China Stocks Surge, S&P Futs Hit All Time High On Latest Chinese Monetary Stimulus

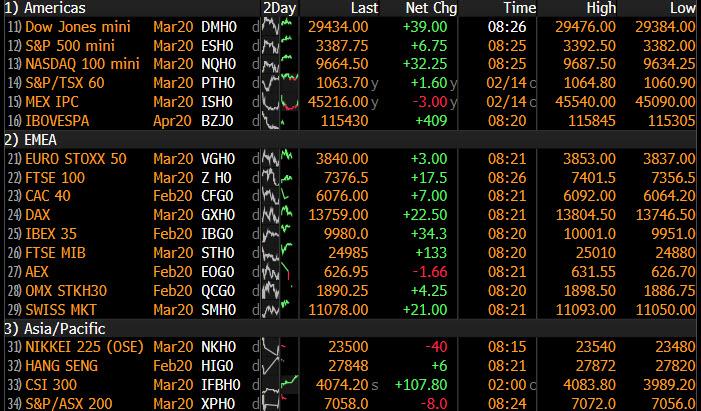

European stocks rose on Monday, Chinese shares surged, recovering all their post-coronavirus losses and S&P and Nasdaq futures jumped to new all time highs as investors took encouragement from the Asian country’s monetary (if not fiscal) pledges to support the world’s second-biggest economy in the face of the coronavirus outbreak. The yen and gold both slipped.

Gains in Europe’s Stoxx 600 Index were led by the China-heavy sectors of automakers and miners. US futures climbed, though Wall Street is shut for a holiday, and Treasuries weren’t trading. European bonds were mixed, while the euro ticked higher after closing on Friday at its lowest since early 2017.

With the US closed for president’s day, the attention was on China, where both cases and deaths linked to the Coronavirus hit a new all time high. The Chinese yuan climbed after China cut rates and added medium-term funding to banks to cushion the impact of a virus outbreak; specifically, the People’s Bank of China offered 200 billion yuan ($29 billion) of one-year medium-term loans on Monday. The rate was lowered by 10 basis points to 3.15%

As a result of the latest burst of monetary stimulus (which came at a time when the finance ministry warned that China would pursue austerity on the fiscal stimulus side), the Shanghai Composite soared almost 2.3% while gains in China’s CSI 300 Index have recouped all losses since trading resumed after the Lunar New Year break, after the central bank unveiled plans to reduce corporate taxes and fees.

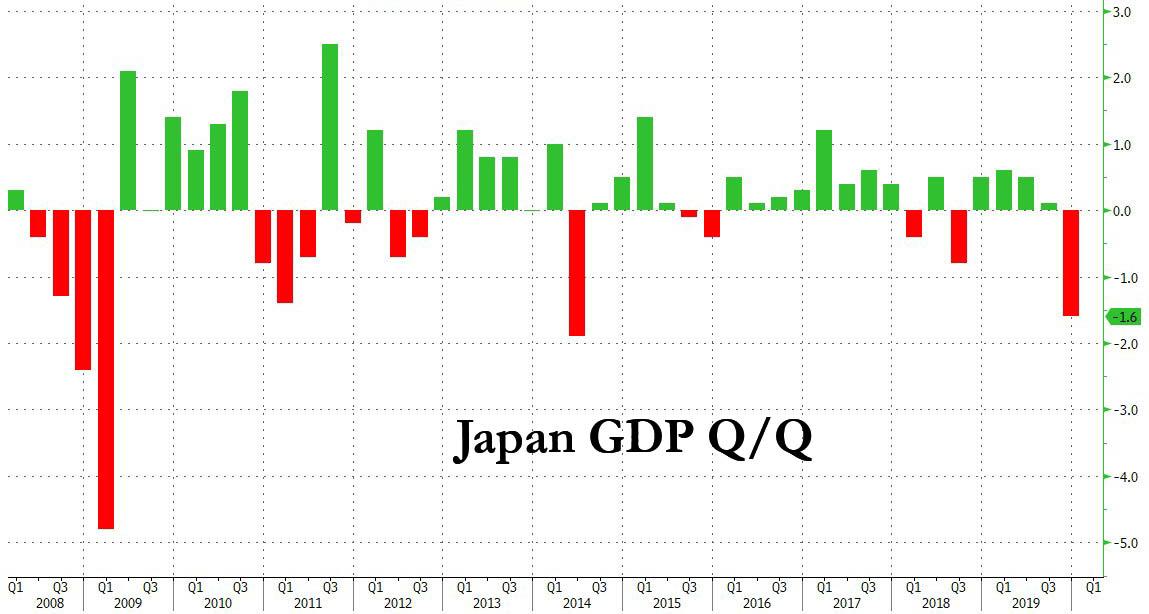

The momentum failed to buoy most Asian markets, however. Stocks dipped in Seoul and Sydney, while Japan’s Topix Index dropped after data showed the country’s GDP cratered shrank the most in five years in the last quarter.

Hurt by a sales-tax hike, Japan’s gross domestic product shrank at an annualized pace of 6.3% from the previous quarter in the three months through December, the worst slide in more than five years. That left the economy on the verge of a technical recession as the virus outbreak hit activity in Q1 2020.

So it’s all back to central bank stimulus. As Saxo Bank’s Eleanor Creagh writes, the S&P 500 and the Nasdaq on Friday closed at an all-time high, but although equities remain resilient, doubts remain about the impact of the virus outbreak on global growth and treasury yields edged lower. Across equities, investors are banking that ample global liquidity and supportive central banks will backstop equity prices even in the face of weaker economic growth. The prospect of weaker inflation via a weaker commodity complex, strong USD and disinflationary pressures arising impact of the coronavirus outbreak underpin an already ongoing recalibration of long term interest rate expectations. This is turn drives large amounts of capital up the risk spectrum into equity markets.

Asian stocks have started the week on a mixed footing, Chinese equities are in the green as investors are heeding the impending monetary and fiscal stimulus and influx of liquidity from the PBOC. Pledges from officials that vow to meet China’s 2020 growth targets underscores the sentiment that authorities will prioritise short term growth over financial stability and deleveraging goals. With this in mind markets expect enough policy support to mitigate downside risks and mainland equities have now recovered all of the losses seen following the Lunar New Year holidays.

In line with those expectations to support the economy, the PBOC today cut interest rates on its one year medium-term lending facility (MLF) by 10 basis points to 3.15% in a bid to reduce funding costs. This along with offering 200 billion yuan of one-year medium-term loans. The move all but guarantees a similar reduction in the loan prime rate (LPR – the new benchmark loan rate) come Feb 20. The pledges of additional fiscal stimulus that came over the weekend, in the form of corporate tax cuts are also lending support to mainland equities today and fuelling risk sentiment.

Continued policy support, both fiscal and monetary, will be required in China to mitigate downside risks from the coronavirus outbreak and promote a self-sustaining trajectory for growth. On that basis we expect more RRR cuts, along with further cuts in the MLF/LPR and more support for private firms as this sector continues to drive job creation, accounting for 80% of jobs and more than 90% of new jobs, according to the National Development and Reform Commission of the People’s Republic of China. Limiting job losses is as ever a key focus as employment remains key for social stability.

Elsewhere in Asia a big miss on Japan 4Q GDP (-6.3% vs. -3.8% estimate) is souring sentiment in Japanese equities. Although the buoyant sentiment across mainland markets has softened the blow.

As Creagh notes, “It is our sense that the Japan 4Q GDP data, which is pre virus outbreak, is just a taste of what is to come in terms of downside surprises to growth. The irony is that as we outlined above, in the current investment paradigm, this bad news is good news as investors anticipate more liquidity. Allowing equities to diverge further from economic fundamentals. Although 2019 saw multiple downwards revision to global growth and earnings forecasts, the S&P 500 returned 30% as the Fed and a raft of other central banks across the globe pivoted their policy stance early in the year. This served as a costly reminder for many not to fight liquidity. As the PBOC pledge ongoing support for the Chinese economy and fiscal stimulus efforts are ramped up, investors do not want to make the same mistake in 2020.”

The caveat – fat tails! There are still many unknowns as it relates to the ultimate impact of the coronavirus outbreak. There is a huge question mark over the reliability of all data relating to COVID-19 cases. This means that within any forecast outcomes should be embedded an enormous degree of variability. As is often case, garbage in, garbage out – incorrect or poor-quality input will produce faulty output, which is likely the case here given the lack of reliable data. And the current virus outbreak may represent an example of a devastating real world event for which a normally distributed model will understate various outcomes potentially leading to large mispricing of risk. Given the complete lack of reliable data we must balance complacent markets with elevated tail risks, participating in the upside momentum and maintaining optionality/tail risk hedging with respect to potentially much more negative outcomes.

Tyler Durden

Mon, 02/17/2020 – 08:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com