End Of An Era As Goldman Stops Reporting Prop Trading Results

It’s the end of an era for Goldman: after a decade of breaking out its prop trading results, which in the aftermath of the Volcker Rule was renamed “Investing and Lending” (because apparently all it took to confuse regulators was a name change), the bank once known as Government Sachs (and in its glory days better known for incubating virtually all central bankers and possessing the street’s most fearsome prop trading desk, but those days are now long gone) and is now better known for its co-branded Apple credit cards which target subprime consumers, has stopped reporting its prop results.

As first noted last week, Goldman revamped its quarterly reporting structure to “inject more visibility” into how the firm makes money, in response to growing investor concerns that report “clarity” could boost the stock price. And while the stock price was indeed boosted, Goldman decided to not only reclassify its revenues making any historical comparison impossible but add far more complexity and opacity into how it makes money, by deleting the investing & lending reporting line as well as any mention of this segment, often its most profitable in periods of rising markets – expect, paradoxically for the current “rising market” – but one that also drew complaints about transparency.

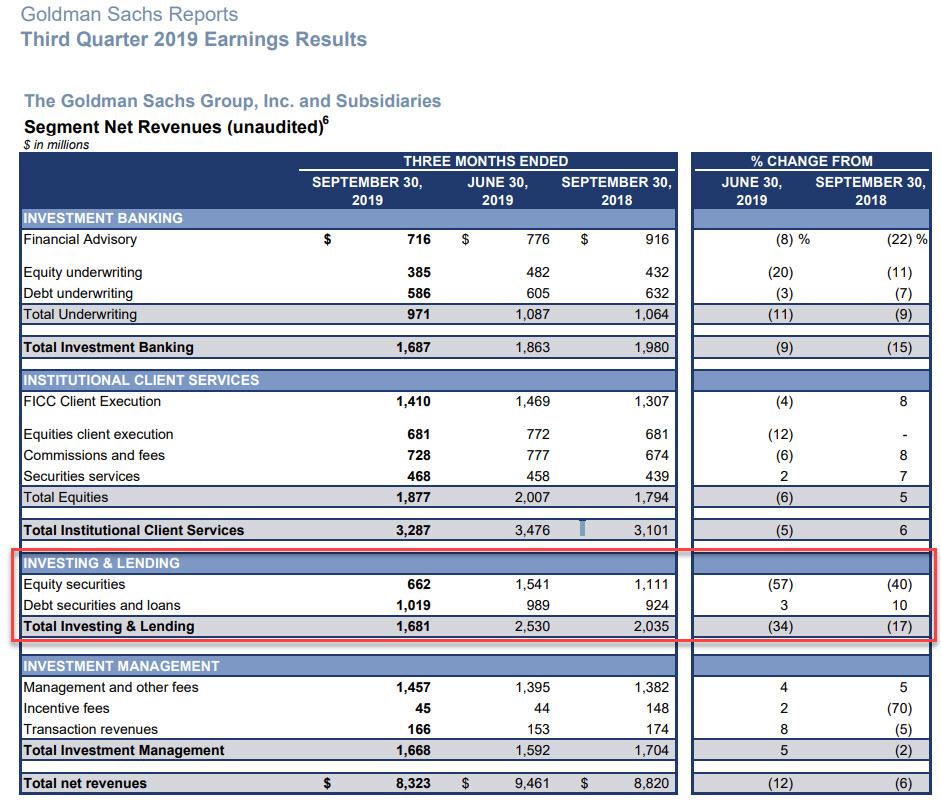

This is what Goldman’s Q3 Earnings summary page looked like: note the prominently featured Investing and Lending group.

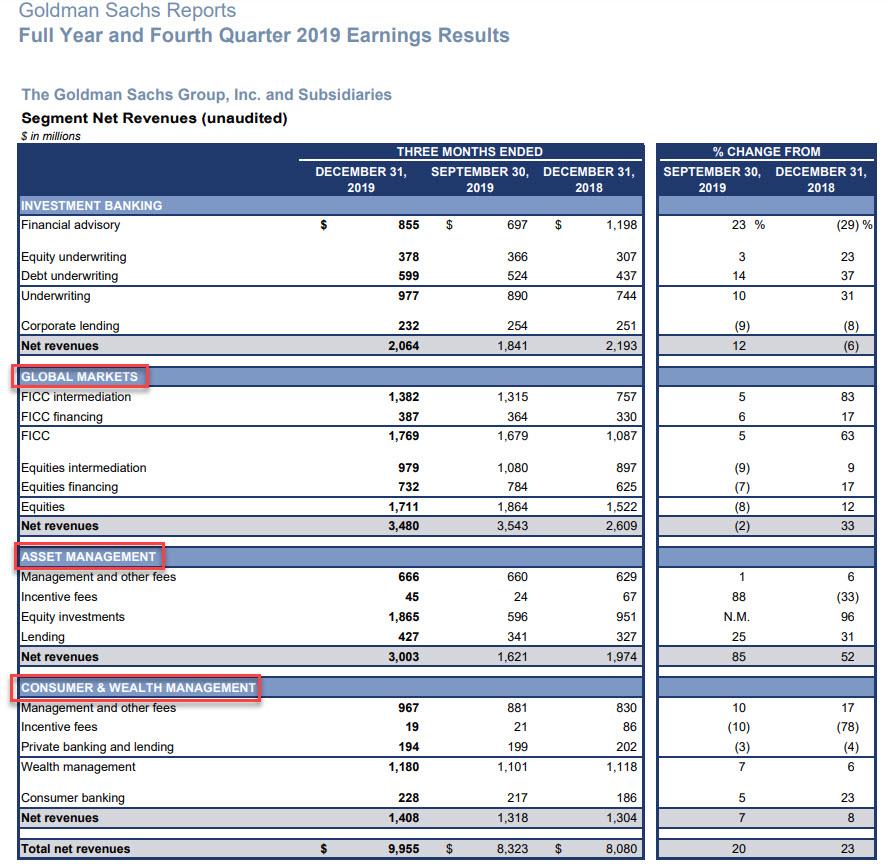

And this is what the Earnings Summary page looks like as of this morning: not only is Investing and Lending completely gone, but while Goldman has kept Investment Banking, it has renamed Institutional Client Services as Global Markets, while Investment Management has been split into i) Asset Management and ii) Consumer and Wealth Management.

So what do we know now? Well, sadly not much, since all the newly broken out data has to be backed into now missing historical income statement lines which Goldman has decided not to do… you know, because it is so concerned with transparency.

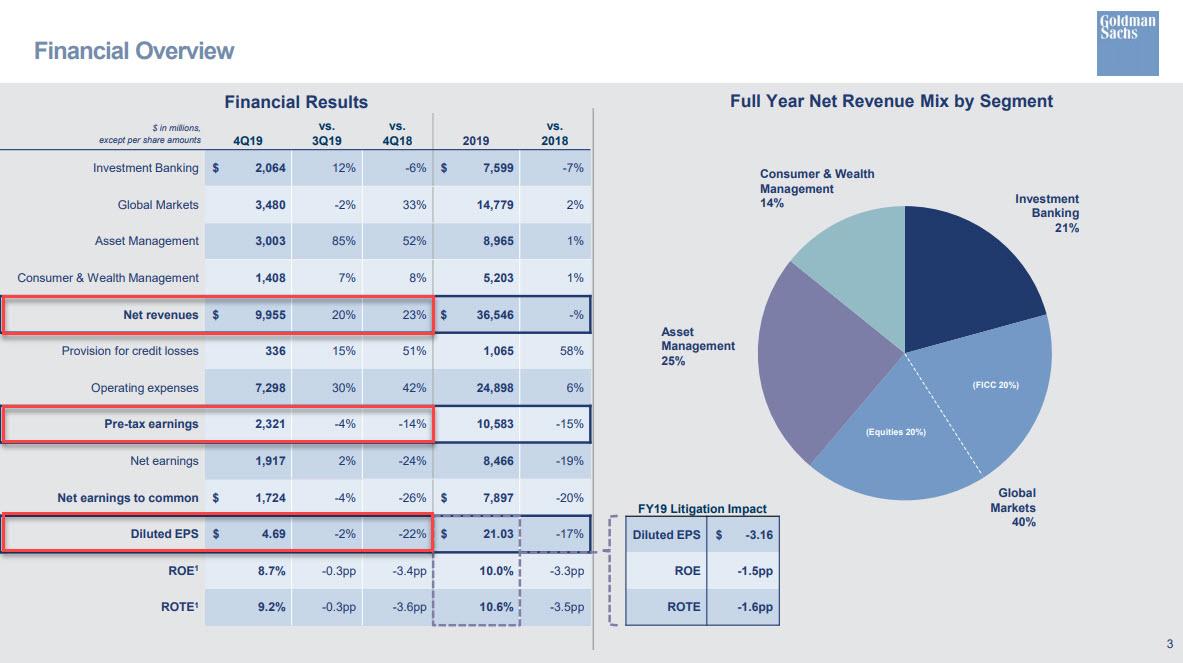

What we do know is what Goldman wants us to know, which is that in Q4, revenues increased by 23% to $9.955BN, stronger than the $8.5BN expected, although due to a 42% surge in operating expenses to $7.3 Billion, Net Income was down by 24% to $1.92 billion, resulting in EPS of $4.69, and missing expectations of $5.54.

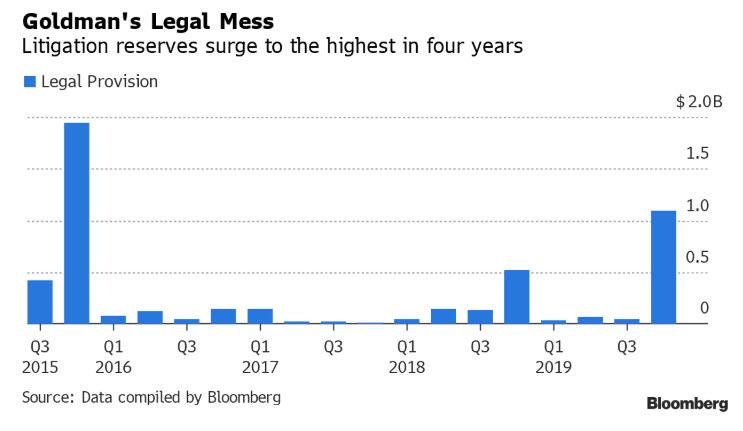

The reason for the expense surge was a $1.09BN legal charge taken as ahead of the bank’s settlement over its criminal activity involving 1MDB. As a reminder, the scandal involves claims of embezzlement and money laundering that triggered investigations in the U.S., Singapore, Switzerland and beyond. Goldman Sachs has been under scrutiny for years over its role in raising money for state-owned investment fund 1Malaysia Development Bhd and for the money it made on the deals, roughly $600 million.

As Goldman notes, while compensation and benefits were essentially unchanged, higher non-compensation expenses included:

- Significantly higher net provisions for litigation and regulatory proceedings ($1.24 billion in 2019 vs. $844 million in 2018)

- Higher expenses related to the firm’s credit card and transaction banking activities (primarily reflected in professional fees and other expenses) and expenses related to United Capital.

- Higher expenses for consolidated investments and technology

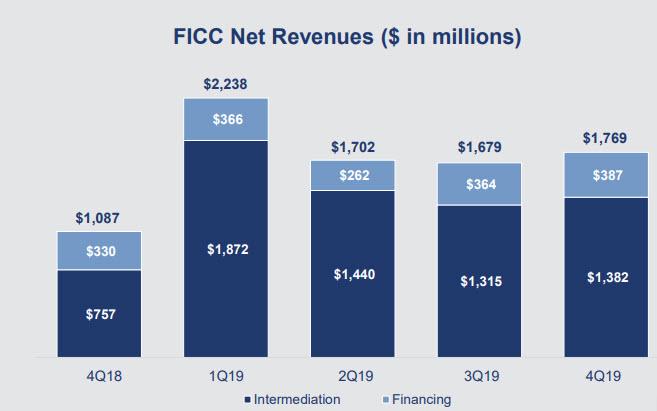

Excluding the $1BN legal charge, Goldman’s earnings were not bad, with FICC leading the rebound as one would expect, surging 63% Y/Y from the woeful Q4 2019, to $1.769B, the bulk of which or $1.4BN came from Credit Intermediation. Commenting on this group, Goldman said that FICC intermediation net revenues were significantly higher, reflecting higher net revenues across most major businesses

- 2019 net revenues higher YoY, due to higher net revenues in FICC intermediation and FICC financing

- 4Q19 operating environment generally characterized by improved market conditions compared with 3Q19, while client activity levels were lower

And visually:

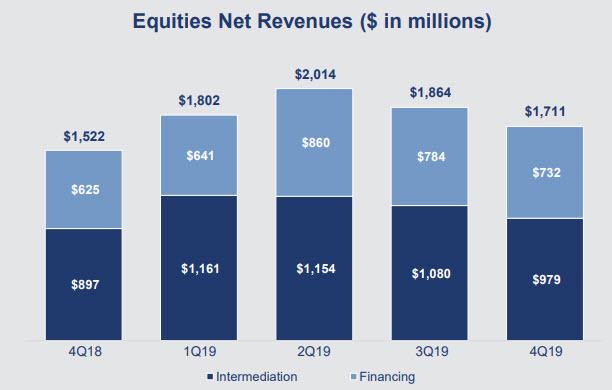

There was far less excitement in the bank’s equities group, where the increase was a far more modest 12% to $1.711BN “reflecting improved spreads and higher average customer balances” while “Equities intermediation net revenues were higher, driven by cash products.”

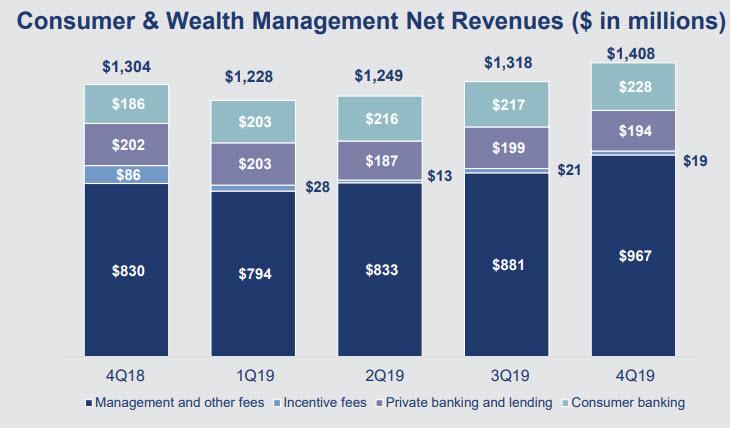

Unfortunately, as noted above, Goldman is no longer reporting its prop revenue, i.e., investing and lending, and instead has broken out its “Markus” attempt to become a plain vanilla retail banks, in the form of Consumer and Wealth Management, where revenue was modestly higher Y/Y, “driven by higher net interest income, primarily reflecting an increase in deposit balances.”

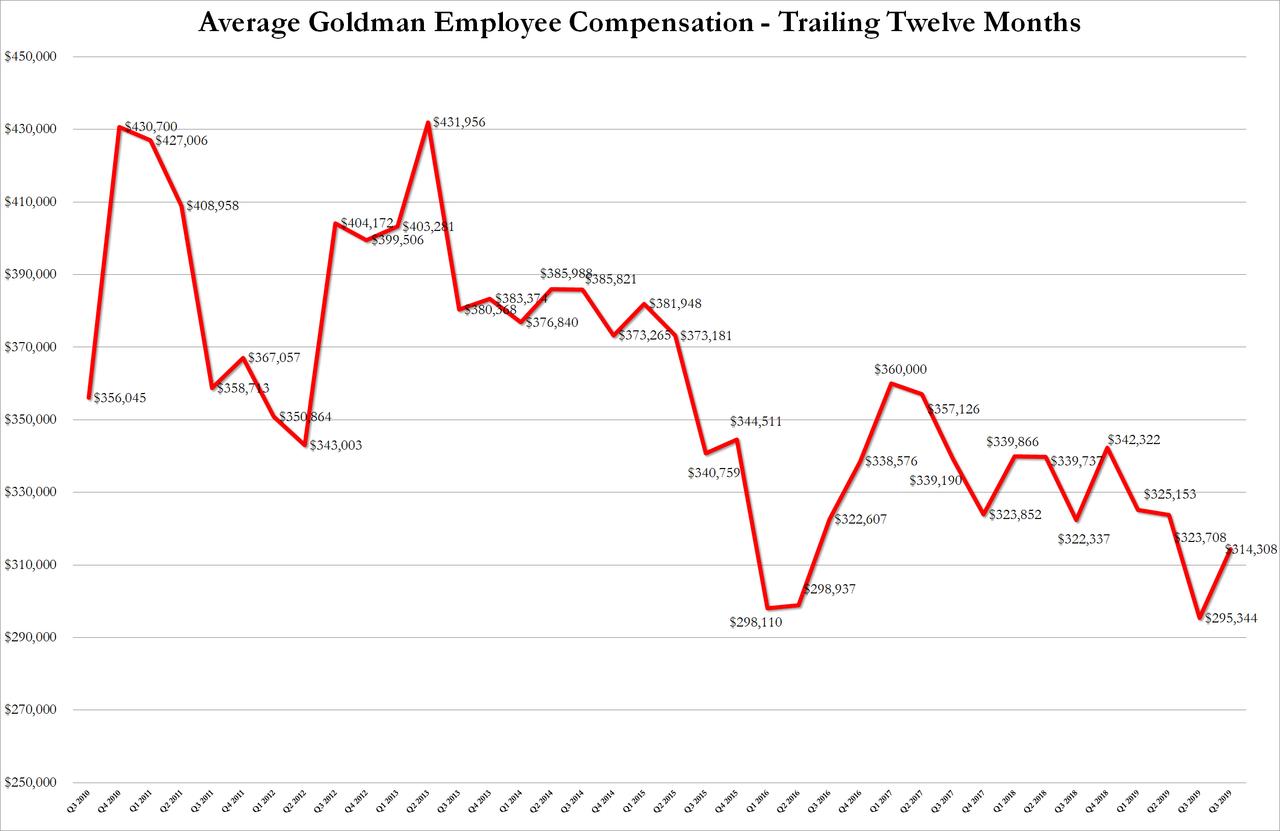

And since Goldman has now officially thrown in the towel on even pretending to be Wall Street’s goto prop desk, which once spawned thousands of hedge fund traders, the compensation was commensurate with the bank’s transformation to a retail bank, and in Q4, average bank comp was $314,308, modestly above the $295,344 report last quarter which was the lowest going back to the financial crisis.

Finally, maybe because algos were too lazy to inquire into why Goldman’s EPS missed so badly or because they were not too excited with the revised earnings, Goldman stocks was sharply lower this morning.

Tyler Durden

Wed, 01/15/2020 – 08:59

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com