Investigating The Mystery Of Weak Wage Growth

Authored by Mike Shedlock via MishTalk,

The Wall Street Journal proposes “Reluctance to Switch Jobs” explains wages. But the Atlanta Fed Macroblog says, nope.

A Wall Street Journal article says One Explanation for Weak Wage Growth: Workers’ Reluctance to Switch Jobs.

From London to Washington to Sydney, policy makers are puzzling over why workers’ pay has been rising only slowly even though official unemployment is at its lowest levels in decades.

That is surprising because changing jobs is often lucrative. U.S. workers who switch jobs gain 4% more pay on average than those who stay put, according to recent research by Giuseppe Moscarini, a labor economist at Yale University.

It is a crucial issue for central banks as they figure out how much to cut interest rates to support their softening economies. One of their key economic models, the so-called Phillips curve, predicted inflation would rise as unemployment fell. That hasn’t happened lately. Inflation remains below central banks’ targets across developed economies.

“Central banks should pay more attention to job switching and what it reveals about people’s preferences for the jobs they have,” Mr. Moscarini says.

The argument runs like this: Workers can demand higher wages only if they have outside offers, regardless of the unemployment rate. People who switch jobs tend to find work that better utilizes their skills, and therefore pays more. Job switchers also improve the bargaining position of workers who stay in their jobs, by encouraging employers to pay more to retain them.

Is Job Switching on the Decline?

John Robertson, a senior policy adviser in the Atlanta Fed’s research asks Is Job Switching on the Decline?

Here’s a puzzle. Unemployment is at a historically low level, yet nominal wage growth is not even back to prerecession levels (see, for example, the Atlanta Fed’s own Wage Growth Tracker). Why is wage growth not higher if the labor market is so tight? A recent article in the Wall Street Journal posited that the low rate of job-market churn likely explains slow wage growth. Switching jobs is typically lucrative because it tends to be going to a job that better uses the person’s skills and hence offers higher pay. Job switchers can also help improve the bargaining position of job-stayers by inducing employers to pay more to retain them.

But is the job-switching rate really lower? A paper that Shigeru Fujita, Guiseppe Moscarini, and Fabien Postel-Vinay presented at the Atlanta Fed’s 10th annual employment conference looked at a commonly used measure of employer-to-employer transitions. That measure, developed by Fed economists Bruce Fallick and Charles Fleischman in 2004, uses data from the Current Population Survey (CPS) on whether a person says that he or she has the same employer this month as last month. Job switchers are those reporting having a different employer.

Fujita and his coauthors discovered a potential problem with these data, noting that the CPS doesn’t ask the same-employer question of all surveyed people who were employed in the prior month. Importantly, the incidence of missing answers has increased dramatically since the 2006.

BLS Question Revision

The Shigeru Fujita, Guiseppe study noted a “dramatic and persistent jump in January 2007” of people staying in the same job.

The study reports “We now provide evidence that the likely culprit is another seemingly small change in the CPS interview protocol, the Respondent Identification Policy (RIP), introduced in that month.”

Thus, there is no sudden dramatic change at all.

Jobertson concludes “The adjusted job-switching rate is only moderately lower than it was 20 years ago and has fully recovered from the decline experienced during the Great Recession. Although a decline in job switching might be a factor in the story behind low wage growth, based on this adjusted measure it doesn’t seem like the dominant factor. The low wage growth puzzle remains a puzzle. “

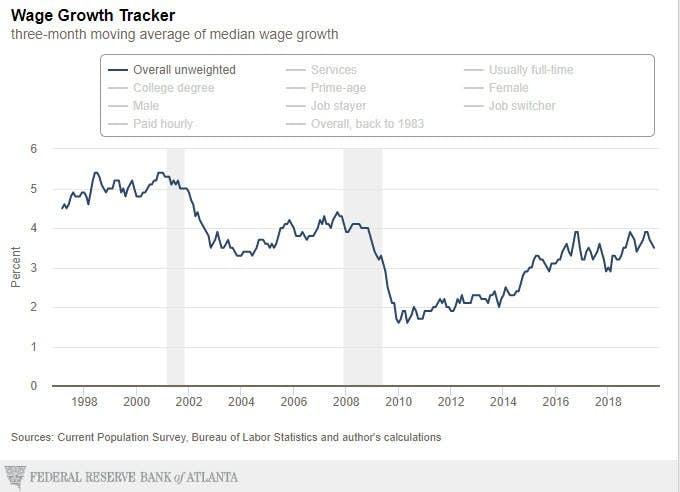

Atlanta Fed Wage Growth Tracker

Weak Wage Growth?

-

The Atlanta Fed Wage Growth Tracker shows weak wage growth.

-

The Wall Street Journal article noted “weak wage growth” without posting any supporting data at all.

Instead of attempting to figure out why wage growth is weak, let’s ask the correct question:

Is Wage Growth Really That Weak?

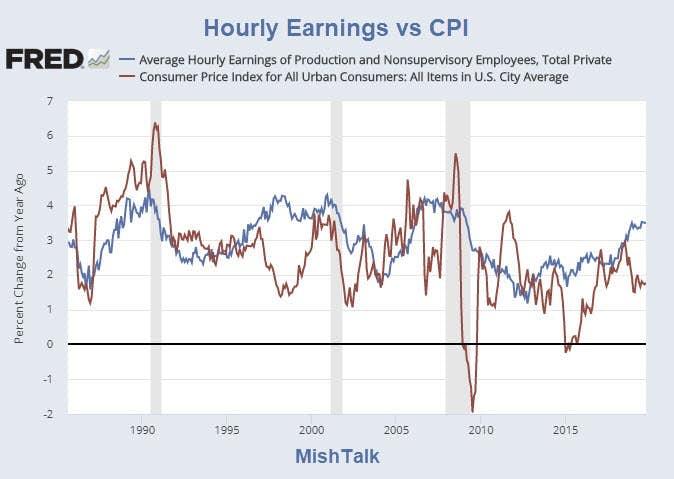

Is nominal wage growth weak because inflation is weak?

Of course, this pressumes one believes the CPI is an accurate measure.

Those those in school, those who have student loans, those wanting to buy a home, and those who buy their own health insurance will certainly scoff at purported measures of inflation.

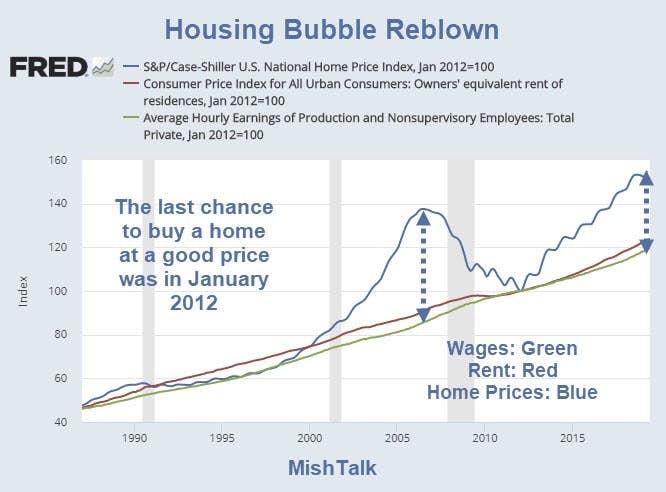

Housing Bubble Reblown: Last Chance for a Good Price Was 7 Years Ago

Please note Housing Bubble Reblown: Last Chance for a Good Price Was 7 Years Ago.

Housing prices are no longer in the CPI. They should be.

I understand the argument that houses are a capital expense. But they are also a fundamental indicator of overall inflation.

Prior to 1997, home prices and rent rose at about the same rate. Since then there have been wild difference. The Fed has repeatedly ignored housing inflation.

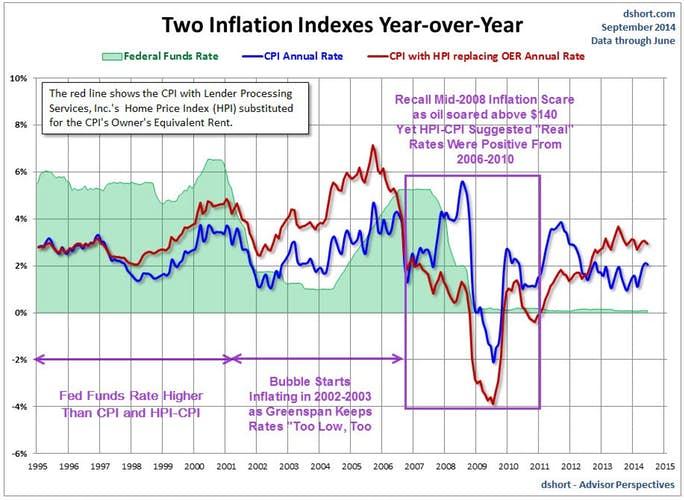

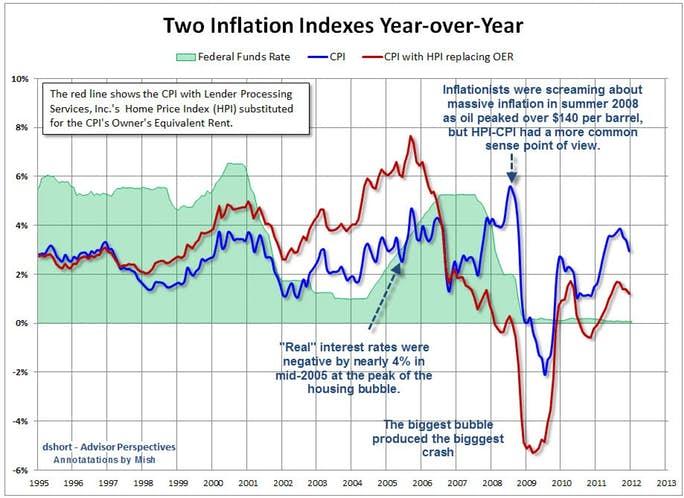

Two Inflation Indexes

In 2013, I proposed calculation the CPI by substituting the Home Price Index (HPI) for Owner’s Equivalent Rent. That chart shows the result.

In mid-2005, inflation, by my measure was running near 7% and the Fed was oblivious.

Please see my 2013 post, Dissecting the Fed-Sponsored Housing Bubble; HPI-CPI Revisited; Real Housing Prices for more on the HPI-CPI and for debunking standard measures of the CPI.

With that necessary diversion aside, let’s return to the alleged “mystery” with a look at the Phillips Curve.

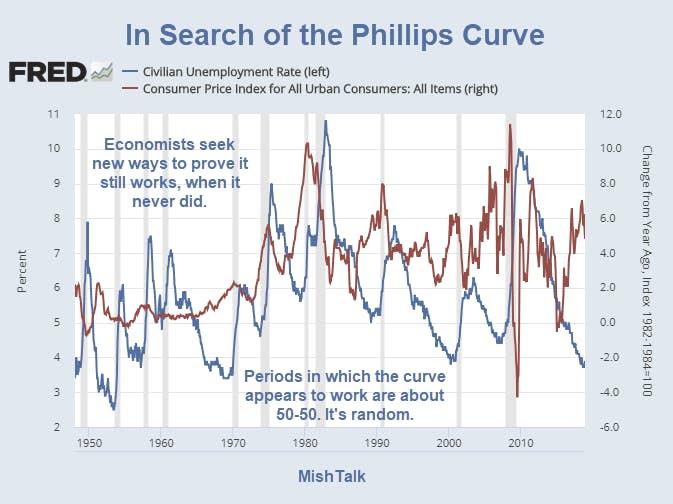

Phillips Curve Nonsense

The WSJ article says “One of their key economic models, the so-called Phillips curve, predicted inflation would rise as unemployment fell. That hasn’t happened lately.”

Anyone citing the long-discredited Phillips Curve as an indicator is sure to get a blast from me.

In Search of the Phillips Curve

On January 15, I wrote Yet Another Fed Study Concludes Phillips Curve is Nonsense.

The Fed study concluded “In sum, a careful look at the wage Phillips curve across states yields little evidence supporting the contention that wage growth sharply rises as the labor market reaches especially tight conditions.”

Head Scratching

The Phillips Curve never worked and never will.

Given that it is random, there will be random periods in which it appears to work and random periods that have economists scratching their heads.

Head scratching is happening again right now over alleged “mysteries” of weak wage growth coupled with fatally flawed studies on workers staying put.

Tyler Durden

Wed, 11/27/2019 – 10:45

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com