WHOphoria Fades, Stocks Slide As Virus Pandemic Nears 10,000 Cases

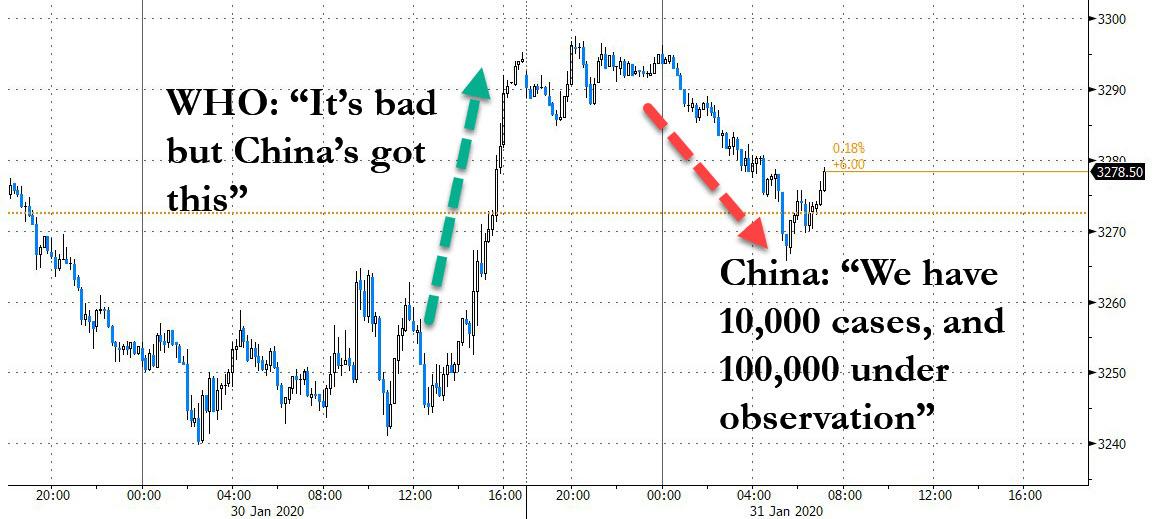

Yesterday, shortly after the WHO managed to unleash a torrid stock rally that sent the Dow over 350 points higher when it declared the coronavirus outbreak and international health emergency and a “global pandemic” yet underscored its faith that China will be able to contain the spread of the disease, we predicted that “Stocks are amping on WHO promoting tourism to China, before reversing after China announces over 10,000 cases at 6pm”

Stocks ramping on WHO promoting tourism to China, before reversing after China announces over 10,000 cases at 6pm

— zerohedge (@zerohedge) January 30, 2020

https://platform.twitter.com/widgets.js

That’s precisely what happened, with futures spiking to just shy of 3,300 as algos were enthused by the WHO’s optimism, only to slide as China reported that nearly 10,000 people are now infected and 100,000 are under observation.

On Thursday, the World Health Organization on Thursday labeled the virus a global emergency. Tedros Adhanom Ghebreyesus, WHO director-general, best known for the 2017 NYT article “Candidate to Lead the W.H.O. Accused of Covering Up Epidemics“, said the greatest worry was the potential for the virus to infect countries with weaker health systems, though his bizarre, travel agency-like praise for China’s response steadied markets, although ironically just after the World Health Organization tried to assure people that things are under control, the U.S. State Department told Americans not to travel to China and said those visiting or living there should to leave.

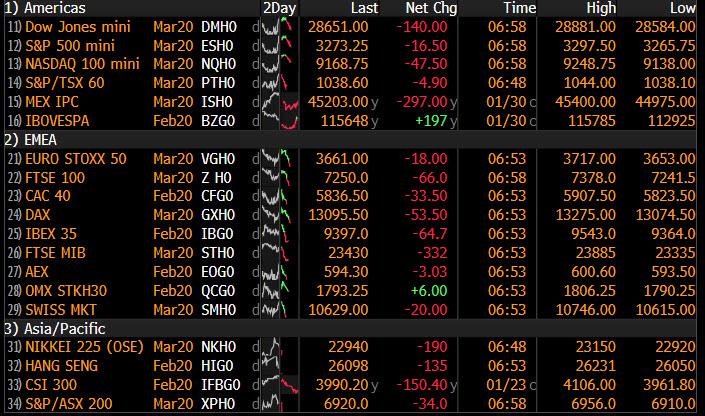

Not even the WHO’s full court press to avoid selling was enough to prevent the latest overnight drop though in Eminis, which was more contained than previous days, as investors still clutched at hopes that China could contain the coronavirus, even as headlines spoke of more cases and deaths, travel bans, evacuations and factory shutdowns. Even so, US equity futures dropped even as Amazon.com soared above $1 trillion in market cap in the pre-market after reporting blow-out earnings. On the other hand, Caterpillar fluctuated in early trading after its 2020 profit outlook trailed analysts’ expectations. The dollar drifted versus a basket of its major peers.

To be sure, sentiment received a boost when Amazon’s sales blew past forecasts and sent its stock soaring 11% after hours, adding over $100 billion in market value. Still, the flow of news on the virus remained bleak with China’s Hubei province reporting deaths from the disease had risen by 42 to 204 as of the end of Jan. 30. More airlines curtailed flights into and out of China and companies temporarily closed operations, while Washington told citizens not to travel to any part of China.

JPMorgan shaved its forecast for global growth by 0.3% points for this quarter: “Based on the patterns observed from other epidemics, we assume that the outbreak will likely run its course over 2-3 months, meaning the hit to activity happens in the current quarter,” JPMorgan analysts said in a note. “Also in line with historical experience, we expect a full recovery to follow.”

Europe opened 0.3% higher following a bounce in Tokyo, but European shares have since slumped into the red across the board and are headed for their worst weekly loss in three months, after the U.K. confirmed its first cases of the coronavirus…

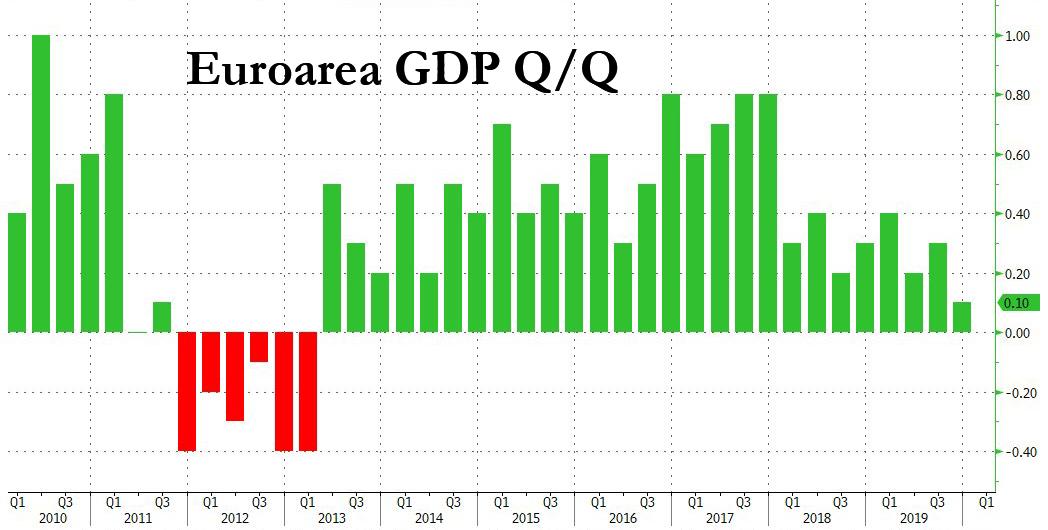

… and following disappointing economic data in Europe, including the worst Euro Area GDP print in almost seven years…

… and an outright drop in Italy.

Earlier in the session, Asia-Pacific shares outside Japan extended their fall, dropping 0.4%, and appeared set for their worst weekly loss in a year, of 4.6%. Thursday’s 2.3% dive was the sharpest one-day loss in six months. Asian stocks reversed earlier gains, with a regional gauge heading to its worst start to the year since 2016. The region’s benchmark MSCI Asia Pacific Index declined as much as 0.2% in afternoon, led by energy and utilities shares. Hong Kong shares erased gains and closed 0.5% lower, while Japan was the best-performing market on the last day of January. India’s Sensex index was little changed before Finance Minister Nirmala Sitharaman outlines India’s annual budget on Saturday. Asian shares are set to finish the first month of 2020 with a decline of 3%, the worst January since 2016, as the spreading coronavirus prompted a sell-off in riskier assets.

Overnight China reported its latest Manufacturing PMI for January, which mysterious came out at 50.0, right on top of the expected 50.0 (down from 50.2), despite nearly 60 million people under quarantine. Pure magic! At the same time, Chinese Non-Manufacturing PMI jumped to 54.1 vs. Exp. 53.0 (Prev. 53.5). That said, even China National Bureau of Statistics admitted the number was purely an estimation and noted the January PMI data does not fully reflect impact of coronavirus and future trend needs to be observed, with the figures said to reflect data as of January 20th.

Reports that some Chinese provinces were asking companies not to re-start until Feb. 10 after the New Year holiday suggested activity would take a hard knock this month.

“Some shorts covered after the director gave the WHO’s stamp of approval to China’s aggressive containment effort,” said Stephen Innes, Asia Pacific market strategist at AxiCorp.

“The coronavirus is outweighing everything else,” said Francesca Fornasari, head of currency solutions at Insight Investments. “We have seen quite a position unwind and … whatever is coming out in terms of data is for the period when the virus hadn’t become quite such a big issue. For now, the market’s risk lights have shifted from flickering on red to a steady shade of amber.”

As risk sold off, safe havens gained, with bonds well bid, and yields on U.S. 10-year Treasuries down 9 basis points for the week so far and near four-month lows. The yield curve between three-month bills and 10-year notes has inverted twice this week, a bearish economic signal.

In FX, sterling extended gains after jumping on Thursday when the Bank of England confounded market expectations by not getting anywhere near an interest rate cut. The pound was last at $1.3128, a relatively solid performance given that Friday is the day the UK officially leaves the European Union after years of political turmoil.

The dollar took a knock overnight when data showed the U.S. economy had grown at its slowest annual pace in three years and personal consumption weakened sharply. Yet it was up a fraction on the yen on Friday at 109.03 and stronger on the euro at $1.1016. Most of the action this week has been nervous investors selling emerging currencies for dollars and yen, leaving the majors little changed against each other.

In commodities, oil bounced on short covering, after hitting its lowest in three months as the global spread of the coronavirus threatened to curb demand for fuel. WTI regained 89 cents to $53.03 a barrel, while Brent crude futures rose 83 cents to $59.12. Spot gold was only just up for the week at $1,573.72 per ounce, having failed to get much of a safe-haven bid as a range of other commodities, from copper to soy beans, were hammered by worries over Chinese demand.

Expected data include personal income and spending. Caterpillar, Chevron, Exxon and Honeywell are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.6% to 3,269.50

- STOXX Europe 600 up 0.03% to 415.27

- MXAP down 0.2% to 165.51

- MXAPJ down 0.6% to 532.45

- Nikkei up 1% to 23,205.18

- Topix up 0.6% to 1,684.44

- Hang Seng Index down 0.5% to 26,312.63

- Shanghai Composite closed

- Sensex down 0.4% to 40,765.88

- Australia S&P/ASX 200 up 0.1% to 7,017.20

- Kospi down 1.4% to 2,119.01

- German 10Y yield unchanged at -0.405%

- Euro down 0.03% to $1.1029

- Italian 10Y yield fell 1.1 bps to 0.776%

- Spanish 10Y yield fell 0.4 bps to 0.267%

- Brent futures up 0.3% to $58.47/bbl

- Gold spot up 0.4% to $1,580.96

- U.S. Dollar Index little changed at 97.91

Top Overnight News from Bloomberg

- The U.K. confirmed two cases of coronavirus in England on Friday, while the U.S. and Japan advised citizens to avoid traveling to China

- The U.S. and Japanese governments advised their citizens to avoid travel to China as the spread of the coronavirus showed few signs of abating. The travel warnings came hours after the World Health Organization declared the outbreak a global health emergency. Global cases of the disease has now grown to surpass the number officially reported during the SARS epidemic

- The first official indicator of the Chinese economy in 2020 signaled the nation’s factories were struggling even before the country shut down for the Lunar New Year holidays and the coronavirus outbreak worsened

- U.K. consumer confidence improved for a second month in January as Britons became more optimistic about their personal financial situation and the wider economy in the wake of Boris Johnson’s election victory

- Japan’s industrial production rebounded more than expected in December, but failed to prevent factory output weighing on the economy in a dismal quarter

- Oil jumped after the WHO said there’s no need for travel and trade bans due to the coronavirus, but was still set for its worst month since May as the outbreak sapped the demand outlook. Oil traders in Asia are expecting refineries to cut operating rates and extend shutdowns as the spread of coronavirus stops people from flying or traveling by road

- Republican Senator Lamar Alexander said he will vote against calling witnesses in President Donald Trump’s impeachment trial, all but closing off chances that Democrats can secure new evidence and making it increasingly likely the trial will wrap up as soon as Friday

- Japanese Prime Minister Shinzo Abe says he will consider the use of reserve funds if needed as he monitors developments in the spread of coronavirus and its effect on tourism.

- Investors are bracing for potential losses in Chinese stocks and commodities when financial markets reopen Monday for the first time since Jan. 23. A gauge of January manufacturing signaled Friday that China’s factories were struggling even before it shut down for the extended Lunar New Year holidays

- More than a dozen Chinese provinces announced an extension of the current Lunar New Year holiday by more than a week as the nation attempts to halt the spread of the novel coronavirus that has killed hundreds of people and sickened thousands

- The U.K. Financial Conduct Authority said it’s examining the spike in the British pound in the minute before Thursday’s Bank of England’s interest-rate decision

- The euro area economy barely grew at the end of 2019 as unexpected contractions in France and Italy dragged it to its weakest quarter in almost seven years

Asian equity markets traded mixed as early relief rolled over from US following a “soft” declaration by the WHO on coronavirus and with US equity futures also underpinned by after-market earnings including Amazon – whose shares rose almost 10% after-hours. The World Health Organization declared the coronavirus a Public Health Emergency of International Concern but also stated that there has been progress made in developing a vaccine and believes measures taken by China “will reverse the tide”, while it opposed any measures or restrictions on travel or trade to China. ASX 200 (+0.1%) and Nikkei 225 (+1.0%) followed suit to the Wall St rebound with outperformance seen in Australia’s tech and healthcare sectors, while sentiment in Tokyo was underpinned by favourable currency flows and with the biggest stock gainers driven by earnings releases. Elsewhere, Hang Seng (-0.5%) initially conformed to the early stock market rebound but then steadily wiped out the gains as coronavirus infections and deaths continued to expand, while Chinese PMI data was inconclusive in which Manufacturing PMI printed in-line with estimates at the 50.0 benchmark level and Non-Manufacturing PMI topped expectations at 54.1 vs. Exp. 53.0, although the Stats Bureau noted this was taken based on data on January 20th and therefore doesn’t fully reflect the impact from the coronavirus outbreak. Finally, 10yr JGBs were relatively uneventful and held on to the prior day’s gains but with further upside limited amid the broad improvement in risk sentiment and overnight retreat in T-notes.

Top Asian News

- India Refutes ‘Unfounded’ Criticism About Government’s GDP Data

- Tourism Businesses Worldwide Brace for a Hit Worse Than SARS

- Biggest Indian Bank’s Profit Rises on Improvement in Bad Loans

European stocks have given up gains seen at the open [Eurostoxx 50 -0.6%] as the region failed to piggyback on the modest recovery seen in APAC sentiment, amid further reports the coronavirus spread – with the UK also confirming its first two cases. Major bourses are in the red with underperformance seen in the FTSE MIB (-1.5%), following a Q4 QQ contraction in the Italian economy. Thus, the Italian financial names lead the losses in the index. Elsewhere, UK’s FTSE 100 (-0.8%) saw early pressure due to a firmer Sterling in early trade, with renewed downside seen after the aforementioned virus contagion in the UK. Sectors opened in positive territory with a reflection of the risk appetite at the time, thereafter sentiment shifted to the other end of the scale with sectors now all in the red and reflecting risk-aversion – energy, once again, lags on renewed pressured in the oil complex. In terms of individual movers, Signify (+5.4%) leads the gains in the pan-European (despite slight revenue and net misses) as the group sees further improvement in adj. EBITDA margin. On the other end, Banco de Sabadell (-11.0%) rests at the foot of the Stoxx 600 in light of dismal earnings. Elsewhere, Thyssenkrupp (-5.0%) share slumped after noting that they are in a tight financial situation and confirmed the value of its elevator unit at EUR 15bln, vs. top-end estimates of EUR 20bln.

Top European News

- U.K. Mortgage Approvals Climb to Highest Level Since 2017

- Ferrexpo Falls as Ukraine Court Restricts Poltava Mining Shares

- K+S Jumps as Investment Newsletter Speculates About Takeover

- Sabadell Slumps as Provisions, TSB Loss Fuel Fresh Worries

In FX, the Pound remains relatively firm, but off best levels forged in the aftermath of super Thursday amidst positive month end vibes via a German bank flagging stock-hedge demand vs the Dollar and Franc in particular, albeit with the bulk of the buying anticipated from 3 to 4 pm London time. Cable reached 1.3140 or so before topping out and Eur/Gbp crossed 0.8400 to circa 0.8387 at one stage before Sterling lost some momentum in tandem with, if not specifically on reports of 2 confirmed cases of China’s coronavirus in the UK.

- AUD/NZD/NOK/SEK – The clear G10 underperformers and extending losses against the Greenback and Euro respectively, as Aud/Usd recoils further from fairly restrained recovery highs through the 0.6700 level to expose the 2019 low (0.6671). The Aussie gleaned scant impetus from mixed Chinese PMIs overnight, supposedly large expiry related hedging at the big figure or the so called ‘soft’ WHO classification of the deadly Chinese disease as a health emergency of international concern in recognition of the strenuous efforts to contain the outbreak and cure the growing number of those contaminated. Similarly, Nzd/Usd has plumbed deeper below 0.6500 towards 0.6450, ignoring more theoretically supportive Kiwi impulses via Westpac upgrading its RBNZ policy views to a possible shift from easing to neutral at the February meeting. Meanwhile, the Scandi Kronas continue to weaken on bearish fundamentals, techs and broad risk sentiment that has also scuppered a pretty tame rebound in crude prices.

- CAD – The Loonie derived enough leverage from hawkish sounding BoC rhetoric to regain 1.3200+ status vs its US counterpart, but the Beaudry reservations about looser policy have already lost impact with Usd/Cad breaching the 200 DMA that had been capping rallies and now eyeing 1.3250 ahead of 1.3270 that represents December 6’s peak. However, impending Canadian GDP and perhaps even PPI could provide some independent direction.

- CHF/JPY/EUR – In keeping with recent trends, underlying safe haven buying has helped the Franc, Yen and Euro to an extent (not to mention Gold) limit declines vs the Buck during periods of improved risk appetite, as Usd/Chf and Usd/Jpy stay tethered to 0.9700 and 109.00 anchors, while Eur/Usd repels attempts to break decisively below 1.1000 despite weak Eurozone data. Note, also mild to strong Dollar selling signals for month end may also be a factor as the DXY struggles to keep sight of 98.000 and threatens to close under a key chart level at 98.011 (50% Fib retracement of pull-back from 99.967 to 96.355 in Q4 last year).

- EM – No real or lasting respite for regional currencies even though the Yuan is keeping afloat above 7.0000, as SA’s Eskom warns about more power outages and wants to discuss a strategy with the Government to meet financial obligations. Usd/Zar now nudging up close to 14.9000 as a result.

In commodities, WTI and Brent front-month futures have given up most of its overnight gains which were spurred by the World Health Organisation’s verdict which did not recommend limiting trade and movements due to the outbreak – thus digested as a “softer” announcement. The declaration revived some demand relief against the backdrop of mass flight cancellations to and from China. However, WTI and Brent futures have waned off highs, with prices now weighed on by the coronavirus’ spread to the UK. WTI hovers just under 52.50/bbl at time of writing, whilst its Brent counterpart breached 57.50/bbl to the downside. Elsewhere, spot gold retains an underlying bid amid the pathogen outbreak and as DXY remains below 98.000. Copper prices resume its downwards trajectory and trade ongoing demand/global growth concerns arising from the spread of virus.

US Event Calendar

- 8:30am: Employment Cost Index, est. 0.7%, prior 0.7%

- 8:30am: Personal Income, est. 0.3%, prior 0.5%;Personal Spending, est. 0.3%, prior 0.4%

- Real Personal Spending, est. 0.1%, prior 0.3%

- PCE Deflator MoM, est. 0.2%, prior 0.2%; PCE Deflator YoY, est. 1.6%, prior 1.5%

- PCE Core Deflator MoM, est. 0.1%, prior 0.1%; PCE Core Deflator YoY, est. 1.6%, prior 1.6%

- 9:45am: MNI Chicago PMI, est. 49, prior 48.9

- 10am: U. of Mich. Sentiment, est. 99.1, prior 99.1; Current Conditions, prior 115.8; Expectations, prior 88.3

DB’s Jim Reid concludes the overnight wrap

So the big day is here. At 11pm GMT tonight we will all move on with our lives. Many will be delighted with the outcome and be optimistic about the future with some even confident that will give them a chance to move ahead of their European counterparts. On the other hand many will feel outraged and furious with the people in charge for letting things get this bad and will claim this is a huge exercise in shooting ones-self in the foot. Yes it’s the close of the transfer window in European football tonight where hopes and dreams fade or get resurrected. It’s also the last chance to see if there’s anyway your team can stop Liverpool winning both the Premier League and the Champions League. Bonne chance!! As a side piece of curiosity, the U.K. leaves the EU at exactly the same time.

Having returned from the EU last night for the last time as an EU citizen it also wrapped up my main 2020 outlook tour that has been going on for over 2 months now. I’m still travelling every week this quarter but the trips now take on a slightly different purpose. Being in Madrid yesterday it’s fair to say that they were generally typical of the audiences I have encountered for the last couple of months. The majority is expecting a year of carry. Not much more but certainly not notably worse than that. I have been more circumspect than virtually all clients as I’m not convinced the risks are fully priced. So no certainty of more difficult times ahead but a challenged risk/reward profile at these valuations. Spreads and equities (US at least) are priced for near perfection and the reality is that global data is still mixed, we’re still in the shadow of 2019’s yield curve inversion, and we have a potentially game changing US election this year. I’ve deliberately left out the Coronavirus as that’s clearly not been part of my calculus and will still have to develop substantially from here to be game changing for the medium-term economic outlook.

On the US election, Monday will see the start of primary season in Iowa where we’ll see the first evidence as to where the Democrats are heading nomination wise. In terms of background the Democratic primary process is based on delegates (need to get to 1990 out of 3979). Pledged delegates (41 in Iowa – only c.1% of national total) are selected under proportional representation, which requires a candidate have a minimum of 15% of a state’s popular vote to receive them. This is important in the narrative game (i.e. “I lost by 1% of the vote, but we got the same number of delegates so we are still in this”). Also big wins mean more delegates. This is why Super Tuesday on March 3rd is a big event as 1360 delegates or 34% of the pie is up for grabs that day.

Iowa on Monday appears very close with RealClearPolitcs’s polling average showing Sanders at 24.2% vs Biden at 21% but with both swapping leads in different polls in recent times. This is a state where Sanders has the demographics to do well, but it’s a primary rife with uncertainty, because it is a caucus, not a straight vote like in New Hampshire (8 days later). During a caucus vote, there is a first round, where – in each district all over the state – people literally walk around a large room and stand in their candidate’s corner. Then, after everyone is tallied, all candidates without 15% of the total voters present are then forced to quickly pick another candidate, this is done repeatedly until no candidate has fewer than 15% of the vote. Also, once your candidate has over 15%, you are not allowed to realign. e.g. Buttigieg is currently on 16.8% in the polls. If he gets past the first round, his voters cannot leave for a more popular candidate even if he is losing but they can if he gets less than 15%. At current polling this could hurt Biden the most as he and Buttigieg have shared the more moderate lane of the Democratic primary so far. This makes predicting the outcome perilous.

So candidates polling under 15% will likely have their votes distributed – therefore a big swing could be based around Warren who is averaging 14.7% currently. If she can’t get to 15%, her voters have a more natural home with Sanders over Biden. On the other hand Klobuchar is sitting at 9%, which is likely going to Biden. The 14% “other” will likely be spread around, with no single ideology among the other candidates. From a Monmouth University poll yesterday, when likely caucus-goers were asked to choose from the top four candidates, the race stands at 29% Biden, 25% Sanders, 20% Buttigieg, and 19% Warren. This follows a lot of polls showing that Biden is a lot of people’s 2nd choice. So in caucuses often the headline poll may not tell the full story.

Overall, Iowa on Monday should be viewed as too close to call and highly dependant on late swings, whether fringe candidates get to 15%, and how second preferences span out. Given that Sanders is favourite in New Hampshire (Feb 11th) and is closing the gap between himself and Biden in polling in Nevada (the 3rd primary on Feb 22 -also a caucus), the possibility of a win here means he could gain a lot of momentum going into Super Tuesday (March 3rd) even if the number of delegates are small. We’ll know more early next week but whatever your politics you would be hard pressed not to acknowledge the fact that markets are not set up for any kind of Sanders momentum.

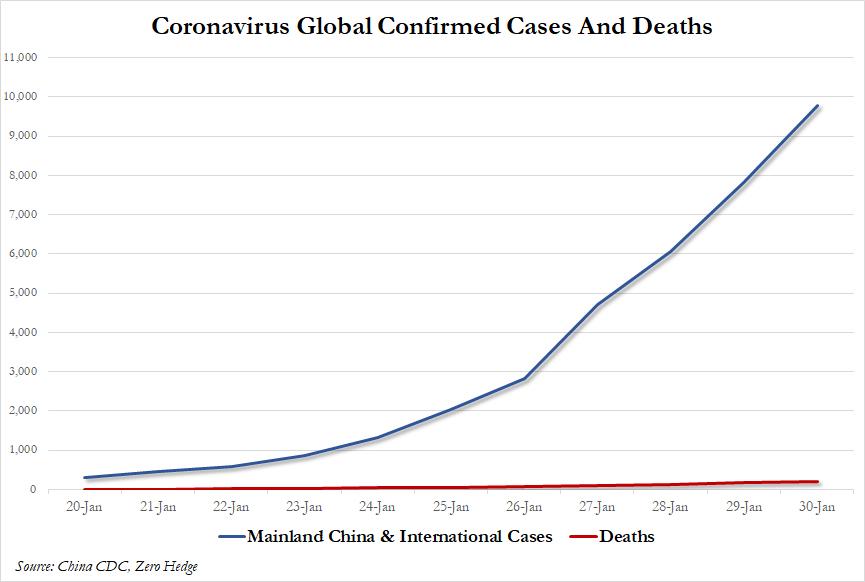

The primaries have been drowned out from the news cycle by the Coronavirus over the last week but as of Monday it should more than compete for headlines. Meanwhile the latest on the virus is there have been 213 confirmed deaths now (up from 170 yesterday) while, number of confirmed cases stand at 9,692 (up from 7,783). The number of confirmed cases have now topped the official recordings of the SARS epidemic (8,096 cases). In other news related to this, the US State Department updated the travel advisory to level 4 saying that the US citizens should not travel to China. It added that travelers should be prepared for travel restrictions to be put into effect with little or no advance notice and added that those in China should consider departing using commercial means. Also, more and more Chinese provinces and cities are extending the holiday period overnight to February 10 from February 2. Russia also announced yesterday that it is closing its land border with China. Even though the Russian border with China was already closed due to the NY holidays, the Russian decision extended the closure until March 1.

Global markets actually reversed losses late in the US session immediately after the World Health Organization declared the Coronavirus outbreak in China a Public Health Emergency of International Concern (PHEIC). Officials cited an increased number of cases outside of China and clear human-to-human transmission now abroad – eight cases across Germany, Japan, Vietnam and the first in the United States yesterday. However, they did not recommend restrictions on trade or travel. Overnight, Hong Kong also confirmed its first case of human to human transfer of the virus. By declaring a Public Health Emergency, the WHO allows global health authorities to aid countries with less-robust health systems to stop the spread of the virus. The WHO reported that there had been 98 cases in 18 countries outside of China, but no deaths so far. However, even though some companies and governments have taken measures to cut off service to China, the WHO Director said there’s no need at this time for measures that interfere with travel and trade.

Yesterday our China economists put out a piece on the coronavirus (link here), asking when the number of new cases would peak. They believe that the turning point is not far away, and that assuming the measures taken are effective at containing the outbreak, the peak of new cases outside Hubei province (where Wuhan is located) will likely happen at some point next week. See their report for more.

Overnight, China’s January PMIs came surprisingly strong with manufacturing printing in line with consensus at 50 while services printed at 54.1 (vs. 53.0 expected) brining the composite read to 53.0 (vs. 53.4 last month). The survey was conducted before January 20, the day we started receiving reported numbers of cases of the virus. So this will be seen as largely meaningless. Our Asia strategists believe that the Caixin PMIs next week will also have a similar problem.

A quick refresh of our screens this morning shows that Asian markets are mostly higher with the Nikkei (+1.10%) and Hang Seng (+0.24%) up but with the Kospi (-0.32%) lower. Markets are off their earlier peaks as the news of US travel advice for China filtered in (see above). Elsewhere, Brent crude oil prices are up c. +2% this morning erasing part of yesterday’s loses (more below). As for other overnight data releases, Japan’s December retail sales printed at +0.2% mom (vs. +1.0% mom expected) while preliminary December industrial production came in at +1.3% mom (vs. +0.7% mom expected). In other overnight news, The Times has reported that UK PM Boris Johnson will call next week for a basic trade deal based on that between the EU and Canada.

Before this, large cap earnings continued to push US equities higher after the bell following the late session turnaround after the WHO report. Amazon surged c.10% after the close, with their holiday-quarter revenues and profits blowing out expectations. The e-commerce giant moved to join Apple, Microsoft, and Google as S&P 500 companies with market values over $1tr in after hours trading. NASDAQ and S&P 500 futures are up +0.21% and +0.12% respectively.

The Asian session comes after US equity markets recovered from earlier losses following the WHO declaration, with the S&P 500 recovering from an intraday low of -0.93% to close up +0.31%. The NASDAQ (+0.26%) and the Dow Jones (+0.43%) also pared back earlier losses to advance on the day. Europe closed before the pullback however, with the STOXX 600 and the DAX ending the session down -1.01% and -1.41% respectively. Brent crude also continued its decline, falling -2.54% to its lowest level in over 3 months. Also, the continued falls in the oil price saw oil and gas stocks underperform, with the STOXX Oil and Gas index in Europe closing down -2.36% at a 5-month low.

In terms of bonds the 3m10y yield curve in the US inverted on an intraday basis again yesterday, though it steepened into the close to finish at +2.7bps. Elsewhere, 10yr Treasury yields also pared back losses to close +0.01bp higher. Once again however, with Europe’s earlier close, bunds (-2.9bps), OATs (-2.3bps) and BTPs (-1.2bps), all saw yields fall. Gilts underperformed, with 10-year yields rising +2.6bps, as the BoE decided to keep rates on hold in what was for the market a knife-edge decision.

It wasn’t so close for the BoE though, with the vote at 7-2, the same as at the previous meeting. Given expectations that the Bank might cut, the fact that no further members voted for a cut compared with last time was taken by the market as relatively hawkish. The statement said that “some modest tightening of policy may be needed to maintain inflation sustainably at the target” were the economy to recover in line with their projections. However, they removed from the previous statement that this modest tightening would be “at a gradual pace and to a limited extent”. Furthermore, the statement sounded a note of optimism on the global and domestic outlook. For example, it mentioned that business activity surveys domestically had picked up, noting this was “quite markedly in some cases”. Nevertheless, the BoE cut their growth forecasts, now seeing 0.75% growth this year, compared with 1.25% back in November. They also revised down their 2021 and 2022 forecast by 25bps, to 1.5% and 1.75% respectively.

In terms of the market reaction, sterling strengthened against other major currencies following the decision, being the best performer among the G10 currencies yesterday. The pound ended a run of 5 successive declines against the dollar to close up +0.55%.

The main data highlight from yesterday was the advance reading of Q4 GDP in the US, which grew at an annualised rate of +2.1% (vs. +2.0% expected), meaning that the full year-on-year GDP growth for 2019 as a whole was at +2.3%. The surprise from the release came with the core PCE reading however, which surprised to the downside with an annualised +1.3% qoq (vs. +1.6% expected), something that will be important to the Fed. We also got the weekly initial jobless claims, which came in at 215k (vs. 216k expected), though the previous month was revised up by +12k. Nevertheless, the 4-week moving average fell to 214.5k, its lowest level since early October.

On the other side of the Atlantic, the Euro Area unemployment rate fell to 7.4% in December, its lowest level since May 2008. In a further sign of a possible economic rebound, the European Commission’s economic sentiment indicator rose for a 3rd consecutive month, up to 102.8 (vs. 101.8 expected) and a 5-month high. Finally, unemployment in Germany fell by -2k (vs. +5k expected), while the EU harmonised CPI reading rose to +1.6% (vs. +1.7% expected), its highest level since April but a touch disappointing.

To the day ahead now, and as mentioned the UK will be leaving the EU at 11pm GMT tonight. There’s also an array of economic data out, including the advance reading of Q4 Euro Area GDP and January’s CPI estimate. Elsewhere in Europe, there’s also German retail sales for December, France’s CPI inflation for January, Italy’s Q4 GDP, and UK consumer credit and mortgage approvals for December. On the other side of the Atlantic, we’ll get US personal income and personal spending data for December, as well as the Q4 employment cost index, the January MNI Chicago PMI and the final University of Michigan sentiment reading for January. Finally from Canada there’ll be November’s GDP reading. And earnings out today include Exxon Mobil, Chevron and Caterpillar.

Tyler Durden

Fri, 01/31/2020 – 07:59![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com