Banks Tighten Credit Card, Auto Loan Standards As C&I Loan Demand Continues To Shrink

The latest senior loan officer survey, released earlier today by the Fed, showed that the benefits from last year’s rate cuts have mostly faded away even as banks tightened standards for several kinds of loans, while demand for all-important commercial and industrial loans, traditionally a leading indicator for any economic rebound, slumped for the sixth consecutive quarter.

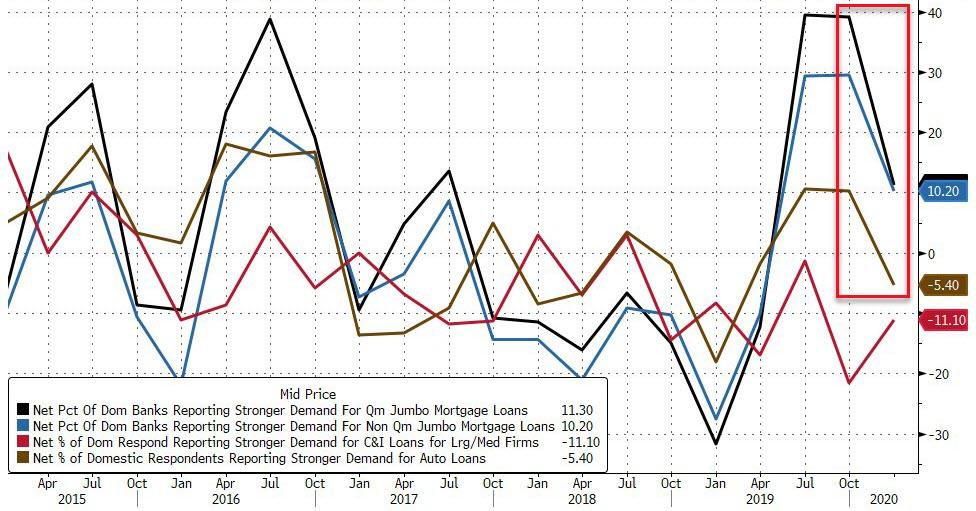

The January SLOOS, which looked at lending standards for commercial and industrial loans in the fourth quarter of 2019, reported that standards for commercial and industrial loans were unchanged and that “demand weakened from firms of all sizes.” And while standards for commercial real estate loans were mostly unchanged, the only source of strength according to loan officers was demand for mortgages, which remained strong following the decline in interest rates in the second half of 2019. However, offsetting this, standards for credit card and auto loans tightened while demand remained unchanged for credit cards and weakened for auto loans.

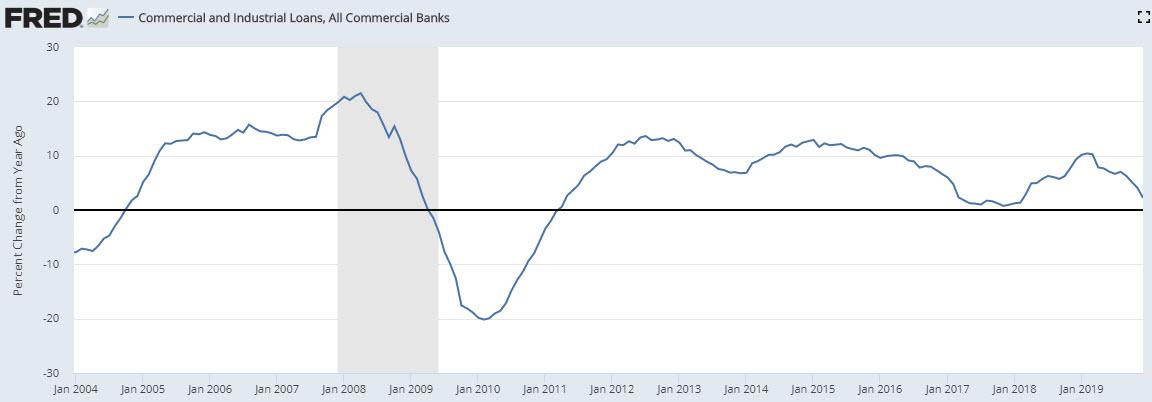

Some more details starting with the broadest type of loans, Commercial & Industrial, which as the following Y/Y% growth chart shows, have seen their growth rate grind to a crawl in recent months, after rebounding sharply in late 2018 and early 2019 as the Fed hiked rates prompting urgency among corporations to raise new secured debt. Ironically, it is the renewed easing by the Fed that appears to be the culprit for rapid slowdown in C&I loans.

According to the Senior Loan Officer Opinion Survey, lending standards for commercial and industrial (C&I) loans were basically unchanged in Q4 2019. A handful of banks eased some terms for C&I loans, as 21% of banks on net narrowed loan spreads over the cost of funds to large and medium-market firms and 10% on net narrowed loan spreads for small firms.

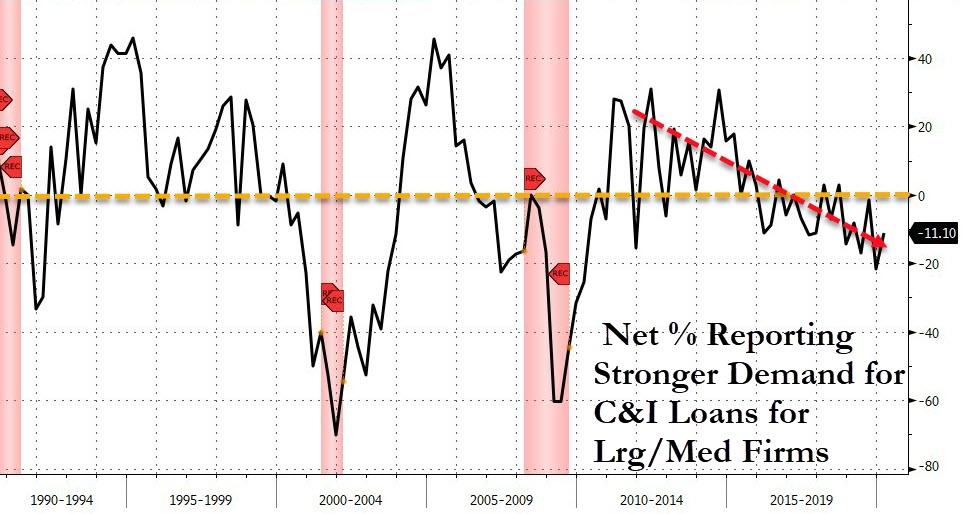

While lending standards were largely flat, demand for C&I loans from large- and medium-sized firms weakened for the sixth consecutive quarter, resulting in a sharp slowdown in the overall rate of growth of C&I loans, which have been virtually unchanged for the past year. The good news: after tumbling 20% in Q3 to the lowest level since the financial crisis, C&I loan demand stage a modest comeback in Q4, even if it still remains deep in negative territory.

In a concerning development, 11% of banks on net reported weaker demand for C&I loans for large and medium-market firms, compared to 22% in the previous survey, which suggests that any tailwinds for loan demand sparked by the Fed’s 2019 rate cuts are now long gone.

Shifting to commercial real estate loans, standards were mostly unchanged in the fourth quarter according to the Fed, except for construction and land development loans which tightened modestly (+7pp). Demand for CRE loans was similarly unchanged for CRE loans except for construction and land development loans, which like C&I loans, weakened (-6pp).

What is curious is that while the Fed’s rate cut appears to have resulted in lower demand for C&I loans, following the drop in interest rates in the second half of 2019, demand for residential mortgage loans remained strong, though a smaller share of banks reported stronger demand for mortgages in Q4 compared to in the previous survey. Banks reportedly left lending standards for most categories basically unchanged, echoing the previous survey.

Banks’ willingness to make consumer installment loans was again little changed in Q4. However, a moderate share of banks again tightened standards for credit card loans by tightening credit limits and increasing minimum credit scores. A modest share of banks also tightened standards for auto loans. Nonetheless, large banks with larger auto loan portfolios reported stronger demand. Demand for consumer loans was little changed since the previous survey.

On net, supply remained same or modestly tighter, even as demand for virtually all loan categories slumped or remained negative in Q4 after surging earlier in the year, when the Fed cut rates for the first time since the financial crisis.

Tyler Durden

Mon, 02/03/2020 – 21:45

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com