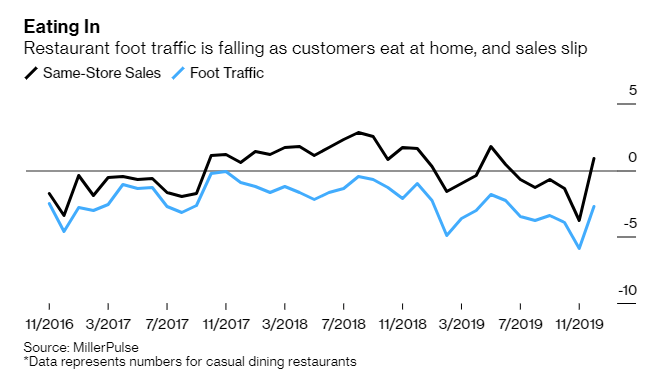

Smaller Restaurants Forced Into Bankruptcy As Foot Traffic Collapses

While the big names in eating out – McDonald’s, Popeye’s, Chick-Fil-A and Olive Garden, to name a few – are all working diligently to get customers through the door at a time when the American eater is staying home more, lesser known restaurants are bearing the brunt of not being able to find new customers.

Names like Bar Louie and American Blue Ribbon Holdings, which owns Village Inn and Bakers Square, both filed for bankruptcy earlier this week, according to Bloomberg. Both cited lower foot traffic in the U.S. as the reason for their downfall.

Michael Halen a senior restaurant analyst at Bloomberg, said: “The business is just over-built, especially casual dining and full-service dining. There are too many restaurants.”

American Blue Ribbon also said that competition, rising labor costs and unprofitable restaurants were all reasons for facilitating its bankruptcy. The company owns and operates 97 restaurants after closing 33 stores prior to filing Chapter 11.

The company’s majority owner, Cannae Holdings, Inc., has agreed to provide a $20 million loan to maintain the company during bankruptcy. Cannae generates about 30% of its revenue from various restaurant companies it is invested in and has said that American Blue Ribbon will focus on strategic options in bankruptcy.

Bar Louie has been opening new locations over the last few years which has grown its top line, but the increase in debt necessary to open new stores has suffocated the company.

Chief Restructuring Officer Howard Meitiner said: “This inconsistent brand experience, coupled with increased competition and the general decline in customer traffic visiting traditional shopping locations and malls, resulted in less traffic at the company’s locations proximate to shopping locations and malls.”

Bar Louie has 110 locations, 38 of which have “seen their sales and profits decline at an accelerating pace” since the company began a strategic review in 2018. Those locations expected a staggering same store sales drop of 10.9% in 2019 and were closed prior to the company filing for bankruptcy. Lenders are providing a loan of as much as $22 million to keep the company operating during the proceedings.

Other restaurant names like The Krystal Co., Houlihan’s Restaurants Inc., Kona Grill Inc. and Perkins & Marie Callender’s all filed for bankruptcy last year as well.

Halen concluded: “We need to see a correction in the restaurant industry. We’ve seen a lot in the last few months, and I think this is just the beginning. Once the economy softens, you’ll see this getting worse.”

Tyler Durden

Fri, 02/07/2020 – 21:45

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com