Fed’s 42-Day Repo 2x Oversubscribed In Scramble For Year End Liquidity

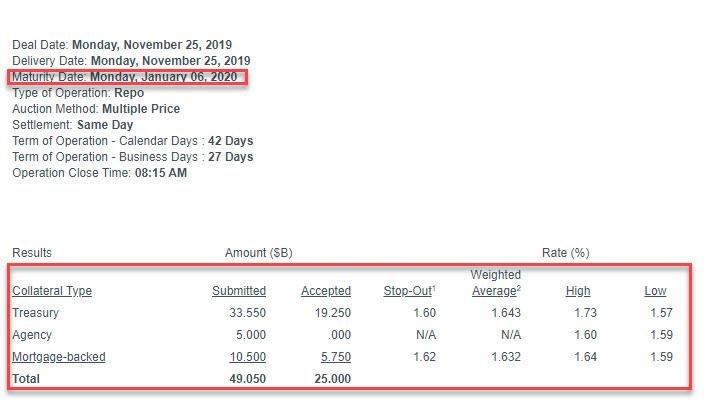

Traders were keenly looking ahead to the result from today’s 42-day repo as this was the Fed’s first liquidity-injection providing dealers with funding to carry them over into next year, as the operation was the first to mature in 2020 or January 6 to be precise. And, as many had feared, year-end liquidity fears remain front and center as the $25 billion operation proved to be roughly half the required size to satisfy all liquidity demands.

Dealers submitted $49.05BN in bids for the 42-day op ($33.55BN in Treasurys, $5BN in Agency, $10.5BN in MBS paper), resulting in a nearly 2x oversubscription of the $25BN in available repo.

While this was only the first operation providing liquidity into the new year, there are two more operations that will allow Dealers to lock in funding into 2020.

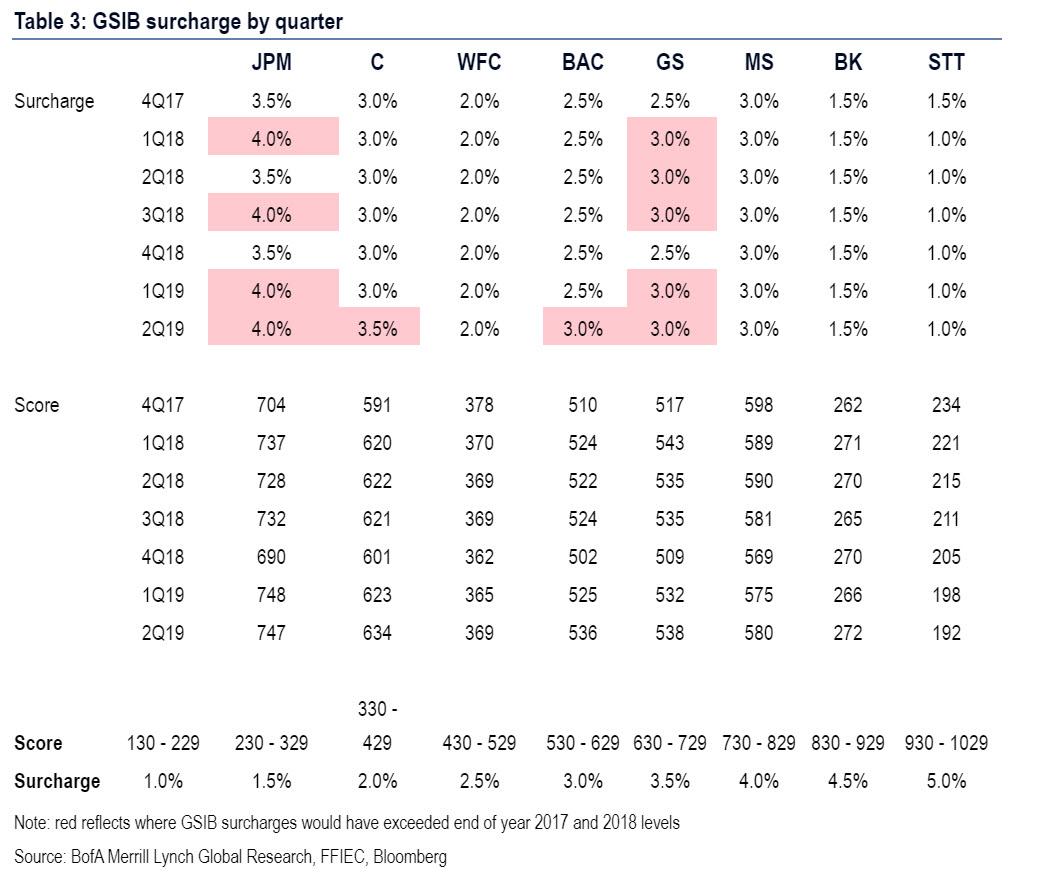

It remains a major question for funding markets why, even with QE4 in place and now daily overnight and short-term repo operations in place, banks continue to fret about year-end liquidity, where some fear a similar explosion in overnight repo rates as was observed on Dec 31, 2018 when General Collateral exploded amid a widespread liquidity shortage. Indeed, as Bloomberg puts it, “even with the Fed’s commitment to continue providing liquidity to the financial system around year-end, the market is still showing concerns. This is due to banks’ year-end balance-sheet constraints related to capital surcharges and other regulatory requirements.”

As are reminder, while most US bank have a GSIB surcharge of around 2%-3%, JPMorgan remains an outlier – and is perceived as the “riskiest” bank – with its 4.0% surcharge. It’s also the reason why the bank has been quietly pulling liquidity away from funding markets ahead of quarter-end periods.

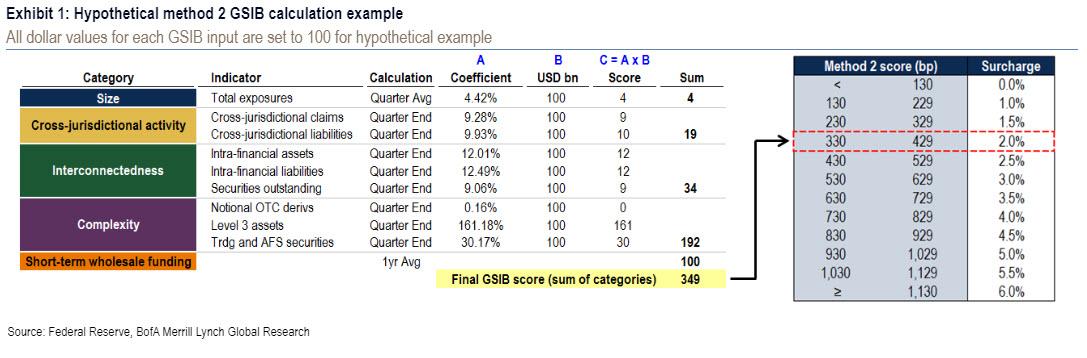

For those curious how the Fed calculates the GSIB surcharge, Bank of America provided the following handy schematic:

Last week, when commenting on what it expects for year end liquidity pressures, BofA said that funding markets are currently very stable but the bank sees risks of repo pressure into year-end, as the Fed faces two funding issues into Y/E:

- a low level of reserves requiring ongoing large Fed repo injections

- dealer repo intermediation constraints stemming from the GSIB surcharge.

The way these issues are linked is through the Fed’s short-term repos; Fed repos pressure dealer balance sheets larger while GSIB constraints encourage dealers to shrink the overall size of their market making activities.

Separately, and in keeping with the recent tradition, the Fed also completed an overnight repo operation, which however showed less funding demand, as “only” $68.5 billion in securities were pledged in exchange for overnight liquidity with the Fed, well below the limit of $120 billion. Yet another troubling observation: while many have expected the total notional on overnight repos to decline over time, the daily use of the overnight repo has stabilized in the $60-$80 billion range and has failed to decline over the past month.

Tyler Durden

Mon, 11/25/2019 – 09:04

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com