Futures Blast Off On First Day Of 2020 As Markets Cheer Chinese Liquidity Injection

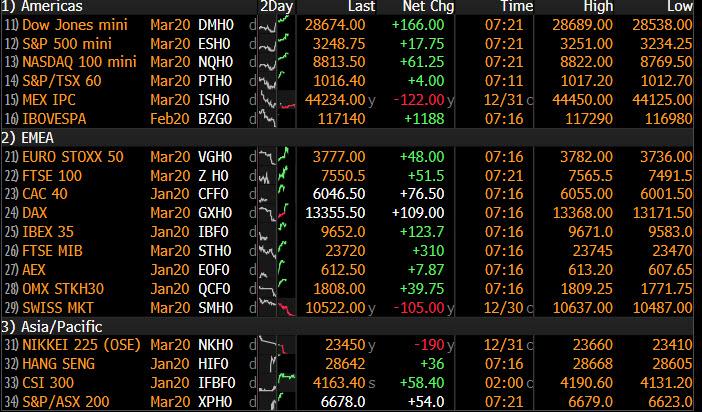

The first trading day of 2020 has started where 2019 left off: with global markets blasting off in a continuation of the powerful meltup that sent US equity futures up 18 points to 3,250 on Thursday, just shy of all time highs.

Contracts for US equity futures all rose in the wake of the best year for American stocks since 2013, and the Stoxx Europe 600 Index advanced for the first session in three as every sector traded in the green.

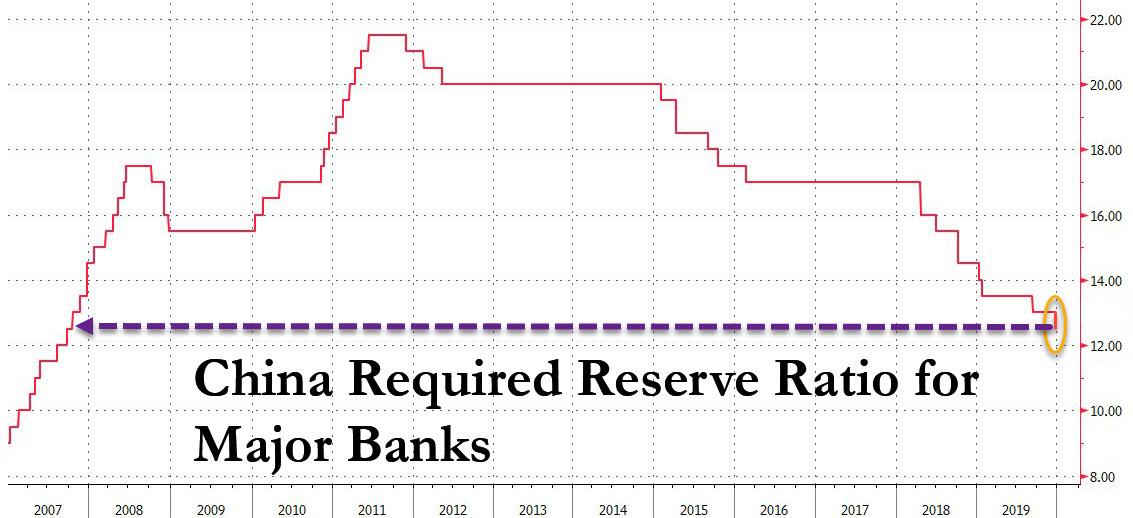

European shares started the new decade on a strong note on Thursday, jumping 1.1% on Thursday ignoring the latest data showing factory activity in the bloc contracting for the eleventh straight month, instead rising on fresh monetary stimulus from Beijing where the PBOC slashed its required reserve ratio for commercial banks by 0.50bps, injecting $115BN into the economy…

… as well as – you guessed it – “growing China-U.S. trade optimism” in the words of Reuters. German shares rose 0.7%, shrugging off figures that showed the manufacturing sector contracted further in December, with the rate of decline in production accelerating for the first time in three months.

Airbus jumped after a report it toppled Boeing to become the world’s biggest planemaker. The European giant was set for its best day in three months after Reuters reported it delivered a forecast-beating 863 aircraft in 2019. The stock helped lift the wider French index by 1.3%. The European Stoxx 600 index was up 0.9%, after declining for two straight sessions as caution crept in about how long a U.S.-China trade truce would last; however the mood brightened on Tuesday after President Trump said the Phase 1 agreement would be signed on Jan. 15 at the White House. Trade-sensitive miners .SXPP led gains on the main index on Thursday, followed by European banks .SX7P.

“The markets are still broadly riding high on the goodwill generated by the announcement that a Phase-1 trade agreement will be signed on Jan. 15,” said Connor Campbell, financial analyst at Spreadex. “(Beyond that) a lack of further escalation might be all investors can expect for the moment.”

And in another continuation of 2019, markets roundly ignored the only actual news of the day, which saw Europe’s manufacturing PMIs accelerate their slump even deeper into contractionary territory.

The UK wasn’t exempt either: its manufacturing output matched its sharpest downturn in more than seven years in December and orders for new work from domestic and overseas clients plunged. IHS Markit said Thursday that the industry as a whole shrank for an eighth straight month.

Earlier in the session, markets in Hong Kong and Shanghai jumped more than 1% after the PBOC said it will increase the supply of cheap funding to banks, in line with market expectations, even if the yuan barely reacted. Asian stocks gained broadly, led by the communications and IT sectors, with activity picking up following the holiday season lull. The region’s benchmark stock gauge rose 0.3% on Thursday after ending flat in the previous session, with most markets in the region advancing. Hong Kong’s Hang Seng Index gained 1.3%, the Shanghai Composite rose 1.1%, though South Korea’s Kospi Index dropped 1%. India’s S&P BSE Sensex Index was up 0.7%. Elsewhere, North Korean leader Kim Jong Un declared he was no longer bound by a pledge to halt missile tests.

Signaling that it stood pat to boost a flagging economy, China’s central bank on Wednesday lowered the reserve requirement ratio for banks for the eighth time since 2018, with the latest cut freeing up around 800 billion yuan ($115 billion).

Emerging-market currencies and stocks continued to fluctuate near their strongest levels since June 2018, starting the year with optimism over a trade truce between the U.S. and China. MSCI Inc.’s measure of developing-nation stocks snapped three days of declines, climbing back toward last month’s highs.

After a stellar 2019 across most major assets, focus now shifts to the year ahead. Thursday gave investors the latest read on Chinese manufacturing, with the Caixin PMI dipping slightly from its November level but remaining in the expansionary zone.

“One of the biggest risks today may be that stocks have already priced in much of the good news,” said Nuveen portfolio manager Bob Doll. “Stock prices can still climb higher, but we don’t expect results anywhere near 2019.”

In FX, the dollar reversed its sharp December losses, and traded higher versus most major peers: the Bloomberg dollar index rose 0.2%, halting a four- session decline. The pound dropped against most major peers as new-year flows triggered stop-loss orders and amid concern the improving optimism toward Brexit masks the fact that many uncertainties remain. The euro slipped after data showed a deepening downturn in euro-zone manufacturing. In EM, the South African rand lead gains while the Thai baht fell as much as 1.8% overnight, its biggest drop since 2007, amid speculation the Bank of Thailand could be intervening to curb the currency’s strength.

Investors are also keeping an eye on geopolitical tensions, including in North Korea, where Kim Jong Un said he was no longer bound by his pledge to halt major missile tests and would soon debut a “new strategic weapon.” In Baghdad, an Iran-backed Iraqi militia broke up its encampment outside the U.S. embassy after an attack on the compound threatened to spiral into a broader confrontation.

In commodities, crude oil climbed alongside gold. WTI and Brent firmed by around $0.30/bbl; supported by the risk-on tone across markets this morning, particularly in European stocks. Focus for the complex remains on geopolitical issues, with an Iran-backed Iraqi militia leaving their encampment at the US embassy in Baghdad. Turning to metals, where spot gold is modestly firmer this morning with the yellow-metal comfortable well above the $1500/oz mark at $1521/oz at best for the session thus far, continuing to be bolstered by the significant downside in the DXY over the holiday period.

On the US calendar, initial jobless claims and manufacturing PMI data are due.

Market Snapshot

- S&P 500 futures up 0.6% to 3,249.00

- STOXX Europe 600 up 0.9% to 419.37

- MXAP up 0.3% to 171.19

- MXAPJ up 0.5% to 555.76

- Nikkei down 0.8% to 23,656.62

- Topix down 0.7% to 1,721.36

- Hang Seng Index up 1.3% to 28,543.52

- Shanghai Composite up 1.2% to 3,085.20

- Sensex up 0.7% to 41,610.44

- Australia S&P/ASX 200 up 0.1% to 6,690.58

- Kospi down 1% to 2,175.17

- German 10Y yield rose 1.1 bps to -0.175%

- Euro down 0.02% to $1.1210

- Brent Futures up 0.3% to $66.20/bbl

- Italian 10Y yield rose 3.8 bps to 1.241%

- Spanish 10Y yield rose 3.0 bps to 0.498%

- Brent futures up 0.3% to $66.20/bbl

- Gold spot up 0.2% to $1,520.75

- U.S. Dollar Index up 0.1% to 96.54

Top Overnight News

- China’s central bank trimmed the amount of cash that lenders must hold in reserve, and signaled continued action in 2020 to reduce borrowing costs for companies. The required reserve ratio will be lowered by 50 basis points from Jan. 6, releasing about 800 billion yuan ($115 billion) of liquidity, the People’s Bank of China said on its website Wednesday

- North Korea’s Kim Jong Un declared he was no longer bound by his pledge to halt major missile tests and would soon debut a “new strategic weapon,” adding to President Donald Trump’s foreign policy concerns in a politically charged election year

- Oil started 2020 on an upbeat note after posting its biggest annual gain in three years as tensions linger in the Middle East and on signs U.S. crude stockpiles extended declines

- An Iran-backed Iraqi militia broke up its encampment outside the U.S. embassy in Baghdad, a move that could ease tensions between Tehran and Washington that escalated after fighters attacked the compound

- Hong Kong began 2020 with a familiar sight: Tear gas, fires, vandalism and roadblocks in busy downtown areas as protesters vowed to maintain their fight for more democracy and less Chinese control

- Asia’s manufacturing industry finished 2019 with a modestly brighter outlook, with fewer economies signaling contraction at factories. Purchasing manager indexes for South Korea, Thailand and Taiwan all moved above 50 in December, data from IHS Markit showed

- U.S. President Donald Trump said he will sign the first phase of a trade deal with China on Jan. 15, sealing an agreement that sees the Asian nation raising purchases of American farm goods in exchange for lower tariffs on some of its products

- The euro area’s manufacturing downturn deepened in December despite renewed monetary stimulus and nascent signs the regional economy is stabilizing. IHS Markit’s gauge of factory activity weakened and posted an 11th consecutive month below 50, signaling contraction

- U.K. manufacturing output matched its sharpest downturn in more than seven years in December and orders for new work from domestic and overseas clients plunged. IHS Markit said Thursday that the industry as a whole shrank for an eighth straight month

Asian stocks gained, led by the communications and IT sectors, with activity picking up following the holiday season lull. The region’s benchmark stock gauge rose 0.3% on Thursday after ending flat in the previous session, with most markets in the region advancing. Hong Kong’s Hang Seng Index gained 1.3%, the Shanghai Composite rose 1.1%, though South Korea’s Kospi Index dropped 1%. India’s S&P BSE Sensex Index was up 0.7%. On Wednesday, the People’s Bank of China said it will increase the supply of cheap funding to banks, slashing the required cash reserve ratio for commercial lenders by 50 basis points. Elsewhere, North Korean leader Kim Jong Un declared he was no longer bound by a pledge to halt missile tests.

Top Asian News

- Kim Promises ‘Shocking’ Action and Says He Has New Weapon

- Jack Ma’s Ant Financial Joins Singapore Digital Banking Race

- Singapore’s Economy Slows at End of 2019 Amid Trade War

Major European bourses are firmer this morning, Euro Stoxx 50 +1.0%, as more participants return from the Christmas period and after yesterday’s New Years Day close. Newsflow thus far for the session has been extremely light, with the main focus being on the PBoC cutting the RRR by 50bps which lent support to APAC equities overnight and continues to aid European peers and US futures; alongside the updates to the US-China trade deal signing schedule, though this is all largely as expected. Currently there is no clear under/out performer amongst European bourses, though the Dax did initially lag potentially as the bourse was closed on New Years Eve. Turning to sectors, the picture isn’t substantially different from the overall stock performance this morning with all sectors firmly in the green; banking sector mildly outperforms its peers, deriving support from the aforementioned PBoC action. It’s been a relatively quiet morning in terms of stock specific stories but Tullow Oil (-4.5%) are the laggard of the Stoxx 600 after reporting disappointing oil well data. Elsewhere, Osram Licht (U/C) shares are flat after AMS reported a final acceptance level of 59.9% for their takeover of Osram, which is below the final acceptance level of 75% which is necessary for a full takeover. At the other end of the Stoxx 600 spectrum things are a quieter, with stocks largely in-line with indices overall performance, whilst a number of banking names such as Deutsche Bank (+5.0%) reside towards the top of the Stoxx 600. Finally, 3 Axis Advisors states that GSK (+0.4%), Sanofi (1.0%) and Pfizer are to increase prices on over 200 drugs within the US.

Top European News

- Turkey’s Parliament Set to Approve Troop Deployment in Libya

- Airbus Outperforms on Report 2019 Deliveries Exceeded Target

- Kurz Seals Historic Pact With Austria’s Greens for Second Term

- Citi Recommends Investors to Be ‘Net Long’ in European Airlines

In FX, the DXY appears to have drawn a line in the sand just off 5 month lows following a sharp slide between Xmas and New Year amidst widespread Greenback declines and positioning for the turn of the year/decade. The index is currently holding a fraction above 96.600 within a tight 96.422-678 range with some support for the Buck gleaned via higher US Treasury yields and a steeper curve on a continuation of improved risk sentiment due to the US and China reaching a Phase 1 trade accord, with added impetus coming via the latter announcing another RRR reduction to take effect from next Monday.

- SEK/NOK – The Scandinavian Crowns have kicked off 2020 on the front foot, as Eur/Sek meanders between 10.5000-4500 or so parameters and Eur/Nok hovers within a circa 9.8550-8175 band in wake of a recovery in Sweden’s manufacturing PMI and acceleration in Norwegian activity from an already comfortable 50+ base.

- CAD/EUR/JPY/CHF/AUD/GBP/NZD – The Loonie is holding up better than G10 rivals and has retained the bulk of its pre-year end gains vs the Usd after advancing through the key/psychological 1.3000 level, while the Euro is struggling to keep its head above 1.1200 even though Eurozone manufacturing PMIs beat consensus or flash prints, bar Italy. Elsewhere, the Yen and Franc have also succumbed to the broad, albeit partial Dollar bounce, and aforementioned ongoing risk-on environment, with Usd/Jpy edging up towards 108.90 and Usd/Chf pivoting 0.9700. However, the Aussie, Pound and Kiwi have all lost momentum and seem vulnerable to deeper pull-backs/retracement from recent peaks, as Aud/Usd loses grip of 0.7000, Cable creeps closer to 1.3200 again and Nzd/Usd hovers a fraction over 0.6700.

In commodities, a similarly quiet session, with WTI and Brent firmer by around USD 0.30/bbl; supported by the risk-on tone across markets this morning, particularly in European stocks. Focus for the complex remains on geopolitical issues, with an Iran-backed Iraqi militia leaving their encampment at the US embassy in Baghdad; though this de-escalation is not likely to be a supportive factor for crude. Looking ahead, due to the holiday period the week’s EIA data will be released tomorrow at 16:00GMT with expectations for another headline draw at 3.167mln barrels. Turning to metals, where spot gold is modestly firmer this morning with the yellow-metal comfortable well above the USD 1500/oz mark at USD 1521/oz at best for the session thus far, continuing to be bolstered by the significant downside in the DXY over the holiday period. Separately, China’s largest steel making city Tangshen has issued a level 2 out of 3 smog alert; for reference, this alert requires non-exempt companies to cut emissions and/or output until the alert is reduced.

US Event Calendar

- 7:30am: Challenger Job Cuts YoY, prior -16.0%

- 8:30am: Initial Jobless Claims, est. 220,000, prior 222,000; Continuing Claims, est. 1.68m, prior 1.72m

- 9:45am: Bloomberg Consumer Comfort, prior 62.3

- 9:45am: Markit US Manufacturing PMI, est. 52.5, prior 52.5

Tyler Durden

Thu, 01/02/2020 – 08:04

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com