in the region.

Debt laden farmers were forced to make additional cuts to spending in response to an ongoing environment of subdued revenue.

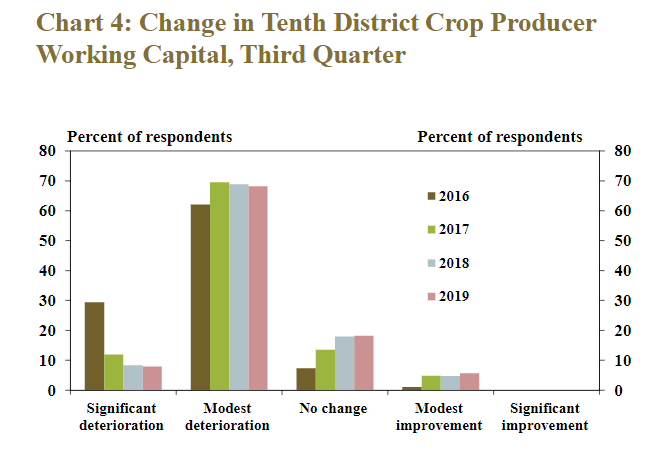

And the report noted that ongoing reductions in farm income put further downward pressure on liquidity positions of crop producers.

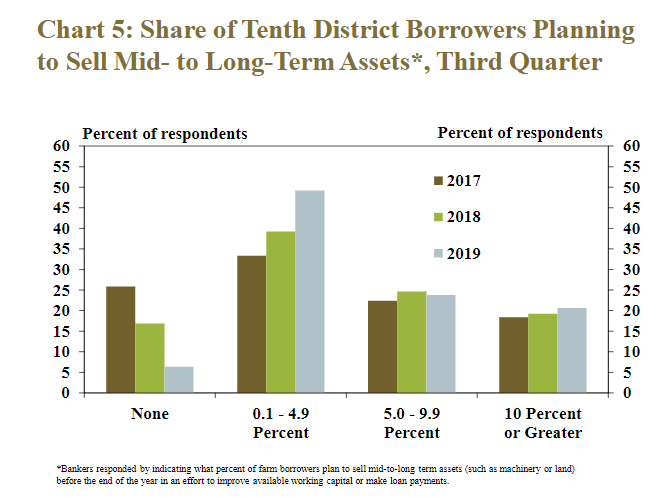

This resulted in deleveraging through selling farm assets…

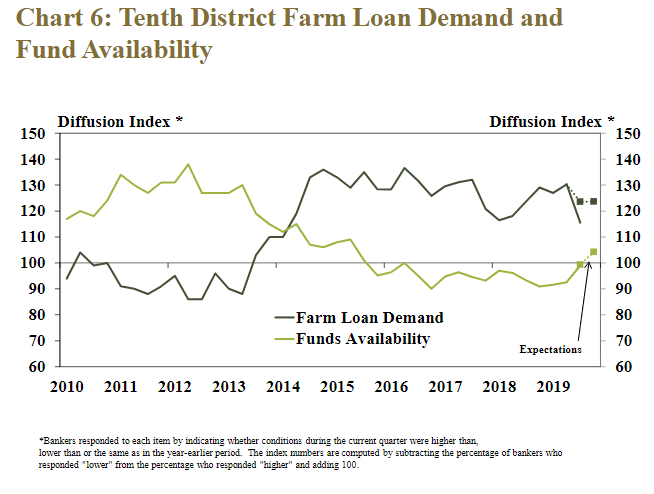

While caused an uptick in demand for farm loans…

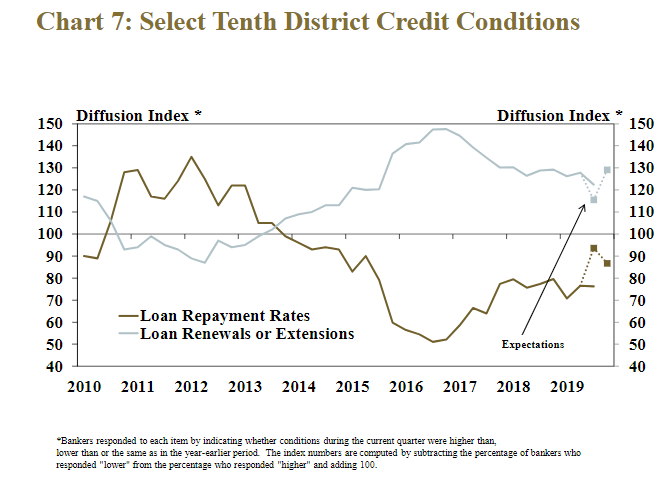

…and steady deterioration of agricultural credit conditions.

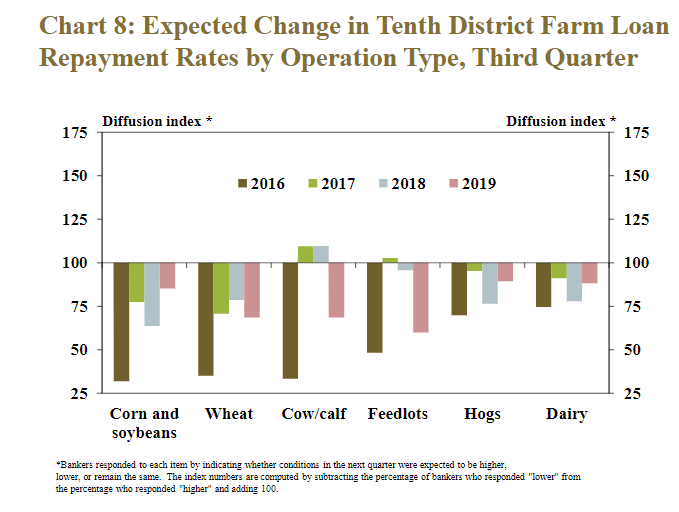

Meanwhile, the outlook for repayment rates through year-end was mixed.

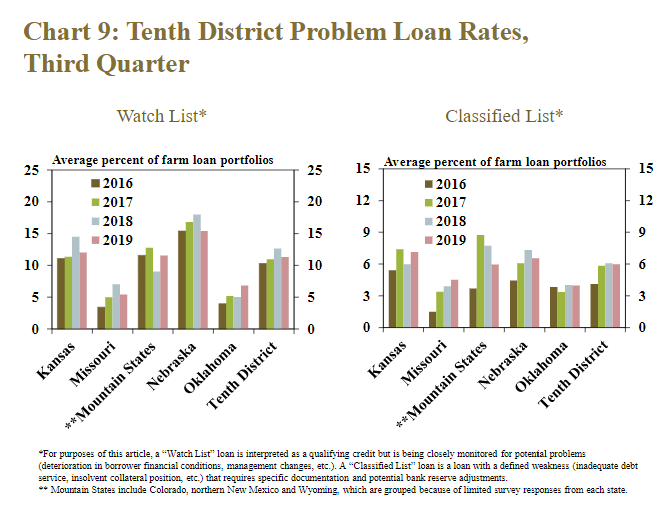

The share of problem loans was steady and the increase in overall credit risk associated with farm loans remained modest, the report noted.

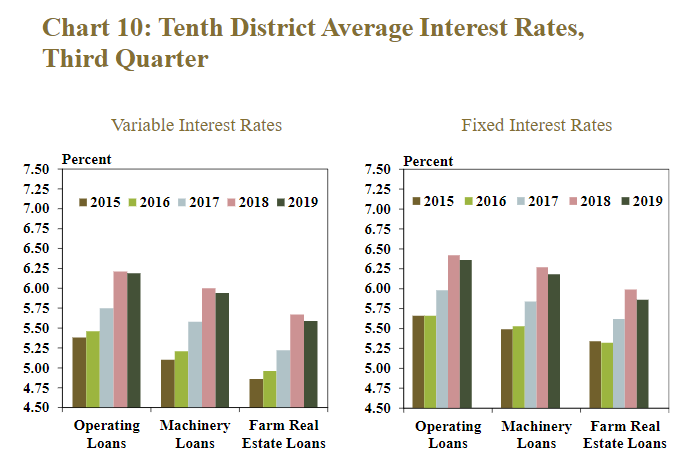

Some temporarily relief came in the form of interest rates on farm loans declining slightly in the third quarter…

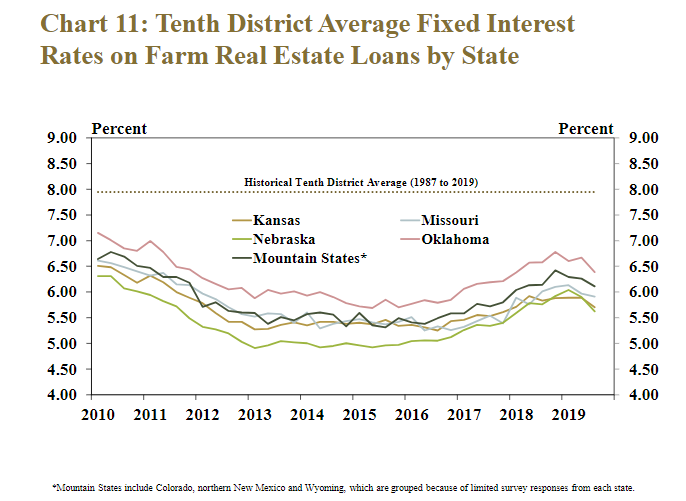

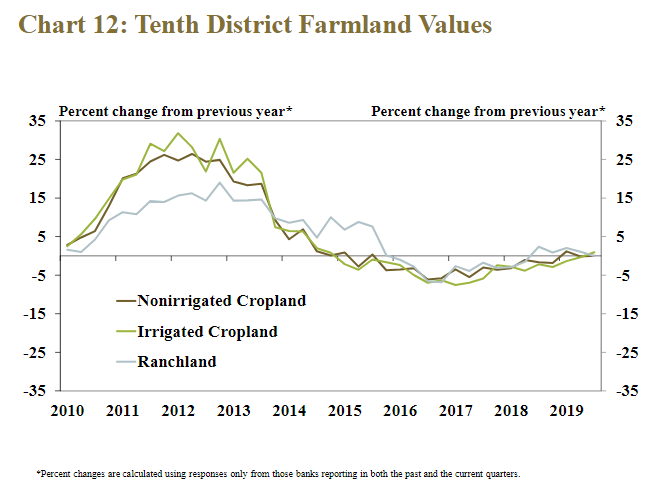

And the entire industry continues to rest on farm real estate values, which have also held up…

…but the outlook for the future remains pessimistic. “Bankers in the Kansas City Fed region expected agricultural credit conditions and farm income to continue to decline in coming months,” the report read.

It continued: “Although numerous contacts indicated that government payments connected to ongoing trade disputes provided some support, most bankers pointed to an ongoing environment of low agricultural commodity prices and elevated costs as the primary factors contributing to the weakness.”

The report says that the stability of farm real estate will continue to provide support to farm finances, and likely will be a key determinant of credit conditions in the year ahead.

And hey, don’t worry – we all know real estate will never crash, right?

Tyler Durden

Fri, 11/15/2019 – 19:25

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com