Carl Icahn Losing Tens Of Millions As “Big Short 2” Trade Turns Sour

Back in July, we passed along a rumor that a certain “iconic” investor had aggressively entered the “Big Short 2” trade, which emerged in early 2017 and consisted of shorting America’s malls by going long default risk via CMBX, or otherwise shorting the CMBS.

A certain iconic investor seems to be aggressively entering the “Big Short 2.0” trade

— zerohedge (@zerohedge) July 29, 2019

https://platform.twitter.com/widgets.js

That investor, we can now reveal thanks to confirmation by the WSJ, was none other than billionaire Carl Icahn, who this summer became the most recent – and most prominent – member of the “Big Short 2” trade. There is just one problem: like most others who bet against the mall sector in the past two years, Icahn has suffered tens if not hundreds of millions in losses so far.

Most recently, we profiled the progression of the Big Short 2 trade one month ago when we reported that one of the firms that had put the “Big Short 2” trade on was hedge fund Alder Hill Management – an outfit started by protégés of hedge-fund billionaire David Tepper – which ramped up wagers against the mall bonds. Alder Hill joined other traders which in early 2017 bought a net $985 million contracts that targeted the two riskiest types of CMBS, in hopes of quick payouts and even quicker mass defaults.

“These malls are dying, and we see very limited prospect of a turnaround in performance,” said a January 2017 report from Alder Hill, which began shorting the securities. “We expect 2017 to be a tipping point.”

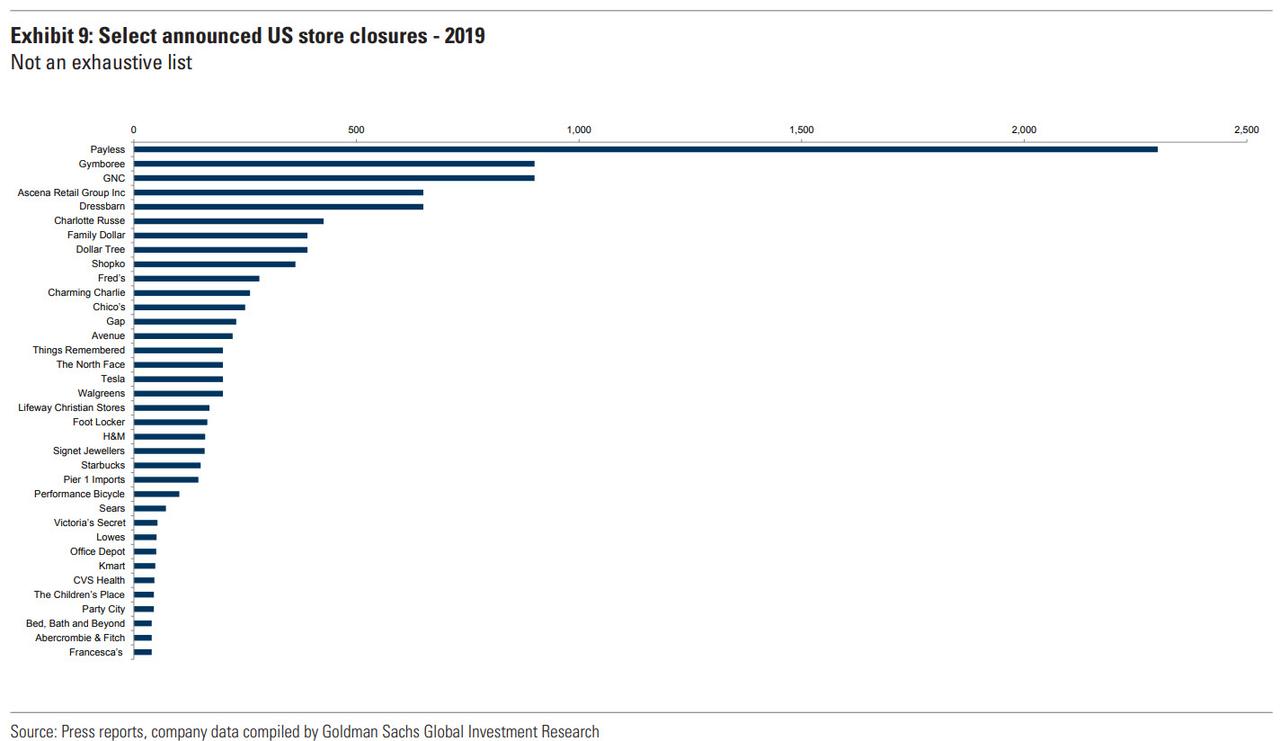

Alas, Alder Hill was wrong, because while the deluge of retail bankruptcies…

… and mall vacancies accelerated since then hitting an all time high in 2019…

… not only was 2017 not a tipping point, but the trade failed to generate the kinds of desired mass defaults that the shorters were betting on, while the negative carry associated with the short hurt many of those who were hoping for quick riches.

As a result, not only did Alder Hill Management close out the trade at around the time Carl Icahn was putting it on, but Eric Yip, the founder of the New York-based hedge fund, also wound down the entire $300 million hedge fund. And while some of Alder Hill’s other trades were profitable, its 2½ years of losses shorting mall debt convinced Yip to shut down, ostensibly long before many of the malls he was betting against.

Ironically, it appears that the way Icahn made his way into the trade is by way of Yip, who worked for Icahn in the 2000s and marketed his trade through presentations with bankers and investors to try to get others to join his bearish stance to push the index lower; and as we reported in October, Yip was forced to exit his loss-making trade over the summer after the index jumped in price, according people familiar with the matter.

And while iconic billionaire investor Carl Icahn is far from shutting down his family office because one particular trade has gone against him, this trade puts him on a collision course with two of the largest money managers, including Putnam Investments and AllianceBernstein, which have a bullish view on malls and have generally taken the other side of the Big Short/CMBX trade, the WSJ reports.

This face-off, in the words of Dan McNamara a principal at the NY-based MP Securitized Credit Partners, is “the biggest battle in the mortgage bond market today” adding that the showdown is the talk of this corner of the bond market, where more than $10 billion of potential profits are at stake on an obscure index.

For those who have not read our previous reports on the second Big Short, here is a brief rundown courtesy of the WSJ:

each side of the trade is speculating on the direction of an index, called CMBX 6, which tracks the value of 25 commercial-mortgage-backed securities, or CMBS. The index has grabbed investor attention because it has significant exposure to loans made in 2012 to malls that lately have been running into difficulties. Bulls profit when the index rises and shorts make money when it falls.

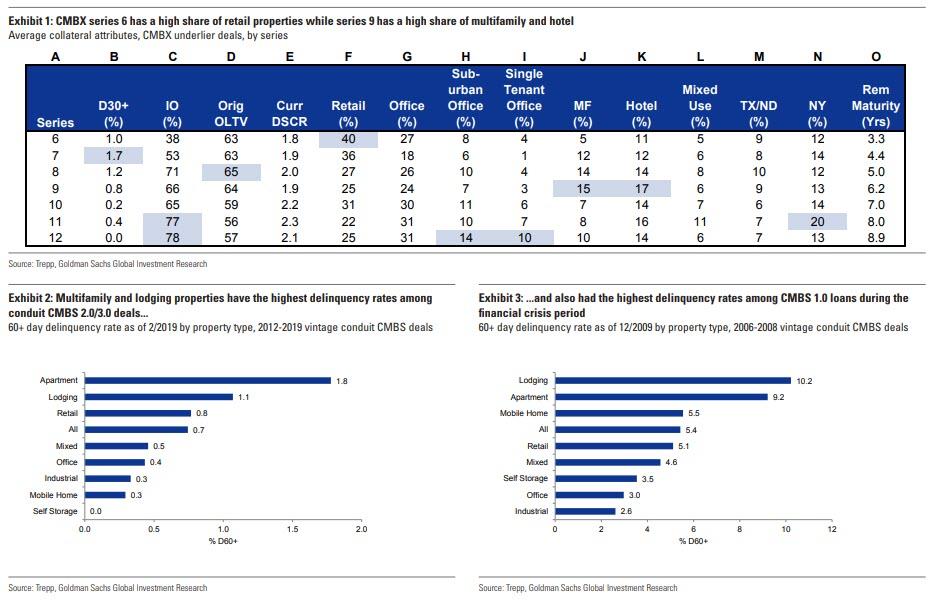

The various CMBX series are shown in the chart below, with the notorious CMBX 6 notable for its substantial, 40% exposure to retail properties.

Ironically, despite a year of record store closures and continued retail bankruptcies, the CMBX 6 series index has climbed about 10% year to date, suggesting either growing optimism about the malls, shopping centers and outlets connected to the index, or merely a flood of liquidity forcing yield-starved investors to bid up every corner of the market, no matter how risky or mispriced it is.

Eventually, other hedge funds followed in the footsteps of Alder Hill’s Yip, and backed off the trade after suffering their own losses, their short squeeze another reason the index is rising and forcing even more shorts to capitulate.

Yet while Icahn has also lost millions on this trade, he hasn’t backed off and according to the WSJ may even be adding to his bearish trade which he now considers a long-term position. Icahn has about 2 more years before the CDS on CMBX Series 6 mature; the insurance contracts will pay off if landlords run into difficulty paying back their debt by 2022.

Meanwhile, despite an acceleration in the “retail apocalypse” courtesy of Amazon.com, even as many malls and shopping centers have suffered deteriorating income, only three of the roughly 40 malls and shopping centers linked to the CMBX 6 have been delinquent on their loans since 2012, according to Trepp LLC, a real-estate data provider.

As bears scrambled for cover, the bulls took the offensive, and in a report released late last month, AllianceBernstein disputed the prevailing view that malls are dying, claiming instead that while it expected some defaults when the mortgages come due in 2022, it believed many of the malls linked to the CMBX 6 index would receive enough rent to support their expenses and debt service. One such example is the Dayton Mall in Ohio which has lost tenants including Payless ShoeSource, but has found new ones, like Ross Dress for Less.

The short sellers are peddling a “false narrative” said Brian Phillips, director of Commercial Real Estate Credit Research at AllianceBernstein. “They are focused on momentum rather than credit fundamentals.”

Short sellers have said they don’t need a large drop in mall occupancies to profit, nor do they need widespread near-term defaults. They are wagering that the net operating income of the malls continues to drop and that owners have trouble paying off loans in three years.

Ultimately, none of the fundamentals matter as long as the Fed is juicing the market with tens of billions in excess liquidity in the aftermath of September’s repocalypse: as long as Powell is merrily flooding the market with excess liquidity, the CMBX indexes will keep rising oblivious to the viability of the underlying collateral.

To be sure, there is a certain symmetry to what Carl is doing now and what Burry and/or Paulson were doing in 2007 by betting against subprime. It was only by shorting some of the favorite longs of “Whale investors” who swore up and down that “subprime losses would be contained” (no doubt inspired by certain comments by a man who would soon become Fed Chairman) that these investors made billions. Then again, they had the trade not only at the right place but also the right time, just before the Fed took over capital markets. Alas for the “Big 2.0 Shorts”, the Fed is now in full-blown liquidity injection mode.

The question then is whether the Fed will keep flooding the market until 2022. As such, the Big Short 2.0 trade has become not one just targeting America’s increasingly empty malls, but the generosity of the Fed itself. For those who persevere and refuse to be stopped out of their positions – like Icahn, at least for now – the rewards with sticking until the bitter end could be very enormous… although if Elizabeth Warren is president in 2022, Icahn may want to reconsider if adding another billion to his net worth at the expense of imploding brick and mortar retailers is really worth the brain damage that will surely follow.

Tyler Durden

Tue, 11/19/2019 – 21:05

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com