Stocks Melt-Up To ‘Most Expensive’ Since DotCom Bust, Bonds Bid Too

At 18.5x, the S&P 500’s Forward P/E is at its highest since the dotcom bust (and the tech sector’s valuation is at its richest to the broad market since the peak in 2007)…

Source: Bloomberg

And as stocks have soared, so Americans’ comfort has roared back to its highest since right before the dotcom collapse too…

Source: Bloomberg

And it’s all because of fun-durr-mentals…

Source: Bloomberg

“This is blasphemy! This is madness! – Madness? This is the stock market!”

[youtube https://www.youtube.com/watch?v=G7AinOjDiNQ]

The Dow came close to tagging 29,000 today, but is now at its most overbought since right before volmageddon and 2018’s collapse…

Source: Bloomberg

Nasdaq continues to lead on the week (Small Caps lagging notably)…

But futures show the chaos better as Nasdaq exploded almost 4% higher off Tuesday night lows…

Short Interest is at its lowest in 2 years…

Source: Bloomberg

AAPL was up again today (up 18 of the last 20 weeks) – pushing it to the most overbought since 2004 – which sparked a 24% drop in the stock…

Source: Bloomberg

And AAPL’s not up on the fundamentals…

Source: Bloomberg

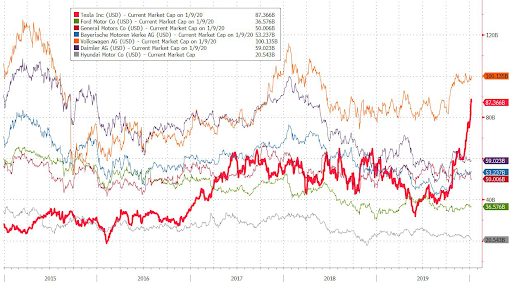

TSLA just won’t stop!

Source: Bloomberg

In fact TSLA is now worth more than GM and Ford combined…

Source: Bloomberg

And TSLA’s rally is all about fun-durr-mentals too…

Source: Bloomberg

But today saw a pullback – the biggest down day since the squeeze really started on 11/22…

Bonds were also bid as stocks rallied (helped by a strong 30Y auction)…

Source: Bloomberg

Treasury yields were all lower today (even as stocks soared) with the long-end outperforming (30Y -4bps, 2Y -1bps)…

Source: Bloomberg

This notably flattened the yield curve…

Source: Bloomberg

The dollar rallied once again, back up to two-week highs…

Source: Bloomberg

Cryptos remain higher on the week, with Bitcoin leading the bunch…

Source: Bloomberg

Commodities were all lower today with crude leading the week…

Source: Bloomberg

WTI hit a $58 handle intraday…

Gold futures held above $1550…

Source: Bloomberg

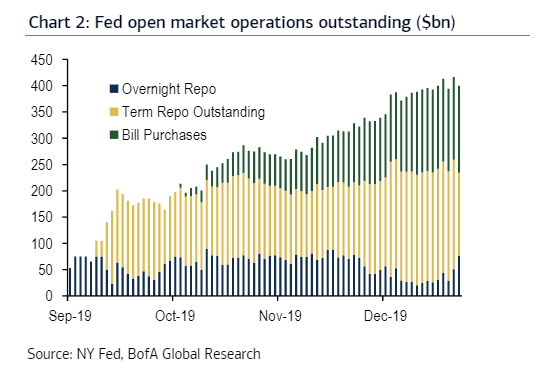

Finally, there’s this… looks like The Fed has this Repo ‘tempest in a teapot’ all “contained”…

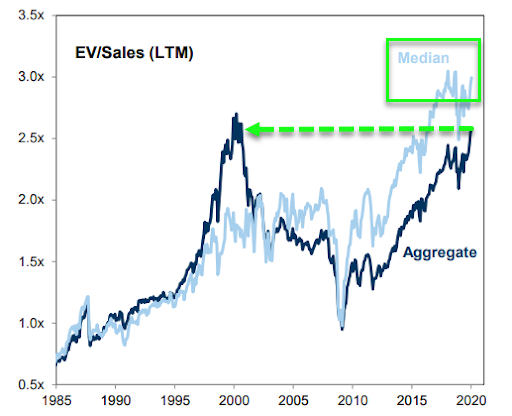

And no matter which way you look at it, valuations are at or near extreme record highs…

We give Rabobank the last word as it summed things up so perfectly:

Indeed, like Elon Musk, markets are happily dad-dancing on stage, unaware of just how stupid they actually look. Of course, they get wild applause from other dads – just like a certain global ride-sharing app, which bleeds money and faces crucial bans and legal challenges, now planning to build flying cars in order to open up exciting new areas of potential litigation, regulatory restriction, and loss-making. I guess the hope is once we all go over the inevitable brink, the flying cars might save some of us.

Trade accordingly!

Tyler Durden

Thu, 01/09/2020 – 16:00

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com