Trump Goes After Bloomberg: Starting March 1, BLS Will Ban Lockup Computers, Hitting HFT Revenues

As first reported on Tuesday, moments ago the BLS confirmed that starting March 1, the Trump admin will ban all electronics including computers from the room where journalists receive early advance access to major economic reports, in an effort to ensure a level playing field, a U.S. official told the same wire services that stand to suffer the most from this major overhaul of how economic data is disseminated.

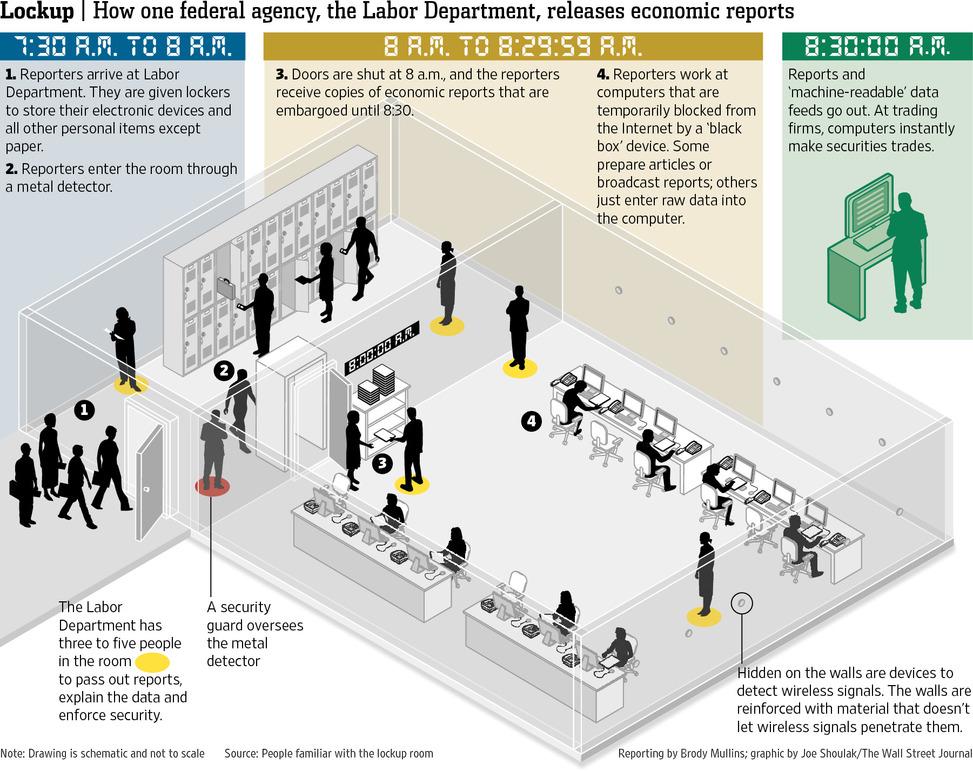

As discussed on Tuesday, currently, the Labor Department hosts “lockups” for major reports lasting 30 to 60 minutes, where journalists receive the data in a secure room, write stories on computers disconnected from the internet, and transmit them when connections are restored at the release time.

Confirming our speculation that this was a way for the Trump admin to hit Mike Bloomberg and his eponymous organization where it hurts, the U.S. official, speaking on a conference call with journalists, said “the change is being made because several news organizations that participate are able to profit by providing the numbers to algorithmic traders in a format that provides them an advantage.”

Translation: Trump is now going after the source of Mike Bloomberg’s wealth – the selling of zero-latency market-moving information to HFTs.

The overhaul will take effect March 1, the official said. Labor Department officials were asked if the change was specifically aimed at Bloomberg News, which participates in the lockups and whose founder and majority owner, Michael Bloomberg, is running for the Democratic presidential nomination. The official denied any political motivation and cited a prior recommendation by the Labor Department’s inspector general.

For those who missed the background on this critical, to all market participants, strateigsts, and traders story, here it is again.

Any time the US Department of Labor releases the jobs report on the first Friday of the month, wire agencies such as Bloomberg and Reuters already have a prepared barrage of market-moving data points ready to go to their paying subscribers (and, on the nanosecond, to frontrunning HFT clients) together with a commentary wrapper that is prepared in the 30-60 minutes before the official data release, prepared by journalists who are in “lockup” in a given government data room, which is meant to prevent them from leaking the data to other, more interested (and better funded) parties.

This is shown schematically in the image below.

However, starting as soon as this week, the “lockup” may now be history, as well as those flashing red jobs headlines that set the market mood for the day, and often, the rest of the month (assuming, of course, that eventually fundamentals will matter again), because in what Bloomberg dubbed the “biggest change to economic data releases in decades“, the Trump administration plans to limit the news media’s ability to prepare advance stories on market-moving economic data, such as the monthly jobs report, “in a move that could create a logjam in accessing figures such as the monthly jobs report.”

Needless to say, Bloomberg – along with Reuters, and countless other wire services, who sell lockup data to extremely generous HFT clients for a lot of money – are not happy.

As noted above, currently the Labor Department hosts “lockups” for major reports lasting 30 to 60 minutes, where journalists receive the data in a secure room, write stories on computers disconnected from the internet, and transmit them when connections are restored at the release time.

However, for reasons not fully clear, the department under pressure from the administration, is looking at changes such as removal of computers from that room, and an announcement could come as soon as this week, said Bloomerg sources.

That, as Bloomberg which would be directly and very adversely affected notes, “could hinder the media’s ability to provide headlines, comprehensive stories and tables at the exact release time.”

That’s one interpretation, another is that it will further democratize information, allowing, or rather forcing, everyone to come up with their own fast take of the data, and even open up the field to new competitors who currently don’t have access to the lockup.

Indeed, as one FX strategist noted, “Quant strategies focusing on reading headlines will need a rethink. Will lead to huge info asymmetry post data releases. Although may boost role of market economists who need to digest raw data as quickly as possible.“

This is big for markets. Quant strategies focusing on reading headlines will need a rethink. Will lead to huge info asymmetry post data releases. Although may boost role of market economists who need to digest raw data as quickly as possible. Watching closely 👀 #GameChanger pic.twitter.com/y0vPeLYGcP

— Viraj Patel (@VPatelFX) January 14, 2020

https://platform.twitter.com/widgets.js

Did we mention that Bloomberg isn’t happy? As the news organization belonging to the Demcoratic presidential candidate notes, “the move would upend decades of practice, and media organizations including Bloomberg News and Reuters have challenged prior changes to procedures. The shift could also spur an arms race among high-speed traders to get the numbers first and profit off the data, raising questions about fairness in multitrillion-dollar financial markets.”

Thank you for the spin Bloomberg, but the arms race between HFTs has been going on for a decade, and it is companies like Bloomberg that not only enabled it but profited generously from it. In fact, a contract that shoots over the data with zero latency is said to cost millions of dollars, something which Bloomberg will not be too happy to see flee to those who are faster and more accurate at reading the data in real time.

There is another fringe benefit such an action would deliver: the US government would finally have to enter the 21st century with modernized websites:

Without news services transmitting their reports at the release time and allowing additional access points, the government may have to prepare its websites to handle potentially heavier loads under the new system, which could mean adding security measures or increasing the traffic capacity.

To be sure, this is not the first time the government tried to overhaul the lockup structure: in 2012, Obama’s Labor Department sought to alter lockups to require journalists to use government-owned computers to write their stories. Officials at the time framed the change as addressing security risks.

After protests from Bloomberg News and other news organizations, and a congressional hearing in which editors testified, the department agreed to allow the media to continue using their own equipment and data lines. Reporters are required to leave mobile phones and other electronic devices in lockers outside of the lockup room, along with personal effects such as umbrellas and purses.

On the other hand, it’s not like this move would be unprecedented: the Labor Department move would follow a similar decision by the U.S. Department of Agriculture in 2018 to scale back lockups covering farm products, particularly the closely-watched monthly crop forecasts that typically move markets in soybeans, corn and wheat.

Finally, the big question remains: why is Trump doing this? One potential explanation is that Trump is seeking to hit his political challenger, Mike Bloomberg, where it hurts: As we noted earlier, if the BLS removes lockups, “billions in HFT data feed fees to wire services like Reuters and Bloomberg go up in smoke.” Leading to the logical question: “Is this Trump targeting Bloomberg terminal?”, which for decades has been Mike Bloomberg’s golden goose, spewing billions in annual subscription fees, allowing him to spend a similar amount to remove Trump at any cost…

If BLS removes lockups, billions in HFT data feed fees to wire services like Reuters and Bloomberg go up on smoke.

Is this Trump targeting Bloomberg terminal?

— zerohedge (@zerohedge) January 14, 2020

Tyler Durden

Thu, 01/16/2020 – 12:06

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com