Coronavirus Makes The Market… Impossible To Predict!

Authored by Bruce Wilds via Advancing Time blog,

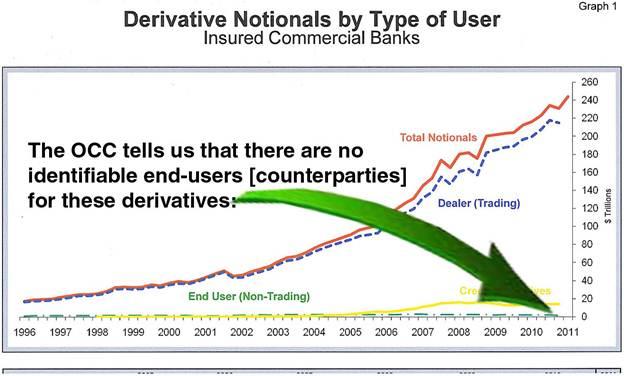

It is impossible to predict what lays ahead! The coronavirus outbreak could be a nothing burger or become a watershed event. A mountain of debt has formed over the years and whether countries and central banks can hurl enough resources at this crisis to calm a growing fear remains to be seen. It is fear versus more promises of stimulus and at some point, all bets are off. To highlight the vulnerability of the financial markets we can always turn the spotlight back upon derivatives. Hundreds of billions of dollars do not matter when we are talking about death or something like the derivative markets.

Currently, China is looking to dump a wagon full of stimulus into an already highly leveraged market to offset the toll taken from virus fear. China said that billions of dollars will start flowing into markets at the opening and the Chinese government has ordered that short-selling of shares be halted. This instability makes it important to revisit issues that have been swept under the rug or simply overlooked. For most people, the derivatives market falls into this category, partly because they don’t understand exactly what derivatives are or why this market is so important. Everyone paying attention knows that the size of the derivatives market dwarfs the global economy. Several books on derivatives have been written and the size of the derivatives market could be larger than $1.2 quadrillion. To put this in perspective it is about 20 times the size of the world economy.

Attempting to regulate and control our complex global markets is easier said than done. This can be seen in derivatives which are usually lengthy complex legally binding agreements that are very difficult to dissect and often reek with potential contagion. Derivatives fall into many categories from futures, options, credit default swaps, and any complex combinations of these. They can also be used to wager, bet, and spectate on a market move or direction. Regulation is difficult and spotty at best in that a derivative transaction in one country might be considered a simple spot trade in another. I have become convinced after studying derivatives that QE following the 2008 financial crisis may have been geared to hold up the underlying value of assets that feed into and support the massive derivative market rather than help the economy.

Derivatives Could Explode Like A Bomb!

Way back in the middle of 2014, the Bank for International Settlements revealed that the amount of over-the-counter (OTC) derivatives outstanding was around 710 trillion dollars at the end of 2013. Most of that exposure is held by banks. The US Office of the Comptroller of the Currency at the time reported the exposure of US banks to derivatives totaling 237 trillion dollars. Of that, four big banks, JP Morgan Chase, Citibank, Goldman Sachs and Bank of America accounted for over 219 trillion dollars. The staggering size of this market is beyond anything that can be comprehended.

When I tried to get more recent numbers I ran into fairly stiff resistance which I contribute to the fact nobody knows the true exposure that is difficult to assess. Hopefully, much of the derivative exposure somehow nets out so that real exposure is far less than the hundreds of trillions of dollars on the books. This is only part of a much larger market that includes hundreds of trillions of dollars in non-reported agreements and private contracts. The efforts to achieve more reporting, more platform trading and central clearing of derivatives have fallen behind because of the complexity of crafting mutually consistent regulations at the jurisdiction level, for a highly globalized market.

While This Is Not A Current Chart Note The Trend Line!

Many derivative writers should be called “too clever by half” if they think they have successfully controlled the risk or removed the implications and problems massive defaults would cause. They pump these out because they make money in the process of structuring and selling these agreements. A derivative is in many cases an insurance policy covered by collateral. Sadly, those who buy and write derivatives often play fast and loose with the value of the collateral or flat out lie about it. This moves them from an insurance policy and into the area of high risk.

Those of us skeptical of the market wonder whether the coronavirus will be dismissed as another over-hyped hysteria or devastate economies. The potential that things could get ugly does exist. If at some point, a “mob mentality” takes over logic could get tossed out the window. This is when claims their actions are for the “greater good” becomes irrelevant. Temporarily, we are on hold while events unfold around us. The window has gone dark and our vision is limited. Just remember those in government generally take care of themselves first, in their minds they are the priority.

Tyler Durden

Mon, 02/03/2020 – 09:50

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com