Real Corporate Profits Are Now The Lowest Since The Financial Crisis

Ask any Wall Street analyst why stocks are at all time highs and the instant answer will be because profits and net income are similarly at or near all time highs, which means that the multiple needed to justify an S&P around 3,150 is not all that egregious. But is that really the case in a world where virtually everything is fake or otherwise “adjusted” to fit a given narrative?

First, consider that one of the more surprising revelations in the aftermath of WeWork’s “community adjusted“ EBITDA debacle is that there is never just one cockroach and that virtually all companies are just as guilty of aggressively abusing GAAP accounting standards. Case in point, a few weeks ago, the WSJ reported that nearly all big companies now use at least one non-GAAP financial metric. In fact, last year 97% of S&P 500 companies used non-GAAP metrics, up from 59% in 1996, according Audit Analytics.

Last week, Factset picked up on this point in a report showing that while all publicly traded U.S companies report EPS on a GAAP (generally accepted accounting principles) basis, most US companies also choose to report EPS on a non-GAAP basis.

To be sure, we have reported in the past that there are “mixed opinions” in the market about the use of non-GAAP EPS. Supporters of the practice – typically the very management teams that hope to paint their results in a far stronger light – argue that it provides the market with a more accurate picture of earnings from the day-to-day operations of companies, as items that companies deem to be one-time events or non-operating in nature are typically excluded from the non-GAAP EPS numbers.

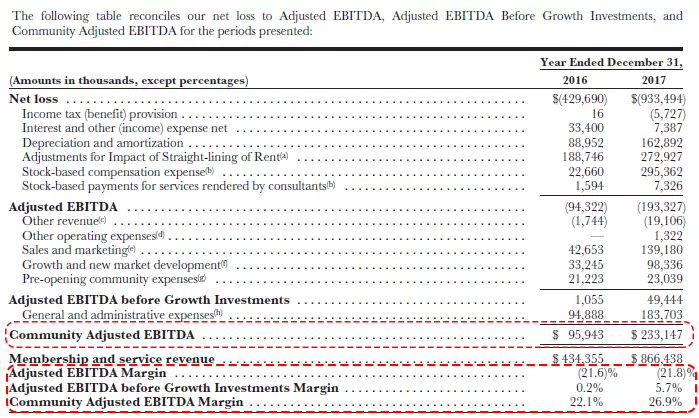

On the other hand, critics of the practice including such iconic names as Warren Buffett (even though his own companies aggressively engage in non-GAAP fudges), argue that there is no industry-standard definition of non-GAAP EPS, and companies can take advantage of the lack of standards to exclude items that (more often than not) have a negative impact on earnings to boost non-GAAP EPS. WeWork’s “community adjusted” EBITDA is just one example:

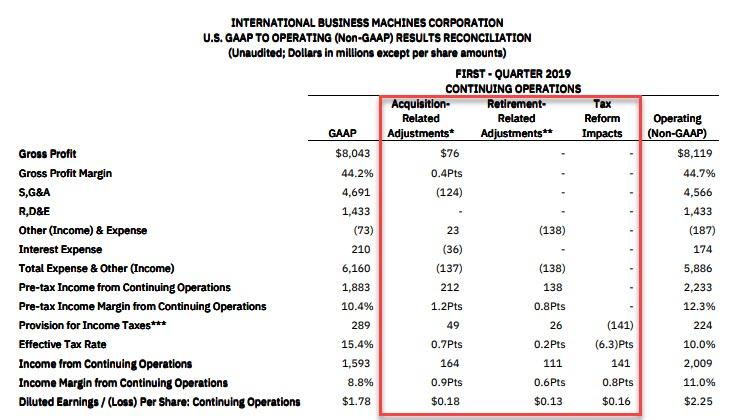

Others include serial abusers IBM (whose recent GAAP to Non-GAAP reconciliation is shown below)…

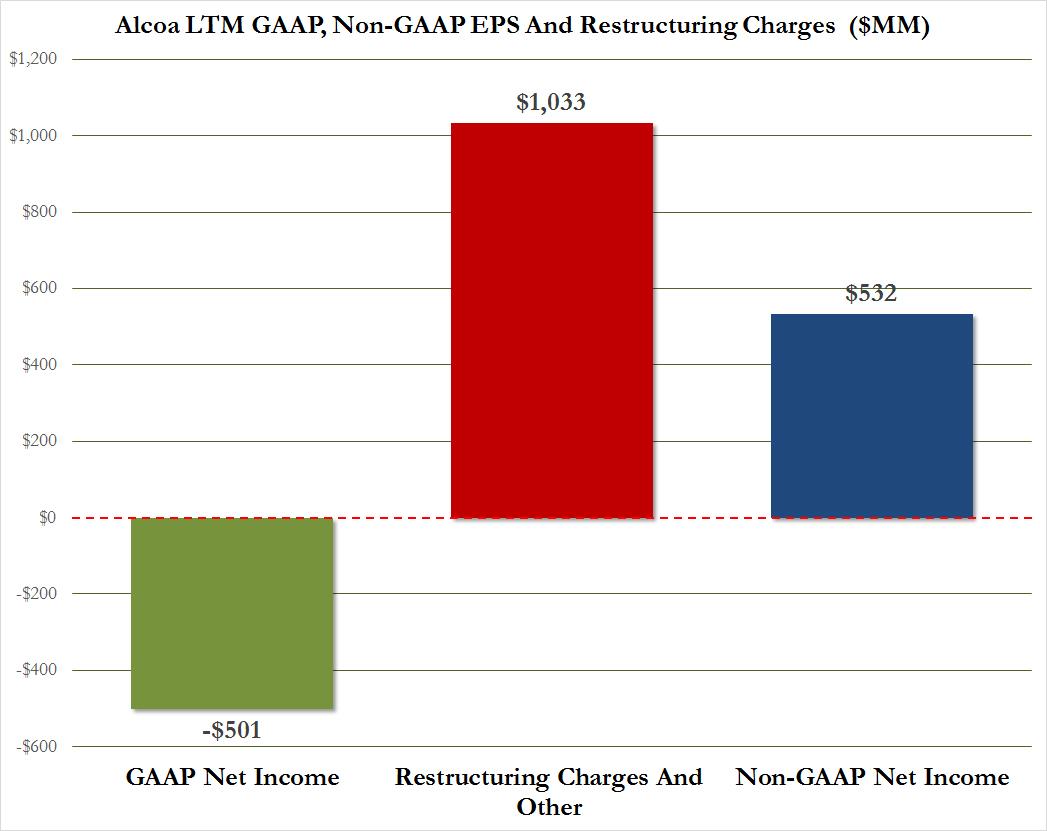

… and Alcoa, which every quarter roughly double their non-GAAP net income by recurringly adding back “one-time, non-recurring“ items.

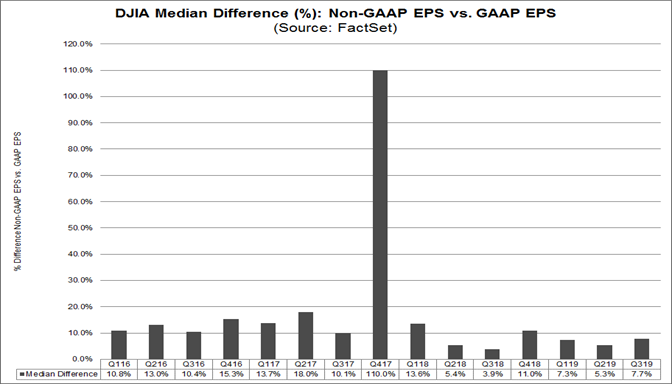

Here a quick case study: now that Q3 earnings season is over, what percentage of the companies in the Doe Jones reported non-GAAP EPS for Q3 2019? What was the median difference between non-GAAP EPS and GAAP EPS for companies in the DJIA for Q3 2019? How did these differences compare to recent quarters?

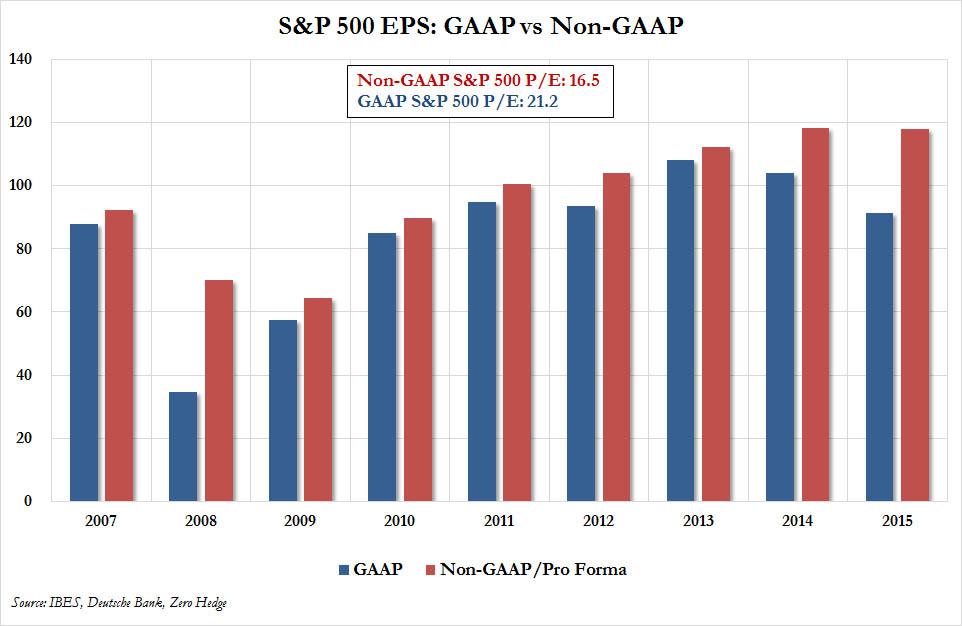

An analysis we conducted not too long ago of GAAP vs non-GAAP EPS showed a dramatic divergence between the two series, with the former peaking in 2013 and declining every since, even as non-GAAP profits have continued to rise.

Fast forward to today, when FactSet points out that since 2016, 73% of companies in the DJIA have reported non-GAAP EPS in addition to GAAP EPS on average. Of these 20 companies, it will not come as a surprise to anyone that since 2016, 75% of companies in the DJIA reported non-GAAP EPS that exceeded GAAP EPS on average. The median difference between non-GAAP EPS and GAAP EPS companies was 7.7%. Since 2016, the median difference between non-GAAP EPS and GAAP EPS has been 10.9%.

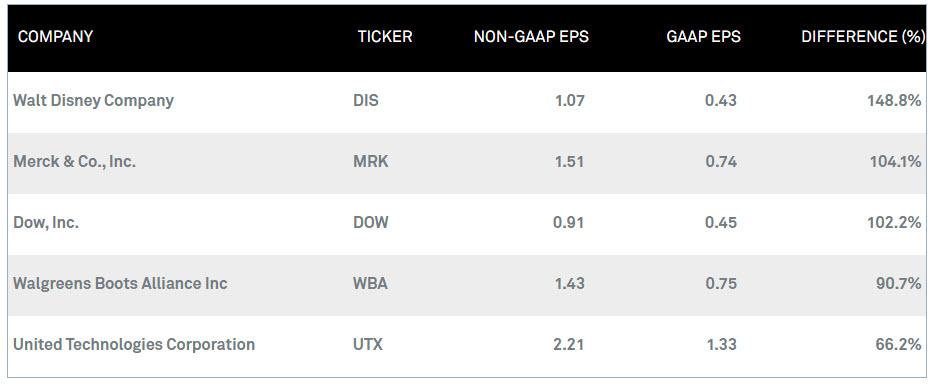

While the median number may not be so shocking, the top 5 outliers surely are. Indeed, when looking at the five biggest non-GAAP adjusters in the DJIA, Factset found that in Q3 2019, the average difference between GAAP and Non-GAAP EPS is about 100%, with Walt Disney the most flagrant abuser, pumping up its GAAP EPS of $0.43 into a non-GAAP EPS of $1.07, some 149% higher!

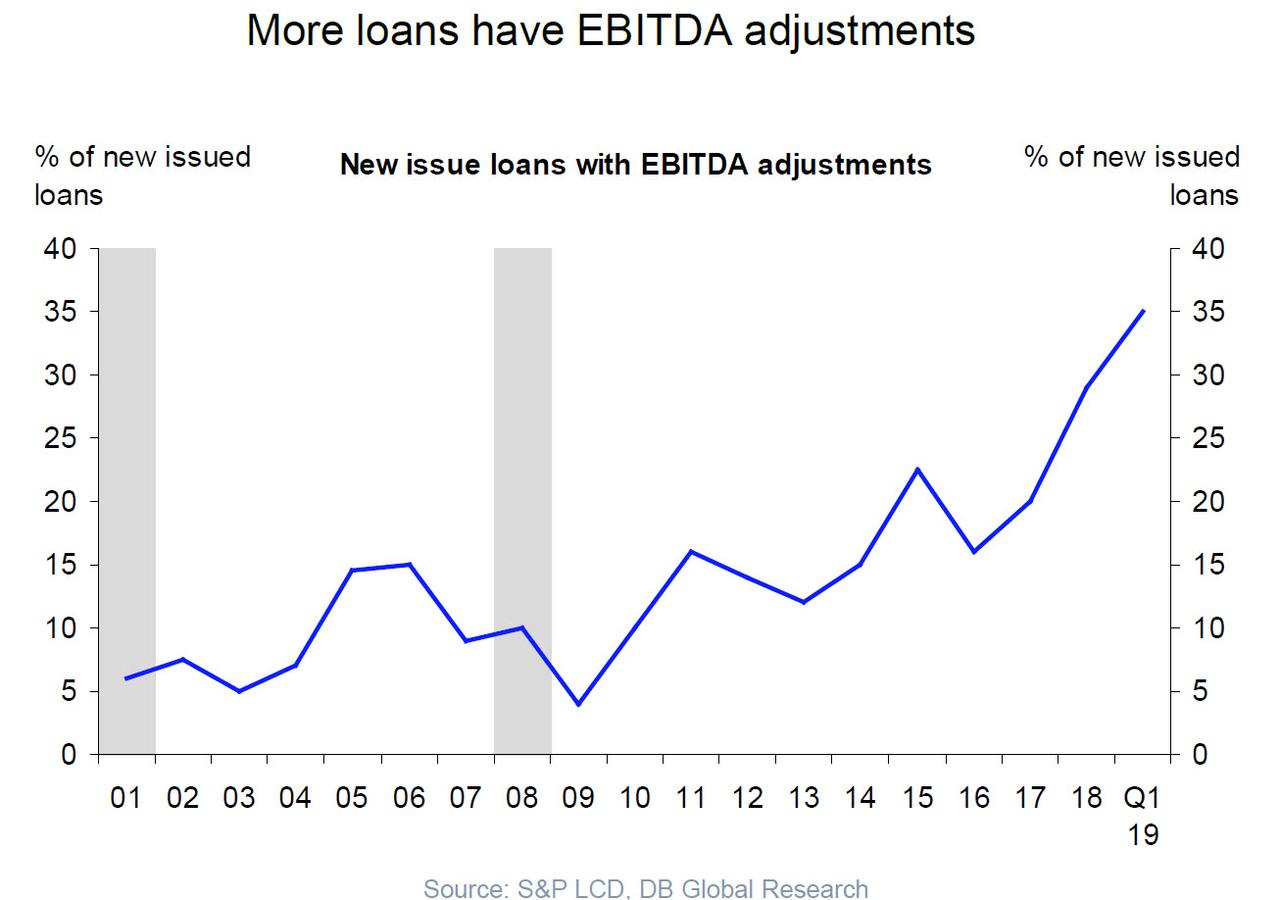

Of course, corporations adjust their results not only when reporting earnings – for many of them, a stronger adjusted EBITDA also means the difference between locking in that much needed loan or bond offering or facing insolvency. It is here that the abuse of GAAP reality is even more dramatic: the following chart from S&P LCD showing the percentage of new issue loans that come with EBITDA adjustments speaks for itself.

Fine, so most companies are “putting lipstick on themselves” and lying about how financially viable they really are. That is hardly a surprise – what is far more surprising is that this practice continues unabated, and that “adjusters” continue to get full credit for their EBITDA adjustments. Interestingly, such flagrant adjustments as “community-adjusted EBITDA” continue to take place long after the SEC launched a crack down on non-GAAP accounting gimmicks. As we reported back in 2016, the SEC’s chief accountant said that “we are going to look harder at the substance of what companies are presenting, rather than what the measures are called.”

Alas, after looking, the SEC appears to have done nothing because it was just a few months ago that WeWork’s “community adjusted” EBITDA farce was still gracing the pages of its financial presentations in order to justify its $47 billion valuation. And more shockingly, nobody on Wall Street cared, until a few weeks ago when the collective psychosis suddenly ended, and WeWork went from one of the world’s most valuable companies to insolvent, and needing a bailout from SoftBank in a matter of days.

Ok, but there has to be some measure of corporate profitability that avoids all these non-GAAP adjustments and one-time addbacks. After all, profits are the lifeblood of a nation’s GDP.

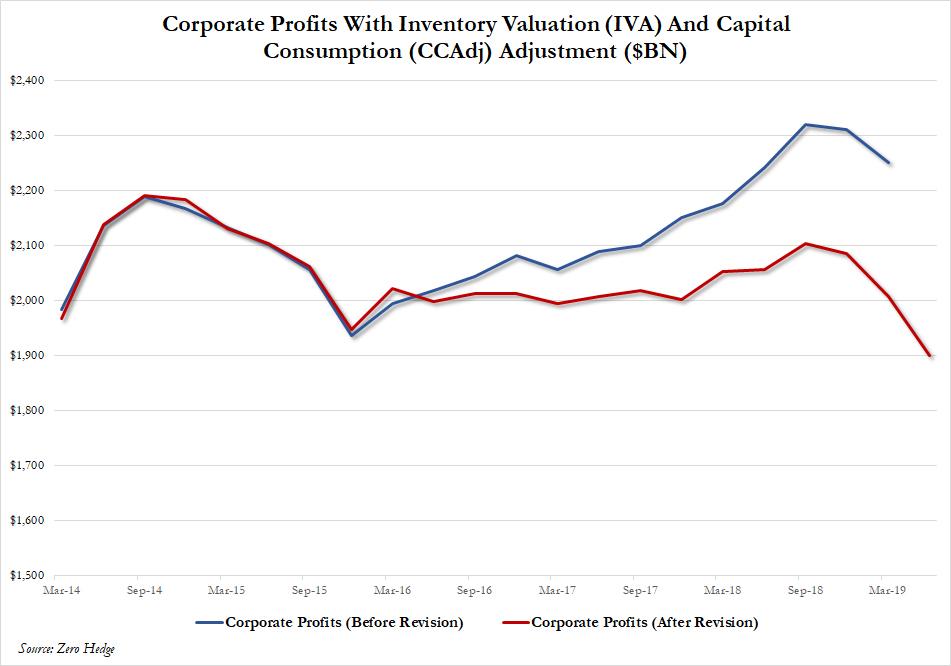

Conveniently, there is precisely such a data set tracking corporate profitability without the benefits of non-GAAP adjustments, and it is reported by the BEA in its purest form as Corporate profits with inventory valuation (IVA) and Capital Consumption (CCAdj) adjustments. Such operating profits, or profits from current production, are the purest form of corporate earnings since this series puts all firms on the same accounting framework – it avoids non-GAAP adjustments – and the profit numbers are not adjusted for the number of shares outstanding.

Yet even here something shocking took place this past July, when a wholesale revision of the economic data revealed something shocking: according to the annual GDP revisions operating profits for 2017 were lowered by $93 billion, or 4.4%, and profits for 2018 were reduced by a whopping $188 billion of 8.3%.

As we first pointed out a few months ago, the revised numbers of corporate profits show that operating profits peaked in Q3 2014 and have been moving sideways even since. Operating profits in the GDP accounts and S&P 500 operating profits over the long run track fairly close to one another, although there can be large differences in any given year. Yet, a flat trend for 5 years in operating profits should not be overlooked or ignored especially since during this period S&P 500 share prices have increased over 50%.

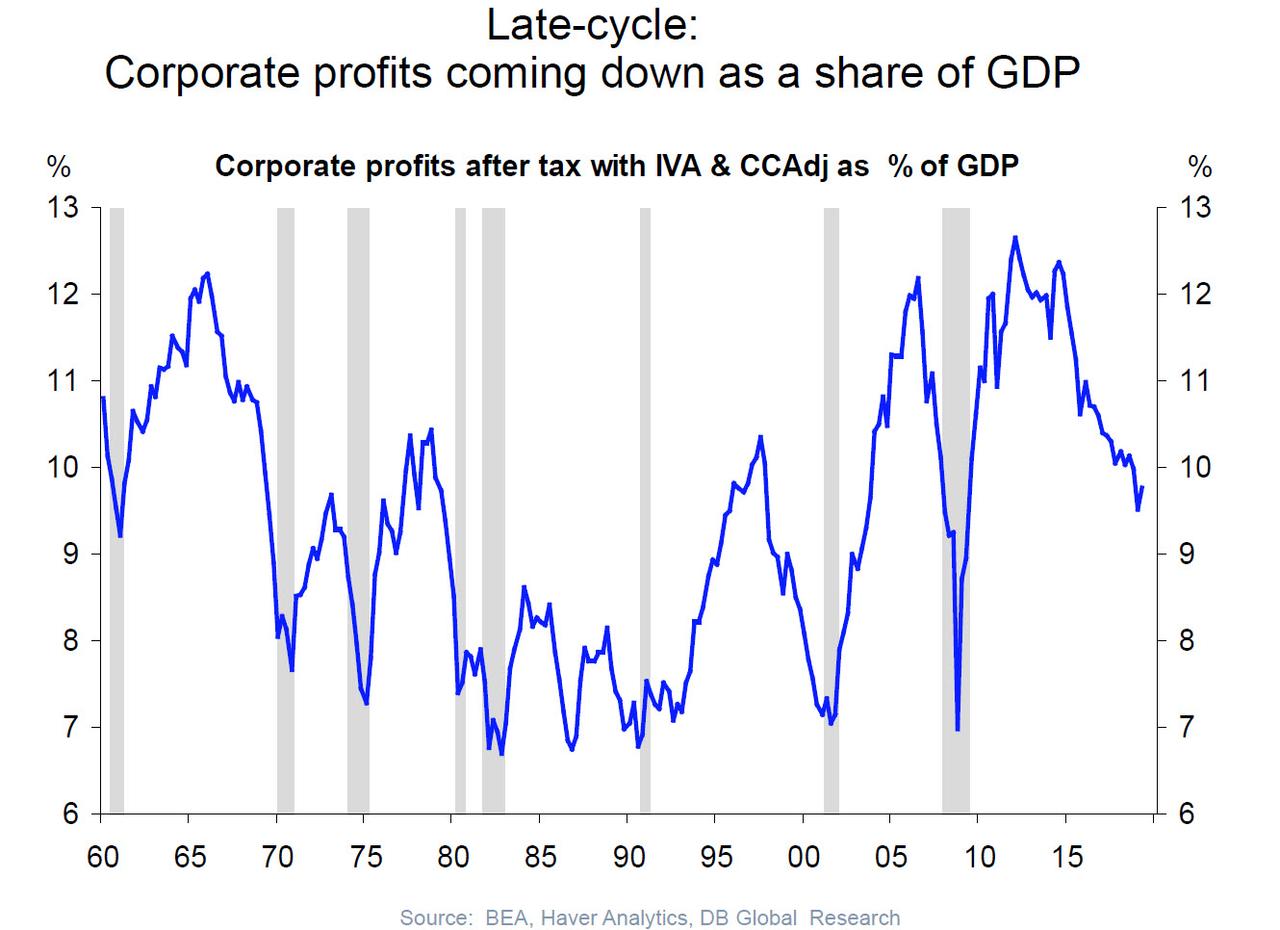

However, an even more accurate way of showing the above data is not in nominal terms, but as a share of GDP: after all, US corporations generate profits not only to boost the pockets of their shareholders but to stimulate the US economy. It is here that something shocking emerges – as the following chart shows, corporate profits (after tax with IVA and CCAdj) as a % of GDP have not only tumbled to the lowest level this decade, but are in fact lower than where they were when the US was sliding into the 2007-2009 financial crisis and when the US entered the 2007 recession!

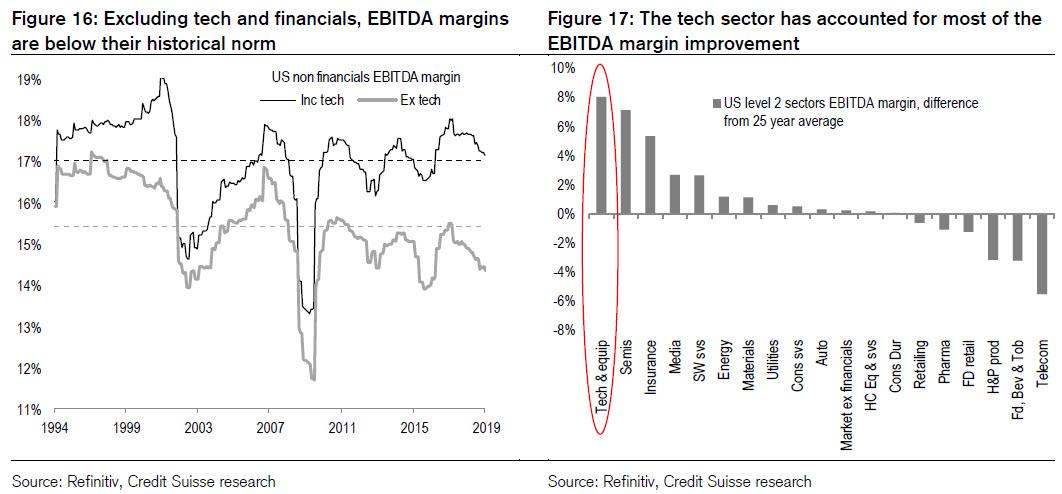

There is yet another way to show the above: for those corporate finance purists who refuse to bow down to the BEA definitions, one can also look at adjusted EBITDA margins but split on a tech vs non-tech basis. What it shows is just as stunning: whereas EBITDA margins for tech companies are near or at all time highs, margins for the rest of the US corporate universe is fast approaching its financial crisis level. In other words, just the tech sector has account for all of the EBITDA margin improvement since the financial crisis!

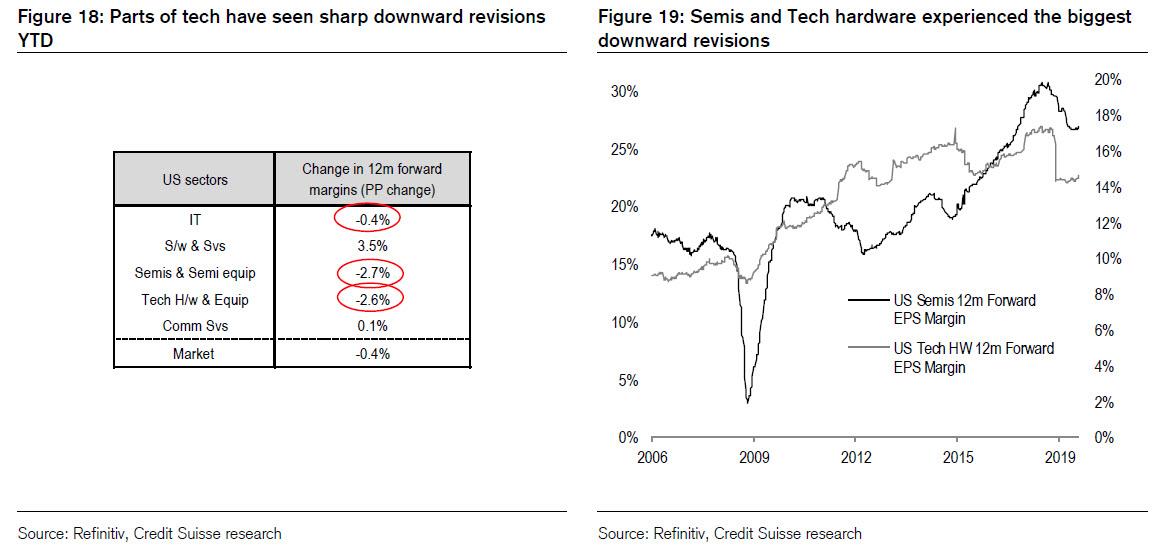

Yet even this is becoming a problem, because as Credit Suisse wrote in its 2020 year ahead outlook, margins within some tech subsectors, such as semis and tech hardware, have started to sag under pressure and it’s only a matter of time before this solitary margin outlier mean reverts.

Whether or not tech succumbs to gravity and finally catches down with the rest of the economy – something that is virtually assured if some of the biggest tech monopolies are broken down in the coming years – is of secondary importance. What is more relevant is that if one looks at the real profits numbers, stripped of all adjustments, revisions and addbacks, a very ugly picture emerges, one where US corporate profitability is the worst since the financial crisis.

Why does this matter? Because as Joseph Carson put it in July, “the argument being used by equity analysts and strategists that the equity market is cheap or inexpensive relative profits appears to be dubious in light of revised data on operating profits, and it suggests that the “actual ” market multiple is a lot higher than what is being reported by analysts.“

Tyler Durden

Thu, 11/28/2019 – 15:30

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com