China To Slash Tariffs On Some U.S. Imports By 50%

While global equity futures continue to soar amid a return of the “coronavirus is contained” following reports that new drugs are in the pipeline to treat the deadly disease on Wednesday, China’s economy is expected to print sub-5% GDP in Q1. This has forced an increasingly desperate Beijing to unexpectedly announce on Thursday that it will slash tariff levied on 1,717 U.S. goods by up to 50%.

China’s finance ministry stated that on Feb. 14, additional tariffs levied on some goods will be reduced from 10% to 5%, and others lowered from 5% to 2.5%, reported Reuters. The finance ministry didn’t explicitly state the value of goods affected by tariff reductions.

In a separate statement, the ministry said tariff reductions would mostly be for products announced during the trade war. They said further tariff adjustments could depend on the bilateral economic and trade situation.

The ministry said soybean tariffs would be reduced from 30% to 27.5%. Tariffs on crude will be halved from 5% to 2.5% after Feb. 14.

“Any move to de-escalate is always good. Especially when the market is overwhelmed by the news about virus, good news about tariff is refreshing,” said Tommy Xie, head of Greater China research at OCBC Bank in Singapore.

“The announcement shows China’s commitment to implement the phase one trade deal despite the disruptions from the recent virus outbreak,” said Xie.

Hu Xijin, the editor from the China Global Times, tweeted Wednesday asking the U.S. to give China some slack in the phase one trade agreement. This could mean China’s expected $200 billion in U.S. purchases over the next two years might not happen.

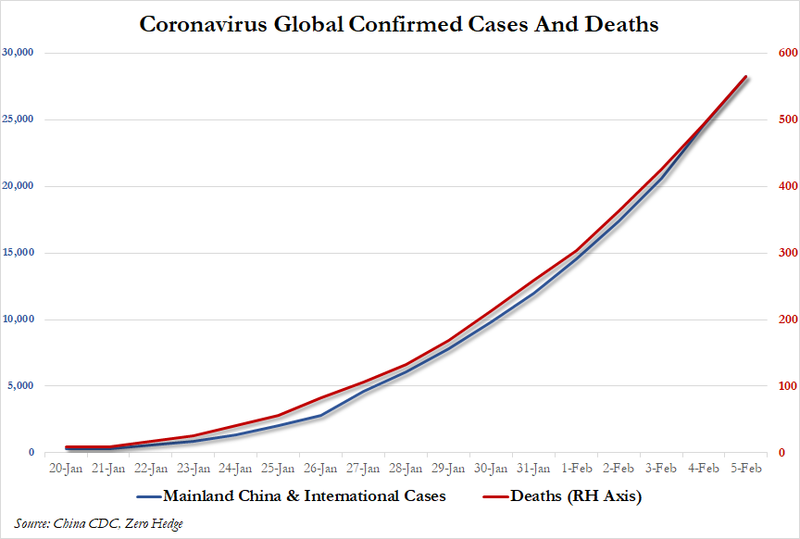

China’s planned tariff reductions come as the coronavirus outbreak continues to broaden with more than 28,000 cases and 565 deaths globally. Much of the epidemic is centered in China.

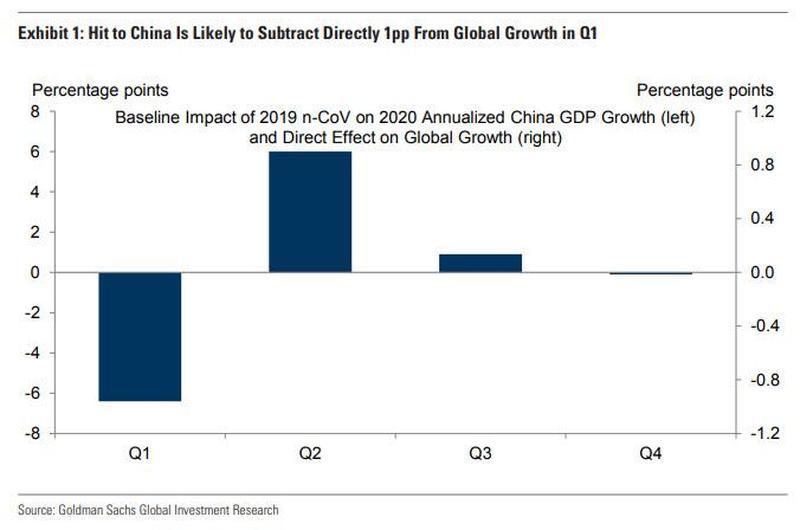

Two-thirds of China’s economy is offline, which will produce an economic “shock” that will send GDP tumbling sub-5% in 1Q.

An economic “shock” in China will likely spill over into the rest of the world in the quarter. The reason: China’s economy has significantly increased in importance since the 2003 SARS epidemic because of the breathtaking growth of the Chinese economy over the past two decades.

Finally, those wondering why China would hint at major weakness by proactively pursuing such a move that puts it at a tactical disadvantage with the US, well that’s the $64 trillion question, and the answer appears to be viral.

How long before people realize that China proactively capitulating on tariffs is a sign of how serious the economic impact of this virus situation actually is?

— Sven Henrich (@NorthmanTrader) February 6, 2020

https://platform.twitter.com/widgets.js

Tyler Durden

Thu, 02/06/2020 – 07:00

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com