Boeing 737 MAX Production Halt Will Slash A Third Off Q1 GDP

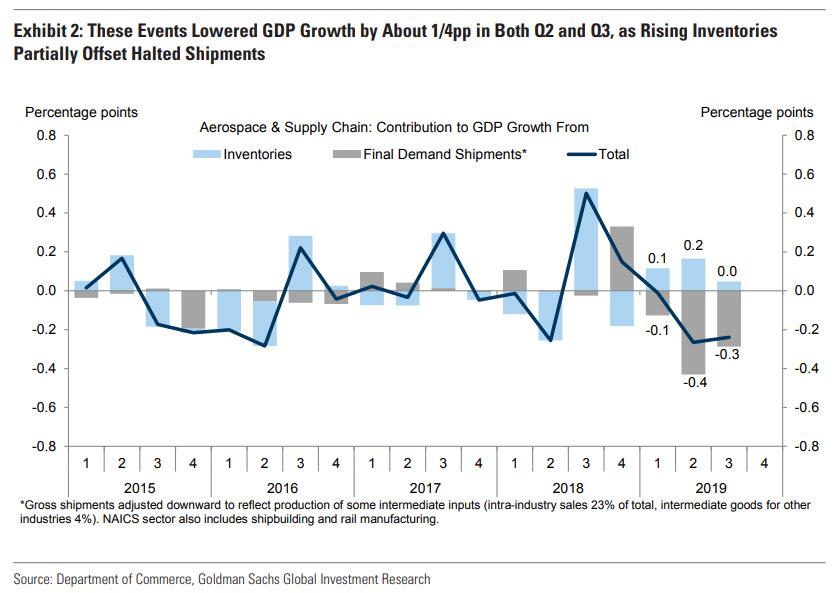

Several months ago, when news of the grounding of Boeing’s 737 MAX fleet first hit, we wrote that this would likely lower GDP growth by around 0.3%-0.5% in both Q2 and Q3, as the collapse in shipments was only partially offset by a pickup in the inventory component. Last night’s announcement that production of the plane will also be halted indefinitely, suggests a longer, and more acute hit to US GDP.

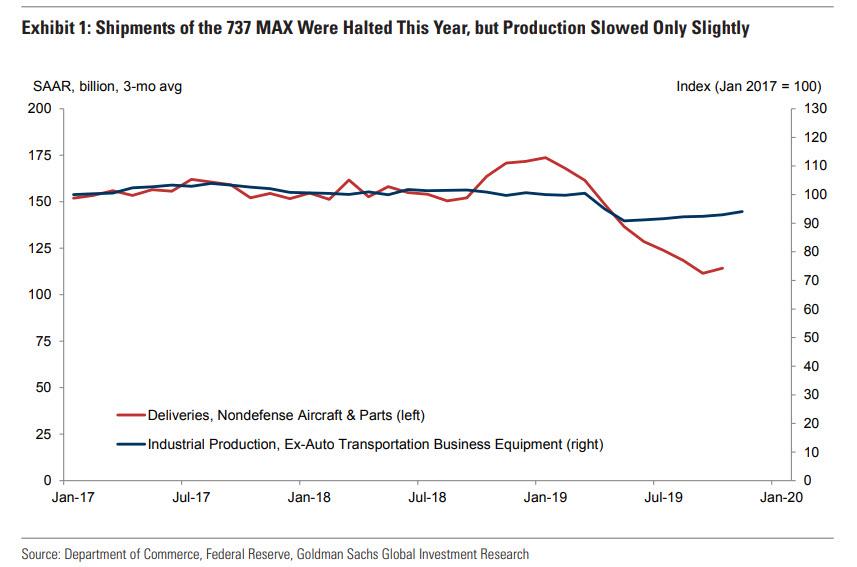

First, some history: After the plane was grounded in March, deliveries were halted, producing a roughly 33% decline in nondefense aircraft and parts shipments. However, Boeing continued to produce the plane—albeit in more limited quantities (42/month vs. 52/month)—and placed them in inventory instead of shipping them out while waiting for reauthorization. As a result, industry-wide production of aircraft declined by a much less dramatic ~20%.

All that stopped last night. According to economists from JPMorgan, Goldman and Capital Economics, Boeing’s work stoppage will cut up to 0.5% from first quarter 2020 GDP, with risk to the upside as Boeing’s suppliers are already reeling from the uncertainty around just how long this production halt will last.

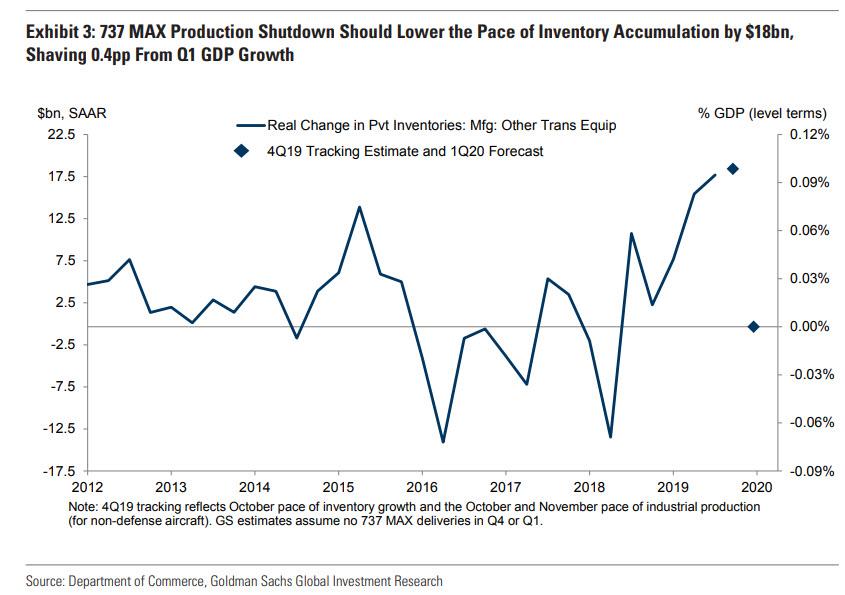

While Boeing previously cut production of the 737 Max to 42 a month, down from 52 in March, the move did not have a shocking impact on the economy. However, a full stop in production means the GDP-boosting rise in inventories will end, resulting in a hit to growth.

In the chart below, Goldman used relevant GDP source data to produce a more comprehensive estimate of the GDP contribution from commercial aircraft output. The bank found that the decline in aircraft shipments has indeed only been partially offset by a pickup in measured inventory investment (the former is reflected in the GDP statistics in business investment, the latter in the change in private inventories).

What happens next?

“The expected drag on 1Q GDP growth should be concentrated in reduced inventory accumulation,” said JPMorgan chief economist Michael Feroli, who also expects the monthly factory orders and non-farm payroll reports to be adversely impacted by Boeing’s production halt.

Meanwhile, according to the FT, Michael Pearce at Capital Economics expects a 0.5% hit to GDP growth in the first three months of the year if the shutdown lasts the entire quarter. He said the move will reduce output of commercial aircraft by about $25bn annualized. Pearce expects the decision could deliver a “big hit to the manufacturing sector just as prospects were beginning to brighten” and cautioned that if staff at Boeing’s suppliers are impacted, “there’s a risk the damage could be even worse.”

Goldman also chimed in today, pointing out that “given that 737 MAX production will halt entirely in January, inventory growth is set to fall sharply, which will weigh on Q1 GDP growth.” Source data available for October and November indicate that the elevated pace of inventory accumulation in Q3 has continued into Q4. Because the second derivative of inventories is what matters for GDP growth, Goldman expects the Q1 slowdown in inventory accumulation to lower growth in the quarter by around 0.4%, reflecting an $18bn decline in the pace of real inventory investment, as shown in the next chart.

The good news is that for now, Boeing has avoided any layoffs, but depending on the length of the stoppage that will change; Pearce expects at least some of the workers “at the more than 600 smaller companies in the supply chain will be furloughed or laid off,” and this could halt their investment plans and could crop up in jobless claims and consumer confidence data.

The bigger issue is that with Q1 GDP already set to print at just 1.5%, another 0.5% in growth being removed will result in the worst quarter for US GDP in years, and would leave the US economy precariously close to a recession.

The silver lining in this situation is that once the 737 Max gets the green light to get off the ground again, the US economy stands to get a big boost as there will be a surge in exports and investment, though this could be delayed until the second half of 2020 . Indeed, as Goldman puts it, “a potential recertification of the plane suggests scope for the level of GDP to rebound by around 0.3% (or 1.2pp annualized) at some point in the future, but we will wait for clarity on the timing before incorporating this into our baseline forecasts.”

Of course, the upside scenario is based on the assumption that the 737 Max grounding will end… eventually. The problem is that the longer this plane remains grounded, the lower its odds of ever flying again. Meanwhile, every quarter 737 Max production is mothballed, US GDP will continue to be hit by about 0.5% relative to some optimistic ~2% or so baseline which assumed airplane production in perpetuity. As such, just a fairly modest hit to the US economy will be sufficient to finally send the economy into a recession.

Tyler Durden

Tue, 12/17/2019 – 23:05

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com