Year-End Repo “Crisis” Ends With A Whimper Amid Massive Liquidity Glut

It was supposed to usher in a market crisis that would prompt the Fed to launch QE4 according to repo guru Zoltan Pozsar. In the end, the preemptive liquidity tsunami unleashed by the Fed in mid-December which backstopped just shy of $500 billion in liquidity, proved enough to keep any latent repo market crisis at bay.

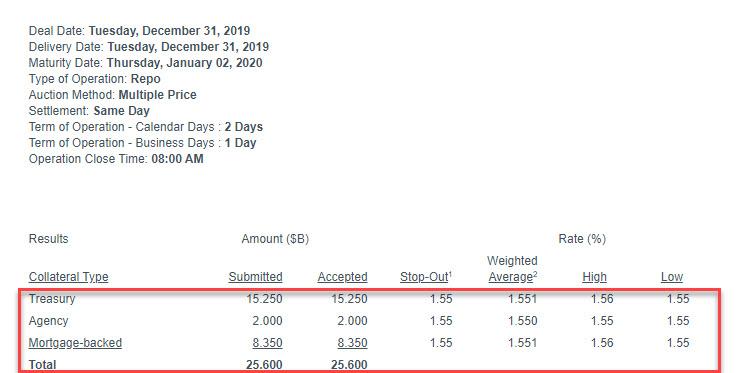

The year’s final overnight repo operation, which the Fed expanded to as much as $150 billion ended up being just 17% subscribed, as Dealers submitted only $25.6 billion in securities ($15.2BN in TSYs, $2BN in Agencies, $8.35BN in MBS) in the year, and decade’s, final overnight repo meant to bridge the financial system’s short-term funding needs into 2020.

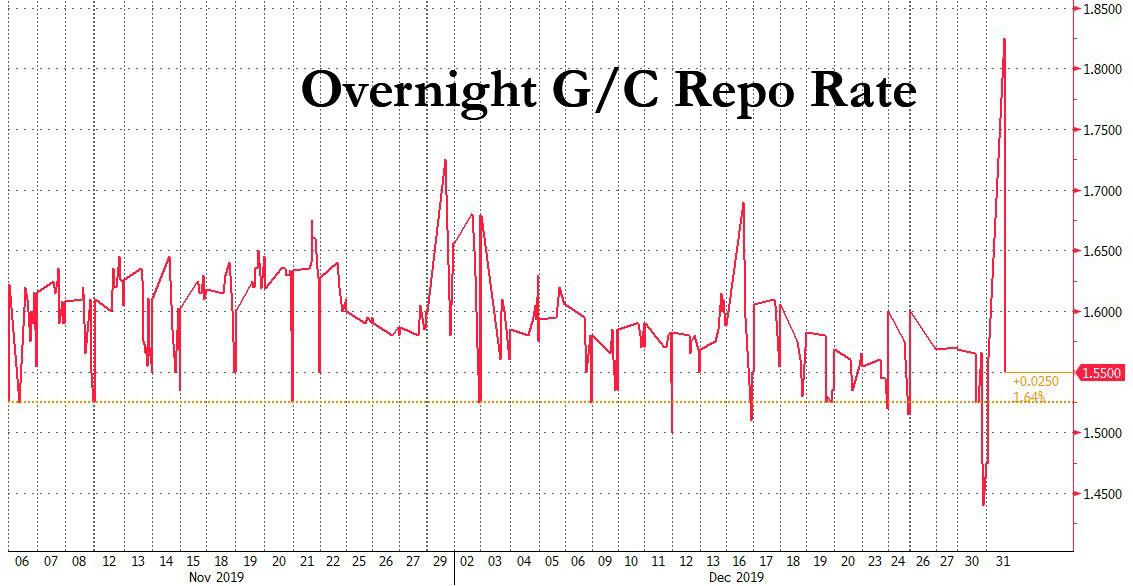

As a result of the Fed’s massive, preemptive liquidity backstop, the overnight G/C term repo rate quickly dropped back to a subdued, and quite normal, 1.55% after starting the day north of 1.80%.

One thing is certain: last New Year’s firework, which saw the overnight G/C repo rate shoot up as high as 5% into Jan 1, 2019, will not repeat itself.

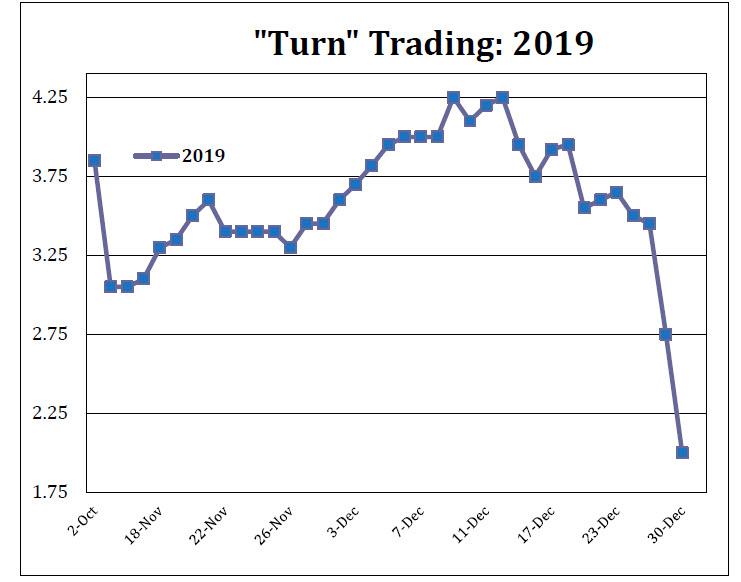

The final hint that a repo crisis would be averted came on Dec 30, when the Turn repo rate dropped another 75 basis points from 2.75% down to 2.00%, confirming that dealers had lost all fears of a year-end funding squeeze. This happened after only $8.3 billion showed up for the 15 day term operation out of a possible $35 billion On Monday. And, as Curvature’s Scott Skyrm explained yesterday, turn rates rallied and the Fed RP term operation was well undersubscribed.

And so, with the “turn” collapsing and today’s overnight repo confirming that all funding needs were met, Skyrm summarized the current, non-crisis state of the repo market as follows:

- There is no more Repo market fear of a year-end rate explosion

- Year-End is now trading more like a quarter-end

- Given the rally in Turn rates, undersubscribed Fed RP operations can be considered to be due to banks getting funded and NOT to full balance sheets

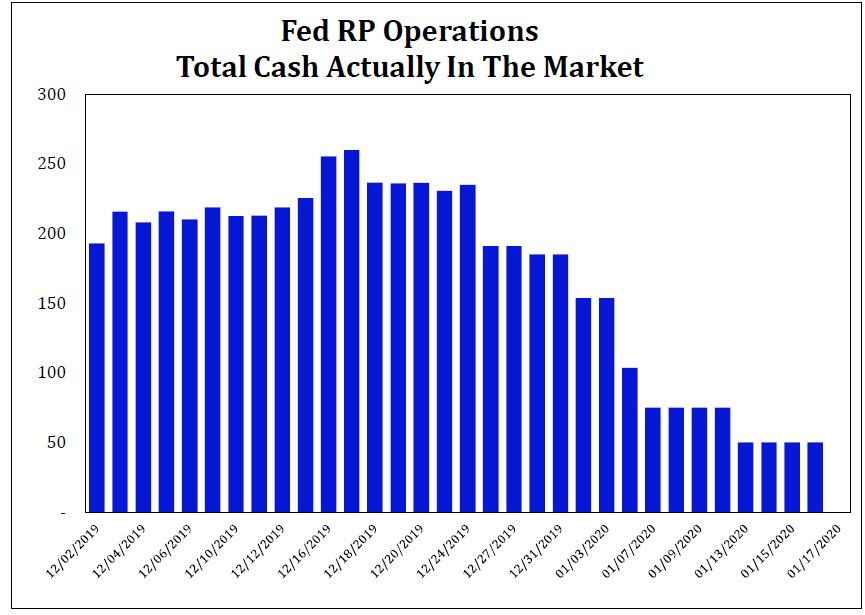

And while a year-end repo crisis was averted thanks to a historic surge in the Fed’s balance sheeet…

… two questions emerge: i) would this have been the outcome had Pozsar not published his report warning about a repo market fireworks had the Fed not unleashed an unprecedented $500 billion liquidity backstop, and ii) will the Fed be able to successful drain the hundreds of billions in excess liquidity it injected to avoid a funding paralysis, while sending stocks to all time highs? While we will never know the answer to the first question, the answer to #2 will be made apparent in the first weeks of 2020 when the Fed decides to either keep rolling its repo operations or end them, cold Turkey, risking another funding crisis for one simple reason: the true level of cash in the market, excluding Fed intervention, has collapsed and once again the entire financial system is living on Fed generosity.

Tyler Durden

Tue, 12/31/2019 – 09:40

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com