IATA Slashes 2019 Global Airline Profit Forecast Amid Mounting Macroeconomic Headwinds

As the global economy continues to decelerate into year-end, the International Air Transport Association (IATA) is out with a new report warning that airline profits are expected to fall much faster than thought in 2019, with slowing likely to continue through 2020.

IATA placed most of the blame for the slowdown on the trade wars that have stymied global growth and led to investment uncertainties.

Reuters noted that IATA slashed its 2019 net profit forecast to $25.9 billion, a 5.1% drop from 2018.

IATA warned that the global airline industry could see a trough, but that was contingent on whether “trade optimism” continued.

IATA slashed its 2019 revenue forecast to $838 billion from the $899 billion and said it could see an improvement to $872 billion for 2020. Still, again, the optimism was contingent on a trade resolution between the US and China.

“Slowing economic growth, trade wars, geopolitical tensions, and social unrest, plus continuing uncertainty over Brexit, all came together to create a tougher than anticipated business environment for airlines. Yet the industry managed to achieve a decade in the black, as restructuring and cost-cutting continued to pay dividends,” said Alexandre de Juniac, IATA’s Director General and CEO.

De Juniac stated that he believes the global economy will bottom in the near term, and 2020 could be a brighter year. Though he might be mistaken, betting on an economic rebound based on “trade optimism” — considering structural declines in the global economy were present several quarters before the trade war started. With China’s credit impulse failing to turn up significantly, we don’t dispute the idea that stabilization could be seen in the global economy in 2020. Still, the bet of a massive rebound seems far fetched at the moment.

“It appears that 2019 will be the bottom of the current economic cycle, and the forecast for 2020 is somewhat brighter. The big question for 2020 is how capacity will develop, particularly when, as expected, the grounded 737 MAX aircraft returned to service and delayed deliveries arrive,” said De Juniac.

IATA said airlines’ net profit per passenger dropped to $5.70 this year from $6.22 in 2018, with the industry’s overall net profit margin expected to slide to 3.1% this year from 3.4% in 2018.

The report noted that the sharpest contractions in the industry came from air freight, where a 3.3% decline in freight demand over the year was the most significant decline since the financial crisis.

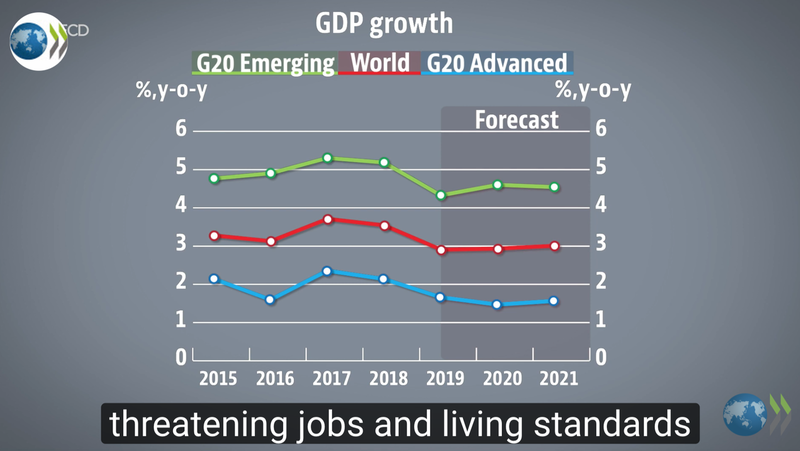

The OECD has recently warned that the global economy is rapidly decelerating at a pace not seen since the financial crisis as monetary policy via central banks becomes ineffective so far to spark growth.

The world economy could slow by as much as 2.9% this year and next, the OECD said. It added that growth could turn up to 3% in 2021.

The consolidation of the global airline industry is underway. A bankruptcy wave has been spreading across the industry at a pace never seen before.

Airline bankruptcies generally start to gain pace right before an economic downturn, and during a recession, which means the latest surge in bankruptcies, from companies like India’s Jet Airways, British travel group Thomas Cook and Avianca of Brazil, suggests 2020 could be a challenging year for the global economy.

The International Bureau of Aviation (IBA) warned: “2019 has seen the fastest growth in airline failure in history,” with about 17 carriers filing for bankruptcy protection as of Sept.

The Reuters Global Airline Index peaked when the global economy started to slow in 4Q17.

The S&P500 Airlines Index shows resistance in the possible form of a double top.

Tyler Durden

Wed, 12/11/2019 – 20:45

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com